- Home

- »

- Clothing, Footwear & Accessories

- »

-

Archery Equipment Market Size And Share Report, 2030GVR Report cover

![Archery Equipment Market Size, Share & Trends Report]()

Archery Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment (Bow, Arrows, Broadheads, Crossbow), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-444-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Archery Equipment Market Summary

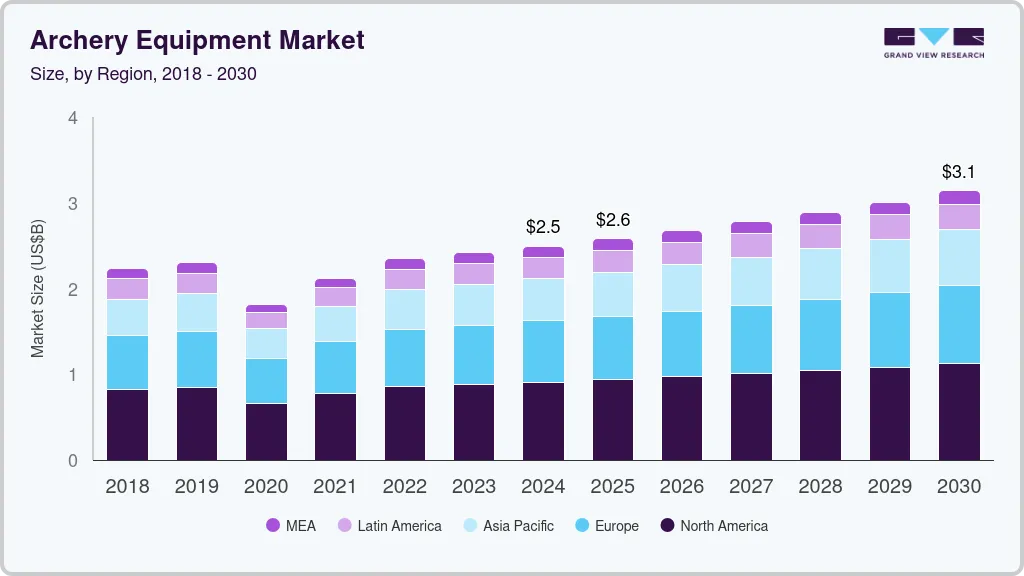

The global archery equipment market size was estimated at USD 2.50 billion in 2024 and is projected to reach USD 3.14 billion by 2030, growing at a CAGR of 3.9% from 2025 to 2030. The rising market demand for archery equipment is primarily driven by the growing popularity of archery as both a competitive sport and a recreational activity.

Key Market Trends & Insights

- North America dominated the archery equipment market with the revenue share of 36.40% in 2023.

- The archery equipment market in the U.S. is anticipated to grow at the fastest CAGR during the forecast period.

- In terms of equipment, the bows segment led the market with the largest revenue share of 48.0% in 2023.

- Based on equipment, the arrows segment is expected to grow at the fastest CAGR of 4.5% from 2024 to 2030.

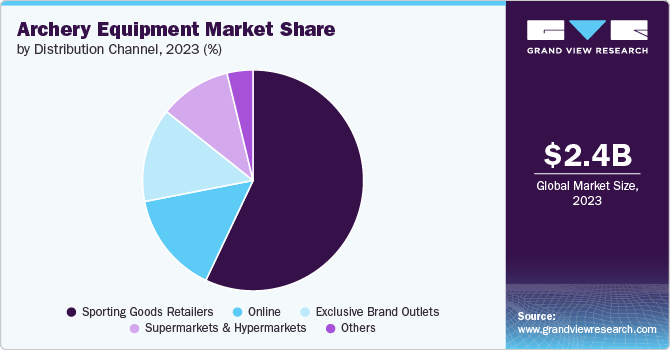

- On the basis of distribution channel, the sporting goods retailers segment led the market with the largest revenue share of 57.04% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 2.50 billion

- 2030 Projected Market Size: USD 3.14 billion

- CAGR (2025-2030): 3.9%

- North America: Largest market in 2023

The inclusion of archery in the Olympics and other international competitions has increased its visibility, inspiring many people to take up the sport. Moreover, archery has gained significant traction as a leisure activity, attracting individuals seeking outdoor hobbies or looking to engage in unique and stress-relieving exercises. This expansion of interest is particularly notable in regions with strong traditions of hunting and outdoor sports, where archery aligns well with cultural pastimes.

