- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Antifog Films And Sheets Market Size, Industry Report, 2030GVR Report cover

![Antifog Films And Sheets Market Size, Share & Trends Report]()

Antifog Films And Sheets Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (BOPP Films, Polyester Films), By Technology (Aqueous Thermosetting Coating, Kneading Surfactant, Photocatalyst Coating), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-503-8

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antifog Films And Sheets Market Trends

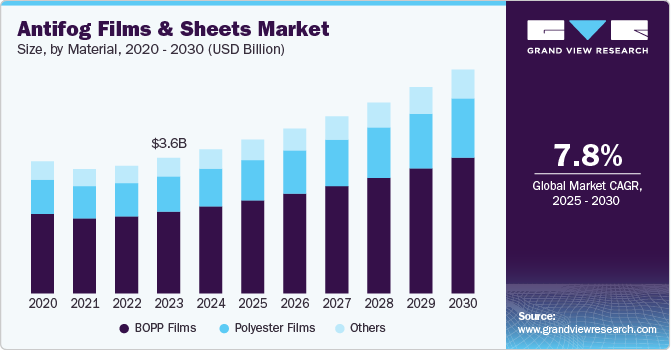

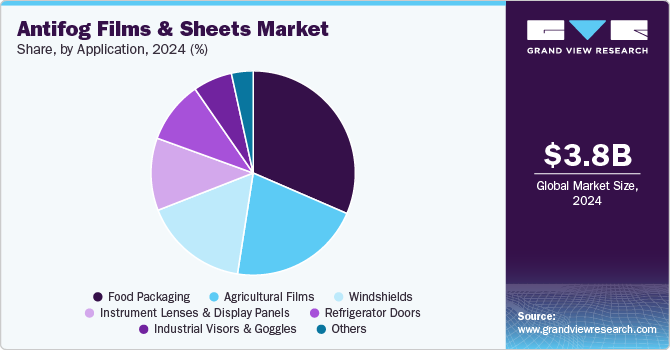

The global antifog films And sheets market size was estimated at USD 3,798.87 million in 2024 and expected to expand at a CAGR of 7.77% from 2025 to 2030. Antifog films and sheets are widely used across multiple sectors, including food packaging, automotive, healthcare, and construction. The food packaging industry, in particular, has seen a surge in demand for antifog solutions as they help maintain visibility and freshness in packaged goods. As consumers increasingly prefer transparent packaging that showcases product quality, manufacturers are adopting antifog technologies to enhance their offerings.

The antifog films & sheets market is witnessing a significant shift toward sustainable and eco-friendly solutions. Manufacturers are increasingly adopting biodegradable and recyclable antifog materials to address environmental concerns and meet stringent regulatory requirements. This trend is driven by the growing consumer preference for sustainable packaging, particularly in the food and healthcare industries, where antifog properties are essential for maintaining visibility and product appeal. In addition, innovations in material science, such as the use of bio-based polymers, are reshaping the market, allowing companies to align with global sustainability goals while maintaining product performance.

Drivers, Opportunities & Restraints

Rising demand for high-quality packaged food products is a key driver for the Antifog Films & Sheets Market. As consumers increasingly prefer visually appealing and fresh food items, the need for packaging that prevents fogging on transparent films has become critical. This is especially true for refrigerated and frozen food products, where condensation can obscure visibility and negatively impact consumer perception. Moreover, advancements in food distribution networks and the proliferation of e-commerce have amplified the demand for efficient packaging solutions, further propelling the adoption of antifog films and sheets across the food packaging industry.

Emerging markets in Asia Pacific and Latin America present a lucrative opportunity for the growth of the antifog films & sheets market. Rapid urbanization, increasing disposable incomes, and changing consumer lifestyles in these regions are driving the demand for packaged food and ready-to-eat products, creating a robust need for antifog packaging. Furthermore, the expansion of modern retail formats, such as supermarkets and hypermarkets, provides a platform for the widespread adoption of antifog films. Companies that invest in strategic partnerships, localized production facilities, and tailored solutions for these regions can capitalize on the untapped potential and gain a competitive edge.

High production costs associated with antifog films and sheets pose a significant challenge to market growth. The incorporation of advanced antifog coatings and specialized additives often increases manufacturing expenses, which are further compounded by fluctuating raw material prices. These costs are typically passed on to consumers, limiting the affordability of antifog products for smaller businesses and cost-sensitive markets. In addition, the complexity of integrating antifog properties into certain packaging formats can hinder widespread adoption, particularly in regions with limited technological capabilities or economic constraints.

