- Home

- »

- Network Security

- »

-

Application Delivery Controller Market Size Report, 2030GVR Report cover

![Application Delivery Controller Market Size, Share & Trends Report]()

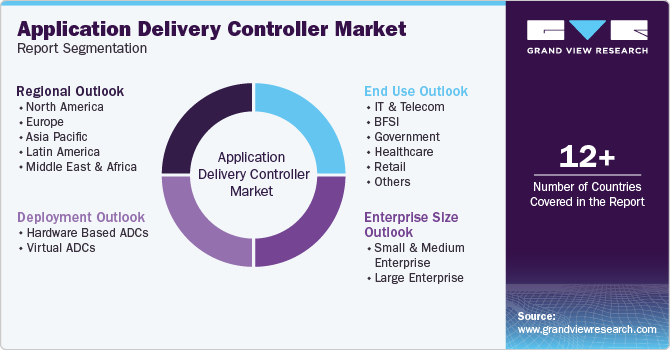

Application Delivery Controller Market (2025 - 2030) Size, Share & Trends Analysis Report By Deployment (Hardware-based ADCs, Virtual ADCs), By Enterprise Size (Small & Medium Enterprise, Large Enterprise), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-166-5

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Application Delivery Controller Market Summary

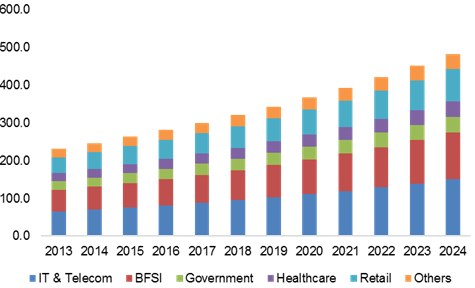

The global application delivery controller market size was valued at USD 4.35 billion in 2024 and is projected to reach USD 8.46 billion by 2030, growing at a CAGR of 12.9% from 2025 to 2030. Application delivery controllers (ADC) manage and optimize the delivery of applications across complex environments, ensuring high availability, security, and performance.

Key Market Trends & Insights

- North America application delivery controller market held the largest share of over 34% in 2024.

- Based on deployment, hardware-based ADCs accounted for the largest share of over 59% in 2024.

- Based on enterprise size, large enterprises accounted for the largest share in 2024.

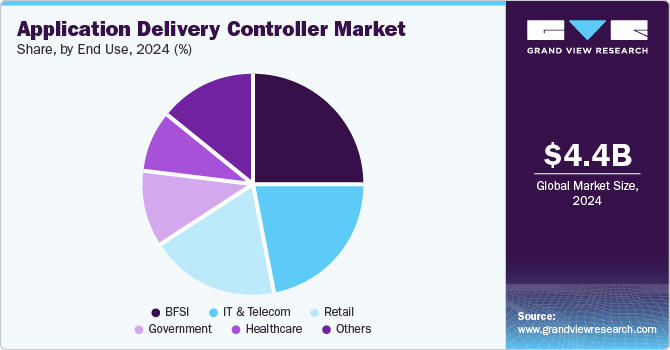

- Based on end use, the BFSI segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.35 Billion

- 2030 Projected Market Size: USD 8.46 Billion

- CAGR (2025-2030): 12.9%

- North America: Largest market in 2024

Traditionally, ADCs were utilized to balance traffic between servers, but modern solutions have evolved to include features such as application acceleration, SSL offloading, web application firewalls (WAF), and security against distributed denial-of-service (DDoS) attacks. The increasing number of cyber threats has made application security a top priority for organizations across industries.

ADCs equipped with security features like DDoS protection, web application firewalls, and intrusion prevention systems help organizations safeguard their applications from potential attacks. The growing demand for mobile applications and the impending rollout of 5G networks are further fueling the market, as ADCs can optimize performance and reduce latency for mobile users. Additionally, the rise of IoT devices and edge computing necessitates efficient traffic management, which ADCs can provide, enabling real-time data processing and analytics. Collectively, these factors position ADCs as essential components in modern IT infrastructures, driving their adoption and market growth.

As the number of connected devices continues to rise with the expansion of the IoT ecosystem, ADCs will play a critical role in managing the influx of data and ensuring seamless application delivery. The integration of edge computing will also drive the demand for ADCs that can operate efficiently in distributed environments, enabling low-latency application access for end-users. Overall, the ADC market is set to witness significant advancements and growth, driven by these trends and the ongoing need for secure, high-performance application delivery in an increasingly digital world.

