- Home

- »

- Animal Feed and Feed Additives

- »

-

Aquafeed Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Aquafeed Market Size, Share & Trends Report]()

Aquafeed Market Size, Share & Trends Analysis Report By Form (Dry, Wet), By Additive (Amino Acid, Feed Acidifiers), By Feed (Grower, Finisher), By Application (Tilapia, Carp), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-104-7

- Number of Report Pages: 137

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

Report Overview

The global aquafeed market size was valued at USD 72.5 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.4% from 2023 to 2030. The product demand is anticipated to be driven by its increasing consumption in the cultivation of various aquatic species, such as tilapia, carp, catfish, and salmon. The global industry is highly fragmented owing to the presence of many players, such as BioMar Group, Cargill, Inc., and Charoen Pokphand Foods PCL. These market players are focused on mergers & acquisitions, partnerships, portfolio expansions, and collaborations to strengthen their presence in the value chain. For instance, Cargill has recently launched a new line of plant-based aquafeed called “Ewos Naturligvis” in Norway. The product is made from sustainable ingredients, such as wheat, soy, and corn, and it is designed to provide optimal nutrition to fish while minimizing the environmental impact.

The industry is expected to witness brisk growth on account of the rising fish farming activities. There is an increasing preference for natural and organic feed products among manufacturers, which has now become the new industry trend. This is anticipated to drive the market for plant-based aquafeed in the coming years. These aquafeed products are manufactured using both traditional as well as modern technology-driven processes.

The traditional method is still widely used despite its low effectiveness and slow speed. The production technique varies according to the demand and requirement of the consumers in the local as well as global market. There is an increase in direct human consumption of fish as it is a low-fat protein when compared to other types of meat, such as cattle and poultry. This rise in consumption is due to the availability of a variety of fish in the retail market. Also, it offers several health benefits, such as enhancing cognitive development in children, lowering the fat level in the body, and assisting in reducing the threat of cardiovascular diseases.

Form Insights

The dry form type segment dominated the global industry in 2022 and accounted for the maximum share of more than 42.70% of the overall revenue. This is attributed to its ability to increase the feed conversion ratio of fish. The segment is estimated to expand further at the fastest growth rate maintaining its leading position throughout the forecast period as the dry form feed is highly palatable. Wet feeds are also a commonly used form of aquafeed products. It contains moisture levels in the range of 45%-70%.

They are made from high moisture content ingredients, such as slaughterhouse waste, undried forage, and fishery waste. These wet feed products are produced on a daily basis at farm sheds and fed mainly to carnivores fish, such as sea bream, sea bass, and eels among others. Apart from dry and wet feed, moist feed form is also widely used. These feed products are made by mixing wet, dry, as well as moist raw materials. The moisture level ranges from 25%-45%. Due to the presence of sodium chloride and propylene glycol in some moist feeds, they do not require frozen storage.

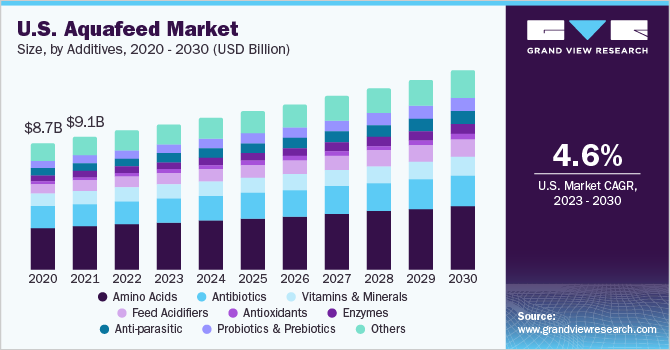

Additive Insights

The amino acids segment dominated the industry in 2022 and accounted for the maximum share of more than 32.80% of the overall revenue. This high share is attributed to its advantages, such as enhancing immunity, increasing larval performance, optimizing the efficiency of metabolic transformation in fish, increasing tolerance to environmental stresses, mediating efficiency and timing of spawning, and improving fillet taste and texture when added in aquafeed. In addition to amino acids, antibiotics are also widely used additives in aquafeed. They promote better growth by improving overall health and are used to maximize productivity and efficiency.

