- Home

- »

- Biotechnology

- »

-

Antibody Optimization Service Market, Industry Report, 2033GVR Report cover

![Antibody Optimization Service Market Size, Share & Trends Report]()

Antibody Optimization Service Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Affinity Maturation, Humanization), By Technology (Phage Display, AI-based Computational Optimization), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-806-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antibody Optimization Service Market Summary

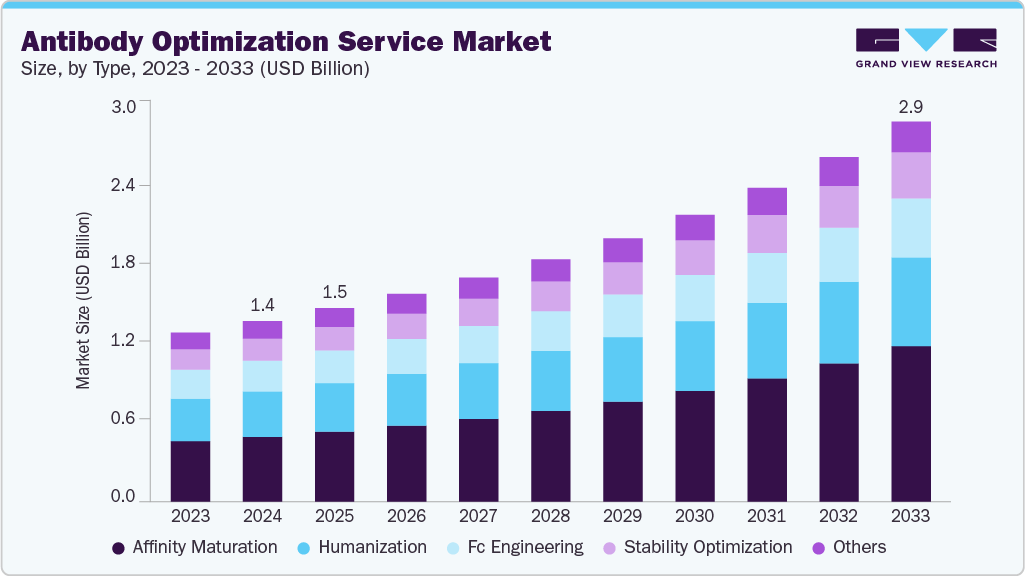

The global antibody optimization service market size was estimated at USD 1.36 billion in 2024 and is projected to reach USD 2.87 billion by 2033, growing at a CAGR of 8.81% from 2025 to 2033. The growth is primarily driven by the increase in demand for next-generation therapeutic antibodies, rising investments in biologics research and development, and advancements in computational modeling and protein engineering platforms.

