- Home

- »

- Consumer F&B

- »

-

Salmon Fish Market Size & Share, Industry Report, 2030GVR Report cover

![Salmon Fish Market Size, Share & Trends Report]()

Salmon Fish Market Size, Share & Trends Analysis Report By Species (Atlantic/Aquaculture, Pacific), By Form (Fresh, Frozen), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-925-2

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Salmon Fish Market Size & Trends

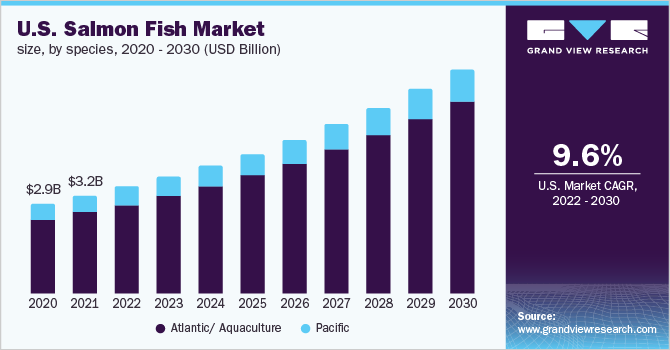

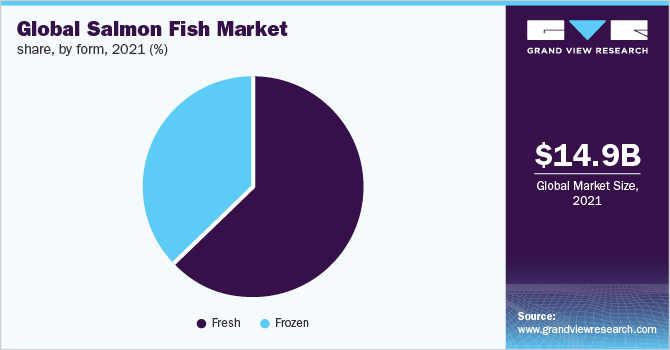

The global salmon fish market size was valued at USD 14.87 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.5% from 2022 to 2030. Increasing product launches in various forms including frozen, canned, and freeze-dried are likely to favor the overall market growth. Moreover, the growing demand for ready-to-eat salads coupled with the rising popularity of hot smoked salmon fish is further anticipated to boost the market growth.

For instance, in October 2020, BluGlacier launched its first direct-to-customer brand, OSHĒN, offering premium fresh & frozen Chilean salmon in eco-friendly packaging to customers across the U.S. Such initiatives are likely to complement the overall growing demand for such products.

The COVID-19 pandemic affected various industry verticals globally. The severe impact across the value chain disrupted the supply of salmon fish across the globe. However, demand for salmon surged across major markets worldwide. During the peak of the pandemic, due to panic buying from people, salmon fish was one of the most sold seafood in the shelf-stable food category across supermarkets. Countries including U.S., and U.K. are the largest markets for such products.

Emerging markets such as Brazil and several countries in Asia grew at significantly higher rates than these traditional markets. However, these markets have a higher food service demand compared to traditional markets and in 2020 demand and supply were impacted by COVID-19 restrictions, thus reducing food service activity.

Fresh and frozen salmon became a major component in the daily diet of people owing to its unique texture and exquisite taste. It is a popular source of nutrition, rich in micronutrients, minerals, marine omega-3 fatty acids, high-quality protein, and several vitamins, which reduce the risk of a large number of other health issues. Many companies witnessed strong growth in farmed salmon products globally.

According to the annual report published by Mowi for the third quarter of 2021, the global harvest of Atlantic salmon amounted to 658,100 tonnes in the third quarter, which was driven mainly by harvest from both Norway and Chile. Moreover, total consumption for Mowi’s products in the U.S. and Asia increased by 11% in the third quarter of 2021 as compared to the same period in 2020, followed by Europe at 4% in the third quarter of 2021.

A key trend propelling the market growth is the availability of prepared seafood kits that only need to be heated before eating. This reduces the barriers for customers who are reluctant to clean and cook seafood. In line with this trend, in April 2019, Fishpeople Seafood, a U.S.-based company, expanded its distribution line for its Ready, Set, Salmon! products on AmazonFresh and GoodEggs in northern California.

The increasing popularity of Asian cuisine and dishes such as sushi and sashimi positively influenced the demand for salmon fish. The rising population of Asians in the U.S. and the increasing number of Asian restaurants in the country boosted the adoption of various ethnic flavors and ingredients, including salmon.

Moreover, the other fish forms such as canned, and freeze-dried are expected to register significant growth during the forecast period. Manufacturers continue to launch canned fish forms to elongate the shelf life of food products. The growing demand for strictly controlled sealing seafood and supportive measures offered by private key players to accomplish the demand for commercially sterile canned seafood also fuels the market growth.