As organizations continue to embrace digital transformation initiatives, the demand for efficient and secure application delivery solutions will only intensify. The ongoing evolution of cloud technologies, coupled with the increasing need for scalability and flexibility, will drive the adoption of cloud-native ADCs designed to cater to dynamic workloads and multi-cloud environments. Furthermore, the growing emphasis on application performance and user experience will compel businesses to invest in advanced ADC solutions that leverage artificial intelligence (AI) and machine learning (ML) for predictive analytics and automation. These technologies will enhance the ability of ADCs to adapt to changing traffic patterns and optimize resource allocation in real time.

Deployment Insights

Hardware-based ADCs accounted for the largest share of over 59% in 2024. Hardware-based ADCs are engineered to deliver superior performance compared to software-based solutions. By leveraging dedicated hardware components, such as Application-Specific Integrated Circuits (ASICs), these devices optimize data processing and traffic management. This specialized architecture enables faster packet processing, resulting in lower latency and higher throughput. As a result, hardware-based ADCs are particularly suited for organizations that experience high traffic loads and require reliable performance for mission-critical applications. With the increasing reliance on real-time applications-such as video conferencing, online transactions, and cloud services-businesses need solutions that can handle intensive workloads without compromising efficiency. Consequently, the demand for high-performance hardware-based ADCs is on the rise, as organizations seek to ensure seamless application delivery, maintain high user satisfaction, and support the growing complexities of their IT environments.

Virtual ADCs are expected to grow steadily over the forecast period. The rapid migration of businesses to cloud environments has significantly boosted the adoption of Virtual Application Delivery Controllers (ADCs). Virtual ADCs seamlessly integrate with cloud-based infrastructures, allowing organizations to deploy them quickly and efficiently without the constraints of physical hardware. This capability enables businesses to scale their application delivery resources dynamically, adapting to fluctuating workloads and ensuring optimal performance. As organizations increasingly embrace hybrid and multi-cloud architectures, the need for effective application delivery solutions across diverse platforms becomes critical. Virtual ADCs provide the flexibility required to manage applications spread across various cloud environments while maintaining consistent performance and security. Their ability to optimize traffic, accelerate application delivery, and enhance user experience further drives their adoption. Consequently, virtual ADCs have emerged as essential components in modern IT strategies, helping organizations meet the demands of a rapidly evolving digital landscape while maximizing the benefits of cloud services.

Enterprise Size Insights

Large enterprises accounted for the largest share in 2024. Large enterprises often manage intricate IT environments that encompass a combination of on-premises, cloud, and hybrid architectures. This complexity creates significant challenges in application delivery, traffic management, and security, necessitating advanced solutions that can adapt to varied infrastructures. ADCs are specifically designed to navigate these multifaceted setups, providing centralized control over application traffic and ensuring seamless integration across different platforms. ADCs enhance operational efficiency by simplifying the management of diverse applications, allowing organizations to monitor and optimize performance from a single point of control. Their ability to balance traffic, ensure high availability, and implement security measures across multiple environments is crucial for large enterprises. As these organizations strive to maintain performance and reliability amidst growing complexities, the demand for ADCs continues to rise, solidifying their role as essential tools for effective application delivery in modern IT landscapes.

The SME segment is expected to grow steadily over the forecast period. As small and medium enterprises (SMEs) seek to improve operational efficiency and enhance customer engagement, many are embarking on digital transformation initiatives. This transition often involves integrating cloud services, which enable SMEs to access resources and applications more flexibly and cost-effectively. ADCs are instrumental in this digital shift, as they ensure reliable access to applications while optimizing performance across various platforms. By managing traffic efficiently, ADCs minimize latency and downtime, significantly improving the user experience for both employees and customers. As SMEs increasingly recognize the importance of digital strategies to stay competitive, the demand for ADC solutions has grown. These tools not only facilitate seamless application delivery but also support the rapid scaling and adaptability needed in today’s dynamic business environment. Consequently, ADCs are becoming essential for SMEs as they navigate their digital transformation journeys and strive to meet evolving market demands.