Key Market Trends & Insights

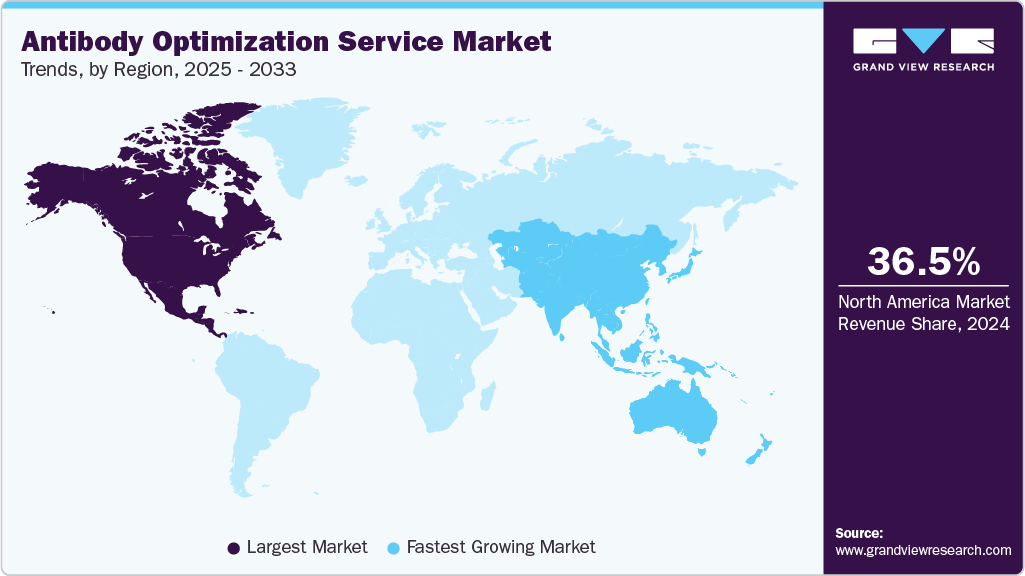

- The North America antibody optimization service market held the largest global share of 36.54% in 2024.

- The antibody optimization service industry in the U.S. is expected to grow significantly from 2025 to 2033.

- By type, the affinity maturation segment held the highest market share of 35.85% in 2024.

- By technology, the phage display segment held the highest market share in 2024.

- By application, the oncology segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.36 Billion

- 2033 Projected Market Size: USD 2.87 Billion

- CAGR (2025-2033): 8.81%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Rising prevalence of complex diseases

The increasing occurrence of complex and chronic illnesses, such as cancer, autoimmune diseases, neurodegenerative diseases, and emerging infectious diseases, is spurring demand for the optimization of antibody services. As patient populations increase and diseases become more heterogeneous, the need for highly targeted, effective biologics that hit specific molecular pathways becomes evident. Monoclonal antibodies and next-generation therapeutic formats have become highly utilized due to their specificity and lower systemic toxicity. To achieve the best possible therapeutic performance, monoclonal and other next-generation proteins must be optimized for the selective enhancement of affinity, stability, specificity, and immunogenicity. This has intensified the demand for specialized optimization platforms and the capability to satisfy the complex needs of contemporary drug development programs.

Disease Prevalence in the U.S. Population

Disease

Prevalence (% of population)

Prevalence (of people)

Obesity

35%

115 million

All cardiovascular diseases

20%

66 million

Type 2 diabetes mellitus

15%

50 million

All cancers

4%

13 million

All autoimmune diseases

3%

10 million

Source: Johns Hopkins University, Presentation, Secondary Research, Grand View Research, Inc.

Moreover, the increasing presence of new pathogens and newly evolving viral variants, in the context of worldwide infectious disease concerns, has pushed the development of rapid and scalable antibodies to the forefront. Optimization of antibodies is crucial for increasing neutralization potency, enhancing therapeutic efficacy, and scaling up production for pandemic preparedness and response. Accordingly, the increasing burden of complex disease expands the therapeutic antibody pipeline and strengthens the rationale for optimization services to develop next-generation clinically relevant biologics.

Growing focus on next-generation biologics

The increasing emphasis on next-generation biologics is a major driver of demand for antibody optimization services. Biopharma companies are increasingly developing more complex, antibody-based therapeutics, such as bispecific antibodies, antibody-drug conjugates (ADCs), nanobodies, and Fc-engineered antibodies, to improve therapeutic precision and clinical outcomes. As drug developers advance beyond traditional monoclonal antibodies, there will likely be a greater demand for unique engineering methods and specialized expertise that will continue to facilitate the growth of the antibody optimization service ecosystem.

Next-generation antibody formats are being developed at an increasingly rapid pace, driven by advancements in protein engineering, computational biology, artificial intelligence-assisted antibody design, and high-throughput screening technology. These actions are saving companies time and money, minimizing development failure and abandonment rates.

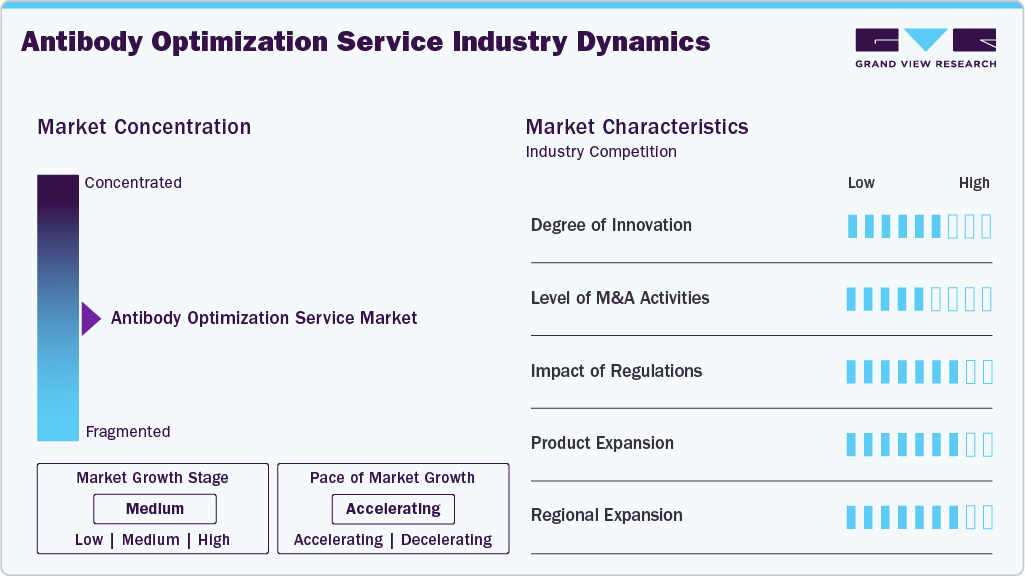

Market Concentration & Characteristics

The antibody optimization service market exhibits a high level of innovation, driven by advancements in protein engineering, AI-enabled antibody design, and high-throughput screening techniques. For instance, in April 2025, Antibody Solutions launched single plasma B-cell discovery services through its Cellestive platform in the U.S., expanding B-cell pathways and enhancing high-throughput, AI-driven antibody discovery capabilities. The emergence of new formats (e.g., bispecifics, ADCs, and nanobodies) provides additional impetus for innovations and renewed collaboration between biopharmaceutical companies and AI-enabled platforms, leading to faster and more precise antibody development.

There is a moderate yet consistent increase in merger and acquisition (M&A) activity in the market, primarily driven by demand for comprehensive biologics development capabilities and progressive engineering technologies. For instance, in September 2024, Valerio Therapeutics acquired Emglev Therapeutics to create a new subsidiary, Valor Bio, which now holds exclusive rights to fully synthetic single-domain antibody platforms for the development of next-generation immunotherapies. The continued growth in deal volume and strategic collaboration interest indicates that the antibody optimization service market is maturing, is continuously adding competition, and is increasingly focusing on consolidation and technology leadership.

Regulations have a significant impact on the antibody optimization service market by enforcing development, safety, and quality standards throughout the biopharmaceutical value chain. Regulatory agencies, such as the FDA and EMA, and other relevant authorities worldwide, have been advocating for the reduction of immunogenicity, ensuring product stability, maintaining process and manufacturing consistency, and promoting clinical safety. These regulatory agencies encourage companies to utilize more sophisticated optimization services early in the development process, particularly as compliance standards are a primary concern. As biologics and antibody-based therapeutics become more mainstream globally, we can expect that regulatory considerations around evolving drug modalities (such as bispecifics, ADCs, or engineered antibodies) will shape future service offerings, and their market expectations will rely on optimization services more than ever.

Product expansion is a key trend in the antibody optimization service industry, with providers broadening their capabilities to offer more integrated and advanced solutions. Companies are seeking to deliver end-to-end support, from discovery to engineering and optimization, in biologics development, aiming to meet the growing demand for efficient, high-precision antibody engineering workflows.

Regional expansion is gaining momentum in the market as companies seek to strengthen their global presence and tap into emerging biopharma hubs. Service providers are beginning to establish infrastructure, partnerships, and research centers in the primary markets of North America, Europe, and the Asia Pacific, with regional expansion unfolding in key clusters such as the U.S., Germany, China, and Singapore. Local capacity enables closer engagement with clients, aligns with regulatory requirements, promotes faster project turnaround, and presents an opportunity to access the rapidly growing interest in biologics development and capacity in developing regions.