For instance, in August 2021, Ramirez-a Portuguese producer of canned fish products launched natural canned salmon to expand its product portfolio in the natural/healthy food segment for Portuguese consumers. The product launched by the company is produced from the Salmo Salar species, which is captured in Norway.

Major retailers in the key American and European markets continue to collaborate with leading fish brands to offer a wide range of variety in this product segment. Retailers such as Walmart, Target, Kroger, and more in the U.S. also partner with brands focused on the sustainable sourcing of salmon species.

However, increased product penetration through offline grocery stores and individual grocery chains is another key opportunity for key players to expand to other international markets as many grocery chains witnessed higher gains in this product category. For instance, overall salmon sales at Giant Eagle, a U.S.-based supermarket chain, soared 40% since 2019, and between 3 and 4% in 2020, according to the seafood category manager for Giant Eagle.

Species Insights

Atlantic species accounted for the largest share of 82.7% in 2021. Atlantic/aquaculture species is an anadromous species that spends part of its time in fresh water and part in salt water; however, most of an adult salmon’s life is spent in the ocean. Aquaculture species have more fat and omega-3s and 46% more calories than Pacific species. Moreover, it is easily available in fresh form. Owing to the rising consumer focus on nutrition and the increased consumption of fresh seafood, the demand for Atlantic species is expected to grow at a rapid pace.

Pacific species are anticipated to register a CAGR of 5.8% over the forecast period. This species group thrives in the North Pacific waters of the U.S. and Canada. It is found in five different species, namely, Chinook/King, Coho, Pink, Red, and Chum. They begin their lives in freshwater streams, rivers, and lakes and then migrate to the sea as small fish called smolts.

This group of species is packed with marine-derived omega-3s, and also contains significant amounts of vitamins D, A, E, B6, B12, niacin & riboflavin, as well as minerals such as potassium, iron, and zinc, making it a superfood. The increasing demand for superfoods coupled with the dietary recommendations of recognized organizations is going to boost product demand for this group of species in the forecast period.

Form Insights

The fresh form segment contributed a share of more than 52.0% in 2021. This form has a high nutrient content and does not contain chemicals or preservatives to ensure its safety. It is high in protein and fat and contains various minerals such as calcium, iron, and potassium. Thus, the increased consumption of the raw fresh form of salmon is expected to drive segment growth.

Furthermore, according to the Chilean Salmon Marketing Council (CSMC), in 2019, 75% of fresh salmon was imported to the U.S. The study also mentioned that it is the leading fresh fish and the second leading seafood consumed in the U.S. Hence, higher consumption of fresh fish in leading countries such as the U.S. is anticipated to fuel the demand for fresh salmon fish during the forecast period.

The frozen form is anticipated to register a CAGR of 8.7% over the forecast period. Freezing helps in the long-term preservation of food. Refrigeration of seafood extends its shelf life and helps maintain its high quality. Furthermore, the increasing demand for frozen seafood has been observed across the globe. This is expected to remain a key driver in the salmon fish market,

According to the data published by the Observatory of Economic Complexity (OEC), in 2020, the trade value for the frozen whole Pacific salmon crossed USD 1.51 billion at a global level, whereas the trade value for the frozen whole Atlantic species amounted to approximately USD 898 million. Such trends are anticipated to bode well with future market trends.

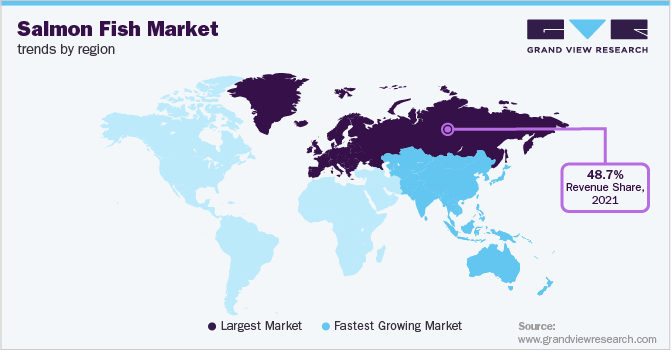

Regional Insights

Europe dominated the market revenue share in 2021, accounting for 48.7% of the total revenue. Europe is among the top traders of fishery and aquaculture products across the globe. Salmon is one of the highest imported products in the region. It remains the most valued commercial entity exported from Europe. Moreover, the growing demand for such products in key countries including U.K., Italy, and Germany is likely to favor overall regional growth. The growing exports of aquaculture salmon fish are anticipated to drive regional growth at a brisk pace over the forecast period.