Material Insights

BOPP films dominated the antifog films & sheets market across the product segmentation in terms of revenue, accounting for a market share of 60.44% in 2024. Plastic flow wrap packaging is driven by its unmatched versatility and cost efficiency, making it a preferred material for a wide range of technologies. Advanced plastic films such as biaxially oriented polypropylene (BOPP) offer superior barrier properties, durability, and transparency, ensuring product freshness and visibility. Ongoing innovations in recyclable and bio-based plastics align with sustainability goals, allowing manufacturers to address environmental concerns without compromising performance. The ability to customize plastic wraps for branding further strengthens its appeal in competitive consumer markets, particularly in food and personal care industries.

Polyester films are gaining traction in the antifog films market due to their superior thermal stability and mechanical strength. These properties make polyester films particularly suitable for applications requiring high durability, such as microwavable or ovenable food packaging. Advancements in antifog coating formulations have improved the performance of polyester films under extreme temperature variations, further driving their adoption. The growing focus on reducing food waste by enhancing product visibility and extending shelf life has positioned polyester films as a preferred choice for premium packaging solutions.

Technology Insights

Photocatalyst coatings dominated the antifog films & sheets market across the technology segmentation in terms of revenue, accounting for a market share of 33.38% in 2024. These coatings provide excellent adhesion and long-lasting antifog effects, even in challenging conditions such as high humidity or temperature fluctuations. As industries move away from solvent-based alternatives due to stringent environmental regulations, aqueous thermosetting coatings offer a safer and more sustainable solution. Their versatility across a wide range of substrates, including BOPP and polyester films, further amplifies their relevance in the market.

Photocatalyst coatings are emerging as a cutting-edge solution in the antifog films market, leveraging nanotechnology to achieve superior performance. These coatings use light to activate a self-cleaning mechanism, effectively preventing fogging while offering antimicrobial benefits. This dual functionality is particularly appealing in food and healthcare packaging, where hygiene and visibility are critical. With increasing investment in nanotechnology and a growing emphasis on high-performance packaging solutions, photocatalyst coatings are poised to revolutionize the antifog market, especially in advanced economies.

Application Insights

Food packaging dominated the antifog films & sheets market across the technology segmentation in terms of revenue, accounting for a market share of 31.97% in 2024. Antifog films ensure that condensation does not obstruct product visibility, enhancing customer confidence and reducing the risk of food spoilage. With the surge in online grocery shopping and meal delivery services, the need for robust antifog packaging solutions has become more pronounced. Regulatory focus on food safety and hygiene standards further supports the adoption of antifog technologies in this segment.

In agriculture, antifog films play a critical role in improving crop yields by maintaining optimal light transmission in greenhouses. Condensation on traditional films can block sunlight and create uneven light distribution, negatively affecting plant growth. Antifog films address this issue by preventing water droplets from forming on the surface, promoting better photosynthesis and healthier crops. The growing need for efficient agricultural practices to meet food security challenges, particularly in regions with harsh climates, has accelerated the demand for antifog films tailored for greenhouse applications.

Regional Insights

Asia Pacific antifog films & sheets market dominated the global market and accounted for largest revenue share of 33.40% in 2024, which is attributable to the booming food and beverage industry, fueled by rapid urbanization and increasing disposable incomes. The region's growing middle class is demanding convenient and hygienic packaged food, creating a strong need for advanced packaging solutions with antifog properties. Moreover, the proliferation of modern retail formats, such as supermarkets and hypermarkets, in countries such as India, Indonesia, and Malaysia is boosting the adoption of antifog films to enhance product visibility and shelf appeal. In addition, the rising emphasis on sustainable packaging materials in this environmentally conscious market is encouraging the use of biodegradable antifog films.

China Antifog Films And Sheets Market Trends

China's antifog films market is expanding rapidly due to the country's flourishing fresh produce export sector. As a leading exporter of fruits, vegetables, and seafood, China requires advanced antifog packaging to maintain product quality during long transit times. Domestic consumption is also on the rise, with urban households increasingly seeking high-quality packaged foods. The government’s support for modern agricultural practices and cold chain logistics has further propelled the demand for antifog films in greenhouse and food packaging applications. Moreover, local manufacturers are heavily investing in cutting-edge antifog technologies to meet both domestic and international standards.

North America Antifog Films And Sheets Market Trends

In North America, the demand for antifog films and sheets is primarily driven by the widespread adoption of high-performance packaging solutions in the fresh produce and meat sectors. Consumers in the region place significant value on visually clear and aesthetically appealing packaging, especially for perishable goods. The ongoing trend of meal-kit delivery services and ready-to-eat products has further amplified the need for antifog packaging to ensure freshness and quality during transportation. Stringent food safety regulations and a focus on reducing food waste are also motivating manufacturers to develop innovative antifog solutions that meet industry standards.

