- Home

- »

- Medical Devices

- »

-

Aortic Valve Replacement Devices Market Size Report, 2030GVR Report cover

![Aortic Valve Replacement Devices Market Size, Share & Trends Report]()

Aortic Valve Replacement Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Leaflet Material (Bovine Pericardium, Porcine Pericardium), By Frame Material, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-197-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

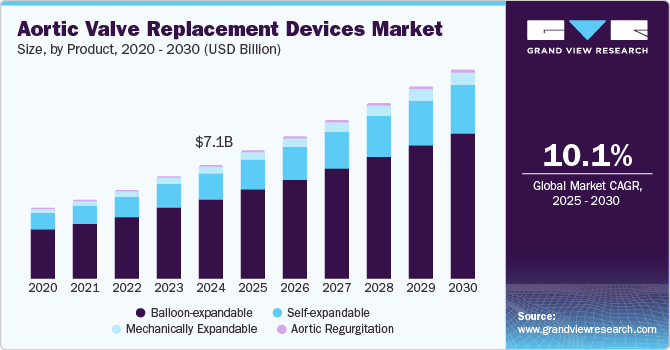

The global aortic valve replacement devices market size was estimated at USD 7.05 billion in 2024 and is projected to grow at a CAGR of 10.1% from 2025 to 2030. The NCBI reports that approximately 2% to 3% of individuals over 65 are affected by aortic stenosis in regions such as North America. This statistic underscores the urgency for effective treatment solutions, especially as the population ages. With the elderly demographic forecasted to expand significantly, healthcare stakeholders must prepare for a rise in demand for aortic valve replacement procedures tailored to this vulnerable population.

The introduction of minimally invasive surgical techniques, such as transcatheter aortic valve replacement (TAVR), has revolutionized treatment paradigms. These innovations enhance patient outcomes and minimize recovery times, thereby increasing the appeal of these interventions for patients and healthcare providers alike. Such improvements align with the global trend toward value-based care, which emphasizes enhanced patient satisfaction and clinical effectiveness-elements crucial to the sustainability of healthcare systems.

According to UN estimates, by 2024, nearly 20% of the population in Europe will be aged 65 and older, the resulting demographic shift will directly increase the prevalence of age-related health conditions, including valvular diseases. This situation necessitates a corresponding rise in healthcare resources, including advanced medical devices, to meet the growing demand for surgical interventions, particularly in regions with a rapidly aging demographic.

Moreover, rising awareness and favorable reimbursement policies are fueling market growth by encouraging more patients to pursue surgical options. In 2023, global life expectancy rebounded to 73.2 years, illustrating improved healthcare and living standards that translate into more individuals living longer and, consequently, experiencing age-associated diseases such as aortic valve disorders. As awareness of treatment benefits continues to grow among patients and practitioners, alongside structural support in healthcare financing, the market is poised for substantial expansion in the coming years.

Product Insights

Balloon-expandable valves dominated the market with a revenue share of 68.7% in 2024. Balloon-expandable valves are increasingly preferred due to their lower risk of valve migration and reliable outcomes. Physicians favor these devices due to their established familiarity and the robust clinical data that underpins their efficacy, ultimately resulting in improved patient outcomes. This proven reliability and effectiveness significantly contribute to their growing popularity among healthcare providers and patients alike.

Self-expandable valves are expected to grow at a significant rate over the forecast period. Self-expandable valves feature a self-deployment mechanism that streamlines implantation, reduces procedure time, and allows for precise positioning across diverse patient anatomies, minimizing complications. Their supra-annular designs enhance hemodynamic performance, contributing to favorable clinical outcomes and driving increased adoption among healthcare providers.

Leaflet Material Insights

The bovine pericardium segment led the market with a revenue share of 72.5% in 2024, owing to its superior mechanical properties and biocompatibility. Rich in collagen, it offers the necessary strength and elasticity for durable bioprosthetic heart valves. Its resistance to physiological stress and reduced calcification, coupled with a strong clinical track record, enhances its appeal among surgeons and patients, promoting widespread adoption in valve replacement procedures.

