- Home

- »

- Pharmaceuticals

- »

-

Anti-aging Supplements Market Size, Industry Report, 2033GVR Report cover

![Anti-aging Supplements Market Size, Share & Trends Report]()

Anti-aging Supplements Market (2026 - 2033) Size, Share & Trends Analysis Report By Ingredient (Collagen, Resveratrol), By Formulation (Capsules, Tablets), By Application (Hair, Skin, Bone and Joint Health), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-299-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-aging Supplements Market Summary

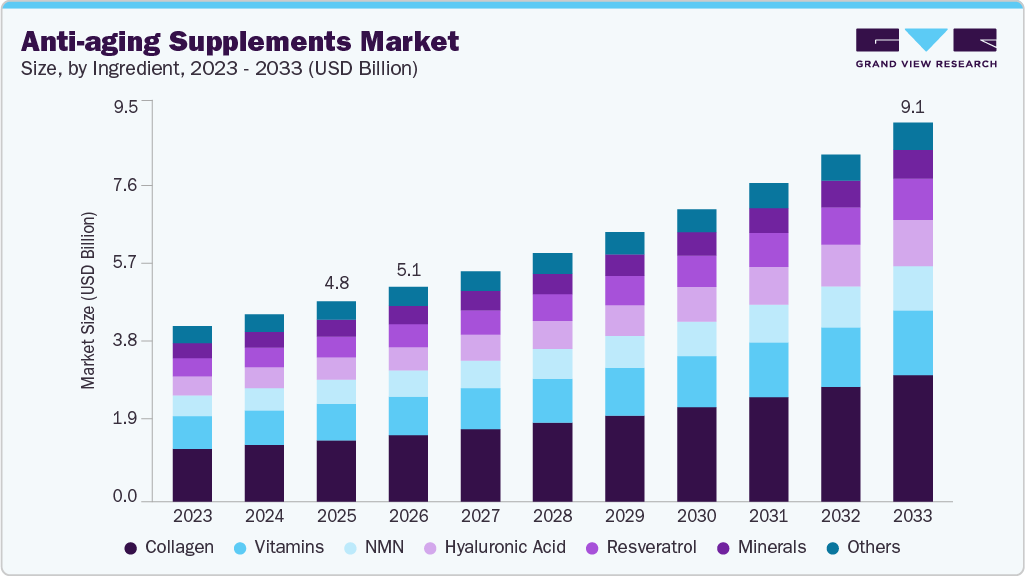

The global anti-aging supplements market size was valued at USD 4.78 billion in 2025 and is anticipated to reach USD 9.06 billion by 2033, growing at a CAGR of 8.49% from 2026 to 2033. The market for anti-aging supplements has grown significantly due to factors such as rising consumer awareness of health and wellness, an aging population, advancements in nutraceuticals, and increased demand for natural and organic products.

