- Home

- »

- Healthcare IT

- »

-

AI In Medical Imaging Market Size, Industry Report, 2033GVR Report cover

![AI In Medical Imaging Market Size, Share & Trends Report]()

AI In Medical Imaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Deep Learning, NLP), By Application (Neurology, Orthopedics), By End Use (Hospitals, Diagnostic Centers), By Modalities, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-993-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI in Medical Imaging Market Summary

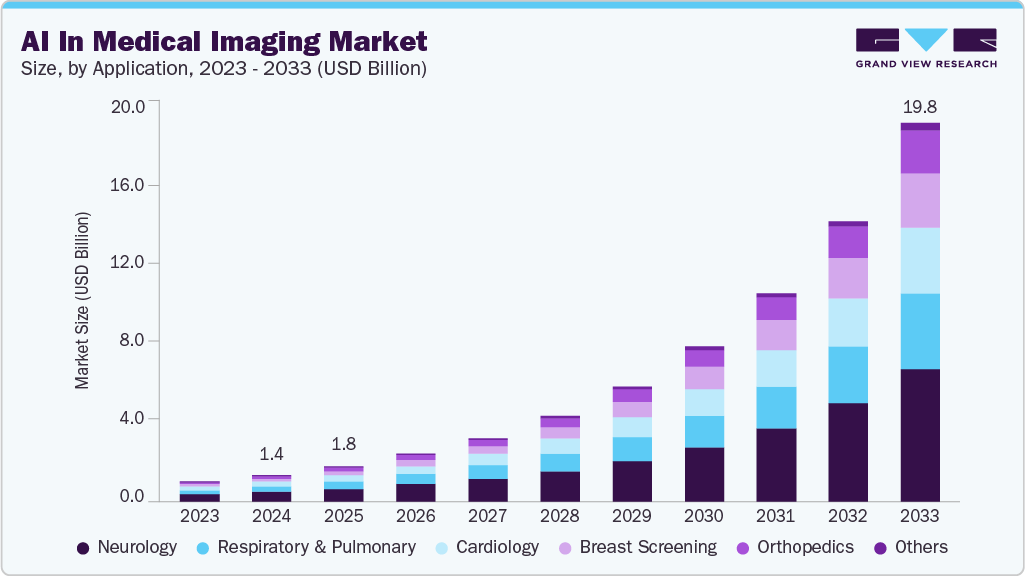

The global AI in medical imaging market size was estimated at USD 1.36 billion in 2024 and is projected to reach USD 19.78 billion by 2033, growing at a CAGR of 34.67% from 2025 to 2033. Rising demand for early & accurate diagnosis, increasing volume of imaging data, and technological advancements in artificial intelligence (AI) and machine learning (ML) contribute to market growth.

