- Home

- »

- Next Generation Technologies

- »

-

AI In Asset Management Market Size Analysis Report, 2030GVR Report cover

![AI In Asset Management Market Size, Share & Trends Report]()

AI In Asset Management Market Size, Share & Trends Analysis Report By Technology (Machine Learning, Natural Language Processing (NLP)), By Deployment Mode (On-Premises, Cloud), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-886-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

The global AI in asset management market size was valued at USD 2.61 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 24.5% from 2023 to 2030. Artificial intelligence (AI) has demonstrated a potential impact on the asset and wealth management industry over the past decade. For instance, AI-enabled solutions like conversational platforms or chatbots have improved customer interactions and related services. In the business-to-consumer (B2C) domain, fintech organizations offer end-use industries a wide range of AI-supported advisor services to make automated investment decisions. However, business-to-business (B2B) market applications, such as fixed-income asset management, still rely on traditional data processing based on human interactions.

Exponentially increasing data volumes, strict regulations, and low-interest rates encourage asset managers to reconsider their traditional business strategies. Also, recent technological advancements have paved the way for artificial intelligence in asset management. Connection of knowledge, domain-enriched ML (machine learning), and NLP (natural language processing) techniques are being adopted by several FinTech companies to offer improved financial and investment services. For instance, in February 2023, The TIFIN Group, the AI-powered platform, announced a partnership with Morningstar, Inc., an American financial services company, to introduce real-time, aggregated industry trend information powering TIFIN AMP (asset manager platform). The new platform integrates distribution intelligence, marketing, and sales capabilities in a software platform to assist asset managers in contemporizing their allocation to non-institutional and retail clients.

Artificial intelligence is integrated with asset and wealth management for several purposes, such as improving operational efficiency, customer experience & interfaces, and investment processes. An essential application of AI to operational efficiency is the monitoring, quality checking, and exception handling of the vast amount of data on financial instruments. Improving data quality is of the utmost importance as it reduces operational risks and helps client retention. For instance, in February 2023, Scotiabank, a Canadian multinational banking and financial services company, launched Scotia Smart Investor, a new tool to offer clients more control over their investments. The tool, which features an AI-powered advice engine, will assist users in planning, creating, monitoring, and updating their financial objectives.

Researchers have made tremendous strides in developing the ultimate human-machine interaction systems in recent years. AI captures audio, text, and imagery data from various vendor/internal databases and public sources by implementing computer vision, NLP, and voice recognition programs. For instance, computer vision and NLP are used to extract data from issuer filings for valuation models and transcription of analyst conference calls. More extensive programs will further process the information gathered from various sources to generate insights into investment decision-making. This often requires advanced AI techniques like machine learning and deep learning.

Considering the novel COVID-19 pandemic, there has been a massive surge in relocations and deployments of devices and equipment, with millions of employees displaced to WFH (work-from-home) environments. The ability to procure, deploy, and manage hardware assets has become considerably complicated, with the urgency of bringing millions of remote devices online. However, businesses that continue to leverage artificial intelligence are expected to take this pandemic as an opportunity. For instance, AI can help firms create actionable insights for connected devices and reduce costs with smart asset management techniques.

Technology Insights

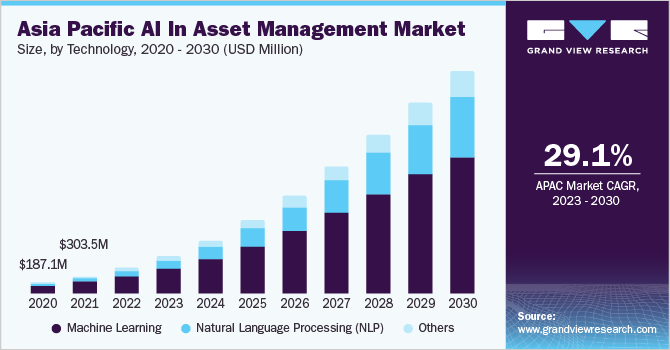

The machine learning segment led the market and accounted for over 65% share of the global revenue in 2022. This high share is attributed to the increasing process automation in manufacturing industries. Machine learning (ML) reflects the natural evolution of technology as machines can sort through large datasets and extract information by identifying patterns and outliers. ML is employed in asset management systems to increase the accuracy and efficiency of operational workflow, improve customer experience, and enhance system performance. For instance, in February 2023, EagleView Technologies, Inc., a prominent provider of aerial imagery, software, and analytics, announced the release of its new asset management solutions. Integrating machine learning (ML) with high-resolution aerial imagery, the company intends to solve various asset management problems for commercial organizations and local governments.