Key Market Trends & Insights

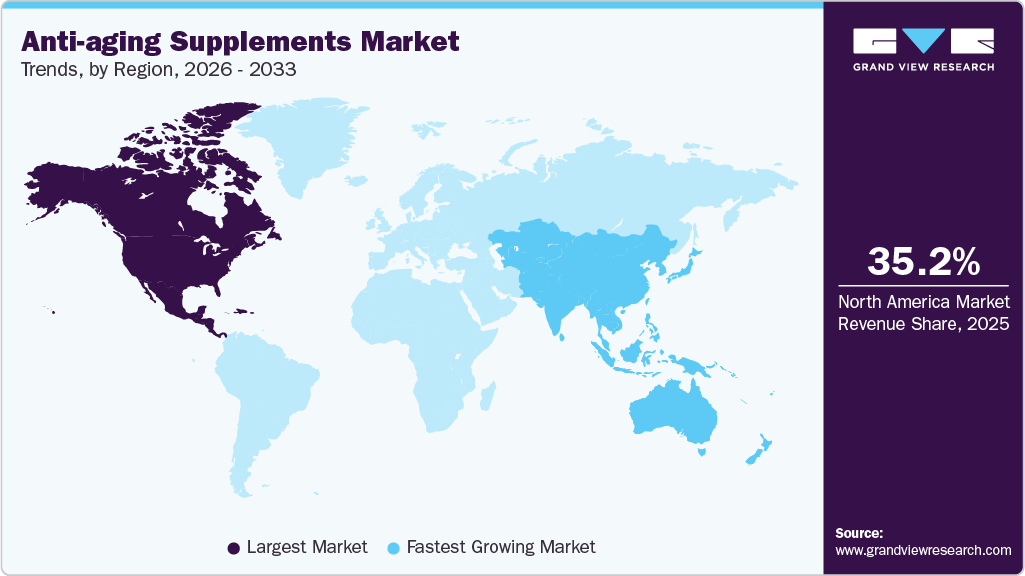

- North America anti-aging supplements industry held the largest global market share of 35.77% in 2025.

- The anti-aging supplements industry in the U.S. is expected to grow over the forecast period due to the expanding aging population.

- Based on ingredients, the collagen segment dominated the market with a share of 30.73% in 2025.

- Based on application, the hair, skin, and nail care segment dominated the market in 2025.

- Based on formulation, the capsule segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.78 Billion

- 2033 Projected Market Size: USD 9.06 Billion

- CAGR (2026-2033): 8.49%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Aging Population Demographics

The global anti-aging supplements market is being pushed by the booming elderly population. With the increase in life expectancy, older people are more and more looking for supplements that will help them maintain mental function, healthy joints, skin brightness, and general wellness. This insurance-type care and longevity-oriented approach are behind the powerful demand for nutraceuticals and functional supplements.

Key Facts on Global Population Ageing

Aspect

Key Insights

Health and social systems

All countries face major challenges in adapting health and social systems to address the impacts of population ageing.

Geographic distribution (2050)

By 2050, approximately 80% of the global older population will reside in low- and middle-income countries.

Speed of ageing

The pace of population ageing is significantly faster than in previous decades.

Demographic milestone (2020)

In 2020, the global population aged 60 years and above surpassed the number of children under 5 years.

Source: Investor Presentations, Annual Reports, Primary Interviews, Grand View Research

Manufacturers are launching targeted formulations, including antioxidants, vitamins, minerals, and collagen supplements, to meet age-related needs. Higher disposable incomes, health-conscious lifestyles, and wider availability through e-commerce and retail channels further reinforce the aging population as a key market driver.

Growing Demand for Natural and Organic Products

Natural and organic products have become the most sought-after market segment, shaping the direction of the anti-aging supplements market. As more and more customers turn to clean-label, plant-based, and minimally processed formulations, the supplements made from synthetic sources and containing harmful chemicals are losing their appeal. These health-conscious older adults have shifted their preferences toward natural products such as herbs, vitamins, and minerals rather than synthetic alternatives because they are concerned about the side effects of pharmaceuticals and seek preventive, holistic health.

Advances in formulation and extraction technologies have improved the bioavailability and effectiveness of natural ingredients, supporting premium positioning and reinforcing natural and organic products as a key driver of market growth.

