- Home

- »

- Healthcare IT

- »

-

AI In Patient Engagement Market Size & Share Report, 2030GVR Report cover

![AI In Patient Engagement Market Size, Share & Trends Report]()

AI In Patient Engagement Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (NLP), By Delivery Type (Cloud-based, On-premise), By Functionality (Enhanced Communication, Predictive Analytics), By Therapeutic Area, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-145-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Patient Engagement Market Summary

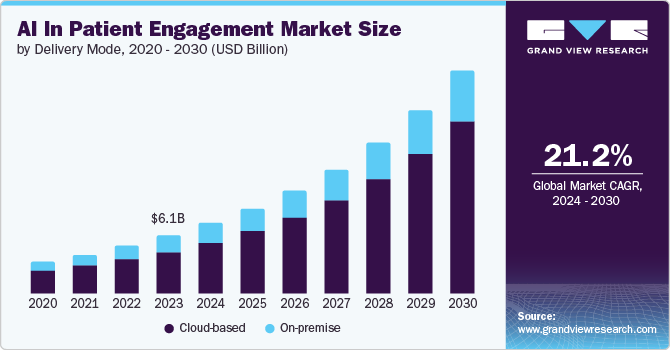

The global AI in patient engagement market size was estimated at USD 6.08 billion in 2023 and is projected to reach USD 23.1 billion by 2030, growing at a CAGR of 21.2% from 2024 to 2030. The market growth is driven by the rising adoption of digital platforms, growing need for an omnichannel approach, and increasing role of artificial intelligence (AI) in enhancing pharmacy efficiency & managing supply chain complexities.

Key Market Trends & Insights

- North America dominated the AI in patient engagement market with a revenue share of over 43.6% in 2023.

- Asia Pacific is anticipated to register the fastest growth in the AI in patient engagement market over the forecast period.

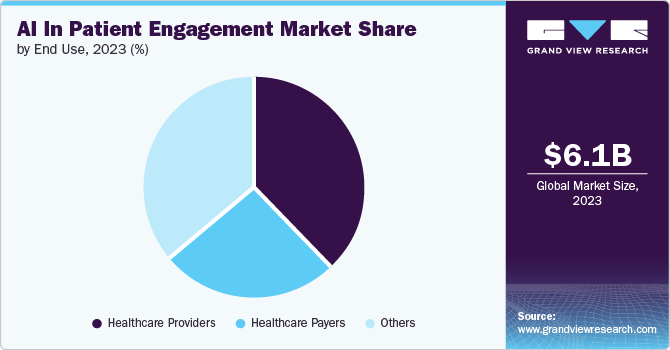

- Based on end use, healthcare providers segment dominated the market, with the largest share of 38.3% in 2023.

- In terms of functionality, the enhanced communication segment dominated the market, with the largest share of 25.8% in 2023.

- Based on technology, Natural language processing (NLP) segment dominated the market, with the largest share of 88.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.08 Billion

- 2030 Projected Market Size: USD 23.1 Billion

- CAGR (2024-2030): 21.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Moreover, a shift toward patient-centered care and rising initiatives by organizations are contributing to the market growth. The increasing demand for personalized treatment plans and healthcare experiences is expected to drive AI adoption in patient engagement in the pharmaceutical & pharmacy sectors. Advancements in AI and big data analytics are making personalized medicine, which tailors treatments to individual patient characteristics, increasingly feasible and necessary. These technologies enable the analysis of vast amounts of patient data to identify the most effective treatments, which can help improve outcomes and reduce adverse effects. Notable players in the market are integrating AI technologies in their patient engagement solutions to get better results. For instance, in May 2023, Pfizer announced the integration of AI-driven solutions to develop personalized treatment plans based on genetic, lifestyle, and clinical data, enhancing patient outcomes & engagement.

Furthermore, pharmaceutical companies are increasingly exploring innovative methods to engage with patients and healthcare professionals. Omnichannel engagement involves utilizing various channels to ensure a seamless and consistent experience for the target audience across all contact points. According to an article published by Medical Digitals in January 2024, Google research revealed that 90% of users switch between multiple devices daily for work and personal purposes. This hinders tracking user behavior across different touchpoints and the ability to deliver personalized experiences.