Key Market Trends & Insights

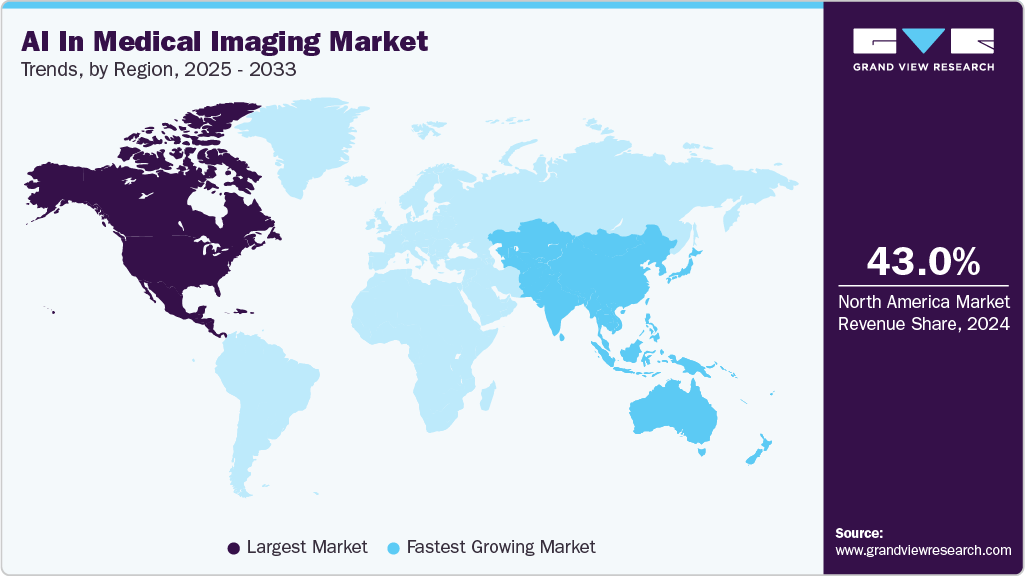

- North America AI in medical imaging market held the largest share of 43.04% of the global market in 2024.

- The AI in medical imaging industry in the U.S. is expected to grow significantly over the forecast period.

- Based on technology, the deep learning segment held the highest market share of 57.67% in 2024.

- Based on application, the neurology segment held the highest market share in 2024.

- By modalities, the CT scan segment held the highest market share in 2024.

- By end use, the hospitals segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.36 Billion

- 2033 Projected Market Size: USD 19.78 Billion

- CAGR (2025-2033): 34.67%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, shortage of skilled radiologists, growing adoption in telemedicine & remote diagnostics, and integration with PACS and cloud infrastructure fuel market growth further. The increasing demand for handling large medical datasets has accelerated the use of AI in medical imaging, owing to its ability to improve diagnostic precision, expedite image analysis, and enhance healthcare efficiency through advanced data management and interpretation. For instance, In November 2023, Koninklijke Philips N.V. expanded its enterprise imaging and introduced its HealthSuite Imaging AI solutions at RSNA23 on Amazon Web Services for faster adoption of new capabilities, improved operational efficiency, and enhanced patient care through secure cloud-based PACS, enabling high-speed remote access and AI-driven workflow orchestration.AI-driven medical imaging tools use advanced algorithms and computing to provide rapid decision support to healthcare providers. Advancements in deep learning, convolutional neural networks, and generative adversarial networks have significantly improved the accuracy and effectiveness of medical image analysis. A Microsoft-IDC study published in March 2024, shows that 79% of healthcare organizations currently use AI technology, with a return on investment of USD 3.20 for every USD 1 invested. This is due to the increasing demand for accurate diagnoses and the complexity of medical imaging data.

The market is also gaining significant financial backing from private players, fostering innovation and development in the sector. Cross-industry collaborations and partnerships are also increasing as diverse sectors collaborate to leverage AI technologies in medical imaging. This financial backing is expected to propel the market growth. For instance, in June 2023, Carta Healthcare, Inc. announced a Series B financing of USD 25 million supported by Memorial Hermann Health System and UnityPoint Health to enhance patient care through clinical data.

Governments globally are investing in integrating AI in healthcare, particularly in medical imaging. This has improved diagnostic accuracy, streamlined workflows, and enhanced patient care. For instance, in September 2022, the National Institutes of Health (NIH) announced a USD 130 million investment to accelerate AI adoption in biomedical and behavioral research. Bridge2AI, an initiative under the NIH Common Fund, aims to create AI-specific tools and datasets for broader adoption. The FDA is also developing a regulatory framework for AI/ML-driven software modifications to ensure safety and effectiveness. The initiative aims to accelerate AI adoption in the medical imaging sector.

Recent Developments in AI in Medical Imaging Market

Institute / Company

Month & Year

Initiative

Perimeter Medical Imaging AI

Perimeter Medical Imaging AI launched the OCT-Tissue Surveillance Registry to collect extensive surgical images and data. This initiative aims to enhance AI deep-learning models for future product development, improving cancer surgery outcomes. The registry is expected to power ongoing AI deep-learning model enhancements for cancer surgery, aiming to enhance real-time tissue assessment, margin detection, and reduce repeat surgeries.

