- Home

- »

- Pharmaceuticals

- »

-

Anti-vascular Endothelial Growth Factor Therapeutics Market, 2030GVR Report cover

![Anti-vascular Endothelial Growth Factor Therapeutics Market Size, Share & Trends Report]()

Anti-vascular Endothelial Growth Factor Therapeutics Market Size, Share & Trends Analysis Report By Product (Eylea, Lucentis, Beovu), By Disease (Macular Edema, Diabetic Retinopathy, Retinal Vein Occlusion), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-346-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

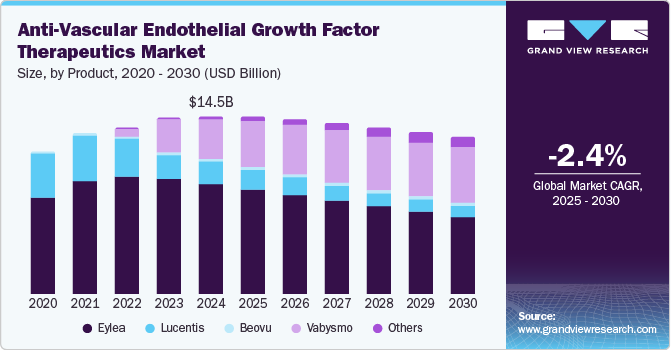

The global anti-vascular endothelial growth factor therapeutics market size was valued at USD 14.54 billion in 2024 and is anticipated to decline at a CAGR of -2.35% from 2025 to 2030. The emergence of biosimilars in the market is contributing to a significant decline in revenue. As these lower-cost alternatives gain approval, they enhance competition, prompting healthcare providers to favor them over branded therapies. This shift is exacerbated by the increasing pipeline of biosimilars targeting established anti-vascular endothelial growth factor (anti-VEGF) treatments, which pressures pricing and reduces market share for original products. Consequently, the presence of biosimilars is causing a decrease in the overall value of the anti-VEGF therapeutics market as patient access expands, but profitability for traditional therapies diminishes.

The anti-VEGF therapeutics industry has witnessed considerable advancements in drug delivery and development, driven by the need to improve efficacy, safety, and patient compliance. The core objective of anti-VEGF therapy is to inhibit angiogenesis, which plays a pivotal role in conditions such as age-related macular degeneration (AMD), diabetic retinopathy, and certain cancers. The recent innovations in this market are not only enhancing treatment outcomes but also revolutionizing how these therapies are administered, offering significant implications for healthcare providers and pharmaceutical companies.

Awareness campaigns initiated by healthcare organizations, patient advocacy groups, and educational institutions have played a critical role in highlighting the importance of regular eye examinations and prompt intervention. In July 2024, the Mary Tyler Moore Vision Initiative launched its inaugural public service announcement (PSA) campaign, featuring narration by Academy Award-winning actor Kevin Kline. The campaign also includes contributions from notable figures such as Oprah Winfrey, Julia Louis-Dreyfus, and Reese Witherspoon. Such initiatives aim to raise awareness about the importance of funding medical research focused on finding a cure for diabetic retinal disease, a condition that impacted Moore during the later years of her life. This shift in focus has not only facilitated earlier detection but also enhanced treatment outcomes, thus fostering a greater demand for anti-VEGF therapies.

However, despite the therapeutic benefits, these anti-VEGF agents are associated with a range of potential side effects and safety concerns that warrant careful consideration from healthcare providers and patients, such as blurry vision, eye pain, increased ocular pressure, including other severe allergic reactions. For instance, in July 2024, Roche's eye implant, Susvimo, designed to deliver continuous doses of Lucentis, encountered a market suspension in 2022 due to manufacturing complications. Moreover, the potential for adverse events increases with the duration of therapy. Long-term use of anti-VEGF agents may lead to cumulative toxicities, raising concerns about their safety in chronic conditions that require extended treatment periods which is anticipated to impact the market growth negatively in the forecast period.

Product Insights

Eylea dominated the product segment with the largest market share of 61.9% in 2024. Eylea (aflibercept), developed by Regeneron Pharmaceuticals in collaboration with Bayer, has been a foremost anti-VEGF therapy for treating retinal diseases such as wet age-related macular degeneration (AMD), diabetic macular edema (DME), and retinal vein occlusion (RVO). Its proven effectiveness in stabilizing vision has notably driven its market traction. For instance, in October 2024, Regeneron Pharmaceuticals, Inc. expanded the availability of Eylea (aflibercept), with approval in the U.S. for a higher dose regimen that offers more convenient dosing intervals. However, as the anti-VEGF therapeutics market becomes increasingly competitive, EYLEA’s growth is anticipated to witness challenges due to rising competition and market saturation.

