Artificial Insemination Market Size & Trends

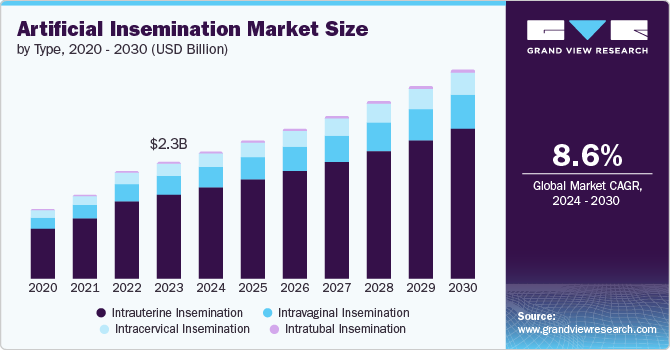

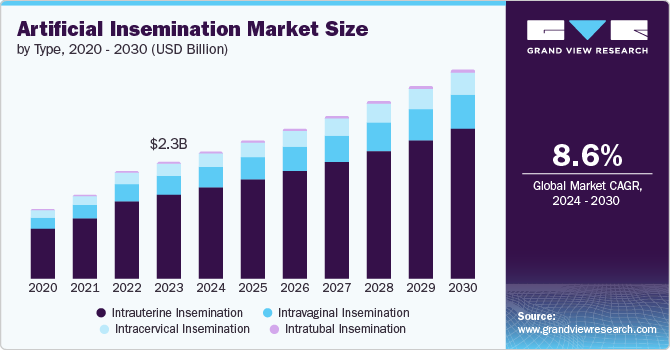

The global artificial insemination market size was valued at USD 2.26 billion in 2023 and is projected to grow at a CAGR of 8.6% from 2024 to 2030. The rising prevalence infertility, growing awareness and social acceptance are driving demand for artificial insemination. Advancements in freezing sperm and other technologies are making the procedure more effective and with rising disposable incomes, more couples are able to afford this treatment further fueling the market growth.

The prevalence of infertility has risen globally, affecting a substantial number of couples. According to WHO, 1 in 6 people is affected by infertility globally. This number is expected to rise in the coming years, due to factors such as delayed childbearing, environmental factors, and sexually transmitted infections. Artificial insemination is a form of assisted reproductive technologies (ART), and is becoming increasingly socially acceptable.

Modern lifestyle changes, including delayed parenthood due to career pursuits and urbanization, have led to increased infertility rates among couples. According to United Nations, the worldwide fertility rate is projected to decrease to 2.4% by 2030 and 2.2% by 2050. This trend drives demand for assisted reproductive technologies such as artificial insemination. The field of artificial insemination is constantly evolving, with new technologies being developed all the time.

Type Insights

Intrauterine insemination (IUI) dominated the market with 71.7% of revenue share in 2023. This is due to its relatively simple procedure, minimal invasiveness, and effectiveness in treating various infertility issues. As more couples face challenges related to conception, IUI offers a viable solution that can be performed in a clinical setting without the need for extensive surgical intervention. The increasing prevalence of conditions such as polycystic ovary syndrome (PCOS) and male factor infertility has led to a higher demand for IUI procedures.

Intravaginal insemination (IVI) is anticipated to witness a significant CAGR of 8.5% over the forecast period. This upward trend is due to its convenience and the ability for couples to perform the procedure at home.

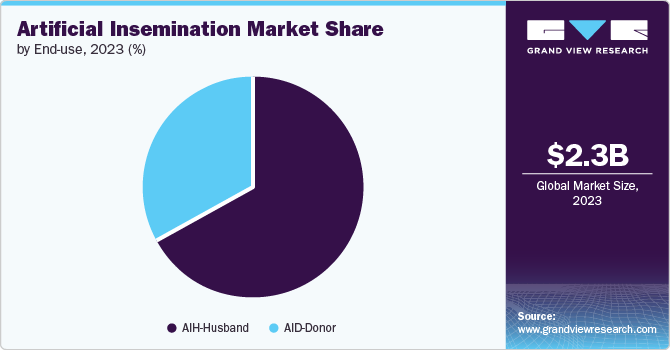

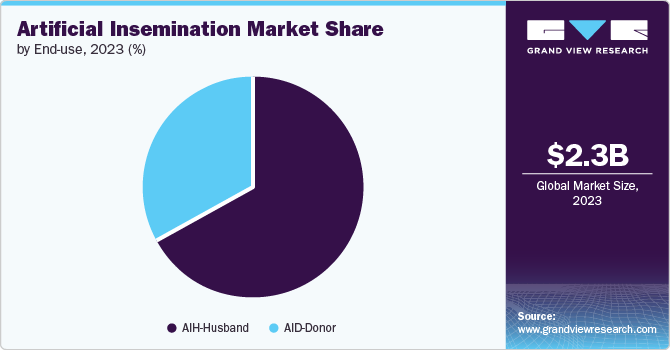

Source Insights

AIH-Husband dominated the market with 66.8% of revenue share in 2023. This is due to the increasing awareness and acceptance of assisted reproductive technologies among couples facing infertility challenges. AIH offers a solution for couples with male infertility issues where the male partner's sperm quality or quantity hinders natural conception. It allows them to conceive using the partner's sperm but with medical assistance to increase the chances of fertilization.

AID-Donor is anticipated to witness the significant growth rate of 8.5% over the forecast period. This is due to the increasing prevalence of single-parent families and same-sex couples. Advancements in donor sperm screening and anonymous donor registries are also contributing to the increasing comfort level with AID.