Perspectum

Perspectum has partnered with the London Institute for Healthcare Engineering (LIHE) to advance AI-powered medical imaging solutions. As part of this collaboration, Perspectum is anticipated to establish a London office within LIHE to accelerate the translation of innovative imaging solutions for metabolic disease and cancer from research to patient care.

Royal Marsden NHS Foundation Trust

The Royal Marsden NHS Foundation Trust partnered with NTT DATA and CARPL.ai to create an AI-powered radiology analysis service to enhance cancer research and diagnostics. Funded by a three-year NIHR grant, the service is anticipated to focus on improving the detection of various cancers, utilizing advanced AI tools in medical imaging.

Philips and NVIDIA

Philips partnered with NVIDIA to enhance MRI technology through AI advancements. This collaboration aims to develop a foundational model for MRI, improving image quality, reducing scan times, and streamlining workflows.

Sutter Health and GE HealthCare

Sutter Health and GE HealthCare entered a seven-year strategic partnership- Care Alliance- to expand access to advanced AI-powered imaging across Sutter’s California network. The collaboration aims to deliver quicker diagnostic results, early disease detection, and a more seamless patient and clinician experience by deploying innovative imaging technologies-including PET/CT, SPECT/CT, MRI, CT, X-ray, nuclear medicine, and ultrasound-across care sites.

ConcertAI

ConcertAI launched a cloud-based SaaS version of TeraRecon’s AI-enabled imaging portfolio, integrating advanced visualization, clinical AI, and generative AI modules.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The AI in medical imaging market is fragmented, with several emerging solution providers dominating the market. The degree of innovation and impact of regulations on industry is high. The level of merger & acquisition activities is moderate. Moreover, the regional expansion of industry is high.

The AI in medical imaging market experiences a high degree of innovation driven by technological advancements. The increasing adoption of artificial intelligence in imaging diagnostics supports new innovations in the market.For instance, in June 2025, Perimeter Medical Imaging AI launched the OCT-Tissue Surveillance Registry to collect extensive images and data from surgical procedures utilizing their imaging technology. This registry is expected to enhance the AI deep-learning model for future product development, improving clinical care and patient outcomes in cancer surgery.

The industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in April 2025, imaging center operator RadNet agreed to acquire breast imaging AI vendor iCAD for USD 103 million. The acquisition aims to accelerate global leadership in AI-powered breast cancer screening, combining advanced risk evaluation, breast density assessment, and arterial calcification classification to improve diagnostic accuracy and patient outcomes.

The FDA in the U.S. has established guidelines for AI-based tools. Regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR) in Europe influence data usage and sharing. Compliance with international standards such as the International Organization for Standardization (ISO) is necessary for market access and is expected to impact product development processes.

Regional expansion ranges from medium to high, with players strategically expanding their global presence. This expansion aims to meet growing demand, monetize emerging healthcare markets, and promote AI in the healthcare industry. For instance, in May 2025, Korean medical imaging AI companies Lunit and Coreline Soft secured supply contracts in Germany to support large-scale cancer screening programs. Lunit's five-year partnership with Starvision Service involves deploying AI solutions across 79 sites, while Coreline Soft supplies lung cancer screening software to University Hospital Bonn, enhancing diagnostic capabilities.

Case Study & Insights

A team of researchers from DeepC and the Department of Diagnostic and Interventional Neuroradiology at the Technical University of Munich conducted a study to evaluate the effectiveness of AI-based triage in head CT scans. Their investigation aimed to determine if this technology could enhance diagnostic accuracy and reduce reporting times.

