- Home

- »

- Personal Care & Cosmetics

- »

-

Ceramide Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Ceramide Market Size, Share & Trends Report]()

Ceramide Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Chemical Synthesis, Yeast Fermentation, Plant Extracts), By Application (Cosmetics, Pharmaceuticals, Food), By Region, And Segment Forecasts

- Report ID: 978-1-68038-673-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceramide Market Size & Trends

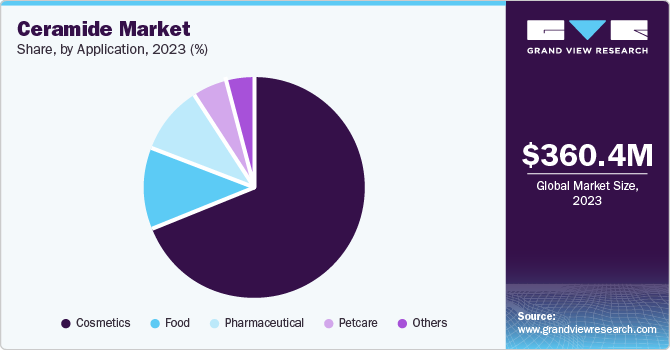

The global ceramide market size was valued at USD 360.4 million in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. The market growth is attributed to the wide range of applications in various industries such as food, pet care, cosmetics, pharmaceutical, and others. In addition, the changing lifestyle of the young generation and increasing habits such as smoking and drinking around the world have increased skin care, aging problems, and the prevalence of diseases such as eczema and psoriasis, which increases the demand for ceramics, which plays a significant role in the treatment.

Ceramides are beneficial for the skin as they have properties that act as emollients and increase the effectiveness of the skin's barrier. This makes them a common ingredient in care products, which increases its demand in manufacturing creams, lotions, serums, and other hair care products. Additionally, ceramide assists in minimizing mishaps of hair breakage and enhances its health, stimulating the need for shampoos, conditioners, and treatments that contain ceramides. These wide ranges of applications in skin care products are influencing the market and are expected to grow in the upcoming years.

Ceramides are heavily utilized in pharmaceuticals for treating some skin diseases, such as eczema, psoriasis, and dermatitis. With increasing skin disorders, the usage rate of ceramide-based treatments is expected to continue to rise. Ceramides must be swallowed as dietary supplements to assist skin health and moisture. This use is due to the growing trend by consumers towards using natural products in their beauty enhancement, such as skin care.

Source Insights

The chemical synthesis source segment dominated the market with the largest revenue share of 52.9% in 2023 driven by technological advancement, which has enhanced the process and resulted in lower waste generation and higher yields. In addition, this process gives cost-effective products in the market, and with stringent regulatory compliance, consumer demand is changing towards pure and safe products. These factors have increased production on a large scale, ensuring purity and quality. Furthermore, technological advancement also brings customization to benefits where manufacturers create specific formulations according to consumers' needs.

The yeast fermentation source segment is anticipated to grow at a CAGR of 7.0% over the forecast period attributed to ceramides' enhanced efficacy and bioavailability, which can be easily broken down into complex molecules, absorbed for skin replenishment, and used in other lipid barriers. Furthermore, this segment is heavily utilized in anti-aging skin care products due to its natural sourcing and ability to strengthen the skin's barrier functions.

Application Insights

Cosmetics applications led the market and accounted for the largest revenue share at 68.7% in 2023, owing to the growing trend of natural and organic beauty, which increases the demand for clean-label ingredients. In addition, diversified products of cosmetics that have ceramides as an ingredient, including skin, hair, and body lotions, are increasing the demand for ceramides for the manufacturers of these industries, thus increasing the market growth.

Thefood application is expected to grow at a CAGR of 6.9% over the forecast period attributed to increasing consumer awareness about health and wellness, prompting demand for ceramide as a dietary supplement, particularly for its skin health benefits. In addition, the aging population is also a significant contributor, as older consumers seek products that support skin hydration and anti-aging. Furthermore, the rise in disposable incomes and the expansion of online sales channels are making ceramide-based food products more accessible, further enhancing market growth.

Regional Insights

The North America ceramide market is expected to grow at a CAGR of 7.2% over the forecast period influenced by the supportive government regulations for increasing the utilization of ceramide-based products, expanding applications of ceramides across industries without being limited to skin care, and the rise of sustainability in the beauty industry with surging demand for eco-friendly methods of sourcing ceramides.

