- Home

- »

- Animal Feed and Feed Additives

- »

-

Aquaculture Additives Market Size & Share, Industry Report, 2019-2025GVR Report cover

![Aquaculture Additives Market Size, Share & Trends Report]()

Aquaculture Additives Market Size, Share & Trends Analysis Report By Product (Amino Acids, Vitamins, Anti-Parasitics, Feed Acidifiers, Anesthetic & Sedation Materials), By Application, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-805-3

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Specialty & Chemicals

Industry Insights

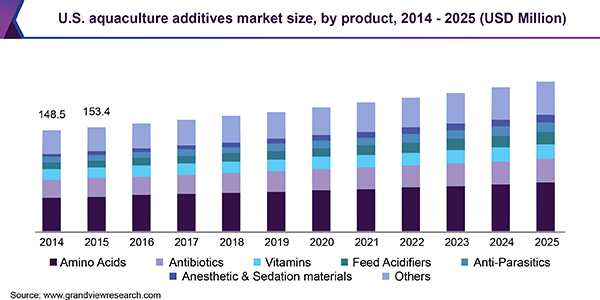

The global aquaculture additives market size was estimated at USD 1.18 billion in 2017. It is projected to expand at a CAGR of 3.2% during the forecast period. Growing knowledge among fish breeders about the advantages of supplying adequate nutrition to fish has been one of the primary factors driving the aquafeed market.

Fish is a valuable source of vitamins and proteins; thus, is primarily utilized for human consumption. It has the lowest fat levels among all forms of meat, such as poultry and cattle. Fish consumption reduces the risk of cardiovascular diseases, improves cognitive development in fetus and children, and reduces the levels of fat in the body, thereby minimizing the risks associated with obesity.

Moreover, fish consumption pattern has witnessed major changes over the past few years owing to numerous factors including changing eating habits and increasing availability of a variety of fish in the retail market. Rising consumer awareness regarding the health benefits of fish has boosted the demand in the past few years.

A variety of fish, such as salmon, tuna, whale blubber, seal blubber, and cod liver is used to obtain Omega 3 fatty acids. Rising health awareness among consumers is projected to augment the demand for supplements that aid in reducing body fat while improving overall health. Increasing prevalence of cardiovascular diseases, obesity, and other illnesses, such as diabetes are projected to augment the consumption of omega-3 based supplements over the next few years.

Furthermore, the consumption of LC-omega 3, derived from either wild and farmed fish or encapsulated fish oil, helps maintain cardiovascular health and asthma, psoriasis, eczema, and Crohn’s disease. It also helps the development of brain tissue and plays an important role during the last trimester of pregnancy as well as in infant nutrition.

The demand for protein is witnessing a surge as a result of rising consumer awareness regarding the consumption of high nutritional food. A high number of consumers in Asia Pacific are opting for protein sourced from animals. This is likely to propel the demand for fish food leading to a surge in the aquaculture additives market over the next few years.

Aquaculture additives contain antibiotics to prevent occurrences of bacterial diseases of fish. Antibiotics provide pathogenic protection to fish as well as promote metabolism. However, the antibiotics market is anticipated to witness hurdles over the next eight years owing to the implementation of bans on several products including malachite green, chloramphenicol, gentian violet, and nitrofuran as they cause water contamination.

Advancements in amino acid nutrition technology and their application in the formulation of environment-oriented and functional aquafeed is projected to aid market growth in the upcoming years. Furthermore, the regulations for reducing nitrogen levels in feeds are projected to enhance the importance of low-protein amino acids.

Product Insights

The market is segmented into amino acids, antibiotics, vitamins, feed acidifiers, anesthetic and sedation materials, and anti-parasitics. Amino acids play an important role in fish metabolism and nutrition. Its functions include appetite stimulation, cell signaling, growth and development regulation, osmoregulation, feed intake, nutrient, and energy utilization, reproduction, immunity, stress responses, larval metamorphosis, and resistance to pathogenic organisms.

In addition, supplements of essential amino acids aids in the modulation of metabolism and helps develop new strategies to provide an amino acid balanced feed which is projected to offset the environmental impact on aquaculture animals, increased profitability, and growth performance of the aquafeed market.

Rising awareness regarding the significance of amino acids for improving the efficiency of protein usage in aquaculture feeding is anticipated to complement the growth of the additives industry. Lysine, threonine, methionine, tryptophan, valine, arginine, isoleucine, phenylalanine, histidine, and leucine are a few essential amino acids that are not synthesized naturally in the body and are required to be supplied as aquafeed additives.

Feed acidifiers are made from organic acids and their salts and they aid refining gastric acid levels in the aquatic animals, thereby strengthening digestion and food assimilation. The demand for acidifiers as additives is projected to witness significant growth as a result of their effectiveness in controlling diseases caused by harmful bacteria, such as Salmonella and E. coli.