Results:

-

Diagnostic accuracy improves with AI assistance, especially for less experienced radiologists

-

Among studies initially deemed healthy by a radiologist, 94.1% were truly healthy (negative predictive value; NPV) without AI support. With AI assistance, false negative diagnoses significantly decreased, raising the NPV from 94.1% to 98.2%. Similarly, abnormal studies' positive predictive value (PPV) rose from 99.3% to 100%. Near-perfect positive and negative predictive values were achievable with AI assistance. In addition, the study revealed a two-thirds reduction in false positive detections when AI-augmented radiological readings

-

Radiologists achieve up to 25% faster reporting with AI support

-

The research observed a 15.7% decrease in the time required for radiological interpretation when AI support was provided. Both experienced and inexperienced radiologists experienced time savings, particularly when reviewing regular scans. For inexperienced radiologists assessing routine scans, reporting times were reduced by 25.7%

Technology Insights

Based on technology, the deep learning segment held the largest revenue share of 57.67% in 2024, owing to its ability to analyze complex medical images and provide accurate diagnostics. Deep learning algorithms, particularly convolutional neural networks (CNNs), have demonstrated enhanced performance in image recognition tasks, leading to their widespread adoption in medical imaging applications. For instance, in March 2025, NVIDIA and GE HealthCare collaborated to advance autonomous diagnostic imaging through Physical AI. This partnership focuses on developing autonomous X-ray and ultrasound technologies, utilizing the NVIDIA Isaac for Healthcare platform to simulate medical environments.

“We look forward to taking advantage of physical AI for autonomous imaging systems with NVIDIA technology to improve patient access and address the challenges of growing workloads and staffing shortages in healthcare.”

-Roland Rott, president and CEO of Imaging at GE HealthCare

The natural language processing (NLP) segment is expected to grow at the fastest CAGR over the forecast period. NLP technology utilizes a computer program that interprets and presents information in the current human language, encompassing text and images. Factors driving NLP are increased application in machine learning (ML) and artificial intelligence (AI). Integrating computer vision into NLP healthcare is noteworthy, as it aids in processing and interpreting complex medical images that may be challenging for humans to analyze accurately. For instance, in September 2023, Clearpath Technology launched PatientConnect, a patient-centric solution developed in collaboration with healthcare institutions. It uses AI and NLP to simplify radiology reports into easily understandable language.

Application Insights

Based on application, the neurology segment held the largest market share of 37.46% in 2024, owing to the increased use of AI in neurology, which provides better patient care and enables higher accuracy and efficiency. The use of AI for detecting neurological conditions holds great promise in addressing the ever-increasing imaging volumes and providing timely diagnoses. Moreover, adopting AI significantly improves the diagnosis and detection of brain tumors and other neurological cancers, offering high accuracy and consistency, thus driving the segment growth.

Studies show that optical imaging combined with deep convolutional neural networks accurately predicts brain tumors in less than 150 seconds, further boosting the adoption of AI solutions in medical imaging of neurological disorders.

The breast screening segment is expected to grow at the fastest CAGR over the forecast period. The increasing incidence of breast cancer cases and the growing patient preference for early-stage detection, enabling prompt and precise treatment initiation, are significant drivers propelling the demand for breast screening. Early detection is crucial for improving survival rates, and AI significantly enhances the accuracy and efficiency of screening processes.

Innovations in AI, particularly in machine learning and deep learning, have led to the developmentof sophisticated algorithms that analyze mammograms and other imaging modalities with high precision. These technologies will likely detect subtle signs of cancer that human radiologists may miss. For instance, in November 2023, GE HealthCare launched MyBreastAI Suite, an AI-based platform designed to aid clinicians in breast cancer detection and workflow productivity. The suite includes three AI applications: PowerLook Density Assessment, SecondLook for 2D Mammography, and ProFound AI for DBT, which improve patient outcomes and operational efficiency.

