- Home

- »

- Healthcare IT

- »

-

AI-based Clinical Trials Solution Provider Market Report, 2030GVR Report cover

![AI-based Clinical Trials Solution Provider Market Size, Share & Trends Report]()

AI-based Clinical Trials Solution Provider Market Size, Share & Trends Analysis Report By Therapeutic Application, By Clinical Trial Phase, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-456-6

- Number of Report Pages: 118

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global AI-based clinical trials solution provider market size was valued at USD 1.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 22.0% from 2023 to 2030. The increasing adoption of AI-based platforms to improve the productivity and efficacy of trials at various stages is driving the market for AI-based clinical trial solution providers. Also, the supportive initiatives by the private and public sectors for different therapeutic areas are some of the factors propelling the market growth. Furthermore, the rising awareness and diversified applications provided by AI in the field of clinical trials such as designing drug trials, improved patient selection, site selection, patient monitoring, etc. is bolstering the market growth.

The utilization of AI in drug trials can be useful to improve the cost, clinical outcomes, and time required for drug trials, as drug development is a cost-intensive and time-consuming process. For instance, in January 2020, Recursion Pharma and Takeda entered into a research collaboration for rare diseases, which resulted in the evaluation of preclinical and clinical molecules in over 60 unique indications in less than 18 months. Moreover, AI can also be used to reduce the bias in medical data. For instance, Genentech collaborated with Stanford University to use an open-source AI system to fight and reduce bias in drug trials. In addition, due to the shifting trend from traditional practices to technology-based approaches, major pharmaceutical companies are highly implementing AI-based technologies in clinical trials, thereby boosting the market growth.

Furthermore, the rising penetration of AI in drug trials and the availability of AI-based solutions can help in different aspects of clinical trials such as drug trial design, patient enrichment & enrollment, investigator and site selection, patient monitoring, medication adherence, and many more, which is boosting the growth of the market for AI-based clinical trial solution providers. Patient eligibility and enrollment are some of the important steps for the success of the overall drug trial and as per research, 85% of the drug trials are delayed during patient recruitment, and 30% are terminated early due to recruitment failure. AI-based platforms are proving to be beneficial in reducing this hurdle. Hence, many researchers are using AI for the drug trial process, thereby fostering the growth of the market for AI-based clinical trial solution providers.

In addition, the COVID-19 outbreak led to the rise in the utilization of AI-based technologies. Increasing adoption of technologically advanced solutions for drug discovery and development and recruited patient data analysis are some of the factors responsible for the increase in penetration of AI-based drug development and drug trial solutions. The pharmaceutical companies, CROs, and academia shifted their focus from the traditional drug development process to the AI-based solution to improve the clinical outcomes and for the minimization of cost and time required for the drug trials. Also, the decentralized drug trials witnessed a boost as many trials were on hold due to COVID-19, due to which many key players turned toward the collection of patient data available.

Clinical Trial Phase Insights

The phase-II segment dominated the market for AI-based clinical trial solution providers and accounted for a revenue share of 46.1% in 2022, owing to the presence of a large number of registered clinical trials active in the second phase. Moreover, the increasing adoption of AI-based tools for the collection of data and the analysis of immediate outcomes of the overall desired outcome through the drug trials in this phase is contributing to the segment growth. Furthermore, the segment holds a higher revenue share as the improvement, determination, and validation of measures with respect to the AI-based tool can be carried out in this phase.

In addition, Phase I is anticipated to register the fastest growth rate of 24.2% during the forecast period. The adoption of AI-based solutions is anticipated to increase, as their utilization since phase I can be beneficial for patient recruitment, retention, and better trial design. Also, these platforms can develop unique patient-centric endpoints and collect real-world data, thereby impelling the adoption of these solutions in phase-I.

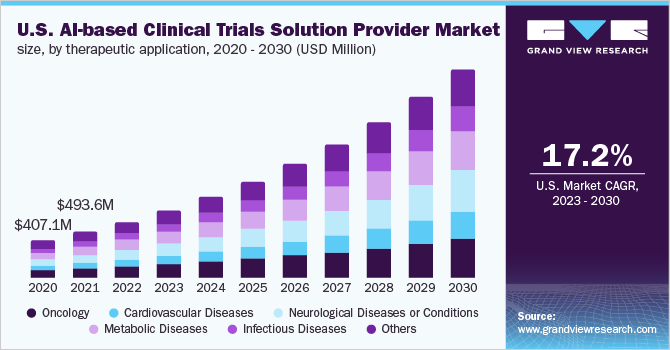

Therapeutic Application Insights

The oncology segment accounted for the highest revenue share of 22.4% in 2022. The high prevalence of cancer across the globe and a large number of drug trials in the field of oncology is contributing to the adoption of AI-enabled technologies. Also, a large number of players are developing and adopting oncology-based AI tools for clinical trials, thereby propelling the segment growth. For instance, in January 2022, Hematology-Oncology Associates of Central New York and Deep Lens partnered for the expansion of a drug trial program, wherein The VIPER provided by Deep Lens will be used to identify the qualified patients for clinical trials by pre-screening all patients.

