- Home

- »

- Medical Devices

- »

-

In Vitro Fertilization Market Size And Share Report, 2030GVR Report cover

![In Vitro Fertilization Market Size, Share & Trends Report]()

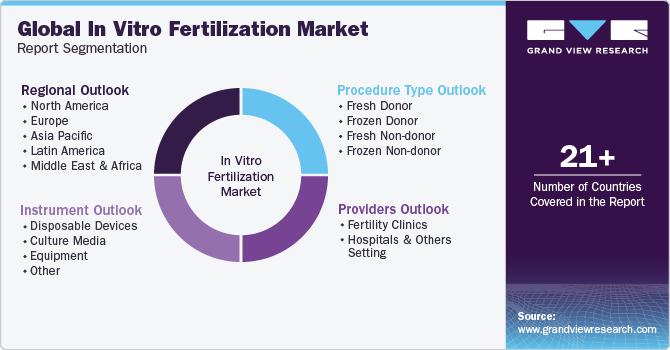

In Vitro Fertilization Market (2024 - 2030) Size, Share & Trends Analysis Report By Instrument (Equipment, Disposable Devices, Culture Media), By Procedure Type (Fresh Nondonor, Frozen Nondonor), By Providers, By Region, And Segment Forecasts

- Report ID: 978-1-68038-823-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

In Vitro Fertilization Market Summary

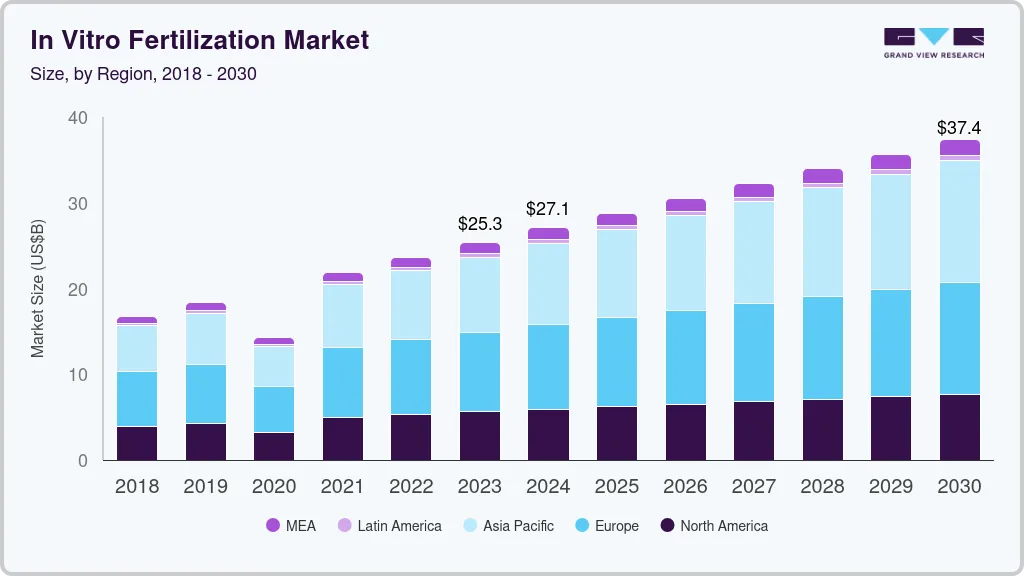

The global in vitro fertilization market size was estimated at USD 25.3 billion in 2023 and is projected to reach USD 37.4 billion by 2030, growing at a CAGR of 5.54% from 2024 to 2030. Rising reproductive tourism and increasing cases of male & female infertility are key factors driving the market growth.