The others segment, which includes biosimilars and pipeline therapies, is expected to grow at a significant CAGR of 19.7% over the forecast period. Biosimilars are increasingly used to treat conditions such as neovascular age-related macular degeneration (nAMD) and diabetic macular edema (DME), which are the leading causes of vision loss worldwide. The rise in biosimilar adoption is fueled by cost-effectiveness and expanded patient access in various regions, notably within emerging markets, where cost constraints often limit access to innovative biologics. Recent trends indicate steady market expansion for biosimilars as healthcare providers and systems seek alternative, affordable treatment options.

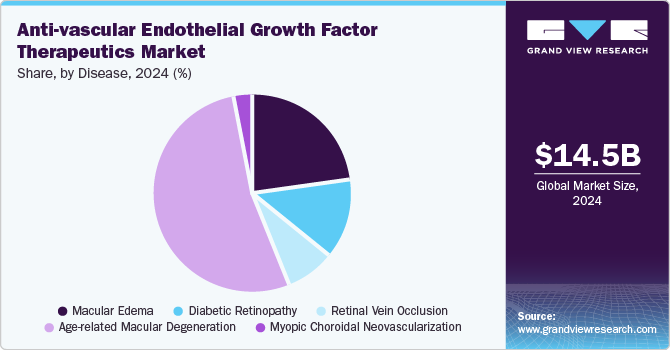

Disease Insights

Age-related Macular Degeneration dominated the anti-VEGF therapeutics market with the largest share of 52.8% in 2024, driven by rising disease prevalence, advancements in drug formulations, and expanding access to healthcare. AMD is one of the primary causes of vision loss in older adults, marked by the degeneration of the macula which is essential for central vision. This disease affects millions globally, with the prevalence estimated at approximately 8.7% in adults aged 45 and older and significantly higher rates in those over 75. According to the study titled "Age-Related Macular Degeneration: Epidemiology, Pathophysiology, Diagnosis, and Treatment," published in Cureus in September 2022, it is projected that nearly 5.4 million Americans will have AMD by 2050. The study also stated that AMD affects approximately 200 million people worldwide, with projections reaching nearly 300 million by 2040. Thus, the increasing prevalence of AMD is a major driver for the segment’s growth.

Macular Edema held the second-largest share in 2024. The segment for anti-VEGF therapeutics in macular edema is witnessing an upward trajectory as cases of DME and RVO increase globally. The growing incidence of diabetes and related complications drives demand for effective treatments. Anti-VEGF agents are instrumental in delaying disease progression, improving vision quality, and lowering the long-term care burden. Notable companies capitalize on this growth potential with product launches, approvals, and M&A activities. Regeneron Pharmaceuticals, Inc. (October 2024), for instance, expanded the availability of Eylea (aflibercept), an anti-VEGF therapy, with approval in the U.S. for a higher dose regimen that offers more convenient dosing intervals

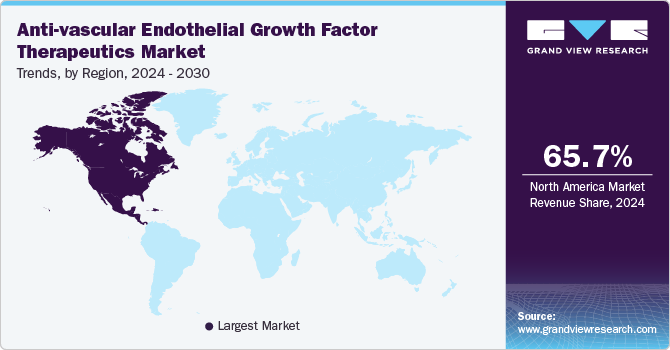

Regional Insights

North America anti-vascular endothelial growth factor therapeutics market dominated the global industry and accounted for 65.71% of revenue share in 2024, which can be attributed to the increasing prevalence of eye-related conditions such as age-related macular degeneration (AMD), diabetic retinopathy, retinal vein occlusion, and macular edema. Key companies in the region are engaged in strategic collaborations and product enhancements to address evolving patient needs and maintain their competitive positions. For instance, in August 2023, the U.S. FDA approved Eylea HD (aflibercept), a high-dose version of the original Eylea developed by Regeneron Pharmaceuticals and Bayer AG. Additionally, increased healthcare spending and investments in the biotechnology sector are attributed to emerging biosimilars to offer more affordable options in anti-VEGF therapies.