In addition, cardiovascular disease is anticipated to register the fastest growth rate of 25.6% during the forecast period owing to the rising prevalence of CVD across the globe. Also, the improving drug trials and increasing penetration of AI-based platforms for the analysis of cardiovascular diseases with a new approach are major factors contributing to the segment growth.

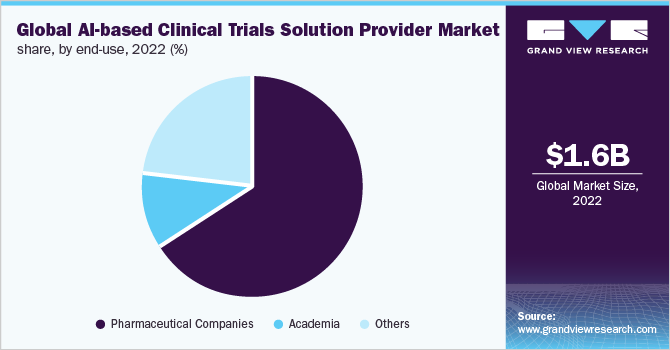

End-use Insights

In 2022, based on end-use, the pharmaceutical companies segment accounted for the highest revenue share of 65.2%. The rising adoption of AI-based technologies for the better development of diagnostic and biomarkers to identify the new drug target, and the overall process of drug development and clinical trials by major pharmaceutical players is one of the major factors contributing to the segment growth. Moreover, these major pharmaceutical players are collaborating with the AI vendors for leveraging the AI technology for R&D and the overall drug discovery process, thereby, impelling the growth. For instance, in April 2020, Vir Biotechnology and GSK signed an agreement to boost the drug discovery for COVID-19 by utilizing CRISPR and AI.

However, the others is anticipated to register the fastest growth rate of 25.0% during the forecast period owing to the rising trend of adoption of AI-enabled solutions by Contract Research Organizations, government agencies, etc. The rising participation of CROs and other organizations in the development and adoption of AI-based platforms and technologies, useful in drug discovery and development, along with clinical trials, is anticipated to boost the growth of the market for AI-based clinical trial solution providers during the forecast period.

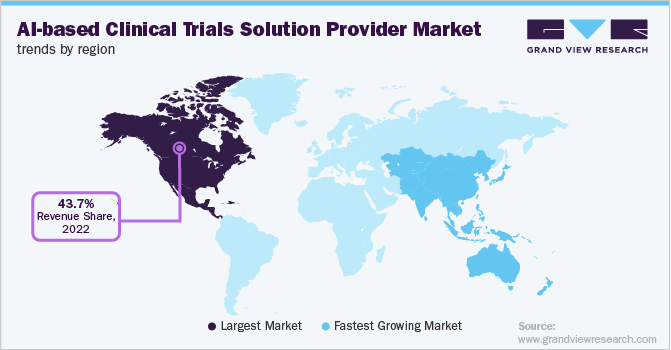

Regional Insights

North America dominated the global AI-based clinical trials solution providers market and accounted for a revenue share of 43.7% in 2022. It is attributed to the presence of a number of AI-based start-ups in the region. For instance, Bullfrog AI is a U.S.-based startup that develops bfLEAP, a proprietary AI platform to enable precision medicine. Furthermore, the growing awareness of AI-based technologies and their adoption to enhance the drug trial outcome is impelling market growth in the region. The supportive government initiatives and increasing strategic initiatives by major players are among a few factors that are driving the demand for AI-based clinical trial solutions in the region.

However, in Asia Pacific, the market for AI-based clinical trial solution providers is anticipated to register the fastest growth rate of 30.0% over the forecast period due to the rising penetration of AI-based tools and favorable government initiatives for the adoption of AI in different healthcare fields. Recruitment for clinical trials is increasing in Asia as compared to North America and Europe. This is due to the presence of a large patient pool and low trial cost. Furthermore, as per Novotech’s CEO, Asia Pacific is now recognized by clinical phase biotechnology firms for accelerated patient enrollment, especially in infectious diseases, oncology, metabolic conditions, immune-oncology, and rare diseases as well as low cost of clinical research combined with experienced investigators and research teams.