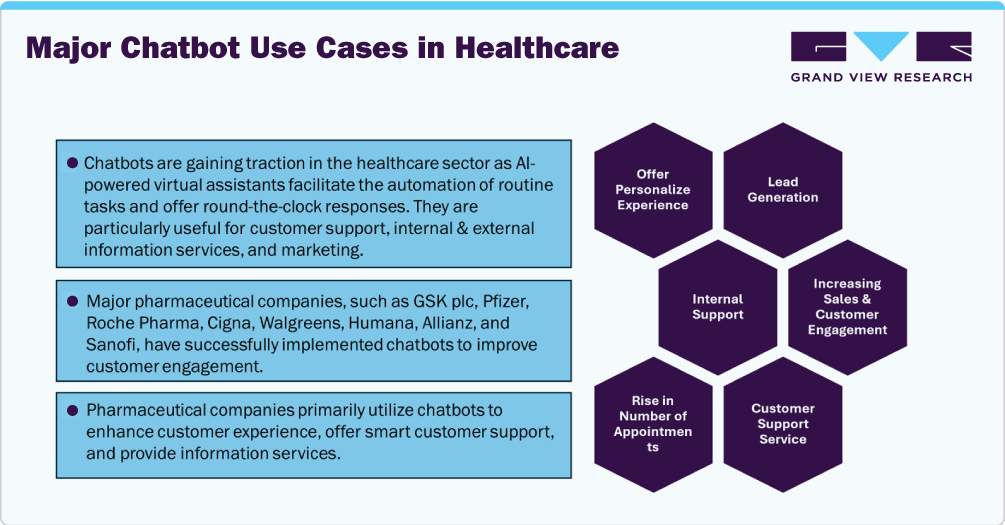

With technological advancements, companies such as Lupin, Humana, GSK, and Roche are increasingly focusing on refining the human element of their chatbots. This involves minimizing misinterpretations of requests & accents, handling customer queries, and understanding customer intent accurately. By doing so, chatbots can deliver personalized experiences tailored to each customer, enhancing patient engagement and satisfaction levels. In addition, sentiment analysis can be employed to enrich customer experience. By analyzing customer emotions, chatbots can gauge satisfaction levels, adjust responses accordingly, and efficiently direct dissatisfied customers to specialized support teams for personalized assistance.

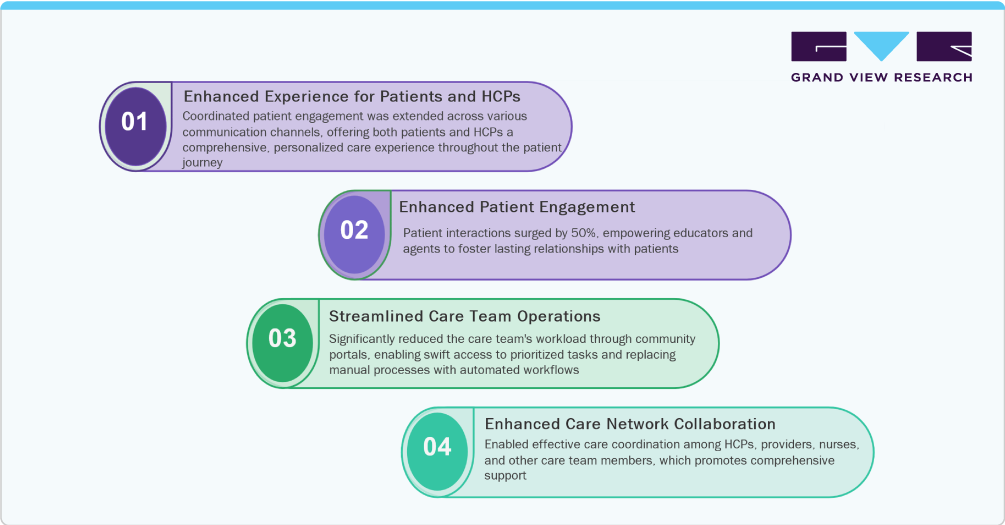

Case Study Insights

ConvergeHEALTH addresses healthcare challenges by delivering personalized experiences at scale. This flexible platform ensures ongoing patient engagement across diverse channels, enhancing partnerships between healthcare providers and patients. Furthermore, it educates, supports, and engages patients to enhance adherence & facilitates care coordination within their networks.

Aim - A leading global pharmaceutical firm's digital health unit aimed to create an all-encompassing patient-centric engagement solution. This initiative aimed to establish an online platform for patients and healthcare professionals to independently manage access to program services.