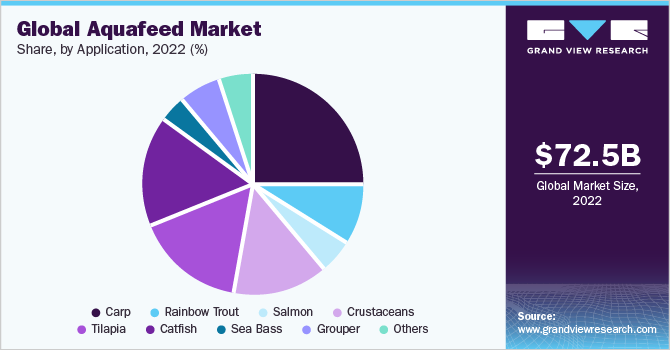

Application Insights

Aquafeed comprises a wide range of plants and animals including fish, mollusks, crustaceans, and seaweeds, and other aquatic plants. Carp led the application segment in 2017, followed by catfish. Carp is one of the important aquaculture species in the European and Asian countries.

Carps are also known to be omnivorous species consuming animal feed including larvae of insects, water insects, zooplankton, mollusks, and worms, along with the seeds, leaves, and stalks of decayed aquatic plants, terrestrial, and other aquatic plants. Common carps are grown by providing natural and supplementary feed in stagnant water ponds, by utilizing the cereals supplied by farmers.

Carps are rich in omega 3 fatty acids and a rich source of low-fat protein. The rising importance of omega 3 fatty acids in the food and beverage industry owing to their ability to reduce cholesterol levels is anticipated to boost carp-related farming activities. Carps are increasingly utilized in rice paddies intended to feed on insects and other organisms associated with rice culture.

Catfish is rich in vitamin D and omega 6 fatty acids. This factor is anticipated to drive the demand for catfish in retail markets and is likely to augment the aquafeed market growth over the next few years. The aquafeed consumed by catfish includes soybean meal, cornmeal, cottonseed meal, peanut (groundnut) meal, and wheat, and it is supplemented with minerals, vitamins, and vegetable oil. Animal protein in the form of fish meal is also provided for channel catfish.

Regional Insights

Asia Pacific majorly contributes to aquaculture and aquafeed production owing to favorable climatic conditions. The region is estimated to lead the market over the forecast years. Expanding aquaculture industry in India and China due to the factors, such as ease of resource availability, induced conditions for aquaculture, and cheap labor is anticipated to bode well for regional growth.

Increasing consumption of seafood in Southeast Asian countries including Vietnam and Thailand is projected to promote aquaculture production in the region and thus is projected to boost the demand for feed in the upcoming years. In addition, favorable climatic conditions in these countries aid the overall aquaculture production, thereby driving the market growth.

North America is projected to witness significant growth owing to the strong support from the governments of both U.S. and Canada for the expansion of aquaculture. The species substantially contributing to the industry growth include salmonids and mollusks, especially hard clams, oysters, and mussels.

Factors challenging the growth of the regional aquaculture industry include the restrictions on effluent discharge and access to freshwater. However, emphasis on the production in intensive recirculating systems and offshore water bodies can overcome this challenge.

Aquaculture Additives Market Share Insights

High demand from China, Vietnam, Norway, Chile, Indonesia, India, U.S., Brazil, Thailand, Canada, and Bangladesh, will fuel the market over the next few years. Big companies are increasing their geographical presence to gain overall market share.

They also engage in business expansions to make their products available to a larger consumer base across the globe. For instance, in January 2018, Cargill, Inc. opened a feed mill dedicated to the fish species in Andhra Pradesh, India. The facility, with a total capacity of over 90,000 tons annually, is anticipated to enable the company to increase its fish feed capacity threefold in the country.

Some of the key companies are Archer Daniels Midland Company (ADM); BASF SE; Biomin Holding GmbH; Skretting A.S.; DSM; Evonik Industries AG; NEOVIA; Novus International, Inc.; De Heus Animal Nutrition B.V.; Nutriad International NV; Avanti Feeds Ltd.; NK Ingredients Pte Ltd.; and Bentoli, Inc.

Report Scope

Attribute

Details

Base year for estimation

2017

Actual estimates/Historical data

2014 - 2016

Forecast period

2018 - 2025

Market representation

Volume in Kilotons, Revenue in USD Million & CAGR from 2018 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Country Scope

U.S., Germany, Norway, China, India, Peru, Chile

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global aquaculture additives market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

Amino Acids

-

Antibiotics

-

Vitamins

-

Feed Acidifiers

-

Anesthetic & Sedation materials

-

Anti-Parasitics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Carp

-

Mollusks

-

Salmon

-

Shrimps

-

Tilapia

-

Catfish

-

Sea Bass

-

Trout

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

Norway

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Peru

-

Chile

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."