Key Companies & Market Share Insights

The increasing demand in the market for AI-based clinical trial solution providers is likely to propel the entry of new companies in the future, fueled by increasing awareness and acceptance regarding AI-based clinical trial technologies and platforms. Furthermore, strategic alliances in the form of mergers and acquisitions, collaborations, partnerships, etc. with other market players as well as increasing R&D in the area of AI-based technologies for clinical trials are some of the initiatives being undertaken by key market players in order to increase their market shares. For instance, in March 2021, Datavant and Saama Technologies, Inc. established a collaborative agreement for mapping patient journeys across various real-world and clinical datasets (LSAC), through Saama's Life Science Analytics Cloud. Such initiatives are likely to boost the adoption of AI-based solutions over the forecast period. Some of the prominent players in the AI-based clinical trials solution provider market include:

-

Unlearn.AI, Inc.

-

Saama Technologies

-

Antidote Technologies, Inc.

-

Phesi

-

Deep 6 AI

-

Innoplexus

-

Mendel.ai

-

Intelligencia

-

Median Technologies

-

Symphony AI

-

BioAge Labs, Inc.

-

AiCure, LLC

-

CONSILX

-

DEEP LENS AI

-

Halo Health Systems

-

Pharmaseal

-

Ardigen

-

Trials.Ai

-

Koneksa Health

-

Euretos

-

BioSymetrics

-

Google- Verily

-

GNS Healthcare

-

IBM Watson

-

Exscientia

AI-based Clinical Trials Solution Provider Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.9 billion

Revenue forecast in 2030

USD 7.8 billion

Growth Rate

CAGR of 22.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Clinical trial phase, therapeutic application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Spain; France; Italy; Russia; China; Japan; India; South Korea; Australia; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Unlearn.AI, Inc.; Saama Technologies; Antidote Technologies, Inc.; Phesi; Deep 6 AI; Innoplexus; Mendel.ai; Intelligencia; Median Technologies; Symphony AI; BioAge Labs, Inc.; AiCure, LLC; CONSILX; DEEP LENS AI; Halo Health Systems; Pharmaseal; Ardigen; Trials.Ai; Koneksa Health; Euretos; BioSymetrics; Google- Verily; GNS Healthcare; IBM Watson; Exscientia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

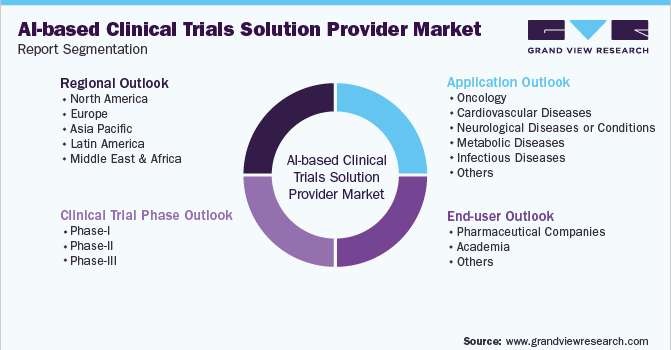

Global AI-based Clinical Trials Solution Provider Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global AI-based clinical trial solution providers market report on the basis of the clinical trial phase, therapeutic application, end-use, and region:

-

Clinical Trial Phase Outlook (Revenue, USD Million, 2016 - 2030)

-

Phase-I

-

Phase-II

-

Phase-III

-

-

Therapeutic Application Outlook (Revenue, USD Million, 2016 - 2030)

-

Oncology

-

Cardiovascular Diseases

-

Neurological Diseases or Conditions

-

Metabolic Diseases

-

Infectious Diseases

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2016 - 2030)

-

Pharmaceutical Companies

-

Academia

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

Spain

-

Russia

-

-

Asia Pacific

-

Australia

-

China

-

Japan

-

South Korea

-

India

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. In 2022, based on therapeutic applications, the oncology segment dominated the AI-based clinical trials solution provider market and accounted for the largest revenue share of 22.4%.

b. The pharmaceutical companies segment dominated the AI-based clinical trials solution provider market and accounted for the largest revenue share of 65.2% in 2022.

b. North America dominated the AI-based clinical trials solution provider market and accounted for the largest revenue share of 43.7% in 2022.

b. The global AI-based clinical trials solution provider market size was estimated at USD 1.6 billion in 2022 and is expected to reach USD 1.9 billion in 2023.

b. The global AI-based clinical trials solution provider market is expected to grow at a compound annual growth rate of 22.0% from 2023 to 2030 to reach USD 7.8 billion by 2030.

b. The phase-II segment dominated the AI-based clinical trials solution provider market and accounted for the largest revenue share of 46.1% in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."