Asia Pacific is expected to expand with a significant CAGR of 13.0% from 2022 to 2030. Japan, China, South Korea, and Thailand remain the leading consumers and importers of smolt in the Asia Pacific. Supportive government regulations and improved transport infrastructure have propelled the trade of fish in the last few years. Pacific salmon, especially chum, is preferred owing to its low cost and abundant availability. As per the Marine Products Export Development Authority (MPEDA), India shipped 12.8 lakh metric tons of seafood worth USD 6.68 billion in 2019, which is expected to rise by 12.6% by the end of 2032.

Key Salmon Fish Company Insights:

The market is characterized by the presence of several well-established players and a few emerging players. New product launches, partnerships, and acquisitions are some of the key strategic initiatives in the industry. For instance:

-

In May 2022, SalMar ASA acquired Norway Royal Salmon, creating the second-largest Atlantic salmon farming business globally. The acquisition will create a strong dividend capacity and significant synergies for the shareholders.

-

In January 2022, Bakkafrost acquired 90% of the shares of the Denmark-based canned fish producer, Munkebo Seafood A/S. The acquisition of Munkebo Seafood will strengthen Bakkafrost’s product portfolio of canned salmon fish and strengthen its ability to increase the value derived from salmon by-products.

-

In June 2020, Ideal Foods Ltd signed a new supply agreement with Mowi ASA to increase its stock availability by an extra 5,000 tons per year. The new partnership was aimed at increasing product availability as well as meeting the global demand for Atlantic salmon.

-

In December 2019, Cermaq entered into a partnership with Labeyrie, one of the leading brands of smoked salmon in France, on a blockchain project to enhance the traceability of both the companies’ products and value chains. Cermaq also partnered with IBM Food Trust to utilize IBM cloud blockchain technology for traceability solutions.

Key Salmon Fish Companies:

The following are the leading companies in the salmon fish market. These companies collectively hold the largest market share and dictate industry trends.

-

Lerøy

-

SalMar ASA

-

Cermaq

-

Mowi

-

Bakkafrost

-

SEA DELIGHT GROUP

-

Nordlaks Produkter AS

-

Atlantic Sapphire

-

Ideal Foods Ltd

-

BluGlacier

Salmon Fish Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 15.96 billion

Revenue forecast in 2030

USD 30.97 billion

Growth Rate

CAGR of 8.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Species, form, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; U.K.; France; Russia; Italy; China; Japan; India; Thailand; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Lerøy; SalMar ASA; Cermaq; Mowi; Bakkafrost; SEA DELIGHT GROUP; Nordlaks Produkter AS; Atlantic Sapphire; Ideal Foods Ltd.; BluGlacier

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Salmon Fish Market Segmentation

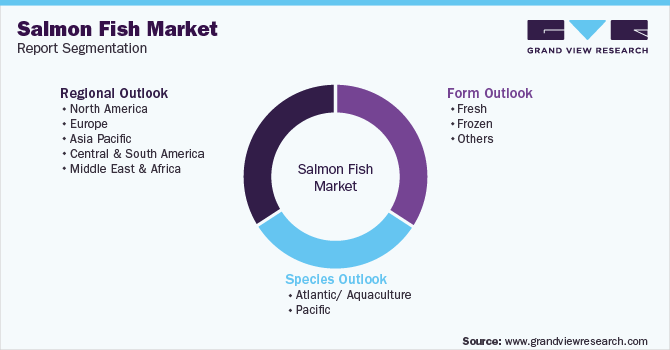

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global salmon fish market report based on species, form, and region:

-

Species Outlook (Revenue, USD Million, 2017 - 2030)

-

Atlantic/ Aquaculture

-

Pacific

-

Coho

-

Chinook/King

-

Pink

-

Red

-

Chum

-

-

Form Outlook (Revenue, USD Million, 2017 - 2030)

-

Fresh

-

Frozen

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global salmon fish market size was estimated at USD 14.87 billion in 2021 and is expected to reach USD 15.96 billion in 2022.

b. The global salmon fish market is expected to grow at a compound annual growth rate of 8.5% from 2022 to 2030 to reach USD 30.97 billion by 2030.

b. Europe dominated the salmon fish market with a share of 48.7% in 2021. The growing consumption of salmon fish products in fresh, frozen, and canned forms in the key countries including the U.K., Italy, and Germany is likely to favor the overall regional growth.

b. Some key players operating in the aquaculture salmon fish market include Lerøy; SalMar ASA; Cermaq; Mowi; Bakkafrost; SEA DELIGHT GROUP; Nordlaks Produkter AS; Atlantic Sapphire; Ideal Foods Ltd.; BluGlacier

b. Key factors that are driving the market growth include the increasing number of product launches in various forms including frozen, canned, and freeze-dried.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."