The U.S. antifog films And sheets market is experiencing robust growth due to the increasing demand for antifog films in the e-commerce grocery sector. With more consumers opting for online grocery shopping, the need for durable and visually transparent packaging has intensified. Antifog films help preserve the appearance and quality of fresh produce and frozen foods, enhancing customer satisfaction. Furthermore, advancements in nanotechnology and coatings have led to the development of high-performance antifog films that cater to the U.S. market's preference for innovative and sustainable packaging solutions. Government initiatives promoting sustainable materials also play a crucial role in shaping the market.

Europe Antifog Films And Sheets Market Trends

The antifog films & sheets market in Europe is driven by strict environmental regulations and the region’s leadership in sustainable packaging practices. The European Union’s push for circular economy initiatives has encouraged the use of recyclable and biodegradable antifog films, particularly in the food packaging sector. In addition, the growing demand for premium-quality packaging for fresh fruits, vegetables, and dairy products is fostering innovation in antifog technologies. Countries such as Germany, France, and Italy are also witnessing a rise in private-label brands that prioritize eco-friendly packaging, further boosting the adoption of antifog films in the region.

Key Antifog Films And Sheets Company Insights

The antifog films & sheets market is highly competitive, with several key players dominating the landscape. Major companies include 3M; SABIC; FSI Coating Technologies, Inc.; Specialty Polyfilms India Pvt. Ltd.; Kafrit Industries Ltd.; DuPont; Amcor plc; Toray Industries; and Weetect Inc. The flow wrap packaging polymers market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Antifog Films And Sheets Companies:

The following are the leading companies in the antifog films and sheets market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- SABIC

- FSI Coating Technologies, Inc.

- Specialty Polyfilms India Pvt. Ltd.

- Kafrit Industries Ltd.

- DuPont

- Amcor plc

- Toray Industries

- Weetect Inc.

- Sumitomo Bakelite Co., Ltd.

- Cosmo Films

- Jindal Poly Films Limited

- Berry Global Inc.

Recent Developments

-

In November 2024, Coveris, a European flexible packaging manufacturer, introduced a new cast polypropylene (CPP) film called Coveris Print Layer (PP CPL). This film is designed for packaging various products, including food and pet food. Key features of PP CPL include high stiffness for product protection, resistance to shrinkage at high temperatures (0% at 150°C), and strong heat-seal resistance up to 180°C. Made entirely from polypropylene, it enhances recyclability and supports the circular economy. In addition, the film offers high transparency and gloss, making it suitable for flexo and rotogravure printing, which can help brands stand out on store shelves.

-

In October 2023, FSICT introduced Visgard Ultra, a PFAS-free anti-fog coating designed to improve the surface feel and aesthetics of safety eyewear and ophthalmic lenses. This innovation ensures consistent, long-term adhesion even under extreme temperature and humidity conditions.

Antifog Films & Sheets Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,055.53 million

Revenue forecast in 2030

USD 5.90 billion

Growth rate

CAGR of 7.77% from 2024 to 2030

Historical data

2018 - 2023

Base year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

3M; SABIC; FSI Coating Technologies, Inc.; Specialty Polyfilms India Pvt. Ltd.; Kafrit Industries Ltd.; DuPont; Amcor plc; Toray Industries; Weetect Inc.; Sumitomo Bakelite Co., Ltd.; Cosmo Films; Jindal Poly Films Limited; Berry Global Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antifog Films And Sheets Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented antifog films & sheets market report on the basis of material, technology, technology, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

BOPP Films

-

Polyester Films

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aqueous Thermosetting Coating

-

Kneading Surfactant

-

Photocatalyst Coating

-

UV Coatings

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Packaging

-

Agricultural Films

-

Windshields

-

Instrument Lenses & Display Panels

-

Refrigerator Doors

-

Industrial Visors & Goggles

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global antifog films And sheets market size was estimated at USD 3,798.87 million in 2024 and is expected to reach USD 4,055.53 million in 2025.

b. The global antifog films And sheets market is expected to grow at a compound annual growth rate of 7.77% from 2025 to 2030 to reach USD 5.90 billion by 2030.

b. BOPP films dominated the antifog films & sheets market across the product segmentation in terms of revenue, accounting for a market share of 60.44% in 2024. Plastic flow wrap packaging is driven by its unmatched versatility and cost efficiency, making it a preferred material for a wide range of technologys.

b. Some key players operating in the antifog films And sheets market include 3M; SABIC; FSI Coating Technologies, Inc.; Specialty Polyfilms India Pvt. Ltd.; Kafrit Industries Ltd.; DuPont; Amcor plc; Toray Industries; and Weetect Inc.

b. Rising demand for high-quality packaged food products is a key driver for the Antifog Films & Sheets Market. As consumers increasingly prefer visually appealing and fresh food items, the need for packaging that prevents fogging on transparent films has become critical.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.