U.S. Anti-vascular Endothelial Growth Factor Therapeutics Market Trends

The anti-vascular endothelial growth factor therapeutics market in the U.S. held a significant share of the regional industry in 2024, driven by advancements in research and development by players such as Biogen, Amgen, and F. Hoffmann-La Roche. Moreover, partnerships and acquisitions among major players, such as Pfizer, Inc., Bausch Health Companies, Inc., and Viatris, Inc., are reshaping the competitive landscape as companies seek to expand their product portfolios and gain a foothold in this high-value market. For instance, in January 2023, Coherus BioSciences announced an agreement to acquire exclusive U.S. commercial rights to FYB203, a biosimilar candidate for Eylea (aflibercept) from Klinge Biopharma.

Europe Anti-vascular Endothelial Growth Factor Therapeutics Market Trends

The anti-vascular endothelial growth factor therapeutics market in Europe is driven by an aging population and increasing prevalence of vision-related diseases such as age-related macular degeneration (AMD), diabetic retinopathy, macular edema, and retinal vein occlusion. Advancements in drug delivery systems, such as longer-acting injectables and sustained-release implants, are expected to boost the regional market. For instance, in September 2024, Regeneron Pharmaceuticals, Inc. shared new analyses of EYLEA HD (aflibercept) and EYLEA (aflibercept) injections of 8mg and 2 mg at the Annual Meeting of the European Society of Retina Specialists (EURETINA), held in Barcelona from September 19-22, 2024.

The UK anti-vascular endothelial growth factor therapeutics market is driven by an increasing prevalence of ocular conditions such as age-related macular degeneration (AMD), diabetic retinopathy, macular edema, and retinal vein occlusion. In addition, regulatory approvals in the region assist in providing new treatments to patients in less time and contribute to revenue generation. For instance, in January 2024, the UK Medicines and Healthcare Products Regulatory Agency (MHRA) approved Bayer's Eylea 8mg (aflibercept) for the treatment of neovascular (wet) age-related macular degeneration (nAMD) and visual impairment associated with diabetic macular edema (DMO).

The anti-vascular endothelial growth factor therapeutics market in Germany is influenced by developments in treatments of eye diseases such as, diabetic macular edema (DME). For instance, a study published in SAGE Journal highlights that in 2022, the prevalence of clinically significant DME in Germany ranged from 1% to 1.4%, with an estimated 160,000 patients newly diagnosed with diabetic eye disease each year.

Asia Pacific Anti-vascular Endothelial Growth Factor Therapeutics Market Trends

The anti-vascular endothelial growth factor therapeutics market in Asia Pacificis influenced by the growing healthcare reforms in the region aided by improved healthcare infrastructure, a growing population, and an increase in the number of companies entering the market. Age-related diseases, especially age-related macular degeneration (AMD), diabetic retinopathy (DR), macular edema, and retinal vein occlusion (RVO), are growing concerns as the population ages and diabetes prevalence increases in this region.

Japan anti-vascular endothelial growth factor therapeutics market is influenced by the rapidly aging population. A scientific report published in Japan in November 2023 noted that 10 million people in the country are affected by diabetes mellitus (DM), with 3 million experiencing diabetic retinopathy (DR). DR is the third leading cause of visual impairment, accounting for 12.8% of visual disorders. Japan being the hub for the highest proportion of the elderly population in the world, significantly impacts the market.

Latin America Anti-vascular Endothelial Growth Factor Therapeutics Market Trends

The anti-vascular endothelial growth factor therapeutics market in Latin America exhibits high growth potential due to the expanding healthcare infrastructure and increased awareness of chronic eye conditions among aging populations.

The Brazil anti-vascular endothelial growth factor therapeutics industry exhibits a growing demand for advanced ophthalmic solutions, particularly for diseases such as diabetic macular edema and retinal vein occlusion. The increasing prevalence of ophthalmic diseases fuels the demand for such treatments and further contributes to market growth. For instance, a study published in BMC Ophthalmology in December 2021 found that age-related macular degeneration (AMD) prevalence in Brazil rises significantly with age: from 1.5% to 16.7% in individuals aged 50 and older, reaching 15.1% in those over 60, and climbing to 31.5% among those 80 and older.

