- Home

- »

- Next Generation Technologies

- »

-

Application Lifecycle Management Market Size Report, 2030GVR Report cover

![Application Lifecycle Management Market Size, Share & Trends Report]()

Application Lifecycle Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-339-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Application Lifecycle Management Market Summary

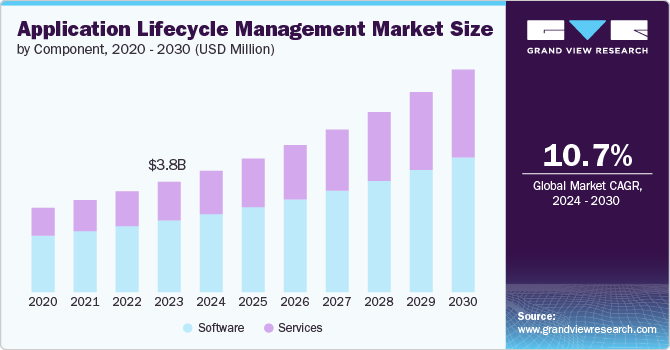

The global application lifecycle management market size was estimated at USD 3,829.3 million in 2023 and is projected to reach USD 7,722.1 million by 2030, growing at a CAGR of 10.7% from 2024 to 2030. The market is witnessing robust growth primarily due to the increasing adoption of digital transformation initiatives across industries.

Key Market Trends & Insights

- North America dominated the application lifecycle management market with the revenue share of 32.2% in 2023.

- The application lifecycle management market in the U.S. is expected to grow at a significant CAGR over the forecast period.

- Based on component, the software segment led the market with the largest revenue share of 65.0% in 2023.

- Based on deployment, the cloud segment led the market with the largest revenue share of 60.7% in 2023.

- Based on enterprise size, the large enterprises segment led the market with the largest revenue share of 38.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3,829.3 Million

- 2030 Projected Market Size: USD 7,722.1 Million

- CAGR (2024-2030): 10.7%

- North America: Largest market in 2023

As organizations strive to innovate and stay competitive in a digital-first economy, the demand for efficient management of software development processes has surged. ALM solutions offer a comprehensive framework that spans the entire lifecycle of applications, from initial concept and requirements gathering to development, testing, deployment, and maintenance. This end-to-end approach ensures that software projects are managed systematically, reducing time-to-market, improving quality, and enhancing collaboration among development teams. Moreover, ALM platforms integrate with agile and DevOps methodologies, enabling organizations to embrace rapid iteration, continuous integration, and deployment automation, which are essential for meeting evolving customer demands and market dynamics.

The growing complexity of software applications and the increasing demand for enhanced governance and compliance are key factors contributing to the expansion of the global market. Modern applications often involve multiple technologies, platforms, and dependencies, making it challenging to ensure seamless integration and interoperability across the entire IT landscape. ALM tools provide visibility and control over project activities, resource allocation, and adherence to regulatory standards and industry best practices. This capability is crucial for industries such as finance, healthcare, and manufacturing, where compliance with regulations like GDPR, HIPAA, and ISO standards is mandatory. ALM solutions also support traceability and auditability of software changes, facilitating risk management and ensuring that organizations can maintain operational efficiency while meeting regulatory requirements.

The market is expanding as organizations recognize the strategic value of optimizing their software development and delivery processes. ALM platforms enable businesses to align IT initiatives with broader business objectives, improving transparency, and decision-making across departments. By centralizing project management, version control, and collaboration tools within a unified platform, ALM solutions empower teams to work more efficiently and effectively. This results in reduced costs, faster time-to-market for new applications and features, and better customer satisfaction. Moreover, ALM supports scalability and agility in software development, allowing organizations to scale resources up or down based on project needs and market conditions. As businesses continue to invest in digital innovation and seek competitive advantages, ALM solutions play a pivotal role in driving operational excellence and enabling organizations to adapt quickly to changing market dynamics.

Component Insights

Based on component, the software segment led the market with the largest revenue share of 65.0% in 2023. The software segment dominates the market primarily due to its critical role in managing and optimizing the development, deployment, and maintenance of software applications. ALM software includes a wide range of tools and platforms designed to simplify workflows, enhance collaboration among development teams, and ensure the quality and reliability of software products. These solutions offer comprehensive capabilities such as version control, requirements management, automated testing, and deployment automation, which are essential for managing the complexities of modern software development. Moreover, as organizations across various industries prioritize digital transformation initiatives, the demand for ALM software continues to grow to support agile methodologies, DevOps practices, and compliance with regulatory standards.

The service segment is projected to grow at a significant CAGR over the forecast period. The services segment in this market is expanding rapidly in response to changing dynamics in software development practices and organizational needs. As companies increasingly prioritize agile methodologies and implement complex software solutions, there is a growing recognition of the necessity for specialized expertise in integrating ALM tools effectively within diverse IT environments. Services such as consulting, implementation, and training have become essential for navigating these shifts, ensuring seamless adoption of ALM platforms, and maximizing operational efficiency. Moreover, the trend towards managed services and outsourcing reflects a strategic adaptation to streamline application testing, release management, and compliance monitoring. These efforts enable organizations to adapt swiftly to evolving market demands while optimizing internal resources for core business activities.

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 60.7% in 2023. Cloud-based ALM solutions offer scalability and flexibility, allowing organizations to scale resources up or down based on project demands without the need for significant upfront investment in hardware or infrastructure. This scalability is particularly beneficial in today's dynamic business environment, where agility and responsiveness are crucial. Cloud ALM solutions facilitate collaboration and remote access, enabling geographically dispersed teams to work seamlessly on software projects. This capability supports agile methodologies and DevOps practices, where continuous integration and delivery are essential for rapid software deployment and updates. Cloud ALM platforms provide centralized management and accessibility of project data and tools from anywhere with an internet connection.

The on-premises segment is predicted to foresee at a significant CAGR during the forecast period. Some businesses, particularly in highly regulated industries such as finance, healthcare, and government, have stringent data privacy and security concerns that require them to maintain full control over their IT infrastructure. On-premises ALM solutions allow these organizations to keep sensitive data within their secure environments, ensuring compliance with regulatory standards and internal policies. Certain organizations may have legacy systems or applications that are not easily migrated to the cloud due to compatibility issues or dependencies on specific hardware configurations. On-premises ALM solutions provide continuity and support for these legacy systems, enabling businesses to manage their software lifecycles effectively without disruption to existing operations.

Enterprise Size Insights

Based on enterprise size, the large enterprises segment led the market with the largest revenue share of 38.9% in 2023. Large enterprises typically manage multiple software projects across various departments and regions, requiring comprehensive ALM solutions that can scale to support large-scale deployments and global operations. These organizations require robust ALM platforms that offer extensive capabilities for project management, collaboration, and integration with existing IT infrastructure. Large enterprises often operate in regulated industries such as finance, healthcare, and government, where compliance with stringent regulatory standards and data privacy laws is mandatory. ALM solutions customized for large enterprises provide advanced security features, audit trails, and compliance management tools that ensure adherence to regulatory requirements while maintaining operational continuity.

The small & medium enterprises segment is projected to grow at a significant CAGR over the forecast period. SMEs grow and expand their operations, they face similar challenges as larger enterprises in managing software development lifecycles efficiently. ALM solutions customized for SMEs offer scalability, affordability, and flexibility, allowing these organizations to adopt agile methodologies and DevOps practices to improve development speed and quality. Cloud-based ALM solutions have democratized access to advanced software lifecycle management capabilities, making them accessible to SMEs without the need for substantial upfront investments in infrastructure. Cloud ALM platforms provide SMEs with the ability to manage projects, collaborate across teams, and automate deployment processes from anywhere with internet access, thereby enhancing productivity and reducing operational costs.

