AI In Healthcare Market Size, Share, And Trends Analysis Report By Component (Hardware, Services), By Application, By End Use, By Technology, By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-951-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

AI In Healthcare Market Size & Trends

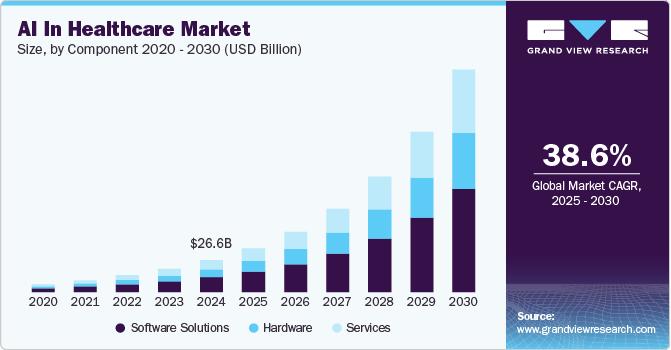

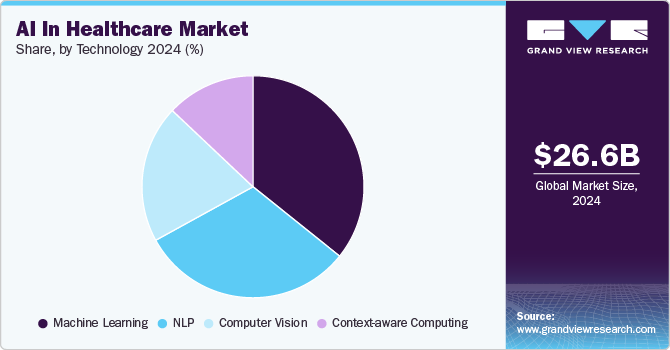

The global AI in healthcare market size was estimated at USD 26.57 billion in 2024 and is projected to grow at a CAGR of 38.62% from 2025 to 2030. A key factor driving market growth is the increasing demand in the healthcare sector for enhanced efficiency, accuracy, and better patient outcomes. According to a March 2024 Microsoft-IDC study, 79% of healthcare organizations are presently utilizing AI technology. In addition, the return on investment (ROI) is realized within 14 months, generating USD 3.20 for every USD 1 invested in AI.

AI technologies hold transformative potential in various areas, including medical imaging analysis, predictive analytics, personalized treatment planning, and drug discovery, with the potential to transform conventional healthcare practices.

The exponential growth in healthcare data, sourced from electronic health records, medical imaging scans, wearable devices, and genomic sequencing, presents significant opportunities for AI-powered solutions to extract actionable insights and support clinical decision-making.

Increasing shortage of healthcare workers is also driving the adoption of AI and machine learning (ML) technologies. According to World Economic Forum estimates from May 2023, there will be a global health worker deficit of 10 million by 2030. Hence, AI algorithms can be trained to analyze patient health data, aiding care providers in rapid diagnosis and treatment planning.

Supportive government initiatives, a rise in mergers and acquisitions, technological collaborations, and the impact of the COVID-19 pandemic have all contributed to the market's growth and accelerated the adoption of AI in healthcare. AI and ML algorithms are increasingly used for rapid and accurate diagnosis, including the detection of COVID-19 positive cases using personalized patient data. For instance, a 2020 NCBI study found that AI-based algorithms accurately detected 68% of COVID-19 positive cases in a dataset of 25 patients initially diagnosed as negative by healthcare professionals.

The implementation of AI and ML technologies aims to enhance patient care, reduce machine downtime, and lower care expenses, driving market growth. The pandemic has further accelerated the adoption of AI-based technologies, particularly in diagnostics, patient and medication management, claims processing, workflow optimization, machine integration, and cybersecurity within healthcare settings.