Type Insights

The affinity maturation segment dominated the global antibody optimization services market in 2024, with a revenue share of 35.85% and is expected to register the fastest CAGR during the forecast period. This growth is driven by the need to enhance antibody-antigen binding for improved therapeutic efficacy, as well as the increasing use of high-affinity antibodies in oncology and autoimmune diseases. Technological advancements in computational modeling and display platforms further support its strong market position.

The stability optimization segment is expected to grow at a significant CAGR during the forecast period. The growth of this segment is facilitated by advancements in protein engineering, analytical characterization tools, and the increasing demand for stable therapeutic antibodies in biopharmaceutical development.

Technology Insights

In 2024, the phage display segment was projected to capture the largest market share of 45.75%. This technology is a popular option for antibody discovery and engineering due to its adaptability, affordability, and the ability to screen large antibody libraries rapidly. Its extensive use in research partnerships and therapeutic antibody development also serves to further solidify its market leadership.

The AI-based computational optimization segment of the antibody optimization service market is expected to witness the fastest growth during the forecast period, driven by the increasing integration of artificial intelligence and machine learning in antibody design and development. Growing adoption of silico modeling and data-driven optimization by biopharmaceutical companies further fuels the segment’s expansion.

Application Insights

The oncology segment dominated the antibody optimization services industry in 2024, accounting for a 45.44% share, driven by the widespread use of therapeutic antibodies, such as monoclonal and bispecific antibodies, in cancer treatment, which is responsible for this dominance. This segment's dominant position is further reinforced by the rising global incidence of cancer and the growing emphasis on creating tailored and targeted immunotherapies.

The neurological disorders segment is expected to register the fastest growth during the forecast period, driven by the rising prevalence of neurodegenerative diseases such as Alzheimer’s and Parkinson’s. Increasing research into antibody-based therapies that target misfolded proteins and neuroinflammatory pathways, along with growing investments in central nervous system (CNS) drug development, are key factors driving the expansion of this segment.

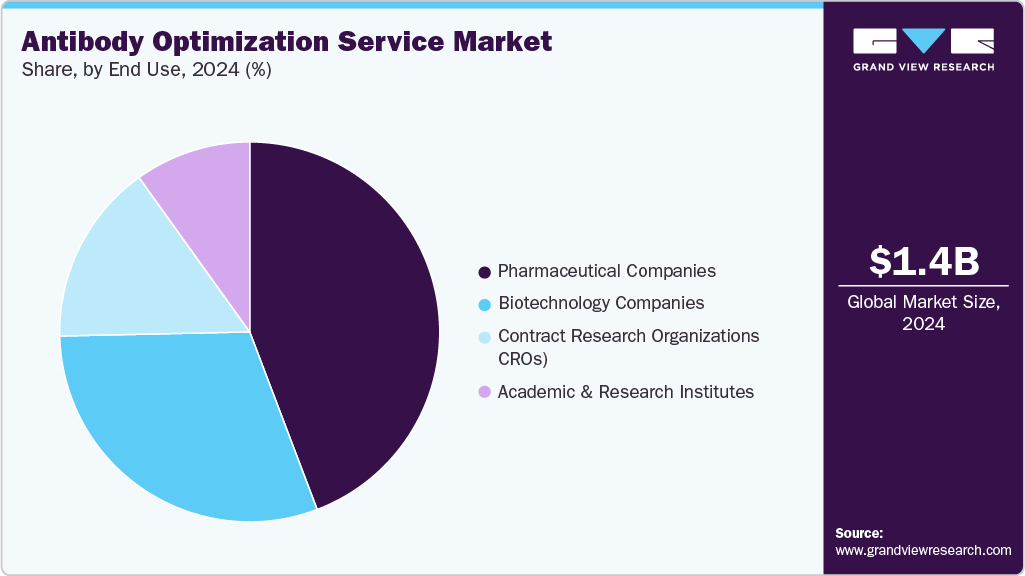

End Use Insights

In 2024, pharmaceutical companies led the antibody optimization service market, with the largest share of 44.22%. Their significant investment in the creation of antibody-based medications, their strategic alliances with biotech firms and CROs, and the expanding pipeline of monoclonal and bispecific antibodies all contributed to this, further solidifying the market's dominance.

The biotechnology companies segment is anticipated to record the fastest CAGR during the forecast period, driven by the growing emphasis on cutting-edge antibody engineering and discovery initiatives. The segment's growth is being further accelerated by increased funding and strategic alliances with significant pharmaceutical companies.

Regional Insights

In 2024, North America led the antibody optimization service market, accounting for the largest revenue share of 36.54%. The increasing demand for innovative therapeutic antibodies, including bispecific and antibody-drug conjugates (ADCs), and the growing funding for precision medicine research continue to drive the use of these services.

U.SAntibody Optimization Service Market Trends

The U.S. antibody optimization service industry has experienced significant growth, supported by expanding antibody discovery pipelines, investment in advanced engineering platforms, and facility expansions by biotech firms to accelerate preclinical optimization and GMP workflows.

Europe Antibody Optimization Service Market Trends

Europe is experiencing steady growth due to its strong research infrastructure, regulatory support for biologics innovation, and research collaboration between the public and private sectors. Investment in AI-based antibody design, display technologies, and precision immunotherapies is strengthening market presence.

The UK antibody optimization service market is expanding due to strong investments in antibody research, growing biotech start-up activity, and government-backed innovation programs in precision medicine. For instance, in February 2025, Vector Laboratories partnered with Etcembly, a UK-based Company, to apply AI for optimizing antibody engineering, aiming to enhance manufacturability and accelerate the development of next-generation therapeutics. Moreover, with the involvement of leading university academics and incubators, new advanced antibody optimization workflows, including AI-based screening and structure-guided engineering technologies, are being adopted more rapidly.

The antibody optimization service market in Germany is a key regional segment, driven by its well-established biotech and pharmaceutical manufacturing industry, government support for infrastructure development in the biotech sector, and active R&D in the development of immunotherapy applications.

Asia Pacific Antibody Optimization Service Market Trends

The Asia Pacific antibody optimization service industry is expected to register the fastest CAGR of 10.96% from 2025 to 2033, driven by the expansion of biologics R&D programs, growth in investments in antibody therapeutics, and the establishment of new partnerships between regional biotech companies and global technology companies.

The China antibody optimization service marketis continuing to emerge as a key player in the region, driven by aggressive government financing, expansion of biomanufacturing at scale, and rapid advances in the biotech startup ecosystem. Domestic companies are investing in in-silico engineering tools and high-throughput antibody screening platforms and forming additional commercial partnerships to accelerate innovation in biologics.

The antibody optimization service market in Japan is expected to witness substantial progress over the forecast period. This growth is expected to be driven by biomedical advances, increasing interest in tailored immunotherapies and the treatment of various complex diseases, as well as strong industry-academic collaboration.

MEA Antibody Optimization Service Market Trends

The Middle East & Africa region is experiencing a rise in interest and demand for antibody optimization services. Government-supported research projects and partnerships with global biotechnology companies are helping to establish advanced platforms for therapeutic antibody development, thereby driving the expansion of this market.

The Kuwait antibody optimization service market is gradually developing. This growth of the market in Kuwait is supported by the growing investments in biotechnology, precision medicine, and research infrastructure.