Key Market Trends & Insights

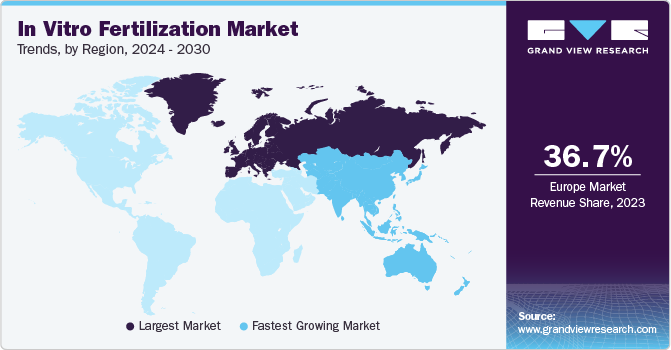

- Europe dominated the market with largest revenue share of 36.7% in 2023.

- Growth of the U.S. IVF services market is driven by various factors, with one significant factor being the notable increase in infertility rates.

- In terms of instrument, the culture media segment dominated the market with the largest revenue share of 40.9% in 2023.

- In terms of procedure type, frozen non-donor segment dominated the market with largest revenue share in 2023.

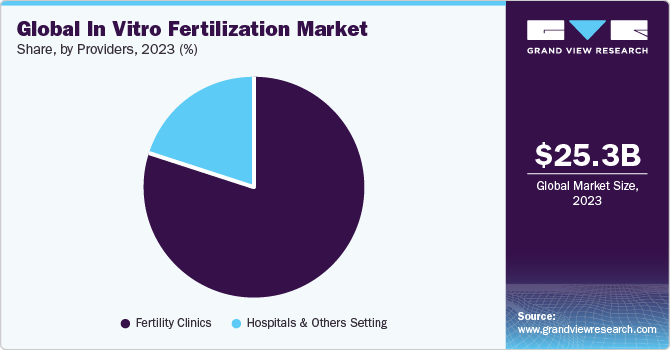

- In terms of providers, fertility clinics segment dominated the market with largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 25.3 Billion

- 2030 Projected Market Size: USD 37.4 Billion

- CAGR (2024-2030): 5.54%

- Europe: Largest market in 2023

Infertility is one of the major health concerns faced by individuals globally. According to WHO, around 17.5% of the adult population worldwide experiences infertility. This shows necessity to enhance accessibility to affordable and top-notch fertility care globally. The American Pregnancy Association states that male infertility constitutes 30% of overall infertility cases and contributes to approximately one-fifth of all infertility instances in the U.S. The average age at which individuals are getting married and having their first child is increasing. This trend has increased number of women seeking IVF treatment. Moreover, to focus on their career, many women freeze their eggs to have child at a later stage. Rising dependence on fertility treatments is expected to aid market growth. The availability of funds is leading to a rise in adoption of in vitro fertilization (IVF) procedures.

To increase success rate of IVF, techniques, such as egg/sperm freezing, vitrification, assisted hatching, Percutaneous Epidydimal Sperm Aspiration & Testicular Sperm Extraction (PESA and TESE), are being introduced along with development of new products. In May 2023, AIVF Ltd., a company based in field of AI-based solutions for IVF clinics, joined forces with Genea Biomedx, a medical device provider for IVF laboratories, to create a comprehensive and cost-effective integrated systems solution for personalized IVF. The collaboration brought together Genea Biomedx’s Geri time-lapse incubator and AIVF Ltd.’s EMA AI platform, creating a powerful suite that offers widespread access to personalized and optimized IVF treatments.

To compete in modern business environment, all organizations (manufacturers, clinics, and hospitals) must develop their virtual presence to increase awareness about infertility treatment, and their services. As infertility is a sensitive issue, people are reluctant to discuss it openly, particularly in developing countries. Hence, developing authenticity and trust through digital platforms is a key challenge for service providers. The providers can take an initial step to gain a center’s or manufacturer’s trust by displaying hospital’s or approval committee’s certificates, introducing doctors or scientists, and sharing their coordinates to establish & authenticate their identity.