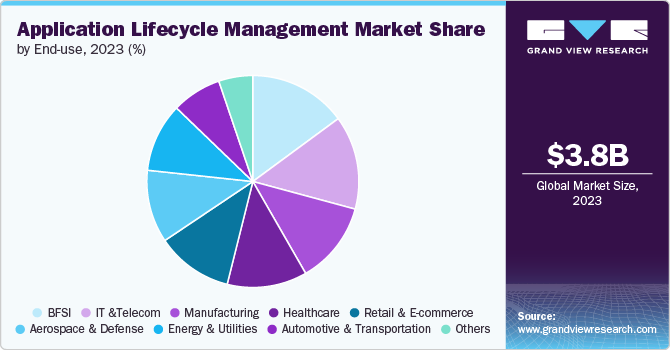

End-use Insights

Based on end use, the BFSI segment led the market with the largest revenue share of 14.9% in 2023. BFSI organizations operate in a highly regulated environment with stringent compliance requirements, necessitating robust ALM solutions that ensure adherence to regulatory standards such as GDPR, PCI-DSS, and others. ALM platforms customized for BFSI offer comprehensive features for governance, risk management, and compliance (GRC), enabling these organizations to manage software development processes while mitigating regulatory risks effectively. BFSI institutions manage vast and complex IT infrastructures supporting critical financial transactions, customer data management, and operational systems. ALM solutions in BFSI provide capabilities for secure application development, testing, and deployment, ensuring the reliability, availability, and security of financial services applications. These capabilities are essential for maintaining customer trust, protecting sensitive information, and safeguarding against cyber threats in a sector where data security and operational resilience are paramount.

The IT and Telecom segment is projected to grow at a significant CAGR over the forecast period. IT and Telecom companies operate in highly competitive environments where innovation and rapid deployment of new technologies are crucial for maintaining market leadership. ALM solutions enable these organizations to simplify software development processes, improve collaboration among cross-functional teams, and accelerate time-to-market for new products and services. The increasing complexity of software applications and the demand for seamless integration across diverse IT infrastructures drive the adoption of ALM platforms in the IT and Telecom sectors. These solutions offer comprehensive capabilities for managing the entire lifecycle of software applications, from initial concept and design to development, testing, deployment, and ongoing maintenance. By standardizing and automating these processes, ALM helps IT and Telecom companies enhance efficiency, reduce operational costs, and ensure high-quality deliverables.

Regional Insights

North America dominated the application lifecycle management market with the revenue share of 32.2% in 2023. North America's leadership in the ALM market originates from its dense concentration of leading technology firms, software developers, and IT service providers. These entities, spanning industries such as finance, healthcare, manufacturing, and telecommunications, prioritize efficient software development processes to maintain competitiveness and meet evolving customer expectations for innovation. Their collective demand drives the adoption and advancement of sophisticated ALM solutions customized to stringent industry standards and regulatory requirements.

U.S. Application Lifecycle Management Market Trends

The application lifecycle management market in the U.S. is expected to grow at a significant CAGR over the forecast period.The U.S. market is poised for substantial growth over the forecast period, driven by increasing cyber threats and widespread adoption of digital technologies across industries. Investments in advanced cybersecurity solutions, including AI-driven threat detection and cloud security, are expected to escalate as organizations prioritize safeguarding sensitive data.

Asia Pacific Application Lifecycle Management Trends

The application lifecycle management market in Asia Pacific is anticipated to register at the fastest CAGR over the forecast period. Asia Pacific is emerging as a hub for IT and software development, with countries like India, China, and Singapore leading the way. These nations have a large pool of skilled IT professionals and are experiencing a surge in startup ecosystems and tech-driven innovation. The growing number of software development projects in the region fuels the need for ALM solutions that can support diverse development environments, manage complex software lifecycles, and cater to the unique requirements of both startups and established enterprises.

Europe Application Lifecycle Management Market Trends

The application lifecycle management market in Europe possesses a strong industrial foundation characterized by substantial investments in key sectors such as manufacturing, automotive, aerospace, and others that heavily depend on sophisticated software solutions. These industries prioritize ALM to streamline development lifecycles, enhance product quality, and ensure compliance with stringent regulatory frameworks such as GDPR. European enterprises are increasingly adopting agile methodologies and DevOps practices to accelerate digital transformation initiatives and improve operational efficiency. ALM solutions help support these practices by enabling continuous integration, automated testing, and rapid deployment of software updates, thereby promoting innovation and responsiveness to market demands.