The porcine pericardium segment is projected to grow lucratively over the forecast period. Porcine pericardium offers superior mechanical properties and a thinner profile than alternative materials, being 30%-40% thinner than bovine pericardium. This allows for enhanced flexibility and larger effective orifice areas, improving hemodynamics. Its excellent durability and biocompatibility further support its increasing adoption in TAVR and other cardiac applications.

Frame Material Insights

Cobalt-chromium frames held the largest market share of 64.0% in 2024 and exhibit exceptional mechanical properties, including strength, durability, and corrosion resistance, making them ideal for TAVR device construction. Their design allows for thinner struts, reducing valve thrombosis risk and improving hemodynamic performance. Consequently, cobalt-chromium devices are favored by both physicians and patients for enhanced longevity and reliability.

Nitinol frames are expected to witness rapid growth over the forecast period. Nitinol, a nickel-titanium alloy, facilitates flexible deployment and self-expansion, ensuring accurate valve positioning within the aorta and minimizing complications. Its biocompatibility and fatigue resistance further enhance reliability for long-term use, establishing nitinol as a popular choice in TAVR devices.

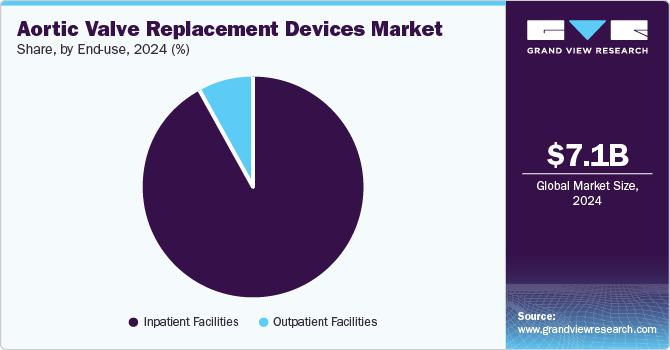

End-use Insights

Inpatient facilities dominated the market and accounted for a share of 92.2% in 2024. Hospitals and clinics are equipped with advanced medical infrastructure, skilled personnel, and essential post-operative monitoring to manage potential complications from aortic valve surgeries. The rising incidence of aortic stenosis and other valvular diseases, particularly in the aging population, underscores hospitals as primary end-users of these devices, promoting optimal patient outcomes and recovery.

The outpatient facilities segment is projected to grow lucratively over the forecast period. Outpatient facilities are increasingly favored as demand rises for minimally invasive procedures such as TAVR. These procedures facilitate shorter hospital stays and faster recoveries. Technological advancements enhancing safety and efficacy, coupled with a focus on cost-effective care, bolster the adoption of outpatient models within healthcare.

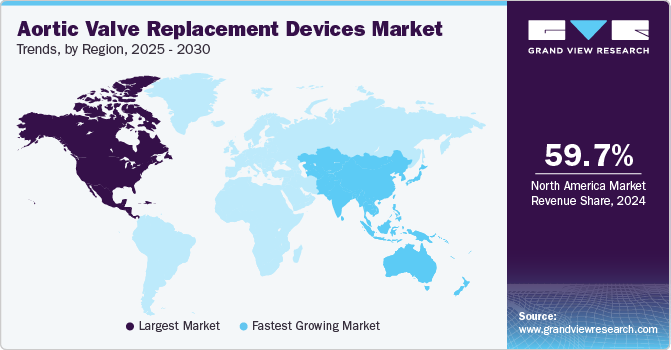

Regional Insights

North America aortic valve replacement devices market dominated the global market with a revenue share of 59.7% in 2024. North America boasts advanced healthcare infrastructure, a high prevalence of aortic stenosis, and substantial investments in medical technology. A robust regulatory framework supports the swift adoption of innovations such as TAVR, driven by an aging population and heightened awareness of heart diseases.

U.S. Aortic Valve Replacement Devices Market Trends

The aortic valve replacement devices market in U.S. dominated the North America aortic valve replacement devices market with a revenue share of 97.0% in 2024. The U.S. has a substantial patient population eligible for valve replacement procedures, propelled by an aging demographic and increasing rates of cardiovascular diseases. Moreover, the nation excels in medical device innovation, bolstered by numerous clinical studies validating the efficacy of TAVR and other advanced therapies, alongside supportive reimbursement policies.

Europe Aortic Valve Replacement Devices Market Trends

Europe aortic valve replacement devices market held substantial market share in 2024. Europe’s robust healthcare infrastructure facilitates advanced surgical techniques, such as TAVR. Favorable reimbursement policies across numerous countries enhance accessibility to these devices. Furthermore, ongoing technological advancements and increasing clinical expertise significantly improve patient outcomes throughout the region.

The aortic valve replacement devices market in Germany is expected to grow in the forecast period. Germany exhibits one of the highest rates of TAVR procedures per capita, underpinned by extensive clinical experience and substantial healthcare funding. Innovations in valve design and delivery systems have enhanced procedural outcomes, establishing TAVR as the preferred treatment for severe aortic stenosis, supported by a strong regulatory framework.

Asia Pacific Aortic Valve Replacement Devices Market Trends

Asia Pacific aortic valve replacement devices market is expected to register the fastest CAGR of 11.2% in the forecast period. Rapid urbanization and increasing disposable incomes are expanding access to advanced medical technologies, such as aortic valve replacement devices. The region’s substantial population offers significant market potential, especially as awareness of minimally invasive procedures such as TAVR increases. Ongoing innovations in device technology further enhance safety and effectiveness.

The aortic valve replacement devices market in Japan dominated the Asia Pacific aortic valve replacement devices market in 2024. Japan has experienced a growing adoption of TAVR procedures, attributed to its aging population with elevated rates of aortic stenosis. A strong emphasis on research and development drives continuous advancements in valve design and delivery systems, enhancing patient outcomes, while favorable reimbursement policies facilitate broader access to these vital procedures.

Key Aortic Valve Replacement Devices Company Insights

Some key companies operating in the market include Boston Scientific Corporation; Artivion, Inc; Edwards Lifesciences Corporationt; among others. Companies are prioritizing portfolio expansion through mergers and acquisitions, bolstering research and development efforts to advance transcatheter technologies, and enhancing market penetration in emerging regions. For instance, in March 2024, Medtronic announced FDA approval for the Evolut FX+ TAVR system, enhancing coronary access while maintaining the superior valve performance expected from the established Evolut platform for treating severe aortic stenosis.

-

Artivion, Inc. specializes in pioneering aortic valve replacement solutions, notably the CryoValve Aortic Allograft for infective endocarditis patients, and the On-X Aortic Heart Valve, which enhances patient outcomes with reduced anticoagulation requirements for improved safety and effectiveness.

-

LivaNova PLC is dedicated to advancing cardiac devices, particularly aortic valve replacements. Their portfolio features the Perceval sutureless aortic valve, enabling faster implantation and reduced surgical duration, thereby emphasizing innovative technologies that improve patient outcomes and support minimally invasive solutions.

Key Aortic Valve Replacement Devices Companies:

The following are the leading companies in the aortic valve replacement devices market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Artivion, Inc

- Edwards Lifesciences Corporation

- LivaNova PLC

- Medtronic

- Abbott

- Comp7

Recent Developments

-

In August 2024, Boston Scientific secured CE mark approval for the ACURATE Prime™ Aortic Valve System, enhancing TAVR options and enabling precise deployment for a broader range of patients with aortic stenosis.

-

In May 2024, Edwards Lifesciences launched the SAPIEN 3 Ultra RESILIA valve in Europe, featuring advanced RESILIA tissue technology aimed at enhancing durability and optimizing long-term outcomes for patients with heart valve disease.

-

In April 2024, Medtronic launched the Avalus Ultra valve, a next-generation surgical aortic tissue valve designed for ease of use and long-term patient management based on a decade of clinical experience.

Aortic Valve Replacement Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.89 billion

Revenue forecast in 2030

USD 12.76 billion

Growth rate

CAGR of 10.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, leaflet material, frame material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Boston Scientific Corporation; Artivion, Inc; Edwards Lifesciences Corporation; LivaNova PLC; Medtronic; Abbott

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aortic Valve Replacement Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aortic valve replacement devices market report based on product, leaflet material, frame material, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Balloon-expandable

-

Self-expandable

-

Mechanically Expandable

-

Aortic Regurgitation

-

-

Leaflet Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Bovine Pericardium

-

Porcine Pericardium

-

-

Frame Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Cobalt-Chromium

-

Nitinol

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Inpatient Facilities

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.