Market Concentration & Characteristics

The degree of innovation is high in the market. Over the years, there have been many advancements and innovations in the field of IVF. The companies are constantly innovating to offer advanced procedures to improve success rates of IVF. For instance, a major innovation has been the use of pre-implantation genetic testing (PGT) to screen embryos for genetic abnormalities before they are transferred to the uterus. In recent years, the use of time-lapse imaging and artificial intelligence (AI) in IVF has also shown promising results in improving success rates. These advancements have made IVF more accessible and effective for couples struggling with infertility. For instance, in May 2023, Genea Biomedx and AIVF partnered to launch an integrated solution for personalized IVF care at a low cost. The integrated suite was built based on the Geri time-lapse incubator of Genea Biomedx and the EMA AI platform of AIVF.

The impact of regulations on the market is high due to stringent regulations in developed and many developing countries. For instance, the U.S. FDA regulates drugs and devices used in IVF, followed by the implementation of the Fertility Clinic Success Rate and Certification Act by the CDC. Moreover, semen analysis and sperm function tests are high-complexity tests regulated by the Clinical Laboratory Improvement Amendments of 1988 (CLIA '88) in the U.S. Strict compliance with standards and on-site inspections are essential.

The level of merger and acquisition activity in the IVF market has been low over the past few years. Mergers and acquisitions are expected to continue as the IVF market continues to grow and evolve. This can be attributed to the increasing competition among IVF clinics and the need for economies of scale to remain competitive. For instance, in August 2023, Reproductive Medicine Associates (RMA) acquired Conceptions Reproductive Associates of Colorado (Conceptions). As a part of the acquisition, Conceptions four fertility clinics in Colorado will be part of RMA.

The level of product & service expansion in the market is expected to remain moderate. The major service providers and equipment manufacturers in the market are heavily investing in product & service innovations and expanding their portfolios to offer diverse, technologically advanced & innovative solutions to end-users. For instance, in May 2023, CNY Fertility launched a program offering a combination of IVF or Egg Freezing treatment and the medications required in discounted packages.

The regional expansion is currently low in the market; however, the market is expected to witness a high degree of regional expansion owing to the growing adoption of multilocation models to extend their services to underserved areas and cater to diverse patient demographics. Moreover, operating multiple IVF clinics at different geographical locations yields economies of scale and could improve operational efficiency.

Instrument Insights

The culture media segment dominated the market with the largest revenue share of 40.9 % in 2023. This can be attributed to factors such as availability of funding and an increase in research activities to improve culture media. In July 2022, FUJIFILM Irvine Scientific launched a mineral oil for embryo culture, Heavy Oil for Embryo Culture. It is a sterile mineral oil that addresses major concerns in IVF procedures, including pH, osmolality changes, and media preservation, owing to its ideal weight viscosity.

Disposable devices segment is expected to grow at the fastest CAGR during forecast years. The growth of this segment is owing to industry players introducing disposable devices, such as slides, needles, and chambers, to meet sterility and regulatory requirements. Such developments are expected to increase adoption of disposable IVF devices. Disposable slides for sperm counting, an imaging-based tracking system to isolate best motile sperm, and use of disposable microchips are some of innovations witnessed by the market in recent years.

Procedure Type Insights

Frozen non-donor segment dominated the market with largest revenue share in 2023 and is expected to witness fastest growth over the forecast period. Certain factors contributing to high share are cost-effectiveness as compared to fresh nondonor and less invasive nature of procedure. The fresh donor segment is expected to grow significantly over forecast period. As per the 2020 National ART Summary report, around 1,477 ART cycles were performed using fresh donors, with around 53.9% of transfers resulting in live-birth deliveries in the U.S.

Although some centers offer risk-sharing plans and refunds only for three cycles, Advanced Fertility Center of Chicago has designed IVF reimbursement plan to provide a 100% refund for up to four cycles with fresh embryos. The Human Fertilization and Embryology Act 1990 does not cover fresh sperm donation, and hence, there is rising concern about sperm donors not being screened before donation. HEFA does not guarantee sperm donation services, which are unlicensed. Hence, HEFA has revised its guidelines, wherein fresh sperm must be quarantined for 180 days for HIV screening. NHS funds a smaller proportion of fertility treatment using donated gametes to homosexuals and single parents.