End Use Insights

The BFSI segment accounted for the largest share in 2024. The BFSI sector is experiencing significant growth, leading to an increase in transaction volumes that financial institutions must manage effectively. This surge in activity necessitates scalable solutions capable of adjusting to fluctuating demands. ADCs play a crucial role in this context, as they provide the flexibility to scale resources up or down in real time. During peak traffic periods, such as month-end closings or promotional campaigns, ADCs ensure that applications can handle the increased load without sacrificing performance. By efficiently distributing traffic and optimizing resource utilization, ADCs maintain high availability and responsiveness, which is crucial for customer satisfaction in a competitive financial landscape. As organizations strive to accommodate growth and meet rising customer expectations, the scalability offered by ADCs becomes essential. This capability not only supports the current operational needs but also positions financial institutions for future expansion and digital transformation initiatives.

The retail segment is expected to grow steadily over the forecast period. The explosive growth of e-commerce has fundamentally reshaped the retail landscape, driving a significant increase in online transactions and customer interactions. Retailers are now prioritizing digital platforms to establish a strong online presence, catering to the rising demand for convenient and accessible shopping experiences. Application Delivery Controllers (ADCs) play a pivotal role in this transformation by optimizing application performance, which is crucial for maintaining fast load times and reliable access to websites. As consumers expect quick and seamless interactions, ADCs help mitigate latency issues, manage traffic effectively, and ensure high availability, thereby enhancing the overall user experience. This optimization is vital for customer retention, as slow or unreliable websites can lead to lost sales and diminished brand loyalty. By investing in ADC solutions, retailers can better meet customer expectations, maximize engagement, and ultimately thrive in an increasingly competitive e-commerce environment.

Regional Insights

North America application delivery controller market held the largest share of over 34% in 2024. North American enterprises, especially in the U.S. and Canada, are leading the way in cloud adoption and digital transformation. As businesses increasingly migrate to hybrid and multi-cloud environments, the need for Application Delivery Controllers (ADCs) has grown substantially. ADCs are essential in ensuring seamless application delivery, providing scalability, and securing the flow of data across various infrastructures. In cloud environments, ADCs play a critical role in optimizing the performance of cloud-based applications, balancing traffic loads, and reducing latency. As organizations rely more on cloud services to enhance operational efficiency, the demand for ADC solutions that can integrate effectively across multiple platforms continues to rise. This trend supports North America's position as a key growth market for ADC providers, as companies seek solutions that enable them to handle dynamic workloads while maintaining high levels of security and performance during their digital transformation efforts.

U.S. Application Delivery Controller Market Trends

The application delivery controller market in the U.S. held a dominant position in 2024. The U.S. has experienced significant growth in e-commerce and digital services, particularly in sectors like retail and financial services. As online platforms face increasing traffic volumes, the need for efficient application performance becomes critical. Application Delivery Controllers (ADCs) play a key role by optimizing performance, minimizing latency, and ensuring the scalability needed to handle peak traffic periods. During high-demand events, such as sales or market fluctuations, ADCs help maintain reliable access and smooth user experiences. This growing dependence on digital platforms has fueled the demand for ADC solutions, driving market growth in the region.

Asia Pacific Application Delivery Controller Market Trends

The application delivery controller market in Asia Pacific is expected to grow significantly at a CAGR of 14.2% from 2025 to 2030. In the Asia Pacific region, small and medium-sized enterprises (SMEs) are rapidly embracing digital technologies and cloud services to enhance their operations. As these businesses expand their digital presence, the demand for scalable and cost-effective Application Delivery Controllers (ADCs) is rising. ADCs help SMEs ensure reliable application performance, improve user experience, and manage traffic efficiently, even as their workloads grow. This shift towards digitalization, supported by the flexibility and affordability of virtual ADCs, is driving market growth in the region, enabling SMEs to compete effectively in the digital economy while maintaining high performance and security standards.

Japan application delivery controller market is expected to grow rapidly in the coming years. Japan’s focus on advanced technologies like AI and IoT is increasing the demand for Application Delivery Controllers (ADCs). These technologies require the efficient management of complex application environments, and ADCs help ensure optimal performance, scalability, and seamless integration across multiple platforms.

The application delivery controller market in China held a substantial market share in 2024. China’s accelerated digital transformation, particularly in key sectors like manufacturing, finance, and healthcare, is boosting the demand for Application Delivery Controllers (ADCs). These sectors rely on ADCs to optimize application performance, streamline operations, and ensure reliable, seamless delivery of services in increasingly digitalized and complex environments.

Europe Application Delivery Controller Market Trends

The application delivery controller market in Europe is growing as the rising cybersecurity threats in Europe are compelling organizations to invest in Application Delivery Controllers (ADCs) that enhance security features and safeguard sensitive data. By integrating advanced threat protection, ADCs help mitigate risks, ensuring secure application performance and compliance with regulatory standards in a complex digital landscape.