The natural language processing (NLP) segment is predicted to foresee significant growth in the forecast period. NLP involves the development of algorithms and techniques that enable machines to understand, interpret, and generate human language. One of the key growth factors driving the development and adoption of NLP is the exponential growth in the amount of digital data generated worldwide. There is a pressing need to develop automated methods for extracting valuable insights and knowledge from this data. Furthermore, the increasing demand for personalized and intelligent interactions between humans and machines drives the segment's growth. This includes applications such as chatbots, virtual assistants, and intelligent search engines that can understand and respond to natural language queries.

Application Insights

Process automation segment led the market and accounted for a share of over 26% of the global revenue in 2022. Furthermore, the portfolio optimization segment held a significant share of the global revenue in 2022. This high share is attributed to the high adoption of machine learning algorithms in asset management to facilitate portfolio management decisions. Portfolio optimization includes several use-cases, such as portfolio construction & optimization, predictive forecasting of long-term price analysis, and development of strategies for risks associated with investments. A prototype for portfolio optimization in the investment process is built based on stock selection, portfolio management process, and asset allocation optimization.

The data analysis segment is anticipated to witness substantial growth over the forecast period owing to the need for more efficient and effective decision-making. By leveraging machine learning algorithms and predictive analytics, asset managers can quickly analyze large volumes of data and identify patterns and trends that would be difficult for humans to detect. Another growth factor is the increasing demand for personalized investment solutions. Asset managers use data analysis and AI to develop more sophisticated and customized investment strategies that consider individual investor preferences and risk tolerances.

Deployment Mode Insights

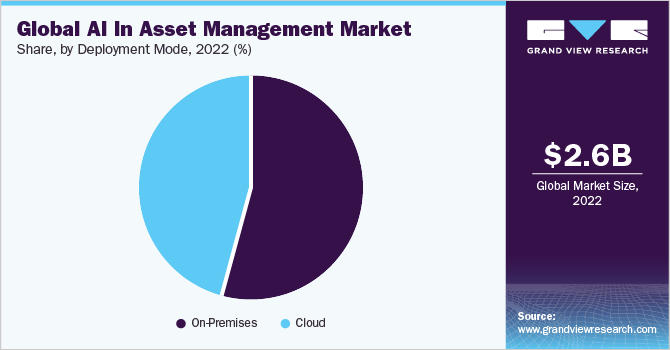

The on-premises segment led the market and accounted for over 54% of the global revenue in 2022. This high share is attributed to the security and privacy provided by the on-premises solutions in asset management. Also, on-premises solutions use edge analytics that reduces the bandwidth requirement. Integrating these solutions on-premises brings higher speed and more reliability to the results. For instance, in March 2023, NVIDIA Corporation, an American multinational technology company, announced the launch of NVIDIA DGX Cloud, an AI supercomputing service. The service allows every business to access its AI supercomputer using a standard web browser, eliminating the sophistication of deploying, acquiring, and managing on-premises infrastructure.

The cloud segment is anticipated to witness substantial growth over the forecast period. This growth is attributable to cloud solutions removing the firewall restrictions that can hamper users' access to an on-premises solution. Cloud-based SaaS (software-as-a-service) solution eliminates maintenance and overhead costs. Also, cloud object storage services provide virtually unlimited storage capacity that removes locally placed hardware's scalability and storage volume restrictions. For instance, in March 2022, Baker Hughes Company, an energy technology company, collaborated with Microsoft, Accenture PLC, and C3.ai, Inc. on industrial asset management (IAM) solutions for customers in the industrial and energy sectors. The partnership concentrates on developing and deploying solutions that utilize digital technologies to improve the efficiency, safety, and emissions profile of field equipment, industrial machines, and other physical assets.