Modalities Insights

Based on modalities, the CT scan segment held the largest market share of 34.86% in 2024 due to its ability to provide detailed cross-sectional images of the body, making them indispensable in medical diagnostics. CT scans are a widely used imaging modality for diagnosing various conditions, including cancers, cardiovascular diseases, trauma, and musculoskeletal disorders. AI algorithms automatically detect and quantify abnormalities in CT images, such as tumors, lesions, and fractures, reducing the workload on radiologists and increasing diagnostic accuracy. This is achieved by automating and optimizing various data acquisition processes, such as patient positioning and setting acquisition parameters. After the data collection phase, AI is crucial in optimizing image reconstruction parameters, implementing advanced reconstruction algorithms, and applying image denoising techniques.

These advancements collectively enhance image quality, mainly by reducing image noise, thereby allowing the use of lower radiation doses during data acquisition. The growth of this segment is also fueled by market initiatives, such as CGI's partnership with Planmeca and Helsinki University Hospital to develop an AI-powered solution for radiologists in May 2023. The solution interprets brain CT scans and detects common non-traumatic brain hemorrhages, demonstrating the potential of AI in improving diagnostic accuracy and efficiency in medical imaging. The X-ray segment is anticipated to expand at the fastest CAGR over the forecast period. This rapid growth is attributed to several factors that highlight the critical role of X-ray imaging in healthcare and the transformative impact of AI technologies.

The primary factor propelling this segment is the rising utilization of interventional X-ray equipment for surgeries guided by imaging, including C-arms and similar devices. AI algorithms automatically detect fractures, infections, tumors, and other abnormalities in X-ray images, improving diagnostic accuracy and reducing the burden on radiologists. In October 2023, Koninklijke Philips N.V. introduced the new X-ray system, Philips Image Guided Therapy Mobile C-arm System 3000 (Zenition 30), which offers real-time image guidance for various clinical procedures, including orthopedics, trauma, spine interventions, pain management, and surgical processes, specifically designed for operating rooms.

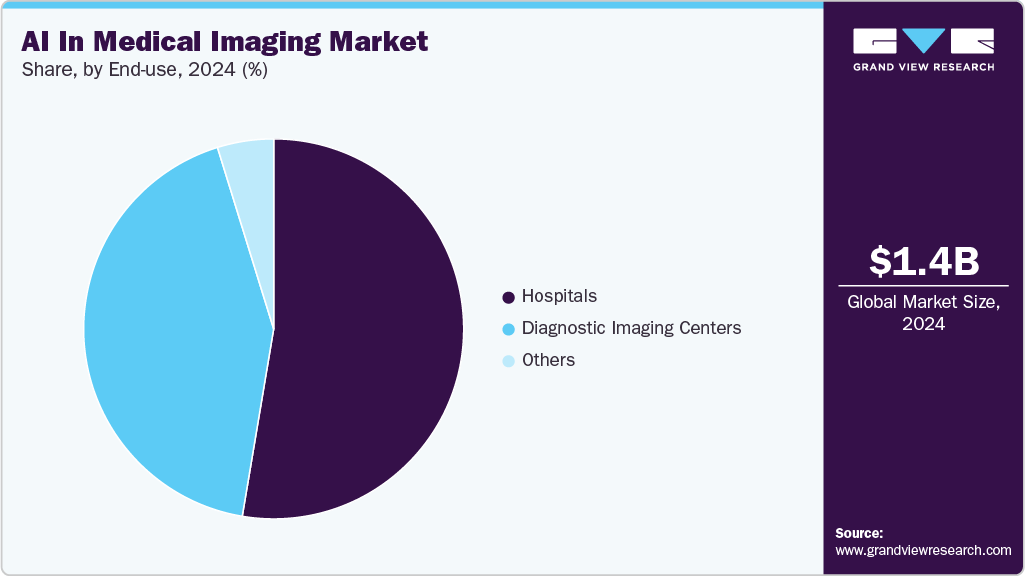

End Use Insights

Based on end use, the hospitals segment dominated the market with the largest share of 52.64% in 2024 and is expected to grow at the fastest CAGR over the forecast period. According to the survey published by Definitive Healthcare 2020, about one-third of hospitals and imaging centers report using AI, machine learning (ML), or deep learning to aid tasks associated with patient care imaging. In addition, the segment growth is observed due to the availability of cutting-edge medical imaging equipment in hospitals with a solid infrastructure.