End Use Insights & Trends

Fertility clinics & others dominated the market with 53.2% share in 2023. These clinics offer a controlled environment with experienced medical professionals to perform the procedure, maximizing its effectiveness. Furthermore, fertility clinics provide crucial pre-treatment evaluations, sperm selection or donor matching, and post-procedure monitoring. This comprehensive care approach gives patients peace of mind and increases the chance of success.

The home segment is projected to grow at a CAGR of 7.8% over the forecast period. This growth is driven by factors such as convenience, privacy, and potentially lower costs compared to clinic procedures. The increasing availability of home insemination kits and online resources make it easier for couples to attempt self-insemination, particularly with simpler methods such as intravaginal insemination.

Regional Insights

North America market is anticipated to witness significant growth in the global artificial insemination market. North America has rising infertility rates and well-developed healthcare systems with numerous fertility clinics equipped with advanced technology and experienced professionals.

U.S. Artificial Insemination Market Trends

The U.S. artificial insemination market dominated the North America market in 2023 due to the advanced healthcare infrastructure. The growing acceptance of LGBTQ+ families also plays a crucial role; many same-sex couples are actively seeking artificial insemination as a means to conceive children. About 1 in 5 women aged from 15-49 years in the U.S. are unable to conceive after one year of trying.

Europe Artificial Insemination Market Trends

The Europe artificial insemination market was identified as a lucrative region in this industry due to advancements in reproductive technologies, increasing awareness about fertility treatments, and a rising prevalence of infertility issues among couples.

The UK artificial insemination market is expected to grow rapidly in the coming years due to increasing public awareness regarding reproductive health and the availability of advanced fertility services.

The artificial insemination market in Germany held a substantial market share due to the rising number of women delaying childbearing due to career pursuits or educational goals. According to Federal Statistical Office of Germany, the average maternal age at first birth in Germany is 30.1 years old .

Asia Pacific Artificial Insemination Market Trends

Asia Pacific artificial insemination market dominated the market with 30.1% share in 2023. This growth is attributed to the rising number of infertile couples and technological advancements in the fertility segment. In addition, growing disposable incomes and increasing awareness of artificial insemination as a treatment option are making it more accessible.

The artificial insemination market in India held a substantial market share in 2023 due to rising number of infertile couples. It is estimated that, in India, 27.5 million couples are trying to conceive and about 10-15 percent of married couples face fertility problems at some stage.

Key Artificial Insemination Company Insights

Some of the key companies in the artificial insemination market are Vitrolife, Genea Pty Limited, Rinovum Women’s Health, LLC, Pride Angel, FUJIFILM Irvine Scientific and others.

- Vitrolife is a global provider in the reproductive health market, focusing specifically on medical devices and genetic testing services. Company offers a comprehensive suite of products designed to support every stage of the IVF process such asIVF media suite, laboratory equipment and many more.

Key Artificial Insemination Companies:

The following are the leading companies in the artificial insemination market. These companies collectively hold the largest market share and dictate industry trends.

- Vitrolife

- Genea Pty Limited

- Rinovum Women’s Health, LLC

- Pride Angel

- HI-TECH SOLUTIONS

- FUJIFILM Irvine Scientific

- Kitazato Corporation

- Rocket Medical plc

- Conceivex, Inc.

Recent Developments

Artificial Insemination Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 2.45 billion

|

|

Revenue forecast in 2030

|

USD 4.01 billion

|

|

Growth Rate

|

CAGR of 8.6% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, source, end use, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Norway, Sweden, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

|

|

Key companies profiled

|

Vitrolife, Genea Pty Limited, Rinovum Women’s Health, LLC, Pride Angel, HI-TECH SOLUTIONS, FUJIFILM Irvine Scientific, Kitazato Corporation, Rocket Medical plc, Conceivex, Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

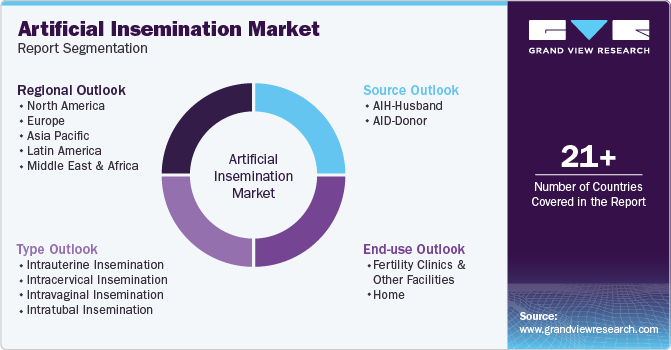

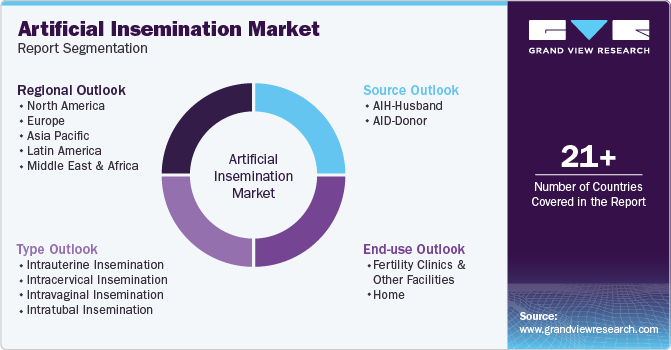

Global Artificial Insemination Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the artificial insemination market report based on type, source, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Intrauterine Insemination

-

Intracervical Insemination

-

Intravaginal Insemination

-

Intratubal Insemination

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

Latin America

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait