- Home

- »

- Next Generation Technologies

- »

-

Apparel Supply Chain Market Size & Share Report, 2028GVR Report cover

![Apparel Supply Chain Market Size, Share & Trends Report]()

Apparel Supply Chain Market (2022 - 2028) Size, Share & Trends Analysis Report By Process (Pre-Production, Trade Logistics), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-941-4

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Apparel Supply Chain Market Summary

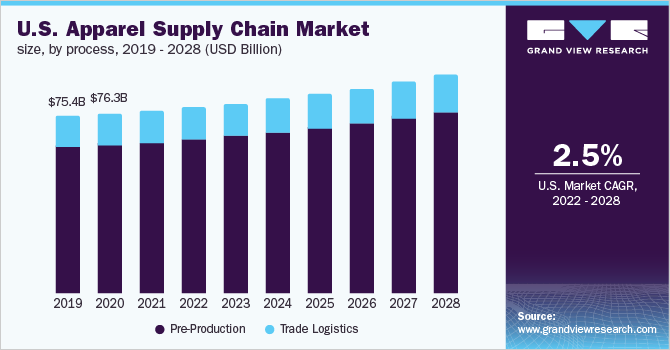

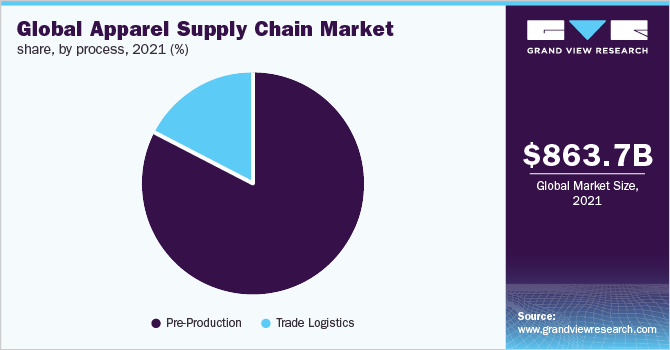

The global apparel supply chain market size was estimated at USD 863.75 billion in 2021 and is estimated to reach USD 1,119.69 billion by 2028, growing at a CAGR of 3.8% from 2022 to 2028. The rising demand for apparel from the fashion sector and the expansion of online retail channels are expected to drive the global apparel supply chain market during the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the market with the largest revenue share of over 55.0% in 2021.

- By process, the pre-production segment led the market, holding the largest revenue share of over 80.0% in 2021.

- By process, the trade logistics segment is expected to expand at significant CAGR of 3.2% during the forecast period.

Market Size & Forecast

- 2021 Market Size: USD 863.75 Billion

- 2028 Projected Market Size: USD 1,119.69 Billion

- CAGR (2022-2028): 3.8%

- Asia Pacific: Largest market in 2021

The apparel supply chain offers companies with control over the aspects of whole process that are included in the apparel supply chain enabling them to quickly pick up the trend in the industry and produce collections for the same. This is expected to create new business opportunities for key players and fuel the apparel supply chain market in the coming years.

COVID-19 outbreak had a negative impact on the apparel supply chain market. Lockdowns across the globe impacted the transport networks and imposed challenges for interconnected supply chains to outsource materials across the globe. Due to COVID-19, a decline in demand has been observed by the transport services along with imbalance in cargo. The shortages of raw materials have also been observed in the manufacturing of apparel hence presenting an overall negative impact on the global apparel supply chain market.

Integration of advanced technologies in the apparel supply chain to collect accurate data in right time, in order to ensure its validity, will create lucrative opportunities for the market. Moreover, integration or incorporation of initiatives for the sustainability in any apparel supply chain has become the utmost necessity to reduce or minimize the carbon emission in the environment and will become an important trend.

The global apparel supply chain encloses the labor and human rights abuse and deficient transparency in the whole supply chain process as well as apparel production, which is a key restraining factor to hamper the market growth during the forecast timeline. Moreover, the significant growth in the apparel industry in emerging economies such as India, China and others further projected to provide ample opportunity to the market growth.

The method of outlining every step included in the procedure of apparel manufacturing, to the step where it reaches the end-user, is known as the apparel supply chain. The process of apparel supply chain initiates with raw material to the final apparel delivery to the consumer. The activities that fall under the apparel supply chain are sourcing raw materials, converting the raw materials into yarns, conversion of raw materials into fabric, manufacturing apparel from fabric, and finally distributing them to end-users.

Supply chain management enables the organizations and enterprises to easily and effectively manage the data generated in the business and enhance the operations of supply chain, along with enabling them to work deliberately hence promoting the adoption of such software and services among them.

Additionally, several advancements are occurring in information technology as well, as they are highly and rapidly being adopted. Integration or incorporation of such advanced technology in supply chains by users supports the overall supply chain along with improving it and taking better decisions, which is propelling the global market forward.