The growing adoption of AI in medical imaging solutions, especially for cancer diagnostics, is propelling the segment's growth. Furthermore, increasing partnerships and collaborations between hospitals and key market players to deploy AI in medical imaging solutions are expected to drive market growth over the forecast period. For instance, in March 2025, ConcertAI’s TeraRecon and 3DR Labs expanded their partnership to deliver advanced AI-enabled imaging and post-processing services for U.S. hospitals.

“High-quality, outsourced 3D medical imaging services and AI-enabled insights enhance our ability to serve our hospital partners efficiently. By leveraging TeraRecon’s technology and partnering to offer AI as-a-service, we can scale our operations to meet increasing clinical needs while maintaining our commitment to exceptional quality and service.”

-Mike Jackman, CEO of 3DR Labs.

Regional Insights

The AI in medical imaging market in North America dominated the global industry in 2024 and accounted for the largest revenue share of 43.04% in 2024. The region's advanced healthcare infrastructure and significant investment in healthcare technology provide a solid foundation for integrating AI solutions. Extensive R&D activities, particularly in the U.S., foster innovation and the development of cutting-edge AI applications in medical imaging. In addition, the increasing prevalence of chronic diseases and the rising demand for early and accurate diagnosis fuel the need for advanced imaging technologies.

U.S. AI in Medical Imaging Market Trends

The U.S. AI in medical imaging market held the largest market share in 2024. This is attributed to the growing adoption of AI technologies for disease diagnosis and treatment in healthcare. This demand is driven by the potential for AI to enhance diagnostic accuracy and its ability to manage increasing workloads efficiently. For instance, a study published by New Intelerad Research in May 2022 revealed that approximately 64% of U.S. consumers highly trust AI for medical imaging applications. This growing confidence underscores the increasing acceptance and adoption of AI-driven solutions among healthcare providers and patients, further propelling market growth.

Europe AI in Medical Imaging Market Trends

AI in medical imaging market in Europe is expected to grow significantly over the forecast period. Europe is home to numerous collaborative research projects and consortia, such as the European Organization for Nuclear Research (CERN) and various Horizon 2020 projects, which focus on advancing AI in medical imaging. The European Union's Medical Device Regulation (MDR) has set clear guidelines for the approval and use of AI in medical imaging, ensuring safety and efficacy. This regulatory environment encourages innovation and the adoption of AI technologies across Europe.

The UK AI in medical imaging market is expected to grow profitably over the forecast period. The UK government has been actively promoting the use of AI in healthcare through initiatives such as the AI Sector Deal and funding from Innovate UK. The National Health Service (NHS) is a significant player in adopting AI to improve diagnostic accuracy and operational efficiency. Strong collaboration between academic institutions and industry players, exemplified by partnerships between leading universities and tech companies, drives innovation in AI medical imaging.

AI in medical imaging market in Germany held the largest market share in 2024 in the European market, attributed to the increasing investments in healthcare technology and robust healthcare infrastructure, and the increasing adoption of artificial intelligence in disease diagnosis. Furthermore, increasing investments in medical imaging in the country propel market growth further. For instance, in November 2024, German startup Mediaire raised USD 14.5 million in a European-led financing round to enhance radiologists' workflows using AI. The investment is expected to allow Mediaire to expand its AI solutions beyond brain, prostate, and knee diagnostics in MRI, improving diagnostic accuracy and efficiency in healthcare.