Intensive aquaculture promotes the growth of some bacterial infections and leads to increased use of antibiotics. Current levels of antibiotics used in aquaculture around the world cannot be easily determined due to different distribution and registration systems in different countries. Furthermore, vitamins are extensively utilized in animal feed formulations. They act as effective barriers against viruses, parasites, and bacteria. Vitamins are naturally present in the feed, but additional supplements are also mixed with vitamins to provide optimal nutrition when added to livestock feeds. Also, there are several mineral elements considered to be essential nutrients for fish. The mineral elements are introduced in the aquafeed in levels to maintain the ability of fish and resist diseases.

Feed Insights

The grower feed segment dominated the industry in 2022 and accounted for the maximum share of more than 34.25% of the overall revenue. Its high share is attributed to its rising usage in animals, which are between the age group of 6 to 20 weeks, to fulfill their dietary requirements. This type of feed is given to the animal until they are ready to start reproducing and laying eggs. Switching from starter to grower feed is necessary as excessive protein content may cause long-term liver or kidney issues. In addition, finisher feeds are also used widely after grower feeds. Finisher feeds are usually given to adult fish/animals that are more than 20 weeks old.

It provides nutrients that meet the key needs of the animals. It comprises 21% of protein with high energy to aid life. A high level of energy is provided by the feed so that habitual activities are performed smoothly. Starter feed is a protein-rich variety of feed prepared to fulfill the dietary needs of animals. It usually contains 21% protein content, which helps in the development of animals. It is the highest amount of protein content the animal will ever have, as they are growing at a significant rate at this stage of life. Starter feeds allow the young animals to adapt to solid feed and improve the absorption of the feeds for the later stage. It is more nutritious and contains nutrients required for the optimum growth of the animals.

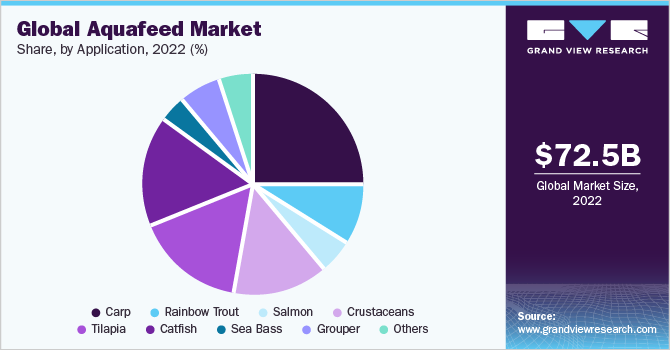

Application Insights

The carp application segment dominated the global industry in 2022 and accounted for the maximum share of more than 25.00% of the overall revenue. The high share of this segment is attributed to the rising consumption of this species as it promotes overall health, boosts immunity, improves heart health, lowers the risk of chronic diseases, and protects gastrointestinal functions. Catfish, being a sustainable fish species, is farmed in freshwater ponds using rice, corn, and soybean as aquafeed. It is the preferred group of farmed aquaculture species due to its ease of farming in less-than-ideal climatic conditions.

Increasing demand for catfish from consumers, on account of its vitamin D and omega-6 fatty acids contents, is expected to augment the segment growth. Tilapia is a freshwater fish and is bred in aquaculture on account of its inexpensive vegetarian feed and fast growth. It grows at a faster rate compared to carnivorous species, such as salmon. The growing production of tilapia species due to its fast growth rate, palatability, high protein content, and large size is expected to amplify the importance of aquafeed in this application segment.

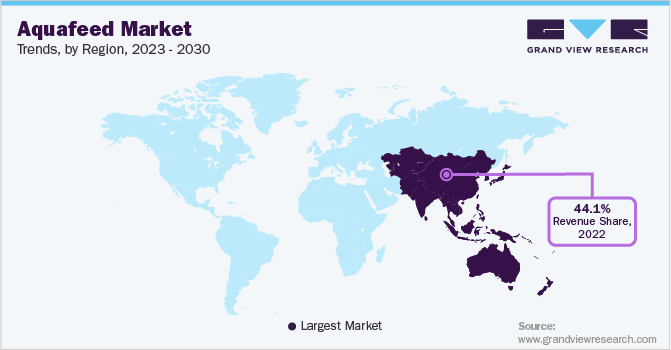

Regional Insights

The Asia Pacific region dominated the global industry in 2022 and accounted for the largest share of more than 44.10% of the overall revenue. The regional market is estimated to expand further at the fastest growth rate maintaining its dominant position throughout the forecast period. This is attributed to the substantial growth of the regional aquaculture sector. In addition, the availability of cheap labor, inducing conditions to promote the growth of aquaculture, and the presence of natural resources in the region will boost the growth.