Process Insights

The pre-production segment dominated the market and contributed a revenue share of more than 80.0% in 2021. It is expected to expand at the fastest CAGR of 3.9% from 2022 to 2028. The rising demand for apparel from the fashion industry along with increasing usage of e-commerce for the purpose of buying apparel had increased the usage of the apparel supply chain for pre-production segment, which is contributing to the market growth.

Additionally, the speedy urbanization and increasing population in developing countries including India, Vietnam, Bangladesh, and others resulted in escalated demand for the apparel and contributing to the growth of the apparel supply chain market. The above-mentioned factors lead to high adoption of the apparel supply chain in the pre-production segment, hence driving the market growth.

The trade logistics segment is expected to expand at significant CAGR of 3.2% during the forecast period. Trade logistics provides a company with flexibility and allows them to control their operations in a better and enhanced way along with saving costs. It also helps them increase overall transparency of the supply chain and aids in better understanding of the cost, operations, inventory management, plus others, which in turn is increasing its usage in the apparel industry, thus driving the market growth.

Regional Insights

Based on the revenue, Asia Pacific accounted for the major market revenue share of more than r55.0% in 2021 and is estimated to increase by the fastest CAGR of 4.4%from 2022 to 2028. The rising usage of e-commerce platforms for buying products coupled with growing sales of apparel in the region are the actors expected to contribute to the market growth.

Moreover, the easy availability of raw materials at a comparatively lower price along with being the leading manufacturers of apparel is also expected to fuel the market expansion. The above-mentioned factors are driving the growth of the Asia Pacific apparel supply chain.

The apparel supply chain market in Europe is likely to expand at a considerable CAGR of 3.9% during the forecast period. This growth is attributed to the presence of favorable policies regarding trade, imposed by the government. Additionally, due to the increased demand for sports & clothing and home-furnishing textile products, the demand for textile is expected to expand significantly during the forecast period.

The presence of major key players operating in the region is another important factor adding to the market growth. Therefore, due to the above-mentioned factors the usage of the apparel supply chain solutions in Europe is high and contributes more to revenue generation.

Key Companies & Market Share Insights

The apparel supply chain market is characterized by the presence of established as well as new players. Most of the key players working in the apparel supply chain market are adopting various strategies such as alliances, partnerships, and mergers to gain maximum share in the market. For instance, in December 2021, Li & Fung Limited formed a strategic partnership and announced to acquire LF Logistics by Maersk in order to simplify and connect supply chains for the customers. Some of the prominent players in the global apparel supply chain market:

-

BSL Ltd.

-

INVISTA Equities, LLC (Koch Industries, Inc.)

-

Luthai Group

-

Paulo de Oliveira company

-

China Textiles (Shenzhen) Co., Ltd.

-

Paramount Textile Mills (P) Ltd.

-

Successori Reda SpA

-

Mayur Fabrics

-

Rhodia SA (Solvay Group)

-

Li & Fung Limited

Apparel Supply Chain Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 890.96 billion

Revenue forecast in 2028

USD 1,119.69 billion

Growth Rate

CAGR of 3.8% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD billion, CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Process, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; Italy; Spain; France; China; Bangladesh; Vietnam; India; Turkey; Brazil; Argentina

Key companies profiled

BSL Ltd.; INVISTA Equities, LLC (Koch Industries, Inc.); Luthai Group; Paulo de Oliveira company; China Textiles (Shenzhen) Co., Ltd.; Paramount Textile Mills (P) Ltd.; Successori Reda SpA; Mayur Fabrics; Rhodia SA (Solvay Group); Li & Fung Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global Apparel Supply Chain Market based on the process, and region:

-

Process Outlook (Revenue, USD Million, 2017 - 2028)

-

Pre-Production

-

Trade Logistics

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Bangladesh

-

Vietnam

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global apparel supply chain market size was estimated at USD 863.75 billion in 2021 and is expected to reach USD 890.96 billion in 2022.

b. The global apparel supply chain market is expected to grow at a compound annual growth rate of 3.8% from 2022 to 2028 to reach USD 1,119.69 billion by 2028.

b. Asia Pacific dominated the apparel supply chain market with a share of 57.4% in 2021. This is attributable to the rising usage of e-commerce platforms for buying products coupled with growing sales of apparel in the region.

b. Some key players operating in the apparel supply chain market include BSL Ltd.; INVISTA Equities, LLC (Koch Industries, Inc.); Luthai Group; Paulo de Oliveira company; China Textiles (Shenzhen) Co., Ltd.; Paramount Textile Mills (P) Ltd.; Successori Reda SpA; Mayur Fabrics; Rhodia SA (Solvay Group); and Li & Fung Limited.

b. Key factors that are driving the apparel supply chain market growth include rising demand for apparel from the fashion sector and the expansion of online retail channels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.