- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Anti-reflective Coatings Market Size, Industry Report, 2030GVR Report cover

![Anti-reflective Coatings Market Size, Share & Trends Report]()

Anti-reflective Coatings Market Size, Share & Trends Analysis Report By Technology (Electron Beam Evaporation, Sputtering), By Application (Eyewear, Electronics, Solar), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-369-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Anti-reflective Coatings Market Trends

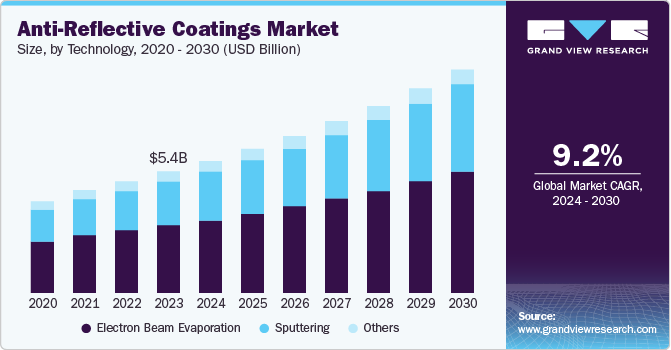

The global anti-reflective coatings market size was valued at USD 5.40 billion in 2023 and is projected to grow at a CAGR of 9.2% over the forecast period from 2024 to 2030. The rising demand for anti-reflective coating for manufacturing lenses and glasses, the rising adoption of high transmitting anti-reflective glasses in the construction industry, and rising demand from solar power generation and telecommunications are the factors driving the anti-reflective coatings market.

The increasing prevalence of vision impairments and the aging population are resulting in a significant boost in demand for anti-reflective coatings in eyewear. A Cleveland Clinic study reveals that 50%-90% of computer users experience symptoms indicative of Computer Vision Syndrome (CVS), including eye strain, headaches, and vision impairment. These coatings enhance visual clarity, reduce glare from screens, and improve comfort for users, making them increasingly popular among consumers. As a result, the eyewear sector is a major contributor to market growth, as anti-reflective coatings are essential for high-transmitting lenses and comfortable eyewear solutions.

Another significant driver of the market is the rising demand for anti-reflective coatings in the solar power generation industry. These coatings are applied to solar panels to minimize light reflection, thereby enhancing light transmission and overall efficiency. As global efforts to adopt renewable energy sources increase, the demand for solar panels-and consequently, anti-reflective coatings-continues to rise, presenting growth opportunities for the market. Furthermore, technological advancements in coating technologies are fostering innovation and expanding the application scope of anti-reflective coatings.

In addition, environmental regulations are playing a crucial role in driving the market. Stricter environmental regulations are encouraging industries to adopt sustainable solutions, and anti-reflective coatings contribute to energy efficiency by enhancing the performance of solar panels and reducing energy consumption in electronic devices. This alignment with environmental goals is encouraging the adoption of these coatings across multiple sectors.

Technology Insights

Electron beam evaporation dominated the market and accounted for a share of 55.6% in 2023 due to its capacity to create intricate multi-layer coatings. The electron beam evaporation technique is widely adopted in the anti-reflective coatings market due to its advantages, including high purity and quality, rapid deposition rates, versatility in material application, precise control and precision, and environmental considerations.

Sputtering technology is expected to register the fastest CAGR of 10.3% over the forecast period. The sputtering technique is a prominent choice due to its exceptional precision and control over coating thickness, yielding superior optical performance and durability. Its versatility in coating various substrates, combined with its efficiency, has led to its dominant usage in industries such as electronics, optics, and automotive.

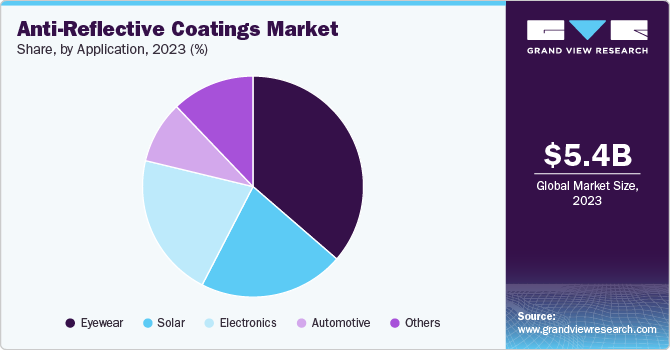

Application Insights

Eyewear accounted for the largest market revenue share of 36.4% in 2023 due to rise in demand for progressive lenses and rise in presbyopia cases. Anti-glare lenses and coatings are increasingly used to reduce screen reflections and enhance visual awareness, particularly in the eyewear industry. As vision impairments rise, demand for improved visual comfort grows, driving market expansion.

The solar segment is anticipated to register the fastest CAGR of 12.1% over the forecast period. Anti-glare coatings enhance light absorption and improve efficiency in solar panels. As the world transitions to sustainable energy sources and solar technology advances, the need for anti-reflective coatings is increasing. By minimizing light reflection, these coatings boost energy conversion, improving efficiency and economic viability, making solar technology more appealing and driving market growth.