Resolution - Leveraging the Patient Support Program (PSP) core, this approach formed the foundation for a multi-country deployment (across six nations). This ensured a versatile, scalable, and extensible solution, achieving swift & agile implementation within 7 months.

Outcome - The solution's strategic implementation resulted in significant enhancements in patient-centric engagement, including:

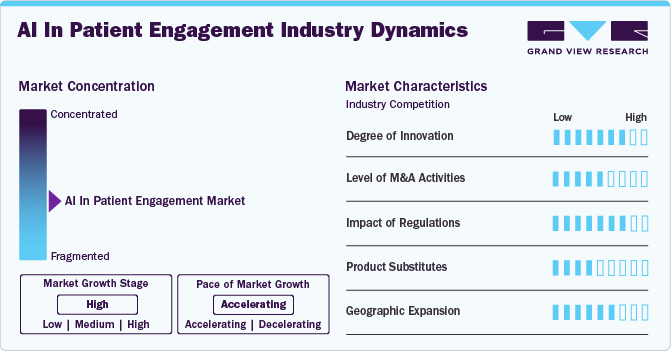

Industry Dynamics

The degree of innovation in the AI in patient engagement industry is high. Technological advancements can be attributed to the growing utilization of AI & ML, cloud computing, natural language processing (NLP), big data analytics, and other technologies. For instance, in August 2023, Huma announced a partnership with Google to employ its Google Cloud's generative AI technology to enhance its regulated disease management platform and address patient engagement challenges.

M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance,in March 2022, Microsoft Corp announced the acquisition of Nuance Communications Inc., a company specializing in ambient intelligence and conversational AI.

The regulatory impact on AI in patient engagement industry is significant. The industry is subject to oversight by various regulatory authorities across different countries. For instance, in October 2023, the World Health Organization (WHO) released essential regulatory guidelines for AI applications in healthcare. This document emphasizes the importance of guaranteeing the safety and efficacy of AI systems, ensuring quick access to appropriate technologies, and fostering communication among key stakeholders, including developers, regulatory bodies, manufacturers, healthcare professionals, and patients.

Geographic expansion drives the AI in patient engagement market by enabling access to diverse data sources, increasing market penetration and revenue, and fostering regulatory compliance and standardization. It also promotes partnerships and collaborations, improves localized healthcare outcomes, and necessitates investment in technological infrastructure.

Delivery Mode Insights

The cloud-based segment dominated the market and accounted for the largest share of more than 70% of the global revenue in 2023. Cloud-based solutions offer scalable resources, allowing healthcare organizations to easily expand or reduce capacity based on demand fluctuations. Moreover, cloud-based platforms enable convenient access to AI-powered patient engagement tools and services from any location with internet connectivity, facilitating remote patient monitoring & management. These solutions provide flexibility in terms of deployment options and support seamless integration with existing healthcare systems and applications.

On-premise solutions allow for greater customization to meet specific organizational needs and preferences, providing flexibility in implementation and configuration. This delivery method can offer higher performance due to dedicated resources and infrastructure. However, the adoption pattern of on-premise solutions remains medium to low. This is attributed to the relatively low penetration and the growing preference for cloud-based solutions, which offer more scalability, cost-efficiency, and ease of maintenance.

End Use Insights

Healthcare providers segment dominated the market, with the largest share of 38.3% in 2023. Several factors such as the growing emphasis on patient-centric care, the need for efficient resource utilization, and the rising demand for personalized healthcare experiences are fueling the adoption of AI in patient engagement among healthcare providers. Moreover, growing investments and expansions & partnerships to launch more effective AI-powered patient engagement solutions are likely to propel market growth in the coming years. For instance, in October 2023, CipherHealth, Inc. expanded AI-driven patient experience investment through collaboration with Google Cloud.

Others segment is expected to grow at the fastest CAGR over the forecast period. The others segment includes pharmaceutical companies, pharmacies. Pharmaceutical companies are increasingly leveraging AI technologies to enhance patient engagement by providing personalized healthcare solutions, improving medication adherence, and streamlining patient communication. These AI-driven advancements enable the delivery of tailored health interventions, ensuring that patients receive the most effective treatments and support.