U.S. Ceramide Market Trends

The ceramide market in the U.S. dominated the North American market with the largest revenue share in 2023. This growth is driven by the increasing demand of consumers for natural products and plant-based products for skin and healthcare; this leads to heavy investment in R&D, which gives technological advancement and innovative extraction methods for better products, and the growing demand for anti-aging products is directly impacting the ceramides demand thus growing the market in the country.

Canada ceramide market is expected to grow significantly in the North American region over the forecast period attributed to the growing e-commerce platforms, which have eased the process for consumers to avail themselves of ceramide-based products, thus increasing their demand. This has led to large-scale manufacturing and technological advancements in product formulation, propelling the country's market growth.

Asia Pacific Ceramide Market Trends

The ceramide market in Asia Pacific dominated the global market and accounted for the largest revenue share of 38.0% in 2023 pertaining to rapid urbanization and changing lifestyles, which have increased pollution and UV radiation, thus increasing the need for effective skincare solutions. Increasing investments in research development to develop new formulations and innovate a wide range of products is also playing a major role in shaping the market in the region.

The ceramide market in China held a substantial revenue share in 2023 owing to a cultural shift towards natural beauty products, which is increasing investments by major brands in developing innovative ceramide products to increase their market share, rapidly growing e-commerce platform in the country, which has an increased the sales and brand visibility which has impacted to growing production of the products thus increasing the demand for ceramides.

Europe Ceramide Market Trends

The ceramide market in Europe is expected to grow significantly over the forecast period owing to the increasing awareness of skin health, leading to rising demand for natural and organic products, including plant-based products such as ceramide. In addition, with a robust cosmetic industry in the region, heavy R&D investments are increasing the number of multifunctional beauty products appealing to consumers, thus driving sales and growing markets in the area.

The UK ceramide market is expected to grow rapidly in the coming years due to an increasing focus on preventive healthcare and not only on appearance. The supportive regulatory environment increases innovations and ensures safety and efficacy in the products, thus increasing sales and growing the market in the country.

Key Ceramide Company Insights

Some of the key companies in the ceramide market include Evonik Industries, Ashland, Doosan Corporation, TOYOBO CO., LTD., Kao Corporation, Vantage Specialty Chemicals, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Evonik Industries is one of the major players in the ceramide market. Due to the heavy use of ceramide in their cosmetic products, they have diversified their product line to help strengthen the skin’s protective shield and retain moisture.

-

TOYOBO CO., LTD. It has been an active ceramide market player with increasing usage of ceramide in its products, such as caramel, which also constitutes biological components such as fatty acids and sugar, with features such as skin absorption and skin layer retention.

Key Ceramide Companies:

The following are the leading companies in the ceramide market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries

- Croda International Plc

- Ashland.

- Doosan Corporation.

- Aurorium

- TOYOBO CO., LTD.

- Kao Corporation

- Arkema

- Mitsubishi Chemical Group Corporation.

- Vantage Specialty Chemicals

- Sabinsa.

Recent Developments

-

In May 2024, Expanscience launched a new ceramide-boosting active ingredient, Gaïaline, derived from flaxseed, tapping into the regenerative skincare trend. This innovative ingredient enhances the skin's barrier function, promoting moisture retention and delaying signs of aging. It is sourced using conservation agriculture methods, ensuring sustainability and soil regeneration. Gaïaline has demonstrated significant ant-oxidative properties and boosts ceramide production, making it an attractive addition to skin and hair care formulations. The ingredient was recently showcased at the in-cosmetics Global event in April 2024.

-

In April 2024, Syensqo strengthened its position in the beauty biotech sector by acquiring JinYoung Bio, a South Korean specialist in cosmetic ingredients. This acquisition aims to enhance Syensqo's portfolio with natural and high-value specialty skincare solutions, particularly biomimetic ceramides produced through biotechnology. Integrating JinYoung Bio's technology aligns with Syensqo's commitment to sustainable innovation. The first product from this ceramide line, along with four functional ingredients, is set to launch in Q2 2024 at Suppliers' Day in New York, supporting Syensqo's growth objectives in the beauty market.

Ceramide Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 383.6 million

Revenue forecast in 2030

USD 569.3 million

Growth rate

CAGR of 6.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

Evonik Industries; Croda International Plc; Ashland.; Doosan Corporation.; Aurorium; TOYOBO CO., LTD.; Kao Corporation; Arkema; Mitsubishi Chemical Group Corporation.; Vantage Specialty Chemicals; Sabinsa

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ceramide Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ceramide market report based on source, application, and region.

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical Synthesis

-

Yeast Fermentation

-

Plant Extracts

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cosmetics

-

Pharmaceutical

-

Food

-

Petcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.