- Home

- »

- Next Generation Technologies

- »

-

Anti-money Laundering Market Size, Industry Report, 2030GVR Report cover

![Anti-money Laundering Market Size, Share, & Trends Report]()

Anti-money Laundering Market Size, Share, & Trends Analysis Report By Component, By Product, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-449-9

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Anti-money Laundering Market Size & Trends

The global anti-money laundering market size was valued at USD 1.51 billion in 2023 and is expected to grow at a CAGR of 16.0% from 2024 to 2030. The growth of the market is driven by increasingly stringent regulations and the need for financial institutions to comply with global standards. Regulatory bodies around the world, such as the Financial Action Task Force (FATF), have been intensifying efforts to combat money laundering and terrorist financing. This regulatory pressure compels financial institutions to adopt advanced anti-money laundering solutions to ensure compliance and avoid substantial penalties. As a result, the demand for robust anti-money laundering solutions has surged, leading to the continuous development and enhancement of technology-driven solutions in this sector. The growing complexity of financial crimes further emphasizes the need for sophisticated tools that can effectively monitor and analyze financial transactions.

The significant growth in online businesses and electronic transactions in recent years has become a major driver of the anti-money laundering market. The rapid expansion of online marketplaces is largely due to the convenience they provide to consumers. Additionally, more financial institutions are introducing innovative online banking services and digital transaction options, which further propel the growth of online commerce. Factors such as digital advancements and the rising popularity of mobile payments are expected to accelerate the adoption of online transactions. Utilizing non-cash transactions helps organizations maintain transparency and effectively monitor any suspicious activities.

Technological advancements are playing a pivotal role in transforming the anti-money laundering landscape. The integration of Artificial Intelligence (AI), machine learning, and big data analytics into anti-money laundering solutions has enhanced the ability of organizations to detect suspicious activities with greater accuracy. These technologies enable financial institutions to analyze large volumes of data in real time, identify patterns, and predict potential risks more effectively. Additionally, automation of routine compliance tasks has reduced operational costs and the occurrence of human errors. This technological shift is driving the adoption of advanced anti-money laundering solutions across various industries, making them more efficient in combating financial crimes.

Digital transformation within the financial services sector has also contributed to the growing importance of anti-money laundering systems. For instance, as per the insights of Worldmetrics.org. in 2024, 67% of financial institutions consider digital transformation essential for their survival. As more transactions move online, the volume and complexity of financial activities have increased, creating new challenges for detecting and preventing money laundering. Additionally, the rise of digital banking, mobile payments, and cryptocurrencies has expanded the landscape in which financial crimes can occur. This evolution necessitates advanced anti-money laundering systems that can monitor and analyze digital transactions across multiple platforms and jurisdictions. Consequently, financial institutions are increasingly investing in cutting-edge AML technologies to stay ahead of evolving threats in the digital era.

Globalization and the rise in cross-border transactions have made the fight against money laundering even more complex. Financial activities that span multiple countries often involve different regulatory environments, making it challenging to maintain consistent compliance. Anti-money laundering solutions must now be capable of handling the intricacies of cross-border financial flows while ensuring adherence to diverse regulatory frameworks. This need for comprehensive and versatile anti-money laundering systems is driving innovation in the market, as providers seek to offer solutions that can effectively address the demands of global finance, thereby contributing to the growth of the market.

Component Insights

Based on component, the software segment led the market and accounted for 63.1% of the global revenue in 2023. The segment growth can be attributed to an increase in demand for anti-money laundering software among banks and payment solution providers. The software helps to detect suspicious activities and reduce the number of genuine transaction declines. Advanced technologies such as artificial intelligence, machine learning, and big data analytics are being integrated into anti-money laundering software, enabling real-time analysis of vast amounts of data. These innovations are not only improving the effectiveness of anti-money laundering programs but also reducing the operational costs associated with manual compliance efforts.