Providers Insights

Fertility clinics segment dominated the market with largest revenue share in 2023 and is expected to witness fastest growth over the forecast period. This can be attributed to a rise in demand for ART treatments; number of fertility clinics and ART centers is increasing considerably. Factors, such as cost-effectiveness, availability of specialists, and minimal or no chances of Hospital-Acquired Infections (HAIs), are anticipated to drive the growth of fertility clinics segment. IVF treatments are also performed in hospitals.

Hospitals and other settings segments is expected to grow at a significant CAGR over the forecast period. Numerous multispecialty hospitals provide infertility treatments, including In-vitro Fertilization (IVF). Growing accessibility and availability of these treatments have contributed to a greater inclination toward hospitals for infertility care. However, hospital IVF treatments cost more than fertility clinics. This is partly due to need for highly skilled physicians and staff to perform these intricate procedures. Consequently, having a dedicated IVF staff in hospitals is considered a less favored approach due to expenses related to their employment, remuneration, and training. These costs can be particularly high in developed countries like the U.S. and UK.

Regional Insights

Europe dominated the market with largest revenue share of 36.7% in 2023. This can be attributed to factors, such as a noticeable surge in medical tourism, with an increasing number of Americans choosing to travel to Czech Republic for more cost-effective IVF treatments. Moreover, individuals who cannot afford to travel abroad are now seeking IVF treatments within the United States at around one-third of the cost charged by clinics in the country. In July 2022, Fairtility obtained approval from the European Union to use AI for embryo assessment. EU's new medical device regulation standards have enabled development of a commercially available AI tool, which holds potential to boost success rate of IVF procedures.

North America is also expected to witness increasing demand for fertility treatment in coming years. Lifestyle changes, including insufficient nutrition, stress, increased obesity, improper eating habits, rise in pollution, lack of exercise, and prevalence of medical conditions like diabetes, have led to a higher incidence of infertility in the region. The growth of can be attributed to several factors such as standardization of procedures through regulatory reforms, automation, government funding for egg/sperm storage, and introduction of more IVF treatments by industry players.

U.S. IVF Market

Growth of the U.S. IVF services market is driven by various factors, with one significant factor being the notable increase in infertility rates. Infertility affects a considerable number of couples in the U.S., with approximately one in eight couples experiencing difficulties in conceiving.

The demand for IVF treatments is expected to increase in Asia Pacific region owing to the growth in fertility tourism, increase in the number of international companies trying to penetrate economically developing countries, and change in the regulatory landscape in APAC. The Asia Pacific Initiative on Reproduction (ASPIRE) is a task force of clinicians & scientists engaged in the management of fertility & ART. This promotes awareness regarding infertility & ART and enhances infertility-related services in the region. According to OECD, in 2022, birth rate in Asia Pacific has fallen to population replacement rate of 2.1 born children per woman. Decrease in birth rate and increase in the geriatric population are among the key factors expected to propel market growth.

India IVF Market

India experienced a remarkable increase in the demand for IVF services. This surge can be attributed to several factors, including delayed marriages, a rise in the average age of pregnancy, an increase in infertility rates, higher disposable income levels, and awareness about the availability of infertility treatments. The average cost of IVF services in India range from USD 1,000 to USD 3,000.

Key Companies & Market Share Insights

The market is moving towards maturation phase with strong growth momentum with the increasing demand and supply chain capabilities in developing countries. Geographical expansions, mergers, and product innovations & commercialization are key strategies adopted by the market players. For instance, in June 2023, Progyny, Inc. and Quantum Health, Inc. entered a partnership to introduce Quantum Health’s Comprehensive Care Solutions platform for family building and fertility solutions.

Key Suppliers in In Vitro Fertilization Companies:

- Bayer AG

- Cook Medical LLC

- EMD Serono, Inc.