The aquaculture sector is growing significantly across European countries, especially in the U.K., France, Italy, and Spain. Improvements in environment management, along with a significant increase in feed efficiency and nutrient consumption by aquatic species, have further fueled the growth of the market in Europe. The North America regional market is also projected to have significant growth over the forecast years. The aquaculture sector in North America is estimated to witness rapid growth over the forecast period owing to the rising consumption of seafood, such as salmonids, mollusks, hard clams, oysters, and mussels.

Key Companies & Market Share Insights

The competition in the global industry is highly dependent on the product portfolio, geographical location, and the number of sellers. The aquafeed producers are engaged in constant R&D activities to develop numerous natural and organic aquafeed to be used in the cultivation of various species. For example, BioMar has developed a range of plant-based aquafeed products that are made from sustainable raw materials, such as peas and canola. These feed manufacturers are working on improving their product portfolios as well as undertaking several activities including the production of poultry products, farming, feeding, and marketing to cut down their operational costs and to produce feed with higher nutritional value. Some of the prominent players in the global aquafeed market include:

-

Cargill, Inc.

-

BioMar Group

-

Ridley Corp. Ltd.

-

Aller Aqua

-

BENEO

-

Alltech

-

Aker Biomarine

-

Charoen Pokphand Foods PCL

-

Skretting

-

Purina Animal Nutrition LLC

-

Dibaq Aquaculture

-

INVE Aquaculture

-

Avanti Feeds Ltd.

-

Biostadt India Ltd.

-

The Waterbase Ltd.

Aquafeed Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 75.57 billion

Revenue forecast in 2030

USD 102.3 billion

Growth rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, additives, feed, application, regions

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Denmark; China; India; Japan; Vietnam; Thailand; Indonesia; Australia; Brazil; Argentina; Chile; Ecuador; South Africa; Egypt

Key companies profiled

Cargill, Inc.; BioMar Group; Ridley Corp. Ltd.; Aller Aqua; BENEO; Alltech; Aker Biomarine; Charoen Pokphand Foods PCL; Skretting; Purina Animal Nutrition LLC; Dibaq Aquaculture; INVE Aquaculture; Avanti Feeds Ltd.; Biostadt India Ltd.; The Waterbase Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aquafeed Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global aquafeed market report on the basis of form, additive, feed, application, and regions:

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Dry

-

Moist

-

Wet

-

-

Additives Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Amino Acids

-

Antibiotics

-

Vitamins & Minerals

-

Feed Acidifiers

-

Antioxidants

-

Enzymes

-

Anti-parasitic

-

Probiotics & Prebiotics

-

Others

-

-

Feed Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Starter Feed

-

Grower Feed

-

Finisher Feed

-

Brooder Feed

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Carp

-

Rainbow Trout

-

Salmon

-

Crustaceans

-

Tilapia

-

Catfish

-

Sea Bass

-

Grouper

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Vietnam

-

Thailand

-

Indonesia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Ecuador

-

-

Middle East & Africa

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global aquafeed market size was estimated at USD 72.5 billion in 2022 and is expected to reach USD 75.57 billion in 2023.

b. The global aquafeed market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 102.3 billion by 2030.

b. Asia-Pacific dominated the aquafeed market with a share of 44.1% in 2022. This is attributable to the rising aquaculture industry owing to factors such as ease of availability of natural resources, induced conditions for aquaculture, and cheap labor.

b. Some key players operating in the aquafeed market include Alltech Inc, Biomar, Ridley, Aller Aqua, Dibaq Aquaculture, Addcon Group GmbH, and Biomin.

b. Key factors that are driving the aquafeed market growth include the growing usage of aquafeed in crustacean and carp farming and static natural production of fishes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."