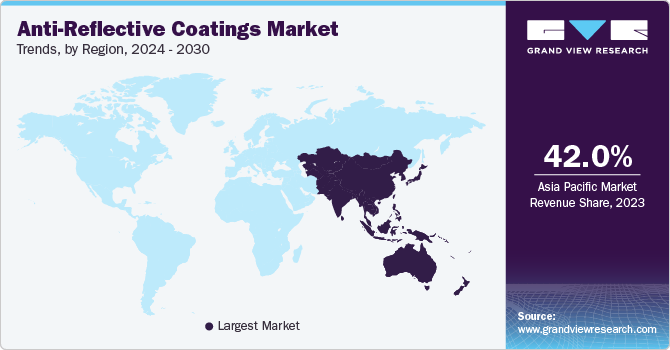

Regional Insights

The Asia Pacific anti-reflective coatings market dominated the global anti-reflective coatings market with a revenue share of 42.0% in 2023. The region is experiencing economic growth, urbanization, and industrialization, driving consumer purchasing power. Strong demand for electronic devices, such as smartphones and LED TVs, and the growing automotive industry support the demand for anti-reflective coatings. The region’s increasing focus on renewable energy sources, particularly solar energy, presents a significant growth opportunity.

Anti-reflective coatings market in China held a substantial market share in 2023. China is the world’s largest electronics manufacturing hub, producing a vast array of products including smartphones, TVs, laptops, and gaming consoles. The country not only meets its domestic demand but also exports electronic products to international markets, driving significant growth in the electronics industry.

North America Anti-reflective Coatings Market Trends

North America anti-reflective coatings market accounted for a substantial share in the global anti-reflective coatings market in 2023, aided by technological advancements, a strong focus on innovation, and high disposable income. The region’s robust infrastructure and advanced manufacturing capabilities contributed to its dominant position. Its emphasis on enhancing visual experiences and applying anti-reflective coatings across various applications solidified its presence in the global market.

U.S. Anti-reflective Coatings Market Trends

Anti-reflective coatings market in the U.S. dominated the North America anti-reflective coatings market with a share of 83.2% in 2023. The growth of advanced driver assistance systems (ADAS) and augmented reality displays in vehicles is driving demand for anti-reflective coatings on windshields and display screens. Furthermore, the increasing adoption of solar energy to combat climate change is fueling demand for anti-reflective coatings to enhance solar panel efficiency.

Europe Anti-reflective Coatings Market Trends

Europe anti-reflective coatings market was identified as a lucrative region in 2023. Consumers in the European market have increasingly prioritized health and wellness, driving demand for eyewear that safeguards their eyes, including anti-reflective coatings. As people increasingly use digital devices, eye strain is a growing concern, prompting consumers to seek anti-reflective coatings for these devices. Advances in thin-film deposition technologies enable the development of stronger and more effective anti-reflection coatings.

Anti-reflective coatings market in the UK is expected to grow rapidly in the coming years. The country’s aging population is experiencing a surge in eye disorders, while the populace prioritizes fashion and technology. As a result, there is a high demand for anti-reflective coatings in eyewear. With the UK’s strong emphasis on innovation and technology, anti-glare coatings are essential for electronic devices, including smartphones, tablets, and laptops.

Key Anti-reflective Coatings Company Insights

Some key companies in the anti-reflective coatings market include NiPro optics; Carl Zeiss AG; Andover Corporation; EssilorLuxottica; Honeywell International Inc; and others. Market players are developing advanced data analytics and event-streaming capabilities to enhance commercial applications, and collaborating with start-ups.

-

PPG Industries, Inc. is a producer of paints, coatings, optical products, and specialty materials. The company offers protective and decorative coatings, sealants, and silicas, serving diverse end-use markets such as industrial equipment, packaging, aerospace, automotive, and consumer products.

-

Andover Corporation is a manufacturer of optical filters and coatings, offering custom-made solutions with automated coating, glass polishing, and fabrication capabilities. The company’s comprehensive testing facilities include advanced spectrophotometers for precise spectral measurements, ensuring high-quality products.

Key Anti-Reflective Coatings Companies:

The following are the leading companies in the anti-reflective coatings market. These companies collectively hold the largest market share and dictate industry trends.

- NiPro optics

- Carl Zeiss AG

- Andover Corporation

- EssilorLuxottica

- Honeywell International Inc

- PPG Industries, Inc.

- DuPont

- Nippon Sheet Glass Co., Ltd

- Merck KGaA

- HOYA

- Applied Materials, Inc.

Recent Developments

-

In July 2024, EssilorLuxottica acquired Optical Investment Group, a Romanian optical retailer, expanding its presence in the region and enhancing access to high-quality vision care worldwide.

-

In May 2024, PPG Industries, Inc. allocated USD 300 million towards advanced manufacturing in constructing a new facility in Loudon County, Tennessee, to meet the demand for paints and coatings in the automotive sector.

-

In September 2023, HOYA Vision Care introduced Super HiVision Meiryo EX4, a premium lens coating, offering exceptional patient benefits, including scratch resistance, durability, and clarity.

Anti-reflective Coatings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.88 billion

Revenue forecast in 2030

USD 9.96 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

NiPro optics; Carl Zeiss AG; Andover Corporation; EssilorLuxottica; Honeywell International Inc; PPG Industries, Inc.; DuPont; Nippon Sheet Glass Co., Ltd; Merck KGaA; HOYA; Applied Materials, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-reflective Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-reflective coatings market report based on technology, application, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Electron Beam Evaporation

-

Sputtering

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Eyewear

-

Electronics

-

Solar

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."