Middle East and Africa Anti-vascular Endothelial Growth Factor Therapeutics Market Trends

The anti-vascular endothelial growth factor therapeutics market in the Middle East and Africa is driven by the increasing prevalence of retinal conditions such as diabetic retinopathy (DR) and age-related macular degeneration (AMD), especially in urban areas with rising diabetes rates. According to the World Health Organization (WHO), an estimated 26.3 million population in the African Region experience some level of visual loss. Among them, approximately 20.4 million have low vision, while about 5.9 million are affected by blindness. Africa is home to around 15.3% of the global population living with blindness.

Saudi Arabia anti-vascular endothelial growth factor therapeutics market is largely supported by the government’s steady commitment to healthcare modernization under Vision 2030. With a rising burden of age-related and diabetes-induced retinal disorders, Saudi Arabia has seen significant demand for anti-VEGF drugs. A 2023 study published by NCBI reported that in Saudi Arabia, diabetic retinopathy (DR) affects between 28.1% and 45.7% of individuals with diabetes. Among these, vision-threatening DR is present in approximately 4.5% to 17.5% of diabetic patients, which increases the need for effective anti-VEGF therapies.

Key Anti-vascular Endothelial Growth Factor Therapeutics Company Insights

The market is highly competitive due to several strategic initiatives, such as new product launches, mergers and acquisitions, and regional expansion, undertaken by key market players to increase their global footprints. Companies are diversifying their product portfolios to address a broader range of applications.

Key Anti-vascular Endothelial Growth Factor Therapeutics Companies:

The following are the leading companies in the anti-vascular endothelial growth factor therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Regeneron Pharmaceuticals, Inc.

- Bayer AG

- Novartis AG

- F. Hoffmann-La Roche Ltd.

- Biogen

- Pfizer, Inc.

- Coherus BioSciences, Inc.

- Amgen, Inc.

- Bausch Health Companies, Inc.

- Viatris, Inc.

View a comprehensive list of companies in the Anti-vascular Endothelial Growth Factor Therapeutics Market

Recent Developments

-

In July 2024, Genentech, a member of the Roche Group, announced promising two-year Phase III data for Susvimo (ranibizumab injection), presented at the ASRS 2024 Annual Meeting. The results demonstrate Susvimo's sustained efficacy in treating diabetic macular edema (DME) and diabetic retinopathy (DR).

-

In March 2024, Roche launched Vabysmo (faricimab), the first bispecific monoclonal antibody for treating neovascular age-related macular degeneration (nAMD) and diabetic macular edema (DME). Vabysmo targets both angiopoietin-2 and vascular endothelial growth factor-A, restoring vascular stability.

-

In August 2023, Regeneron Pharmaceuticals announced that the FDA approved its EYLEA HD (aflibercept) 8 mg to treat wet age-related macular degeneration (wAMD) and diabetic macular edema (DME).

Anti-vascular Endothelial Growth Factor Therapeutics Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 14.53 billion

The revenue forecast in 2030

USD 12.90 billion

Growth rate

CAGR of -2.35% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, disease, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Regeneron Pharmaceuticals, Inc., Bayer AG, Novartis AG, F. Hoffmann-La Roche Ltd., Biogen, Pfizer, Inc., Coherus BioSciences, Inc., Amgen, Inc., Bausch Health Companies, Inc., Viatris, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Anti-vascular Endothelial Growth Factor Therapeutics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-vascular endothelial growth factor therapeutics market report on the basis of product, disease, and regions:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Eylea

-

Lucentis

-

Beovu

-

Vabysmo

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Macular Edema

-

Diabetic Retinopathy

-

Retinal Vein Occlusion

-

Age-related Macular Degeneration

-

Myopic Choroidal Neovascularization

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global anti-vascular endothelial growth factor therapeutics market size was estimated at USD 14.54 billion in 2024 and is expected to reach USD 14.53 billion in 2025.

b. The global anti-VEGF therapeutics market is expected to witness a compound annual growth rate of -2.5% from 2025 to 2030 to reach USD 12.90 billion by 2030.

b. North America held the largest share of 65.71% in 2024 due to due to increase in disease prevalence, rise in customer awareness, technological advancements, proactive government initiatives, and improved healthcare infrastructure.

b. Key players in the market for global anti-vascular endothelial growth factor therapeutics include Regeneron Pharmaceuticals, Inc.; Bayer AG; and Novartis AG. Other key companies operating in anti-VEGF therapeutics market are F. Hoffmann-La Roche Ltd; Biogen; Pfizer, Inc.; Coherus BioSciences; Amgen, Inc.; Bausch Health Companies, Inc.; and Viatris, Inc.

b. Key factors responsible for market decline include the emergence of biosimilars. As these lower-cost alternatives gain approval, they enhance competition, prompting healthcare providers to favor them over branded therapies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."