Similarly, pharmacies are adopting AI-driven solutions to enhance patient engagement through personalized medication management, automated reminders, and efficient communication channels. These innovations help improve medication adherence, streamline pharmacy operations, and offer personalized care. Consequently, these advancements are driving the demand for AI technologies in both the pharmaceutical and pharmacy segments, highlighting the growing importance of AI in improving patient outcomes and operational efficiencies.

Functionality Insights

The enhanced communication segment dominated the market, with the largest share of 25.8% in 2023. With the increasing adoption of AI-driven solutions in healthcare, the demand for advanced communication capabilities is growing. These functionalities empower healthcare organizations to interact with patients more efficiently, delivering timely information and support. By leveraging AI technologies, such as NLP and sentiment analysis, healthcare systems can personalize patient interactions, improving engagement and satisfaction. In addition, enhanced communication functionalities enable healthcare organizations to streamline administrative tasks, such as appointment scheduling and medication reminders, further enhancing patient experience. As a result, the integration of advanced communication features into AI-powered patient engagement solutions is expected to significantly drive market growth in the coming years.

The chatbots and virtual health assistants segment is expected to grow at the fastest CAGR over the forecast period. These AI-driven solutions serve as crucial intermediaries between patients and healthcare organizations, offering timely assistance, information dissemination, and even basic medical advice. The growing adoption of these technologies is fueled by their ability to streamline communication, enhance accessibility to healthcare resources, and alleviate the administrative burden on healthcare staff.

Companies are continuously innovating chatbots and virtual assistance technologies for various healthcare applications. For instance, in April 2023, TeleVox, a provider of omnichannel digital patient technology, launched its latest innovation, Iris, at the HIMSS Conference. Iris represents the newest addition to TeleVox's comprehensive digital patient engagement platform, operating as a powerful AI-driven virtual agent. Iris is accessible through web, voice, and SMS interactions and can be seamlessly integrated into HouseCalls Pro's patient engagement workflows.

Technology Insights

Natural language processing (NLP) segment dominated the market, with the largest share of 88.8% in 2023. NLP models enhance patient engagement and education by delivering personalized, easily understandable health information. By analyzing patient-generated data, such as social media posts and online forums, NLP identifies patient needs, concerns, & preferences. This enables healthcare providers to deliver personalized educational materials, improve communication, and foster shared decision-making. By leveraging predictive analytics and NLP, smart assistance technologies improve patient satisfaction, streamline healthcare processes, and enable proactive management of patient needs. For instance, in June 2023, Vital, an AI-based digital health company, announced the introduction of the industry’s first AI-Powered Video Education feature. Vital's technology employs advanced algorithms to auto-prescribe the most comprehensive and relevant content for each patient. This feature uses AI to analyze nurses' notes & free-form doctors as well as structured orders and procedural codes.

Others segment is expected to grow significantly over the forecast period. The others segment includes computer vision, machine learning technologies, etc. These advanced technologies have a wide range of applications across healthcare settings, contributing to improved patient outcomes and enhanced operational efficiency. Computer vision enables the analysis of medical images, facilitating early disease detection and diagnosis. Machine learning algorithms can analyze vast amounts of patient data to identify patterns and predict health risks, enabling proactive interventions & personalized treatment plans.

Therapeutic Area Insights

Chronic disease management segment dominated the market, with the largest share of 64.9% in 2023. AI technologies play a crucial role in this area by providing predictive analytics, personalized care plans, and real-time monitoring, which help healthcare providers to better manage and engage patients with chronic diseases.

According to a study published in December 2023 by TechTarget, researchers found that using a voice-based conversational AI app enabled patients to effectively manage the self-titration of insulin, leading to improved chronic disease management. In addition, the study involved 32 patients and revealed that those using conversational AI reached optimal insulin dosing faster-achieving it in 15 days compared to 56 days for those who did not use AI. These patients exhibited 32% better adherence to insulin medication, were more likely to achieve glycemic control, and saw greater glycemic improvement throughout the study.

Health & wellness segment is expected to grow at the fastest CAGR over the forecast period. With the increasing focus on preventive care and personalized health management, AI technologies are being leveraged to enhance patient engagement in this sector. According to a 2024 report by VI Ltd. currently, approximately 35% of healthcare organizations, including health & wellness companies, utilize AI in their portfolios and gain a benefit of 20% reduction in operational efficiency which support the overall growth of the companies. The integration of AI in this area supports the broader trend of including a combination of images, videos, and numeric data with the help of multimodal AI models to achieve a more patient-centric approach in healthcare, leading to substantial market growth.