Survey/Case Study Insights

- Medtronic Survey, November 2023: AI's Potential for Earlier Diagnosis and Improved Access to Care

Survey Insights:

Analyst Insights:

- Infosys Survey: Amplifying Human Potential Through Purposeful Artificial Intelligence

Survey Insights:

Analyst Insights:

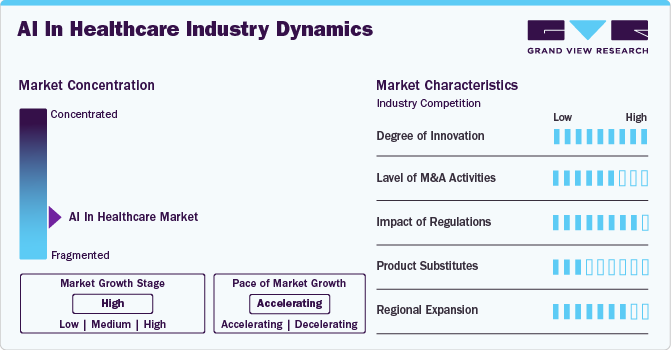

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The X-axis represents the level of market concentration, ranging from low to high. The Y-axis represents various market characteristics, including industry competition, degree of innovation, level of mergers & acquisition activities, regulatory impact, and regional expansion. For instance, the artificial intelligence (AI) in healthcare industry is highly fragmented, with many players entering the market and launching new innovative products.

The Healthcare AI market exhibits a high degree of innovation, characterized by ongoing advancements in technology. Rapid developments in machine learning, deep learning, natural language processing, and computer vision are driving the evolution of AI-powered healthcare solutions. For instance, in June 2023, Saama introduced two innovative machine learning (ML) and artificial intelligence (AI)-based solutions for clinical trials.

Mergers and acquisitions (M&A) play a significant role in shaping the healthcare AI market landscape. Companies engage in M&A to expand their AI software and services, expand their market reach, or acquire specialized technology and expertise. For example, in January 2023, GE Healthcare acquired MIM Software Inc., a provider of AI-based imaging analysis software for radiology.

Regulations such as HIPAA (Health Insurance Portability and Accountability Act) in the United States and GDPR (General Data Protection Regulation) in Europe establish standards for safeguarding patient data privacy and security. Compliance with these regulations is crucial for AI applications in healthcare to ensure the safe and secure handling of patient information, reducing the risk of data breaches and unauthorized access.

Threat of substitute products in the AI healthcare market is anticipated to be low throughout the forecast period. While alternative technologies or approaches may serve as substitutes in specific AI applications within healthcare, their capabilities often differ from AI-driven solutions. For example, in drug discovery, traditional research and development methods may be utilized instead of AI-driven algorithms for identifying potential drug candidates. Similarly, wearable devices and IoT sensors offer alternative means of gathering patient data for monitoring and diagnosis, but they typically lack the advanced analytical capabilities inherent in AI systems.

End Users are becoming increasingly aware of the potential benefits of AI in improving patient care, operational efficiency, and healthcare outcomes. Education initiatives and industry events helped raise awareness about the capabilities and applications of AI in healthcare.

Component Insights

Based on component, the software solution segment dominated the market with the largest revenue share of over 46% in 2024, and it is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to the rapidly growing adoption rate of AI-based software solutions amongst healthcare providers, payers, and patients. For instance, in September 2019, GE Healthcare partnered with five Chinese local software developers, namely, 12Sigma Technologies, Biomind, Shukun Technology, Yizhun Medical AI, and YITU Technology, to collaboratively work on developing the Edison AI platform and support the smooth digital transformation of GE Healthcare.

The services segment is anticipated to grow at a significant CAGR from 2024 to 2030. This significant growth rate is attributed to the rising penetration of AI-based technologies in several healthcare applications such as clinical trials, virtual assistants, robot-assisted surgeries, dosage error reduction, and fraud detection.

Application Insights

Based on application, the robot-assisted surgery segment dominated the market in 2024 with the largest revenue share of over 13%. The surge in robot-assisted surgeries, coupled with increased funding and investment in AI platform development, are key drivers propelling AI penetration in this field. For instance, according to a May 2023 Nasdaq, Inc. article, Intuitive Surgical, a leading surgical robotics provider, reported robust Q1 2023 results, with revenue up by 14% YoY to USD 1.7B, driven by a 26% growth in robotics procedures, surpassing expectations by 12 points. Moreover, the placement of 312 systems exceeded expectations. In addition, the establishment of the Clinical Robotic Surgery Association in India in August 2019 underscores the growing demand for robotic surgeries and the need for trained professionals in this domain. The anticipated rise in AI adoption is attributed to the shortage of skilled surgeons.

The fraud detection segment is anticipated to grow at the fastest CAGR from 2025 to 2030. The increasing penetration of health insurance, coupled with the rising number of fraud cases in the healthcare industry, are factors contributing to segment growth. For instance, in March 2024, the government issued guidelines to intensify measures on healthcare frauds. Moreover, the growing focus on curbing healthcare costs, along with the technological advancements to launch advanced analytical techniques, is also expected to fuel segment growth. For instance, in August 2024, MediBuddy launched an artificial intelligence (AI)-powered fraud detection system for healthcare reimbursement claims. The system uses machine learning algorithms to provide real-time analysis and alerts, aiding in the identification of potential errors and fraud before they occur.

Technology Insights

Based on technology, the machine learning segment held the largest market share of over 35 % in 2024. The healthcare industry generates vast amounts of data, including electronic health records (EHRs), medical imaging, genomic data, and wearable device data. Machine learning excels at extracting valuable insights from these large and diverse datasets, enabling healthcare providers to make data-driven decisions and improve patient outcomes. This technology is extensively integrated into healthcare solutions for disease diagnosis, prognosis, and treatment planning. Leveraging patient data patterns and correlations, machine learning models can detect early disease indicators, forecast patient outcomes, and propose personalized treatment strategies, thereby enhancing the accuracy and timeliness of interventions.

The context-aware computing segment is expected to grow at the fastest CAGR over the forecast period. AI algorithms integrate and analyze diverse data sources such as electronic health records (EHRs), real-time vital signs, medical history, environmental factors, and patient activity to understand patient context dynamically.

End Use Insights

Based on end use, healthcare companies dominated the market with the largest revenue share of over 30% in 2024. The widespread adoption of AI technologies in drug development, leveraging genomic information, medical records, and clinical trial data, enables the identification of personalized treatment options and the targeting of therapies to specific patient groups. For instance, in April 2025, PRISM BioLab and Elix partnered to advance AI-driven drug discovery using PRISM BioLab's small-molecule peptide-mimetic PepMetics technology and Elix's AI drug discovery platform.

“Improving drug discovery efficiency is an eternal challenge. Delivering better medicines to patients and healthcare professionals as quickly as possible requires innovation. Our PepMetics technology has characteristics that are highly compatible with AI applications.”

-PRISM BioLab CTO Tatsuya Toma

Moreover, AI-driven analytics and predictive modeling improve the design, execution, and analysis of clinical trials, resulting in more efficient and cost-effective trials. As per a study by Scilife N.V. in January 2024, approximately 80% of professionals in the pharmaceutical and life sciences sectors utilize AI in drug discovery. Furthermore, research from another study suggests that AI technology reduces the time required by pharmaceutical companies to discover new drugs from 5-6 years to just one year.

The healthcare providers (hospitals, outpatient facilities, and others) segment is expected to grow significantly over the forecast period. AI-powered medical imaging analysis tools aid healthcare providers in interpreting medical images like X-rays, MRIs, and CT scans. These tools improve diagnostic accuracy, shorten interpretation time, and facilitate early disease detection, resulting in prompt interventions and enhanced patient care. For instance, in February 2025, researchers in Switzerland developed a robust AI model that can automatically segment major anatomical structures in MRI images, independent of the imaging sequence. This advancement enhances the efficiency and accuracy of MRI analysis, potentially transforming diagnostic practices in medical imaging.

In addition, hospitals are leveraging AI-driven predictive analytics to anticipate patient admission rates, pinpoint at-risk populations, and allocate resources effectively. These factors are driving growth within the segment throughout the forecast period.

Regional Insights

North America AI in healthcare industry dominated the global market and accounted for the largest revenue share of over 54% in 2024. This can be attributed to advancements in healthcare IT infrastructure, growing care expenditures, widespread adoption of AI/ML technologies, favorable government initiatives, lucrative funding options, and the presence of several key market players. Factors such as a growing geriatric population, changing lifestyles, increasing prevalence of chronic disorders, growing demand for value-based care, and rising awareness levels towards the implementation of AI-based technologies are further propelling market growth in North America.

U.S. AI In Healthcare Market Trends

The Artificial Intelligence (AI) in healthcare industry in the U.S. is expected to grow significantly over the forecast period. This can be attributed to rising demand for efficient and personalized healthcare solutions, coupled with advancements in AI research and development, especially in machine learning and natural language processing, alongside regulatory initiatives and supportive policies.