The market is experiencing significant growth due to the rising popularity of archery as a recreational sport. While rooted in ancient traditions, archery has transformed into a contemporary, captivating activity that attracts people of all ages. The sport’s unique mix of precision, focus, and physical coordination has caught the attention of many, leading enthusiasts to invest in high-quality archery gear. As individuals seek engaging ways to spend their leisure time, archery presents a distinctive combination of physical exercise and mental focus. This increasing interest has resulted in a higher demand for bows, arrows, targets, and other accessories.

Technological advancements have made archery more accessible and appealing to a broader audience. Innovations such as compound bows, crossbows, and advanced sight systems have improved the performance and customization options available to archers, making the sport more enjoyable and easier to learn. This technological progress has been a significant factor in attracting both new enthusiasts and seasoned archers looking for high-performance equipment. Furthermore, archery's appeal as a sport that combines physical fitness with mental focus has aligned with the growing trends of mindfulness and wellness, drawing in individuals interested in activities that enhance concentration, discipline, and coordination.

The rise in competitive archery and the supportive infrastructure around the sport have also contributed to increased demand. With more regional, national, and international competitions, there is a growing number of people participating in archery at competitive levels, leading to higher sales of specialized and high-quality equipment. The availability of dedicated archery ranges, skilled instructors, and online tutorials has made learning and practicing archery more accessible than ever. This supportive ecosystem encourages more people to try and stay with the sport, driving the market growth.

Equipment Insights

Based on equipment, the bows segment led the market with the largest revenue share of 48.0% in 2023. Innovations in bow technology, such as the development of compound bows, recurve bows, and crossbows with enhanced features like adjustable draw weights, improved accuracy, and greater durability, have made archery more accessible and appealing. These advancements attract both beginners and experienced archers, driving up the demand for new and advanced bows. In addition, the growth of archery programs in schools, camps, and community organizations, as well as the increasing number of regional, national, and international archery competitions, has led to a rise in the number of participants. This has created a consistent demand for bows to accommodate both novice and seasoned archers.

The arrows segment is expected to grow at the fastest CAGR of 4.5% from 2024 to 2030. The popularity of bow hunting and outdoor sports has grown, particularly in regions with strong hunting traditions. Hunters often require specialized arrows designed for specific game, conditions, and bow types, which boosts the demand for a variety of arrows suited to different purposes. Also, the expansion of archery tournaments and recreational events has heightened the need for arrows, especially as participants often require multiple sets for different competition styles and practice sessions. This growth in events contributes to a steady increase in arrow sales.

Distribution Channel Insights

Based on distribution channel, the sporting goods retailers segment led the market with the largest revenue share of 57.04% in 2023. Sporting goods retailers often carry a diverse selection of archery equipment, including bows, arrows, targets, and accessories. This variety allows customers to compare different brands and models in one location, making it easier to find equipment that suits their needs and preferences.

Sporting goods retailers often provide additional services, such as equipment setup, maintenance, and repair, which add value to the purchase. These services ensure that customers have ongoing support and access to necessary adjustments or upgrades, encouraging them to buy from these retailers.

The online segment is expected to grow at the fastest CAGR of 4.7% from 2024 to 2030. Online retailers often offer a broader range of archery equipment, including niche brands and specialized products that may not be available in local stores. This extensive selection enables customers to find exactly what they are looking for, whether it’s a specific type of bow, arrows, or unique accessories.These stores frequently provide competitive pricing, discounts, and promotions that are not always available at brick-and-mortar retailers. Customers can easily compare prices across multiple websites to find the best deals, which can be a significant incentive for buying archery equipment online.

