Application Programming Interface Security Market Size, Share & Trends Analysis Report, By Offering, By Deployment Type, By Enterprise Size, By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-173-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

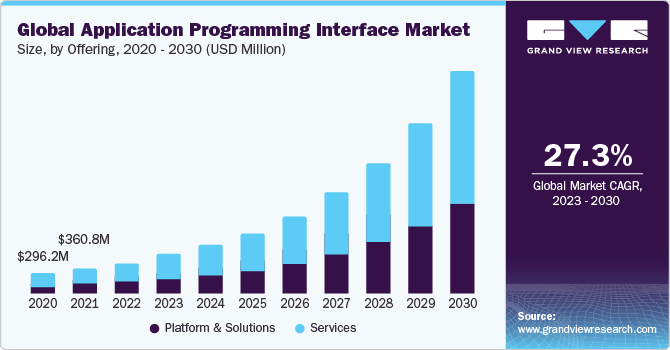

The global application programming interface security market size was valued at USD 438.9 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 27.3% from 2023 to 2030.APIs have grown in level of complexity, providing a wide range of functions and serving as the foundation of interconnected systems. APIs serve an essential part in the implementation of applications for smartphones and cloud-based services. API security is essential for preserving the data and operations accessed via these cloud-based avenues.

The necessity for sharing information and insights to track and respond to the pandemic led to the creation of APIs that access, aggregate, and analyze data from a variety of sources, including medical information, infection rates, and tracking of contacts. The pandemic's urgency encouraged collaboration and innovation with the API sector. APIs for contact tracing apps, immunization records, and other medical solutions have been developed by companies and developers operating collaboratively.

The pandemic accelerated industry-wide digital transformation initiatives. APIs are crucial to these shifts as organizations strive to adopt technological innovations. The increased use of APIs necessitates strong security solutions. The pandemic increased cybersecurity threats. Threat actors exploited vulnerabilities made accessible by a remote work shift. API security measures are essential for mitigating growing threats, including data theft and API-based attacks. Moreover, API security solutions are getting more closely linked with API management systems. Blockchain technology and distributed database solutions will play a role in improving API security, notably for supply chain administration, online identification, and encrypted sharing of information services.

Offering Insights

Based on the offering, the API security market is segmented into platforms & solutions, and services. The services segment held the largest market share in 2022. API security involves specialized knowledge in identifying and reducing multiple API-related threats. Service providers in this space often focus on API security and offer a level of technical expertise that private firms may need help to maintain in-house.

Cyber security risks are constantly developing. API security service providers are able to remain up to date on current threats, dangers, and security standards, in addition to altering their services to offer proactive security.

Deployment Insights

On the basis of deployment, the market is segmented into on-premises and cloud. Cloud held the largest market share in 2022. Application programming interface security platforms that are cloud-based usually provide central administration and monitoring. API security solutions based on the cloud adapt to flow variations and high loads. They automatically increase resources to cope with additional traffic, assisting in the maintenance of API functionality and safety during periods of high demand. Furthermore, cloud services can be implemented worldwide, which is significant for enterprises with a global presence. Cloud-based API security may deliver uniform safety safeguards across geographical regions, ensuring that all APIs are shielded consistently.

Enterprise Size Insights

On the basis of enterprise size, the market is segmented into small and large enterprises. Large enterprises held the largest market share in 2022. Large enterprises employ comprehensive API security testing that involves checking for vulnerabilities, attack detection, and inspection of code. These tests aid in identifying vulnerabilities and security risks in APIs and the apps that utilize services. To govern API access, large organizations use powerful authentication techniques such as API keys OAuth, and OpenID Connect. Furthermore, they enable authentication and authorization systems for users and applications to manage who has access to APIs. Only authorized users and programs can communicate with APIs, owing to identity access management solutions.

Vertical Insights

On the basis of vertical, the market is segmented into IT & telecom, BFSI, retail & e-commerce, healthcare, manufacturing, government, and education, among others. IT & telecom held the largest market share in 2022. Telecom corporations often utilize APIs to control their telecommunications networks. These APIs manage navigation, quality of service (QoS), and network efficiency. Security is critical in network management APIs to avoid unwanted access and subsequent network outages.

Furthermore, telecom providers frequently provide customers with self-service websites that allow consumers to handle their account information, alter services, and obtain use data. Such websites are dependent on APIs for performance and require robust safety measures to secure customer data.

Regional Insights

Asia Pacific dominated with the largest market share in 2022. The growth of the region can be attributed to the presence of prominent players such as Noname Security, Palo Alto Networks, and Salt Security, Inc., among others. Furthermore, language and translating assistance is in high demand in the APAC region due to the region's diversity of languages. APIs provide translation services that overcome language gaps in an array of applications, such as website localization and assistance for customers. Many APAC firms have shifted to cloud-based API solutions to meet their specific requirements. Cloud providers such as Amazon Web Services Inc., Microsoft Azure, and Google Cloud provide robust, safe API management solutions that are readily available in the region.

Key Companies & Market Share Insights

Key players operating in the market are Akamai.com, 42 Crunch Ltd, Cequence Security, Inc., Fastly, Inc., Imperva, Red Hat, Inc., Noname Security, Palo Alto Networks, Salt Security, Inc. and Spherical Defense, among others. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives:

-

In August 2023, Salt Security, Inc. collaborated with API testing leaders to improve API security capabilities, with the aim of improving threat detection and mitigation within APIs, underlining the increasing importance of API security.

-

In September 2022, Salt Security, Inc. invested in CrowdStrike’s Falcon Fund. This contribution demonstrates CrowdStrike's support for Salt Security in its dedication to improving API security. Salt Security offers API safety measures, which are becoming increasingly important in the fight against cyber-attacks. The investment emphasizes the significance of API security in the field of cybersecurity.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."