The services segment is expected to register significant growth from 2024 to 2030. The services segment in the anti-money laundering market is gaining traction as financial institutions seek expert guidance and support to navigate the complexities of AML compliance. Several companies across the globe are focusing on developing and launching AI-powered anti-money laundering services to help banks eliminate anti-money laundering risks. For instance, in April 2024, Oracle launched an AI-powered cloud service, the Oracle Financial Services Compliance Agent, designed to help banks eliminate anti-money laundering (AML) risks more efficiently. The service enables banks to conduct scenario testing, identify suspicious activities, and optimize their transaction monitoring systems. This tool leverages artificial intelligence and machine learning to enhance the effectiveness of AML programs, reducing costs and improving decision-making.

Product Insights

The transaction monitoring segment accounted for the largest market revenue share in 2023. The growth of the segment can be attributed to the rising financial crimes, which necessitates advanced monitoring systems capable of analyzing vast volumes of transactions in real-time. Regulatory pressure from global and regional authorities is also pushing financial institutions to adopt more robust transaction monitoring tools to ensure compliance and avoid hefty fines. At the same, companies across the globe are developing AML solutions to focus and prevent high-risk activities. For instance, in October 2023, WorkFusion launched a new AI solution, Isaac, designed to enhance AML transaction monitoring by automating the first-level alert review process. Isaac utilizes machine learning to assess alerts, auto-escalate those requiring further investigation, and close non-suspicious alerts with supporting documentation. This innovation reduced the burden on AML analysts, allowing them to focus on higher-risk activities.

The customer identity management segment is expected to grow significantly from 2024 to 2030. The growth of the segment can be attributed to the rising importance of robust Know Your Customer (KYC) processes in the fight against money laundering. Financial institutions are increasingly adopting customer identity management solutions to verify the identities of their clients, ensuring that they are not inadvertently facilitating illicit activities. The surge in digital banking and online transactions has heightened the need for accurate and efficient identity verification processes. Advanced technologies, such as biometric authentication and AI-driven identity verification, are being integrated into these solutions to enhance their accuracy and reliability.

Deployment Insights

The on-premise segment accounted for the largest market revenue share in 2023. The on-premise segment of the anti-money laundering market remains crucial for organizations that prioritize control and security over their compliance systems. Many institutions prefer on-premise solutions due to their ability to customize and integrate with existing IT infrastructure, providing greater control over data security and regulatory compliance. On-premise anti-money laundering systems offer the advantage of being tailored to specific organizational needs, allowing for more rigorous and specialized compliance processes.

The cloud segment is expected to grow significantly from 2024 to 2030. The cloud segment of the anti-money laundering market is experiencing rapid growth due to its flexibility, scalability, and cost-effectiveness. Cloud-based anti-money laundering solutions offer organizations the advantage of easier updates and integrations, reducing the burden of maintaining and upgrading on-premise systems. These solutions enable financial institutions to access advanced features and technologies, such as artificial intelligence and real-time data analytics, without the need for extensive infrastructure investments. The rise of remote work and the increasing adoption of digital banking services have further accelerated the shift towards cloud-based AML solutions.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2023. Large enterprises are increasingly prioritizing anti-money laundering (AML) measures due to the heightened regulatory scrutiny they face globally. With vast and complex operations, these organizations are vulnerable to sophisticated money laundering schemes, making robust AML systems essential. The adoption of advanced technologies such as AI and machine learning is becoming common among large enterprises to detect and prevent illicit activities more efficiently.

The small & medium enterprises segment is expected to grow significantly from 2024 to 2030. Although small & medium enterprises often have fewer resources compared to large enterprises, they are adopting cost-effective and scalable AML solutions to address their unique challenges. The rise of cloud-based AML platforms is particularly beneficial for SMEs, enabling them to implement sophisticated monitoring systems without the need for substantial infrastructure investments. Additionally, small & medium enterprises are becoming more aware of the reputational risks associated with non-compliance, driving them to prioritize anti-money laundering measures.

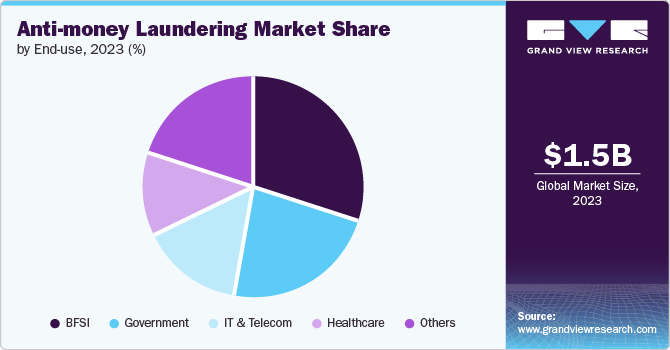

End-use Insights

The BFSI segment accounted for the largest market revenue share in 2023. High fines imposed on banks for violating anti-money laundering laws are expected to drive the growth of the segment. With these penalties being potentially crippling, banks are now placing a greater emphasis on investing in advanced technologies and systems that can better detect and prevent money laundering activities. The risk of significant financial loss and damage to reputation is driving banks to improve their compliance strategies, making this a priority in their operations. This shift is anticipated to fuel growth in the anti-money laundering market, as banks around the world seek to upgrade their systems to prevent regulatory breaches.

The government segment is expected to grow significantly from 2024 to 2030. Anti-money laundering software is widely used by government bodies to reduce tax abuses, corruption, cybercrimes, foreign and domestic terrorist financing, human trafficking, and other crimes. Anti-money laundering solutions enable government agencies to detect, monitor, and investigate suspicious financial transactions, thereby reducing the risk of these activities occurring within the public sector. By implementing robust anti-money laundering frameworks, governments can enhance transparency and trust in public institutions, ensuring that taxpayer funds are used appropriately and that the financial system is protected from abuse.

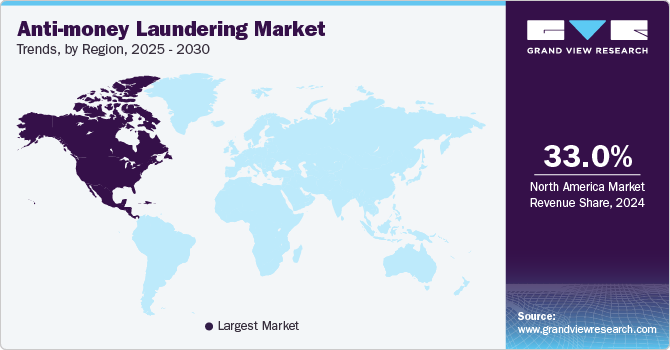

Regional Insights

North America anti-money laundering market dominated the global market and accounted for 29.2% in 2023. North America holds the largest share in the anti-money laundering (AML) market due to its stringent regulatory environment and the strong enforcement of anti-money laundering laws. The region is home to major financial institutions that are required to comply with complex regulations, driving demand for advanced anti-money laundering solutions. Additionally, North America has a high level of investment in cutting-edge technologies, such as AI and machine learning, which are integral to modern anti-money laundering systems. The presence of well-established financial hubs, along with the increasing volume of financial transactions, further contributes to the region's dominant position in the anti-money laundering market.

U.S. Anti-money Laundering Market Trends

The U.S. anti-money laundering market is anticipated to register significant growth from 2024 to 2030. According to the 2024 Money Laundering and Financial Crime Report, the U.S. recorded a total of 11,472 anti-money laundering events, highlighting the growing need for robust anti-money laundering solutions. This surge in anti-money laundering incidents underscores the importance of implementing sophisticated systems to effectively address and mitigate financial crimes across the country.