Europe AI In Healthcare Market Trends

The Artificial Intelligence (AI) in healthcare industry in Europe is anticipated to witness significant growth during the forecast period. This can be attributed to the widespread adoption of AI technologies and increasing investments in AI by both government and private organizations. For example, in 2021, the Department of Health and Social Care in Europe allocated USD 49.3 million (£36 million) across thirty-eight AI initiatives aimed at enhancing patient care and expediting diagnosis.

Artificial Intelligence (AI) in healthcare industry in the UK held the largest market share in the European region in 2024. AI applications are becoming increasingly prevalent in healthcare, particularly in areas such as medical imaging analysis, predictive analytics, and personalized treatment planning. The UK's National Health Service (NHS) is actively exploring AI technologies to enhance patient care, optimize operations, and tackle various healthcare challenges. In addition, supportive government initiatives are expected to propel market growth further. For instance, in April 2025, the UK government encouraged the use of AI in hospitals to improve patient care.

Asia Pacific AI In Healthcare Market Trends

The Artificial Intelligence (AI) in healthcare industry in the Asia Pacific region is expected to experience significant growth in the coming years. This growth is fueled by rapid innovations and advancements in IT infrastructure, as well as the emergence of entrepreneurship ventures specializing in AI-based technologies. Increasing investments from private investors, venture capitalists, and non-profit organizations aimed at enhancing clinical outcomes, improving data analysis and security, and reducing costs are driving adoption rates in the region. In addition, favorable government initiatives that support and promote the adoption of AI-based technologies by healthcare organizations and providers are key factors driving the growth of the Asia Pacific market.

The Artificial Intelligence (AI) in healthcare industry in China held the largest market share in the Asia Pacific region in 2024. This can be attributed to the increasing adoption of AI technologies for diagnosis, medical imaging, and robot assisted surgeries in the country. Moreover, supportive government initiatives and partnerships and collaborations by key market players contribute to market growth further. For instance, in May 2024, Wuhan Union Hospital and Baidu Health partnered to enhance outpatient services by integrating AI technology into healthcare.

Latin America AI In Healthcare Market Trends

The Artificial Intelligence (AI) in healthcare industry in Latin America is anticipated to grow significantly in the coming years. This can be attributed to the growing awareness about AI technologies, increasing government spending and collaboration activities.

Middle East & Africa AI In Healthcare Market Trends

The Artificial Intelligence (AI) in healthcare industry in Middle East & Africa region is anticipated to grow significantly during the forecast period. The rising prevalence of chronic diseases in the region and the growing need for efficient and accurate diagnosis and treatment methods are prompting Healthcare providers to integrate AI into their systems.

Key AI In Healthcare Company Insights

Market players are utilizing innovative product development strategies, partnerships, and mergers, and acquisitions to expand their presence in response to the increasing demand for early and accurate disease detection, cost containment, addressing the shortage of healthcare providers, and providing value-based care.

Key AI In Healthcare Companies:

The following are the leading companies in the AI in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- IBM

- NVIDIA Corporation

- Intel Corporation

- Itrex Group

- GE Healthcare

- Medtronic

- Oracle

- Medidata

- Merck

- IQVIA

Recent Developments

-

In April 2025, HelloCareAI raised USD 47 million to expand its AI-driven virtual care platform for smart hospitals. The initiative focuses on enhancing patient care through AI-assisted nursing, remote monitoring, and efficient workflow management.

-

In February 2025, Innovaccer launched "Agents of Care," AI-powered assistants designed to combat burnout among healthcare professionals. These agents automate routine administrative tasks, enhancing operational efficiency and enabling healthcare professionals to dedicate more time to patient interactions.

-

In January 2025, VitVio secured USD 2.05 million in pre-seed funding to develop AI-powered operating rooms to enhance surgical efficiency and patient safety.

-

In September 2024, Huawei Launched Medical Technology Digitalization 2.0 Solution to facilitate precision healthcare with AI.

-

In June 2024, the National Health Research Institute (NHRI) and Chang Gung Memorial Hospital (CGMH) adopted NVIDIA's accelerated computing and generative AI technologies to advance biomedical research.

“The use of AI in healthcare will fundamentally change the way we approach disease prevention and treatment. With AI’s ability to analyze vast amounts of data quickly and accurately, we can develop personalized medicine strategies and early intervention methods that were previously unattainable.”

-Dr. Hung-Yi Chiou, director of the Institute of Population Health Sciences (IPHS) at NHRI.