Regional Insights

North America dominated the archery equipment market with the revenue share of 36.40% in 2023. Archery is becoming more popular as a recreational sport in North America, appealing to a wide range of people, including families, youth groups, and outdoor enthusiasts. The sport’s accessibility, combined with its focus on skill development, mental focus, and physical activity, makes it an attractive option for those looking for a new hobby.

U.S. Archery Equipment Market Trends

The archery equipment market in the U.S. is anticipated to grow at the fastest CAGR during the forecast period. There is strong support for archery in U.S. from various programs and organizations, such as schools, camps, community centers, and archery clubs. These organizations offer training and promote the sport, making archery more accessible to newcomers and encouraging continuous participation, which in turn increases demand for archery equipment.

Asia Pacific Archery Equipment Market Trends

The archery equipment market in Asia Pacific is expected to grow at the fastest CAGR of 4.6% from 2024 to 2030. Archery is gaining popularity as a recreational and leisure activity in the Asia Pacific region, attracting enthusiasts of all ages. The sport is seen as a way to improve concentration, focus, and physical fitness, leading to increased participation and demand for equipment.There is a growing interest in competitive archery at both the amateur and professional levels. Many schools, colleges, and sports clubs in countries like South Korea, China, and India are incorporating archery into their sports programs, which drives demand for high-quality equipment.

Europe Archery Equipment Market Trends

The archery equipment market in Europe is expected to grow at a significant CAGR of 4.1% from 2024 to 2030. There is a growing trend towards outdoor and traditional sports in Europe, driven by a desire for physical activity and connection with nature. Archery, as a traditional and outdoor activity, fits well with this trend, leading to increased interest and equipment purchases. European countries have active national archery associations that promote the sport through events, training programs, and youth initiatives. This support helps to foster a new generation of archers and stimulates demand for equipment as more people get involved in the sport.

Key Archery Equipment Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including equipment innovation, regional equipment capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality equipment.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the types used while strictly adhering to international regulatory standards.

Key Archery Equipment Companies:

The following are the leading companies in the archery equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Easton Archery

- Hoyt Archery

- Mathews Archery

- Bear Archery

- PSE Archery

- Bowtech Archery

- SAS (Southwest Archery)

- Black Gold Sight

- Apex Gear

- Scott Archery

Recent Developments

-

In February 2023, Heritage Outdoor Group announced the acquisition of Precision Shooting Equipment, Inc., one of the leading manufacturers of archery equipment in the U.S.The Heritage Outdoor Group plan to maintain and strengthen PSE's "made in the USA" reputation, ensuring that all parts of their bows are sourced from the United States. PSE and Heritage Outdoor Group will continue to operate as separate entities, with Heritage focusing on the marketing and sales side of the business.

Archery Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.58 billion

Revenue forecast in 2030

USD 3.14 billion

Growth rate

CAGR of 3.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Easton Archery; Hoyt Archery; Mathews ArcheryBear Archery; PSE Archery; Bowtech Archery; SAS (Southwest Archery); Black Gold Sight; Apex Gear; Scott Archery

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Archery Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global archery equipment market report based on equipment, distribution channel, and region.

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Bows

-

Broadheads

-

Arrows

-

Crossbows

-

Other Accessories

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global archery equipment market size was estimated at USD 2.42 billion in 2023 and is expected to reach USD 2.50 billion in 2024.

b. The global archery equipment market is expected to grow at a compounded growth rate of 3.9% from 2024 to 2030 to reach USD 3.14 billion by 2030.

b. Arrows are expected to growth with a CAGR of 4.5% from 2024 to 2030. The popularity of bow hunting and outdoor sports has grown, particularly in regions with strong hunting traditions. Hunters often require specialized arrows designed for specific game, conditions, and bow types, which boosts the demand for a variety of arrows suited to different purposes.

b. Some key players operating in the archery equipment market include Easton Archery, Hoyt Archery, Mathews ArcheryBear Archery, PSE Archery, and others.

b. Key factors that are driving the market growth include rising recreational activities and increasing health consiousness among consumers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.