Asia Pacific AI in Medical Imaging Market Trends

The Asia Pacific AI in medical imaging market is expected to experience significant growth in the coming years. This growth is attributed to the increasing investments in AI within the healthcare sector, enabling businesses to enhance their revenue share through AI-driven medical imaging. For example, China aims to lead the world in artificial intelligence by 2030, supported by substantial government funding and investments to accelerate the adoption of AI technologies across various industries.

The Japan AI in medical imaging market held the largest market share of the APAC market revenue in 2024. This can be attributed to the increasing focus on technologies, such as AI, to improve diagnostic capabilities and manage healthcare demands. Key companies such as Fujifilm and Canon are leading the way in developing sophisticated AI algorithms for medical imaging. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) supports AI innovations, streamlining approval processes for AI-based medical devices. The increasing number of startups in Japan launching novel AI-driven technologies in medical imaging is likely to propel market growth over the forecast period. For instance, in May 2024, NOVIUS, a healthcare startup, launched its innovative AI-driven technology, N-Vision 3D, which converts two-dimensional imagery to three-dimensional imagery in real time and helps in enhancing surgical procedures. N-Vision 3D has the potential to revolutionize imaging for X-ray fluoroscopy equipment, endoscopes, and angiography. Notable advancementsinclude the existing 2D endoscopes (monocular cameras) that can be used with N-Vision 3D without any modifications.

AI in medical imaging market in China is expected to grow at the fastest CAGR over the forecast period. Increasing government initiatives, rapidly growing healthcare infrastructure, and technological advancements drive market growth.

Latin America AI in Medical Imaging Market Trends

The Latin America AI in medical imaging market is anticipated to grow at a significant CAGR over the forecast period. This is attributed to the growing awareness about AI technologies, the rising prevalence of chronic diseases, increasing government spending, and growing advancements in healthcare infrastructure.

Middle East and Africa AI in Medical Imaging Market Trends

The Middle East and Africa AI in medical imaging market is expected to grow at a significant CAGR over the forecast period. The market is characterized by a dynamic landscape driven by the growing adoption of healthcare IT solutions, increasing healthcare expenditures, and supportive government policies. Significant integration of AI in healthcare technology across the region contributes to market growth further. For instance, Gulf Cooperation Council (GCC) countries such as the UAE and Saudi Arabia are heavily investing in healthcare innovation as part of their national strategies-Saudi Vision 2030 and the UAE’s National AI Strategy. These policies emphasize AI integration into healthcare systems, including diagnostic imaging.

The UAE AI in medical imaging market is expected to grow rapidly over the forecast period, owing to continued support from government initiatives and technological advancements. For instance, the UAE government's increasing focus on digital transformation, aligned with the UAE National Artificial Intelligence Strategy 2031, is a significant driver for adopting AI technologies, including medical imaging in healthcare.

Key AI in Medical Imaging Company Insights

Key players operating in the AI in medical imaging market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key AI in Medical Imaging Companies:

The following are the leading companies in the AI in medical imaging market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Microsoft

- Digital Diagnostics Inc.

- TEMPUS

- Butterfly Network, Inc.

- Advanced Micro Devices, Inc.

- HeartFlow, Inc.

- Enlitic, Inc.

- Canon Medical Systems USA, Inc.

- Viz.ai, Inc.

- EchoNous, Inc.

- HeartVista Inc.

- Exo Imaging, Inc

- Nano-X Imaging Ltd.

Recent Developments

-

In April 2025, Spark Radiology launched a cloud-based workflow platform for radiologists in India to streamline imaging operations and reporting. The platform integrates AI-powered tools for automated case triage, structured reporting, and collaboration, enhancing diagnostic accuracy and efficiency.

-

In February 2025, the Madras Medical Mission (MMM) in Chennai launched an AI-powered cardiac care center equipped with advanced imaging technologies, including a state-of-the-art cath lab offering AI-driven diagnostics for angioplasty and stenting. The AI algorithms enhance diagnosis accuracy by identifying angiogram blockages and abnormalities, improving treatment planning and patient outcomes.