- In March 2024, Microsoft collaborated with NVIDIA to enhance AI innovation and accelerate computing capabilities. This collaboration leverages Microsoft Azure's global scale and advanced computing along with NVIDIA's DGX Cloud, and Clara suite, to accelerate innovation and improve patient care.

“Microsoft is building on its longstanding collaboration with NVIDIA to empower the healthcare and life sciences industry with the power of Azure and generative AI, helping unlock new horizons for clinical research, drug discovery and patient care worldwide. Through this collaboration, we aim to help the industry unlock breakthroughs in healthcare, making care more precise, accessible and effective to deliver a meaningful difference in the lives of patients globally.”

- Peter Durlach, corporate vice president, Health & Life Sciences, Microsoft

- In March 2024, NVIDIA introduced new Generative AI Microservices to transform medical technology (MedTech), drug discovery, and digital health. This innovative approach aims to reshape healthcare technology by harnessing advanced artificial intelligence (AI) capabilities.

“For the first time in history, we can represent the world of biology and chemistry in a computer, making computer-aided drug discovery possible. By helping healthcare companies easily build and manage AI solutions, we’re enabling them to harness the full power and potential of generative AI.”

- Kimberly Powell, vice president of healthcare at NVIDIA

- In September 2023, Merck KGaA entered into a strategic collaboration with Exscientia and BenevolentAI to drive accelerated drug discovery with the integration of high-end AI platforms.

AI In Healthcare Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 36.67 billion |

|

Revenue forecast in 2030 |

USD 187.69 billion |

|

Growth rate |

CAGR of 38.62% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, application, technology, end use, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; Spain; France; Italy; Sweden; Denmark; Norway; Russia; Japan; China; India; South Korea; Australia; Singapore, Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Microsoft; IBM; NVIDIA Corporation; Intel Corporation; Itrex Group; GE Healthcare; Google; Medtronic; Oracle; Medidata; Merck; IQVIA |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global AI In Healthcare Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country-level and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the AI in healthcare market report based on component, application, technology, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Processor

-

MPU (memory protection unit)

-

FPGA (Field-programmable gate array)

-

GPU (Graphics processing unit)

-

ASIC (Application-specific integrated circuit)

-

-

Memory

-

Network

-

Adapter

-

Interconnect

-

Switch

-

-

-

Software Solutions

-

AI platform

-

Application Program Interface (API)

-

Machine Learning Framework

-

-

AI Solutions

-

On premise

-

Cloud based

-

-

-

Services

-

Deployment & Integration

-

Support & Maintenance

-

Others (Consulting, Compliance management etc.)

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Robot Assisted Surgery

-

Virtual Assistants

-

Administrative Workflow Assistants

-

Connected Medical devices

-

Medical Imaging & Diagnostics

-

Clinical Trials

-

Fraud Detection

-

Cybersecurity

-

Dosage Error Reduction

-

Precision medicine

-

Drug discovery & development

-

Lifestyle management & remote patient monitoring

-

Wearables

-

Others (Patient engagement, etc.)

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Machine Learning

-

Deep learning

-

Supervised

-

Unsupervised

-

Others (Reinforcement learning, Semi supervised)

-

-

Natural Language Processing

-

Smart Assistance

-

OCR (Optical Character Recognition)

-

Auto Coding

-

Text analytics

-

Speech analytics

-

Classification and categorization

-

-

Context-Aware Computing'

-

Computer Vision

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare providers (hospitals, outpatient facilities, and others)

-

Healthcare payers

-

Healthcare companies (Pharmaceutical, Biotechnology, Medical Devices)

-

Patients

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Singapore

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence in healthcare market size was estimated at USD 26.57 billion in 2024 and is expected to reach USD 36.67 billion in 2025.

b. The global AI in healthcare market is expected to grow at a compound annual growth rate of 38.62% from 2025 to 2030 to reach USD 187.69 billion by 2030.

b. Key factors that are driving the AI in healthcare market growth include the increasing demand in the healthcare sector for enhanced efficiency, accuracy, and better patient outcomes, supportive government initiatives, and Increasing shortage of healthcare workers.

b. North America dominated AI in healthcare market and accounted for the largest revenue share of over 54% in 2024.

b. Some key players operating in the AI in healthcare market include Microsoft; IBM; NVIDIA Corporation; Intel Corporation; Itrex Group; GE Healthcare; Google; Medtronic; Oracle; Medidata; Merck; and IQVIA.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."