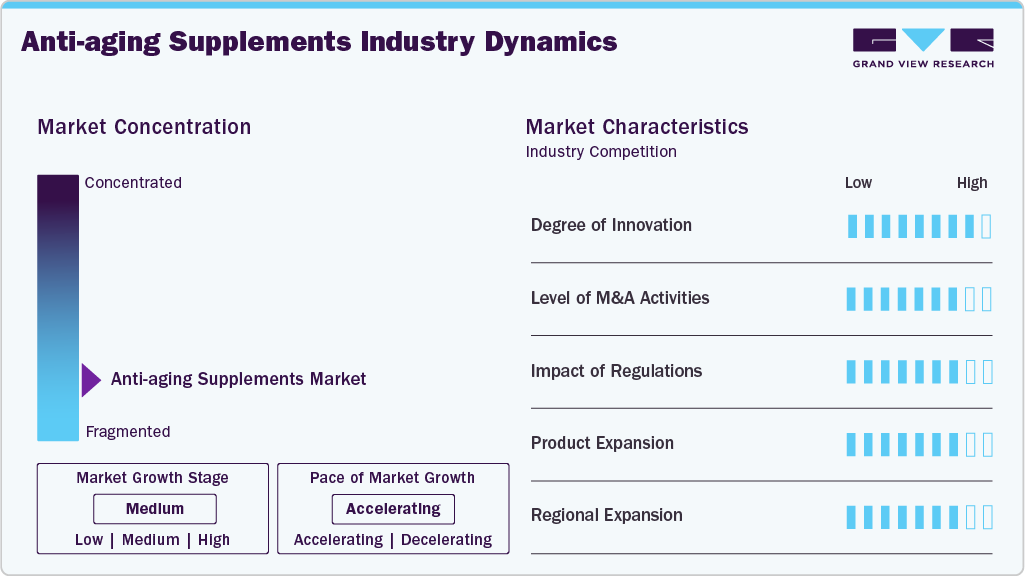

Market Concentration & Characteristics

The anti-aging supplements industry is witnessing a rapid growth phase, supported by the new ingredients and the innovative formulations targeting precise consumer needs. The constant flow of new products is creating a wider array of effective and easy-to-buy products, thus maintaining strong market momentum. For instance, in August 2023, Shaklee introduced Vivix, a gummy anti-aging supplement made with polyphenols to boost cellular defense and guard against cellular damage. These kinds of innovations not only showcase the lively and competitive spirit of the market but also reaffirm its position as a center for advanced and effective anti-aging solutions.

Mergers & acquisition in the anti-aging supplements industry are moderately prevalent, indicating a medium level of strategic engagement. For instance, in March 2024, The Vitamin Shoppe partnered with Pure Encapsulations to expand the availability of Pure Encapsulations’ products across its retail stores and online platforms, strengthening market reach and distribution.

The anti-aging supplements industry is significantly impacted by regulations that control the safety of ingredients, the manner of labeling, and the health claims that are allowed. In addition to the benefits associated with consumer protection and trust that come with the limiting of misleading claims, the regulations also impose a burden of compliance costs, causing delays in product launches and creating high barriers to entering the market, particularly for smaller companies.

Product expansion in the anti-aging supplements industry is driven by rising demand for healthy aging solutions, with companies introducing new ingredients, formulations, and delivery formats. For instance, in March 2024, BIGVITA launched Youth+, a ready-to-drink anti-aging supplement formulated to support cellular health, energy metabolism, and beauty benefits through scientifically researched ingredients.

The anti-aging supplements industry is expanding regionally to reach a wider consumer base, driven by growing awareness of supplement benefits and rising demand for longevity and vitality solutions. This regional expansion is creating new opportunities for market players and supporting overall market growth.

Ingredient Insights

In 2025, the collagen segment accounted for the largest market share of 30.73%, driven by its critical role in supporting skin elasticity, joint health, and overall well-being. Growing consumer awareness and preference for natural, “soft” anti-aging solutions further boosted demand in the anti-aging supplements industry.

The hyaluronic acid segment is projected to experience the fastest CAGR during the forecast period, primarily driven by its strong efficacy in skin hydration, anti-wrinkle benefits, and joint lubrication, along with rising demand for beauty-from-within and preventive anti-aging solutions.

Application Insights

The hair, skin, and nail care segment dominated the anti-aging supplements market in 2025, accounting for 38.88% share, and is expected to register the fastest CAGR over the forecast period. The increasing number of older adults who require care, along with the consumers' growing concern for good appearance and their daily grooming, are the main reasons behind the market's growth. On the other hand, the increasing consumption of vitamins, minerals, and herbal extracts in hair, skin, and nail health supplements is another factor supporting this trend.

The energy and stamina segment is experiencing strong growth, driven by demand for energy and stamina boosting supplements that support vitality and active lifestyles. Consumers are increasingly opting for anti-aging supplements containing adaptogens, vitamins, minerals, and natural ingredients, which are claimed to improve energy levels, stamina, and overall mental and physical performance.