Key Application Lifecycle Management Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in March 2024, LambdaTest, a U.S.-based software company, and Inflectra Corporation have partnered to integrate LambdaTest's cross-browser testing platform with Inflectra's SpiraTeam, creating a unified solution for efficient software development and testing. This collaboration enhances workflow management, enabling teams to simplify software delivery with improved speed, quality, and reduced risk.

Key Application Lifecycle Management Companies:

The following are the leading companies in the application lifecycle management market. These companies collectively hold the largest market share and dictate industry trends.

- Atlassian Corporation Plc

- CollabNet, Inc.

- HP Development Company, L.P.

- Inflectra Corporation

- International Business Machines Corporation (IBM)

- Micro Focus International plc

- Microsoft

- NimbleWork, Inc.

- Parasoft Corporation

- Polarion Software GmbH

- SAP SE

Recent Developments

-

In May 2024, Sonatype Inc., a software company in the U.S., announced an integration with ServiceNow to embed Sonatype Lifecycle’s software composition analysis and open-source vulnerability scans into ServiceNow workflows, enhancing vulnerability management and remediation efficiency. This integration allows users to directly import scan results into ServiceNow’s Application Vulnerability Response, streamlining the identification, tracking, and remediation of open-source software vulnerabilities

-

In May 2024, Microsoft Power Platform announced the general availability of the Block unmanaged customizations feature. This feature allows system administrators to prevent direct changes and unmanaged solution imports in production environments, ensuring all modifications go through approved ALM processes for enhanced reliability and auditing

-

In April 2024, International Business Machines Corporation (IBM) acquired HashiCorp, Inc., an American software company, for $6.4 billion. The company aims to integrate HashiCorp's multi-cloud infrastructure automation with IBM's hybrid cloud and AI capabilities, thereby enhancing its application lifecycle management solutions. This strategic acquisition aims to enable IBM to provide more comprehensive and streamlined infrastructure and application management across hybrid and multi-cloud environments

-

In January 2024, Siemens Digital Industries Software and Salesforce, Inc. is an American cloud-based software company that launched the Teamcenter SLM app on Salesforce AppExchange. This app integrates Siemens' PLM technology with Salesforce's Service and Manufacturing Clouds to enhance service-centric business models

Application Lifecycle Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4,206.0 million

Revenue forecast in 2030

USD 7,722.1 million

Growth rate

CAGR of 10.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Atlassian Corporation Plc; CollabNet, Inc.; HP Development Company; L.P.; Inflectra Corporation; International Business Machines Corporation (IBM); Micro Focus International plc; Microsoft; NimbleWork, Inc.; Parasoft Corporation; Polarion Software GmbH; SAP SE.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Application Lifecycle Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global application lifecycle management market report based on component, deployment, enterprise size, end-use and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Manufacturing

-

Aerospace & Defense

-

BFSI

-

Energy & Utilities

-

Retail & E-commerce

-

Healthcare

-

IT & Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global application lifecycle management market size was estimated at USD 3,829.3 million in 2023 and is expected to reach USD 4,206.0 million in 2024.

b. The global application lifecycle management market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 7,722.1 billion by 2030.

b. North America dominated the application lifecycle management market with a share of 32.2% in 2023. This is attributable to its robust technological infrastructure, high adoption of advanced software development practices, and significant investments in IT.

b. Some key players operating in the application lifecycle management market include Atlassian Corporation Plc, CollabNet, Inc., HP Development Company, L.P., Inflectra Corporation, International Business Machines Corporation (IBM), Micro Focus International plc, Microsoft, NimbleWork, Inc., Parasoft Corporation, Polarion Software GmbH, and SAP SE.

b. Key factors that are driving the market growth include increasing adoption of cloud-based solutions and services, growing demand for efficient software development and deployment processes, and rising emphasis on digital transformation initiatives across industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.