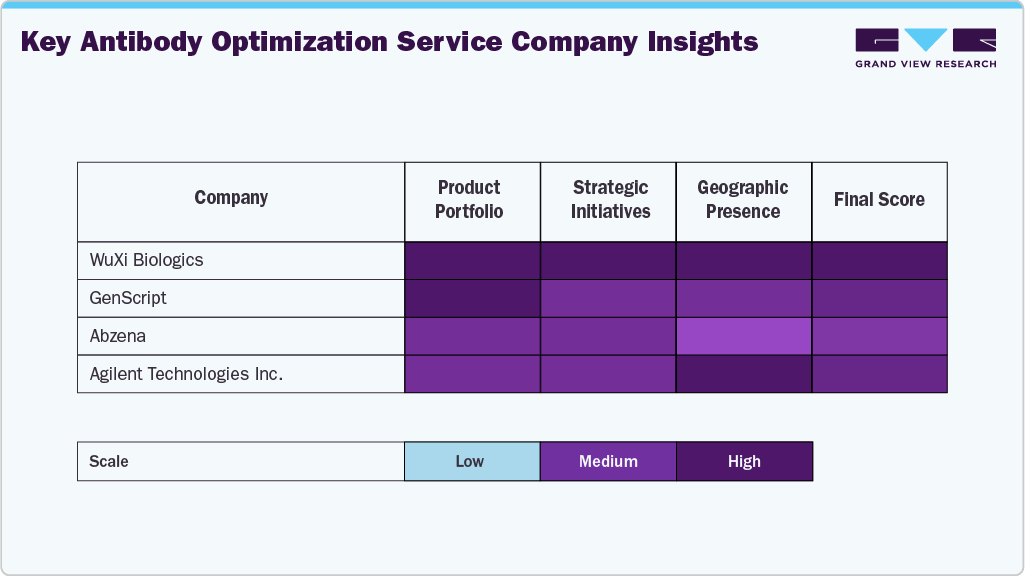

Key Antibody Optimization Service Company Insights

The antibody optimization services industry comprises a range of established multinational companies, as well as biotechnology companies offering specialized services built upon advanced engineering platforms, artificial intelligence design tools, and a high level of expertise in biologics development. Leading companies, including WuXi Biologics, GenScript Biotech, Evotec SE, Fusion Antibodies plc, and Abzena, possess significant competitive advantages in the market and offer a comprehensive range of services across multiple aspects of antibody engineering, including development assessments, affinity maturation, and advanced protein analytics. These well-established companies continue to expand their capabilities through state-of-the-art discovery platforms, proprietary optimization technologies, and collaborations with a broad range of pharmaceutical and biotechnological partners.

In addition, firms such as Sino Biological Inc.; AvantGen Inc.; Thermo Fisher Scientific Inc.; Agilent Technologies Inc.; and Bio-Rad Laboratories Inc. are actively enhancing their market presence by offering specialized optimization tools, recombinant antibody platforms, and scalable solutions for next-generation biologics.

Key Antibody Optimization Service Companies:

The following are the leading companies in the antibody optimization service market. These companies collectively hold the largest market share and dictate industry trends.

- WuXi Biologics

- GenScript Biotech

- Evotec SE

- Fusion Antibodies plc

- Abzena

- Sino Biological Inc.

- AvantGen Inc.

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

Recent Developments

-

In October 2025, Fusion Antibodies secured a multi-target antibody humanisation project with a European pharmaceutical firm, highlighting growing demand for antibody optimization services to advance complex VHH-based therapeutic programs.

-

In June 2025, Ecolab Life Sciences introduced its Purolite AP+50 chromatography resin to enhance monoclonal antibody purification efficiency, supporting biomanufacturing improvements and driving demand for antibody optimization services focused on yield and process performance.

-

In July 2025, Twist Bioscience launched a humanized transgenic mouse model to accelerate antibody discovery and optimization, reinforcing demand for antibody optimization services supporting rapid, flexible, and fully human therapeutic development.

Antibody Optimization Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.46 billion

Revenue forecast in 2033

USD 2.87 billion

Growth rate

CAGR of 8.81% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, application end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

WuXi Biologics; GenScript Biotech; Evotec SE; Fusion Antibodies plc; Abzena; Sino Biological Inc.; AvantGen Inc.; Thermo Fisher Scientific Inc.; Agilent Technologies Inc.; Bio-Rad Laboratories Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Antibody Optimization Service Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the antibody optimization service market report based on type, technology, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Affinity Maturation

-

Humanization

-

Fc Engineering

-

Stability Optimization

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Phage Display

-

Yeast/Mammalian Display

-

Ribosome/mRNA Display

-

AI-based Computational Optimization

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Autoimmune & Inflammatory Diseases

-

Infectious Diseases

-

Neurological Disorders

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical Companies

-

Biotechnology Companies

-

Contract Research Organizations (CROs)

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.