Formulation Insights

The capsule segment dominated the market in 2025 with a share of 35.79%, due to various factors, including convenience, portability, and ease of consumption, capsules provide a hassle-free way for consumers to intake their daily doses of anti-aging supplements, making them a popular choice among health-conscious individuals.

The powder segment is projected to register the fastest CAGR during the forecast period, driven by consumer preference for convenient formats that can be easily mixed with foods or beverages. Product innovations support this trend; for example, in June 2023, Codex Labs expanded its Antü Skin Barrier Support Supplement line, designed to complement its skincare range and strengthen the skin’s protective barrier.

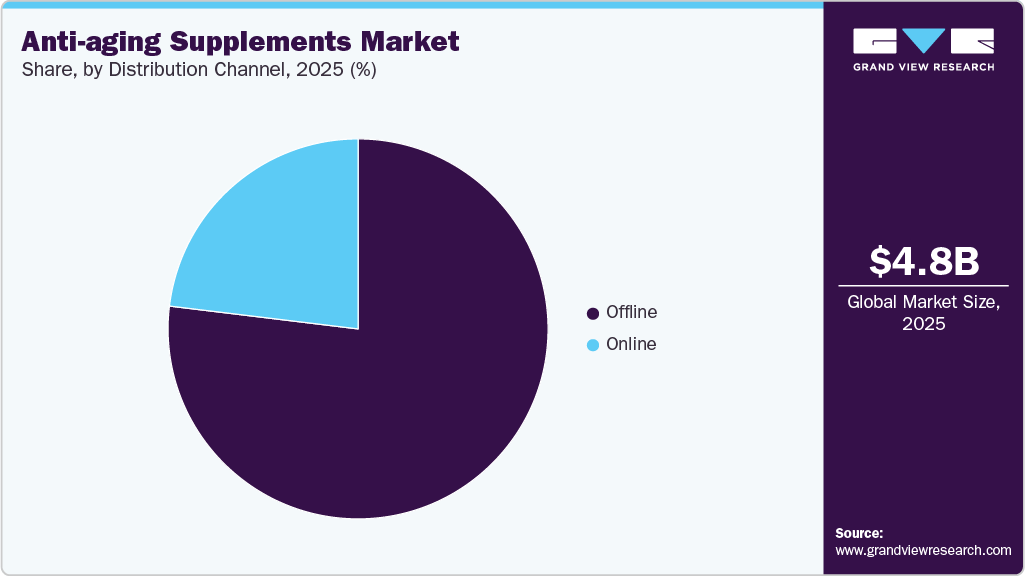

Distribution Channel Insights

In 2025, the offline segment held the largest share of the anti-aging supplements market, owing to the increase in demand and consumer awareness for longevity and wellness products. The pharmacies, health food stores, and specialty shops still attract the consumers by providing in-store promotions, professional support, and personalized recommendations that strengthen the offline channel’s position as a major driver of growth.

The online segment is expected to register the fastest CAGR over the forecast period, driven by the rapid expansion of e-commerce and the convenience of at-home purchasing. The accessibility of product information, reviews, pricing comparison, and the use of digital marketing techniques, together with the rapid move to online shopping after COVID-19, are still the main reasons for the strong growth of anti-aging supplements sales on the internet.

Regional Insights

North America held the largest share of 35.77% of the anti-aging supplements industry in 2025, driven by high health awareness and a growing aging population. Ongoing investments in research and development and the launch of innovative formulations and ingredients have further supported regional market growth.

U.S. Anti-Aging Supplements Market Trends

The U.S. anti-aging supplements market is expected to grow steadily, driven by the expanding aging population and rising demand for vitality and wellness solutions. According to the Population Reference Bureau, the population aged 65 and above is projected to increase from 58 million in 2022 to 82 million by 2050, raising its share of the total population from 17% to 23%, thereby supporting sustained market growth.

Europe Anti-Aging Supplements Market Trends

The Europe anti-aging supplements industry is witnessing growth due to several factors. These include an aging population, increasing health awareness, rising disposable incomes, and advancements in product formulations. In addition, the emphasis on preventive healthcare and the popularity of natural ingredients contribute to the market's expansion across Europe.