Regional Insights

North America dominated the AI in patient engagement market with a revenue share of over 43.6% in 2023. It accounted for the largest share of the global market in 2023 due to the availability of technologically advanced healthcare infrastructure, growing awareness regarding the benefits of adopting advanced AI-enabled patient engagement solutions, and rising demand for personalized treatment plans & healthcare experiences.

U.S. AI In Patient Engagement Market Trends

AI in patient engagement market in the U.S. is being driven by the market players developing AI-enabled solutions to assist patients suffering from chronic diseases. For instance, in February 2024, Belong.Life, a notable player in the AI-driven patient education and support sector, launched the BelongAI Dave - Cancer Mentor app. This technology signifies an innovative approach to cancer care, offering a 24/7 comprehensive, conversational AI support system for both patients and caregivers globally.

Europe AI In Patient Engagement Market Trends

AI in patient engagement market in Europe is expected to be driven by the region’s significant burden of disease and the need for more efficient healthcare solutions. Strong regulatory support for AI innovation, substantial funding from EU authorities & national governments, and well-established healthcare infrastructure are key factors expected to propel the regional market. For instance, in December 2023, the EU announced a provisional agreement on the basic content of the upcoming Artificial Intelligence Act (AI Act) to promote ethical data safeguarding and transparency regarding the usage of AI applications. The proposed legislation-anticipated to take effect between May 2024 and July 2024-was released early, providing stakeholders a view of the Act’s structure.

AI in patient engagement market in the UK is expected to grow significantly during the forecast period. Market growth in the country can be attributed to the availability of technological infrastructure and support from the government in the form of policies and investments aimed at integrating AI in the healthcare sector. For instance, according to an article published by UK Research and Innovation (UKRI) in August 2023, the UKRI invested USD 16.61 million toward AI advancements in healthcare research.

The Germany AI in patient engagement market had a substantial market share in 2023. Increasing adoption of AI-enabled patient engagement solutions focused on enhancing communication, patient education, and medication management among the end users is fueling market growth in the country. For instance, in November 2023, Huma and Merck KGaA partnered to create a digital platform to enhance cancer patients’ understanding & management of their conditions and treatments. The platform, aimed at patients undergoing cancer therapies by Merck KGaA, sought to improve patient awareness of their disease and treatment regimens, promoting adherence to prescribed therapies.

Asia Pacific AI In Patient Engagement Market Trends

Asia Pacific is anticipated to register the fastest growth in the AI in patient engagement market over the forecast period. The market is driven by factors such as strategic initiatives, technological advancements, and increasing government support. Key players are launching new products, engaging in mergers & acquisitions, and forming partnerships to enhance AI-powered patient care. Investments in technology are leading to better, patient care systems, with significant government support, such as substantial fund allocations for AI initiatives, further fueling market growth.

AI in patient engagement market in Japan has a significant market share in 2023. The market is witnessing significant growth due to the increasing government support through funding and policies. For instance, in February 2024, the Ministry of Industry announced fund allocation of USD 56 million for the AI initiative including universities and startups. This government initiative is expected to create a growth opportunity for startups and universities over the forecast period.

The India AI in patient engagement market is expected to grow significantly during the forecast period. The market growth in the country is attributed to the increasing awareness regarding the benefits of adopting AI-enabled patient engagement solutions. Moreover, prominent players in the market are adopting strategic initiatives to strengthen their market position and expand their customer base. For instance, in January 2024, Innovaccer announced the acquisition of Cured, a startup specializing in digital marketing and customer relationship management. This acquisition incorporates more than 20 health systems and digital health clients into Innovaccer's existing base of over 95 customers. The acquisition is expected to enhance Innovaccer's capabilities in patient engagement and growth strategies.

Key AI In Patient Engagement Company Insights

The market is fragmented owing to the presence of several players. This is expected to intensify the competition in the coming years. Key companies are increasingly adopting strategies such as new product development, collaborations, and mergers & acquisitions to strengthen their market position. For instance, in April 2024, Novo Nordisk partnered with IBM Watson to leverage AI in creating personalized treatment plans for diabetes patients, helping them manage their condition more effectively through individualized care strategies.