Regional Insights

North America dominated the market and accounted for over 50% share of global revenue in 2022. This is attributed to favorable government initiatives to encourage the adoption of AI across various industries. Many asset management firms in North America have already started to adopt AI technology, and this trend is expected to continue as the benefits become more widely recognized. This includes the automation of processes, the implementation of machine learning algorithms for improved decision-making, and the use of natural language processing for better customer engagement.

The Asia Pacific is anticipated to witness significant growth in AI in the market. This growth owes to the significantly increasing investments in AI in asset management. For instance, in March 2023, Accenture PLC agreed to acquire Flutura, a Bangalore-based AI solutions company. The acquisition intends to bolster Accenture PLC’s industrial AI services to improve the performance of refineries, plants, and supply chains while helping customers to achieve their net zero goals faster.

Key Companies & Market Share Insights

Vendors in the market are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers & acquisitions, partnerships, and collaborations with other key players in the industry. For instance, in February 2023, Arcadis N.V., an engineering and consultancy company, announced a collaboration with Niricson Software Inc., a digital technology provider. The partnership intends to scale digital asset management technologies worldwide. Some of the prominent players in the global AI in asset management market include:

-

Amazon Web Services, Inc.

-

BlackRock, Inc.

-

CapitalG

-

Charles Schwab & Co., Inc

-

Genpact

-

Infosys Limited

-

International Business Machines Corporation

-

IPsoft Inc.

-

Lexalytics

-

Microsoft

-

TABLEAU SOFTWARE, LLC

-

Next IT Corp.

-

S&P Global

-

Salesforce, Inc.

AI In Asset Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.68 billion

Revenue forecast in 2030

USD 17.01 billion

Growth rate

CAGR of 24.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, deployment mode, application, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; Brazil

Key companies profiled

Amazon Web Services, Inc.; BlackRock, Inc.; CapitalG; Charles Schwab & Co., Inc; Genpact; Infosys Limited; International Business Machines Corporation; IPsoft Inc.; Lexalytics; Microsoft; TABLEAU SOFTWARE, LLC; Next IT Corp.; S&P Global; Salesforce, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

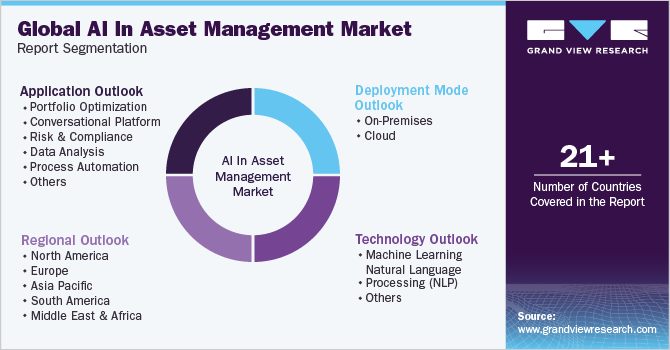

Global AI In Asset Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global artificial intelligence (AI) in asset management market report based on technology, deployment mode, application, and region.

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Machine Learning

-

Natural Language Processing (NLP)

-

Others

-

-

Deployment Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premises

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Portfolio Optimization

-

Conversational Platform

-

Risk & Compliance

-

Data Analysis

-

Process Automation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global AI in asset management market size was estimated at USD 2.61 billion in 2022 and is expected to reach USD 3.68 billion in 2023.

b. The global AI in asset management market is expected to grow at a compound annual growth rate of 24.5% from 2023 to 2030 to reach USD 17.01 billion by 2030.

b. North America dominated the AI in asset management market with a share of 50.1% in 2022. This is attributable to the fact that the North American market has emerged as the largest AI in asset management market on account of increasing investments in machine learning and AI solutions for financial services.

b. Some key players operating in the AI in asset management market include Amazon Web Services, Inc.; BlackRock, Inc.; CapitalG; Charles Schwab & Co., Inc; Genpact; Infosys Limited; International Business Machines Corporation; IPsoft Inc.; Lexalytics and Microsoft.

b. Key factors that are driving AI in asset management market growth include the growing demand for process automation for various tasks, including fraud detection, financial management, and investment banking.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."