The UK anti-aging supplements market held a significant share in 2025, supported by the presence of key local players offering innovative and effective formulations. Strong focus on research and development, along with strategic marketing initiatives, continues to drive market growth and meet evolving consumer needs.

The Germany anti-aging supplements market is thriving, driven by a health-conscious population, advanced healthcare infrastructure, and the availability of high-quality wellness products.

Asia Pacific Anti-Aging Supplements Market Trends

The Asia Pacific anti-aging supplements industry is expected to register the fastest CAGR of 9.40%, driven by a growing aging population and rising demand for healthy aging solutions. By 2050, one in four people in the region will be aged 60 or above, prompting increased investment in research, product development, and marketing tailored to Asian consumers, making the area a key growth market.

The China anti-aging supplements market is growing rapidly, driven by rising health awareness, an aging population, and a shift toward preventive healthcare, supported by advancements in research and technology.

The Japan anti-aging supplements market is growing steadily, driven by a rapidly aging population and rising demand for health and wellness products. With over 10% of the population aged 80+ and nearly 30% aged 65+, the market is expanding to meet diverse age-related needs.

Middle East & Africa Anti-aging Supplements Market Trends

The MEA anti-aging supplements market is experiencing moderate growth, driven by rising health awareness, increasing disposable incomes, and a growing aging population, along with expanding interest in preventive healthcare and beauty-focused nutritional solutions.

The Kuwait anti-aging supplements market is growing steadily, supported by high purchasing power, increasing adoption of premium wellness products, and growing interest in science-backed nutritional solutions for skin health and healthy aging.

Key Anti-aging Supplements Company Insights

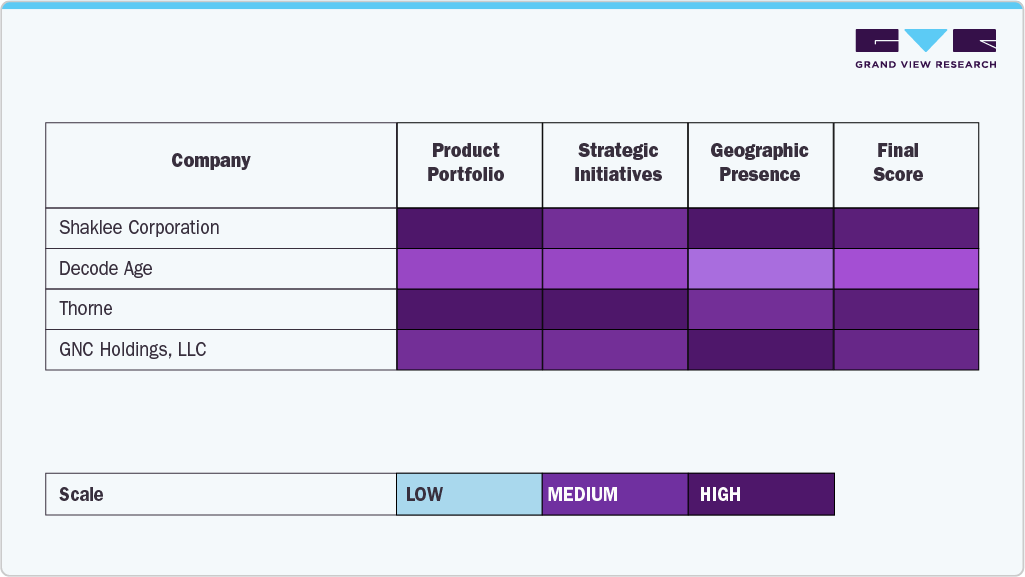

The anti-aging market features a competitive mix of global nutraceutical brands and fast-growing wellness companies, with players such as Shaklee Corporation, GNC Holdings, LLC, Thorne, Life Extension, Nu Skin Enterprises, and ChromaDex, Inc. holding meaningful positions. These companies primarily compete in dietary supplements, functional nutrition, and ingestible beauty segments, leveraging science-backed formulations, clinically studied ingredients, and strong brand credibility. Established global brands benefit from wide distribution networks, including direct-to-consumer, specialty retail, and practitioner-led channels.