- Ferring B.V.

- FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation)

- Genea Biomedx

- EMD Serono, Inc. (Merck KGaA)

- Merck & Co., Inc.

- The Cooper Companies, Inc.

- Thermo Fisher Scientific, Inc.

- Vitrolife

Key Service Providers in In Vitro Fertilization Companies:

- Boston IVF

- Nova IVF

- RMA Network (Reproductive Medicine Associates)

- TFP Thames Valley Fertility

- Fortis Healthcare

- U.S. Fertility

Recent Developments

-

In June 2023, FUJIFILM Irvine Scientific, Inc. expanded its Presagen’s Life Whisperer platform capabilities to help with clinical decision-making in IVF.

-

In May 2023, Merck KGaA introduced Fertility Counts to address societal, economic, and social challenges associated with low birth rates in the Asia Pacific (APAC) region.

-

In May 2023, Ovation Fertility combined with US Fertility to created fertility platform offering advanced fertility care and IVF services in the U.S.

-

In April 2023, Boston IVF signed 3 years supply chain solutions agreement with Cryoport, Inc. to support the reproductive material shipment across the U.S.

In Vitro Fertilization Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.1 billion

Revenue forecast in 2030

USD 37.4 billion

Growth rate

CAGR of 5.54% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Instrument, procedure type, providers, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; France; Germany; Italy; Spain; UK; Belgium; Netherlands; Switzerland; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Bayer AG; Cook Medical LLC; EMD Serono, Inc.; Ferring B.V.; FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation); Genea Biomedx; EMD Serono, Inc. (Merck KGaA); Merck & Co., Inc.; The Cooper Companies, Inc.; Thermo Fisher Scientific, Inc.; Vitrolife; Boston IVF; Nova IVF; RMA Network (Reproductive Medicine Associates); TFP Thames Valley Fertility; Fortis Healthcare; U.S. Fertility

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In Vitro Fertilization Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented global in vitro fertilization market report on the basis of instrument, procedure type, providers, and region:

-

Instrument Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Devices

-

Culture Media

-

Cryopreservation Media

-

Embryo Culture Media

-

Ovum Processing Media

-

Sperm Processing Media

-

-

Equipment

-

Sperm Analyzer Systems

-

Imaging Systems

-

Ovum Aspiration Pumps

-

Micromanipulator Systems

-

Incubators

-

Gas Analyzers

-

Laser Systems

-

Cryosystems

-

Sperm Separation Devices

-

IVF Cabinets

-

Anti-vibration Tables

-

Witness Systems

-

Other

-

-

-

Procedure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fresh Donor

-

Frozen Donor

-

Fresh Non-donor

-

Frozen Non-donor

-

-

Providers Outlook (Revenue, USD Million, 2018 - 2030)

-

Fertility Clinics

-

Hospitals & Others Setting

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

France

-

Germany

-

Italy

-

Spain

-

UK

-

Belgium

-

Netherlands

-

Switzerland

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global in vitro fertilization market is expected to grow at a compound annual growth rate of 5.54% from 2024 to 2030 to reach USD 37.4 billion by 2030.

b. Europe dominated the IVF market with a share of 36.7% in 2023. This is attributable to it being the first region to come up with the in-vitro fertilization procedure, to remove the title experimental from cryopreservation of eggs, and the first one to legally approve the three parent’s IVF or the mitochondrial transfer technique.

b. Some key players operating in the IVF market include OvaScience; EMD Serono Inc.; Vitrolife AB; Irvine Scientific; Cook Medical Inc.; Cooper Surgical Inc.; Genea Biomedx; Thermo Fisher Scientific Inc.; Progyny, Inc.; and Boston IVF.

b. Key factors that are driving the in vitro fertilization market growth include an increase in cases of infertility and the development of advanced technologies such as lensless imaging of the sperms.

b. The global in vitro fertilization market size was estimated at USD 25.3 billion in 2023 and is expected to reach USD 27.1 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.