The UK application delivery controller market is expected to grow rapidly in the coming years as organizations increasingly adopt cloud services the demand for Application Delivery Controllers (ADCs) grows to effectively manage hybrid and multi-cloud environments. ADCs facilitate seamless integration and communication between applications, ensuring optimal performance and reliability across diverse cloud platforms.

The application delivery controller market in Germany is expected to hold a significant market share in the coming years. Germany's strong manufacturing and IT sectors are pivotal in increasing the demand for Application Delivery Controllers (ADCs). These industries require optimized application delivery and performance to enhance operational efficiency, manage complex IT environments, and ensure seamless communication across diverse applications and platforms.

Key Application Delivery Controller Company Insights

Some of the key companies in the application delivery controller market include F5 Networks, A10 Networks, Citrix Systems, Barracuda Networks, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

F5 Networks is known for its advanced solutions that optimize the performance, security, and scalability of applications across multi-cloud and on-premises environments. F5's ADCs are designed to enhance application availability, ensure secure traffic management, and provide flexible load balancing. With the rise of cloud computing, F5's innovations in ADC technology, including integration with security features like Web Application Firewalls (WAF), make it a critical component for businesses undergoing digital transformation.

-

Citrix Systems is a significant player in the Application Delivery Controller (ADC) market. Citrix's ADCs are designed to enhance the performance, security, and scalability of applications across cloud and on-premises environments. NetScaler ADCs are known for their robust load balancing, application acceleration, and security features, making them a popular choice for enterprises looking to improve application delivery.

Key Application Delivery Controller Companies:

The following are the leading companies in the application delivery controller market. These companies collectively hold the largest market share and dictate industry trends.

- F5 Networks

- A10 Networks

- Citrix Systems

- Radware

- Array Networks

- Kemp Technologies

- Fortinet, Inc.

- Cisco Systems

- Barracuda Networks

- ZEVENET

Recent Developments

-

In August 2024, Broadcom Inc. unveiled VMware Tanzu Platform 10, designed to accelerate cloud-native application delivery by enhancing governance and operational efficiency for platform engineering teams. It reduces complexity for developers and introduces Tanzu AI Solutions to enable rapid, secure deployment of GenAI-powered applications.

-

In April 2023, A10 Networks launched an integrated cloud-native Thunder Application Delivery Controller (ADC) with Fastly's next-gen Web Application Firewall (WAF), enhancing cloud defense capabilities. This solution provides improved security, performance, and scalability for businesses by combining Fastly’s advanced threat detection with A10's application delivery expertise, addressing evolving cloud threats effectively.

Application Delivery Controller Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.61 billion

Revenue forecast in 2030

USD 8.46 billion

Growth Rate

CAGR of 12.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, Australia, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa.

Key companies profiled

F5 Networks; A10 Networks; Citrix Systems; Radware; Array Networks; Kemp Technologies; Fortinet Inc.; Cisco Systems, Inc.; Barracuda Networks; ZEVENET.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Application Delivery Controller Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global application delivery controller market report based on deployment, enterprise size, end use and region:

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware based ADCs

-

Virtual ADCs

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Government

-

Healthcare

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global application delivery controller market size was estimated at USD 4.35 billion in 2024 and is expected to reach USD 4.61 billion in 2025.

b. The global application delivery controller market is expected to grow at a compound annual growth rate of 12.9% from 2025 to 2030 to reach USD 8.46 billion by 2030.

b. The Hardware based ADCs segment accounted for the largest share of over 59% in 2024. Hardware-based Application Delivery Controllers (ADCs) are engineered to deliver superior performance compared to software-based solutions. By leveraging dedicated hardware components, such as Application-Specific Integrated Circuits (ASICs), these devices optimize data processing and traffic management. This specialized architecture enables faster packet processing, resulting in lower latency and higher throughput.

b. Some key players operating in the application delivery controllers market include F5 Networks, A10 Networks, Citrix Systems, Radware, Array Networks, Kemp Technologies, Fortinet, Inc., Cisco Systems, Barracuda Networks, and ZEVENET. .

b. The growing demand for mobile applications and the impending rollout of 5G networks are further fueling the market, as ADCs can optimize performance and reduce latency for mobile users. Additionally, the rise of IoT devices and edge computing necessitates efficient traffic management, which ADCs can provide, enabling real-time data processing and analytics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.