Key AI In Patient Engagement Companies:

The following are the leading companies in the AI in patient engagement market. These companies collectively hold the largest market share and dictate industry trends.

- Medadvisor Solutions

- Innovaccer, Inc.

- EnlivenHealth (a subdivision of Omnicell, Inc.)

- EmpiRx Health, LLC.

- IBM

- Huma

- mPulse Mobile

- AllazoHealth

- P360

- Brand Engagement Network, Inc.

- Oracle

- Nuance Communications, Inc. (Microsoft)

- Health Catalyst

- Ada Health GmbH

- Aiva, Inc.

- Claritas Rx

- AiCure

- UST Global Inc

- ZS

- IQVIA Inc

Recent Developments

-

In June 2024, Medadvisor Solutions announced the launch of THRiV, an omnichannel pharmacy engagement powered by its AI-enabled platform. This suite enabled pharmacies to enhance their digital patient engagement strategies and existing initiatives, including providing paperless options increasingly preferred by patients.

-

In June 2024, Brand Engagement Network partnered with OSF HealthCare to introduce BEN's AI assistants to specific healthcare facilities, enhancing simulated training operations for medical professionals' continuing education.

-

In January 2024, Innovaccer, Inc.acquired 100% stakes of cured. This strategic acquisition enhanced the patient engagement offering of Innovaccer, Inc.

-

In November 2023, Huma partnered with Merck KGaA to create a digital platform to enhance cancer patients' comprehension and management of their conditions and treatments. This collaboration seeks to boost patient outcomes by employing advanced educational tools, timely reminders, and various patient engagement strategies.

AI In Patient Engagement Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.3 billion

Revenue forecast in 2030

USD 23.1 billion

Growth rate

CAGR of 21.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Delivery mode, functionality, technology, therapeutic area, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Spain; France; Italy; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medadvisor Solutions; Innovaccer, Inc.; EnlivenHealth (a subdivision of Omnicell, Inc.); EmpiRx Health, LLC.; IBM; Huma; mPulse Mobile; AllazoHealth; P360; Brand Engagement Network, Inc.; Oracle; Nuance Communications, Inc. (Microsoft); Health Catalyst; Ada Health GmbH; Aiva, Inc.; Claritas Rx; AiCure; UST Global Inc; ZS; IQVIA Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Patient Engagement Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global AI in patient engagement market report based on delivery mode, functionality, technology, therapeutic area, end use, and region:

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premise

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Enhanced Communication

-

Patient Education

-

Chatbots and Virtual Health Assistants

-

Predictive Analytics

-

Administrative and Streamlined Operations

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Language Processing (NLP)

-

Smart Assistance

-

OCR (Optical Character Recognition)

-

Auto Coding

-

Text Analytics

-

Speech Analytics

-

Classification and Categorization

-

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Health & Wellness

-

Chronic Disease Management

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Providers

-

Healthcare Payers

-

Others (Pharmaceutical Companies, Pharmacy)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global AI in patient engagement market size was estimated at USD 6.08 billion in 2023 and is expected to reach USD 7.3 billion in 2024.

b. The global AI in patient engagement market is expected to grow at a compound annual growth rate of 21.2% from 2024 to 2030 to reach USD 23.1 billion by 2030.

b. North America dominated the AI in patient engagement market with a share of 43.6% in 2023. Owing to the availability of technologically advanced healthcare infrastructure, growing awareness regarding the benefits of adopting advanced AI-enabled patient engagement solutions, and rising demand for personalized treatment plans & healthcare experiences.

b. Some key players operating in the AI in patient engagement market include Medadvisor Solutions; Innovaccer, Inc.; EnlivenHealth (a subdivision of Omnicell, Inc.); EmpiRx Health, LLC.; IBM; Huma; mPulse Mobile; AllazoHealth; P360; Brand Engagement Network, Inc.; Oracle; Nuance Communications, Inc. (Microsoft); Health Catalyst; Ada Health GmbH; Aiva, Inc.; Claritas Rx; AiCure; UST Global Inc; ZS; IQVIA Inc

b. Key factors driving the market growth are the growing demand for AI-driven personalized treatment plans and healthcare experiences, the emergence of digital platforms and necessity for an omnichannel approach, the increasing role of AI in enhancing pharmacy efficiency and managing supply chain complexities, the shift toward patient-centered care, the growing need to curb rising healthcare costs, and rising initiatives by organizations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.