Mid-sized and emerging players such as Decode Age, Nutrova, Cureveda, and Oziva are gaining traction by addressing rising demand for clean-label, plant-based, and personalized anti-aging solutions. These companies differentiate through Ayurveda-inspired formulations, bioavailable ingredients, and targeted offerings focused on longevity, cellular health, and skin nutrition. Strong digital marketing capabilities and e-commerce-led distribution enable these brands to rapidly scale in urban and health-conscious consumer segments, particularly across Asia-Pacific and emerging markets.

Overall, market share remains moderately fragmented, with no single player exerting dominance across all anti-aging categories. Competitive intensity is driven by innovation in ingredients such as NAD+ boosters, adaptogens, and antioxidants, as well as increasing consumer preference for preventive and holistic aging solutions. Companies that combine clinical validation, transparent sourcing, and omnichannel distribution are expected to strengthen their competitive positioning and expand market share over the forecast period.

Key Anti-Aging Supplements Companies:

The following are the leading companies in the anti-aging supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Shaklee Corporation

- Decode Age

- Thorne.

- GNC Holdings, LLC

- Life Extension.

- Nu Skin Enterprises

- Nutrova

- Cureveda

- ChromaDex, Inc.

- Oziva

Recent Developments

-

In March 2025, Elysium Health launched Cofactor, a 4-in-1 collagen supplement combining collagen peptides, NR, hyaluronic acid, and vitamin C to support collagen production and address age-related skin and joint health.

-

In February 2024, the heritage brand announced the upcoming launch of its NJHealth NMN 20000mg supplement, developed with patented technology to boost NAD⁺ levels and support healthy aging.

-

In January 2024, Healthy Extracts Inc. launched its LONGEVITY Anti-Aging product, formulated to support skin radiance, arterial flexibility, and cellular and joint health, featuring trans-resveratrol for antioxidant benefits.

-

In January 2024, Watsons Singapore introduced Tru Niagen Immune, a revolutionary formula designed for age transformation and enhancing immunity.

Anti-aging Supplements Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.12 billion

Revenue forecast in 2033

USD 9.06 billion

Growth rate

CAGR of 8.49% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, formulation, application, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Malaysia; Taiwan; Hong Kong; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Shaklee Corporation; Decode Age; Thorne.; GNC Holdings, LLC; Life Extension; Nu Skin Enterprises; Nutrova; Cureveda; ChromaDex, Inc.; Oziva

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Anti-aging Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the anti-aging supplements market on the basis of ingredient, formulation, application, distribution channel, and region:

-

Ingredient Outlook (Revenue, USD Million, 2021 - 2033)

-

Collagen

-

Resveratrol

-

Vitamins

-

Minerals

-

Hyaluronic Acid

-

NMN

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Hair, Skin, and Nail Care

-

Bone and Joint Health

-

Energy and Stamina

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2021 - 2033)

-

Capsules

-

Tablets

-

Powder

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies & Drug Stores

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Malaysia

-

Taiwan

-

Hong Kong

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global anti-aging supplements market size was estimated at USD 4.78 million in 2025 and is expected to reach USD 5.12 million in 2026.

b. The global anti-aging supplements market is expected to grow at a compound annual growth rate of 8.49% from 2026 to 2033 to reach USD 9.06 billion by 2033.

b. Some key players operating in the anti-aging supplements market include Shaklee Corporation; Decode Age; Thorne.; GNC Holdings, LLC; Life Extension.; Nu Skin Enterprises; Nutrova; Cureveda; ChromaDex, Inc.; and Oziva.

b. The market for anti-aging supplements has grown significantly owing to various factors such as increasing consumer awareness about health and wellness, rising elderly population, advancements in nutraceuticals, and growing demand for natural and organic products.

b. On the basis of application, hair, skin & nail care dominated the anti-aging supplements market with a share of 38.88% in 2025. This is attributed to the growing geriatric population and societal emphasis on beauty & grooming across the regions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.