-

In February 2025, Coreline Soft, a South Korean medical imaging AI company, launched in Australia through a partnership with ParagonCare to support major hospitals in the National Lung Cancer Screening Program.

-

In January 2024, GE HealthCare announced an acquisition agreement with MIM Software from Cleveland, a global provider of medical imaging analysis and AI solutions in molecular radiotherapy, radiation oncology, urology, and diagnostic imaging. The acquisition aims to integrate MIM Software's imaging analytics and digital workflow capabilities across diverse care areas, enhancing innovation and distinguishing GE HealthCare's solutions to positively impact patients and healthcare systems globally.

-

In November 2023, GE HealthCare announced its AI suite, MyBreastAI, at the RSNA 2023 conference. This innovative product helps streamline radiologists' workflows, offering them advanced tools to identify and diagnose breast cancer at earlier stages, ultimately improving patient outcomes.

-

In November 2023, Brainomix, a company focused on developing AI-powered software solutions for precision medicine in stroke, lung fibrosis, and cancer, declared its ongoing expansion in the U.S.

-

In July 2022, the FDA gave Philips SmartSpeed AI-based software its 510(k) approval, enabling it to offer ground-breaking high-speed, high-resolution MR imaging. Its broad compatibility enables quicker and higher-quality scans for almost all patients with various illnesses, including those with implants (97% of clinical protocols). In addition, the intelligent MR acceleration software offers three times quicker scans, which increases MR department efficiency with high-quality picture resolution.

AI in Medical Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.83 billion

Revenue forecast in 2033

USD 19.78 billion

Growth rate

CAGR of 34.67% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, modalities, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE HealthCare; Microsoft; Digital Diagnostics Inc.; TEMPUS; Butterfly Network, Inc.; Advanced Micro Devices, Inc.; HeartFlow, Inc.; Enlitic, Inc.; Canon Medical Systems USA, Inc.; Viz.ai, Inc.; EchoNous, Inc.; HeartVista Inc.; Exo Imaging, Inc.; Nano-X Imaging Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Medical Imaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI in medical imaging market report based on application, modalities, technology, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Deep Learning

-

Natural Language Processing (NLP)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Neurology

-

Respiratory and Pulmonary

-

Cardiology

-

Breast Screening

-

Orthopedics

-

Others

-

-

Modalities Outlook (Revenue, USD Million, 2021 - 2033)

-

CT Scan

-

MRI

-

X-rays

-

Ultrasound

-

Nuclear Imaging

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global AI in medical imaging market size was estimated at USD 1.01 billion in 2023 and is expected to reach USD 1.36 billion in 2024.

b. The global AI in medical imaging market is expected to grow at a compound annual growth rate of 34.8% from 2024 to 2030 to reach USD 8.18 billion by 2030.

b. North America dominated the AI in medical imaging market, with a share of over 43.00% in 2023, owing to the technologically advanced infrastructure and significant investment in healthcare technology, which provide a solid foundation for integrating AI solutions. In addition, increasing research and development activities, particularly in the U.S., foster innovation and develop cutting-edge AI applications in medical imaging.

b. Some key players operating in the AI in medical imaging market are GE HealthCare, Microsoft, Digital Diagnostics Inc., TEMPUS, Butterfly Network, Inc., Advanced Micro Devices, Inc., HeartFlow, Inc., Enlitic, Inc., Canon, Medical Systems USA, Inc., Viz.ai, Inc., EchoNous, Inc., eartVista Inc., Exo Imaging, Inc, and NANO-X IMAGING LTD.

b. Key factors driving the AI in medical imaging market growth include the rising number of diagnostic procedures, shortage of radiologists, increased funding for AI-based start-ups by private players, government initiatives to endorse the use and benefits of AI-based tools and technologies in the medical industry, and growing cross-industry collaborations and partnerships are some of the factors driving this market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.