Asia Pacific Anti-money Laundering Market Trends

The Asia Pacific anti-money laundering market is anticipated to register significant growth from 2024 to 2030. The expansion of financial services and the rise in cross-border transactions in Asia Pacific are further fueling the demand for advanced AML solutions. Additionally, the region's rapid economic growth and the modernization of its financial systems are contributing to the increased focus on AML compliance. As regulatory oversight intensifies, Asia Pacific's AML market is expected to experience substantial growth in the coming years.

Europe Anti-money Laundering Market Trends

The European anti-money laundering market is poised for significant growth from 2024 to 2030. The European Union has implemented stringent directives, such as the Anti-Money Laundering Directive (AMLD), which mandates comprehensive anti-money laundering measures across member states. European financial institutions are investing in advanced anti-money laundering solutions to meet these regulatory demands and avoid substantial penalties. Additionally, the region’s diverse and interconnected financial landscape requires robust systems to monitor cross-border transactions effectively. As a result, Europe's commitment to maintaining financial integrity and transparency is driving the growth of its anti-money laundering market.

Key Anti-money Laundering Company Insights

Businesses are primarily focusing on offering on-premise software solutions to enterprises owing to security-related benefits. Moreover, the on-premise anti-money laundering solutions help businesses enhance their security level and thereby improve the satisfaction level of their customers.

Product launches are the new strategies adopted by the market players to expand their anti-money laundering offerings. This has helped businesses to develop efficient products and expand their sales across different geographies. For instance, in June 2023, Google Cloud launched an AI-powered Anti Money Laundering (AML) product designed to help financial institutions detect money laundering efficiently. The AML AI system utilized machine learning to enhance risk detection, reduce operational costs, and improve compliance by minimizing false positives. HSBC, one of the early adopters, reported detecting 2-4 times more suspicious activities while reducing alert volumes by over 60%. The product was implemented across various global jurisdictions, offering benefits such as increased accuracy and reduced investigation time.

Key Anti-money Laundering Companies:

The following are the leading companies in the anti-money laundering market. These companies collectively hold the largest market share and dictate industry trends.

- NICE Actimize

- Cognizant Technology Solutions Corporation

- Tata Consultancy Services Limited

- SAS Institute, Inc.

- ACI Worldwide, Inc.

- Oracle Corporation

- Fiserv, Inc.

- Accenture

- BAE Systems

- Experian Information Solutions, Inc.

- Open Text Corporation

Anti-money Laundering Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.74 billion

Revenue forecast in 2030

USD 4.24 billion

Growth rate

CAGR of 16.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, product, deployment, enterprise size, end-use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa

Key companies profiled

NICE Actimize, Tata Consultancy Services Limited, Cognizant Technology Solutions Corporation, ACI Worldwide, Inc., SAS Institute, Inc., Fiserv, Inc., Oracle Corporation, BAE Systems, Accenture, Open Text Corporation, and Experian Information Solutions, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-money Laundering Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the anti-money laundering market based on component, product, deployment, enterprise size, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Compliance Management

-

Currency Transaction Reporting

-

Customer Identity Management

-

Transaction Monitoring

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global anti-money laundering market size was estimated at USD 1.51 billion in 2023 and is expected to reach USD 1.74 billion in 2024.

b. The global anti-money laundering market is expected to grow at a compound annual growth rate of 16.0% from 2024 to 2030 to reach USD 4.24 billion by 2030.

b. North America dominated the anti-money laundering market with a share of 29.2% in 2023. This is attributable to increased illegal activities that facilitate the use of cash for drugs, human smuggling/trafficking, and corruption in the U.S.

b. Some key players operating in the anti-money laundering market include NICE Actimize; Tata Consultancy Services Limited; Cognizant Technology Solutions Corporation; ACI Worldwide, Inc.; SAS Institute, Inc.; Fiserv, Inc.; Oracle Corporation; BAE Systems; Accenture; Open Text Corporation; and Experian Information Solutions, Inc.

b. Key factors that are driving the anti-money laundering market growth include a growing volume of non-cash transactions, stringent government compliance, and growth of advanced analytics to identify threat patterns.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."