- Home

- »

- Healthcare IT

- »

-

AI In Medical Imaging Market Size And Share Report, 2030GVR Report cover

![AI In Medical Imaging Market Size, Share & Trends Report]()

AI In Medical Imaging Market Size, Share & Trends Analysis Report By Technology (Deep Learning, NLP), By Application (Neurology, Orthopedics), By End Use (Hospitals, Diagnostic Centers), By Modalities, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-993-0

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

AI In Medical Imaging Market Size & Trends

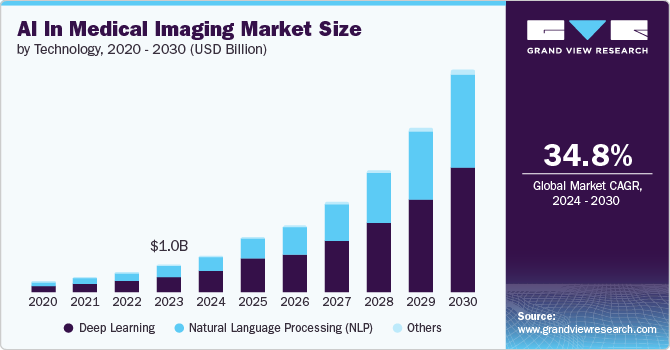

The global AI in medical imaging market size was estimated at USD 1.01 billion in 2023 and is estimated to grow at a CAGR of 34.8% from 2024 to 2030. The rising demand for the influx of complex and large datasets, increasing attention to lessen radiologists' workload, increased funding for AI-based start-ups by private players, government initiatives to endorse the use and benefits of AI-based tools and technologies in the medical industry, and growing cross-industry collaborations and partnerships are some of the factors driving this market. For instance, in June 2021, VUNO Inc., an artificial intelligence (AI) developer based in South Korea, announced a partnership with Samsung Electronics to integrate VUNO's AI-powered chest X-ray diagnostic solution into Samsung's high-end mobile digital X-ray system, the GM85.

The increasing demand for handling large medical datasets has accelerated the use of AI in medical imaging, owing to its ability to improve diagnostic precision, expedite image analysis, and enhance healthcare efficiency through advanced data management and interpretation. For instance, In November 2023, Koninklijke Philips N.V. expanded its enterprise imaging and introduced its HealthSuite Imaging AI solutions at RSNA23 on Amazon Web Services for faster adoption of new capabilities, improved operational efficiency, and enhanced patient care through secure cloud-based PACS, enabling high-speed remote access and AI-driven workflow orchestration.

AI-driven medical imaging tools use advanced algorithms and computing to provide rapid decision support to healthcare providers. Advancements in deep learning, convolutional neural networks, and generative adversarial networks have significantly improved the accuracy and effectiveness of medical image analysis. A Microsoft-IDC study published in March 2024, shows that 79% of healthcare organizations currently use AI technology, with a return on investment of USD 3.20 for every USD 1 invested. This is due to the increasing demand for accurate diagnoses and the complexity of medical imaging data.

The market is also gaining significant financial backing from private players, fostering innovation and development in the sector. Cross-industry collaborations and partnerships are also increasing as diverse sectors collaborate to leverage AI technologies in medical imaging. This financial backing is expected to propel the market growth. For instance, in June 2023, Carta Healthcare, Inc. announced a Series B financing of USD 25 million supported by Memorial Hermann Health System and UnityPoint Health to enhance patient care through clinical data.

Governments worldwide have been investing in integrating AI in healthcare, particularly in medical imaging. This has improved diagnostic accuracy, streamlined workflows, and enhanced patient care. For instance, In September 2022, the National Institutes of Health (NIH) announced a USD 130 million investment to accelerate AI adoption in biomedical and behavioral research. Bridge2AI, an initiative under the NIH Common Fund, aims to create AI-specific tools and datasets for broader adoption. The FDA is also developing a regulatory framework for AI/ML-driven software modifications to ensure safety and effectiveness. The initiative aims to accelerate AI adoption in the medical imaging sector.

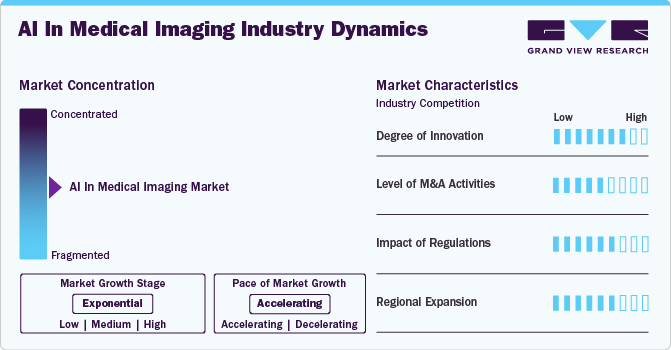

Industry Dynamics

The AI in the medical imaging market is characterized by a high degree of innovation driven by rapid technological advancements. For instance, Microsoft Corporation provides various AI capabilities and services, including computer vision, speech recognition, and language understanding. It also offers pre-trained models, SDKs, and APIs that help build AI-based workflows for various applications. Similarly, GE HealthCare, a prominent player in the market, integrates AI into medical imaging, leveraging cutting-edge technology to enhance diagnostic capabilities. The company has expertise in innovative AI solutions, such as the MyBreastAI suite, aimed at simplifying radiologists' workflows and facilitating early detection of conditions like breast cancer

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This growth is attributable to the growing technological partnerships, access to complementary expertise, and strategic consolidation of resources.Large healthcare companies and tech giants are acquiring AI startups to integrate advanced AI capabilities into their existing product lines. In May 2021, ThinkCyte and Sysmex Corporation collaborated to improve diagnosis accuracy and treatment while also developing novel testing and diagnostic technologies with high clinical value

The market is also subject to increasing regulatory scrutiny. This is due to concerns about the need to ensure patient safety, data privacy, and the reliability of AI-driven diagnostic tools. The FDA in the U.S. has established guidelines for AI-based tools, while regulations like the Health Insurance Portability and Accountability Act (HIPAA) and General Data Protection Regulation (GDPR) in Europe influence data usage and sharing. Compliance with international standards like the International Organization for Standardization (ISO) is necessary for market access and can influence product development processes. These regulations can prolong the time to market for AI solutions in the medical imaging industry. For instance, the AI Risk Management Framework, Executive Order 14091 of February 2023, and the Blueprint for an AI Bill of Rights were issued to ensure that AI complied with all Federal laws and promote careful oversight, robust technical evaluations, rigorous regulation, and engagement with affected communities

Regional expansion ranges from medium to high, with players strategically expanding their global presence. This expansion aims to meet growing demand, monetize emerging healthcare markets, and promote AI in the healthcare industry. For instance, in November 2023, Brainomix, a company focused on developing AI-powered software solutions for precision medicine in stroke, lung fibrosis, and cancer, declared its ongoing expansion in the U.S. The company introduced its complete set of FDA-cleared modules within the Brainomix 360 platform, a comprehensive solution for stroke imaging

Case Study & Insights

A team of researchers from DeepC and the Department of Diagnostic and Interventional Neuroradiology at Technical University of Munich, conducted a study to evaluate the effectiveness of AI-based triage in head CT scans. Their investigation aimed to determine if this technology could enhance diagnostic accuracy and reduce reporting times.

Results:

-

Diagnostic accuracy improves with AI assistance, especially for less experienced radiologists

-

Among studies initially deemed healthy by a radiologist, 94.1% were truly healthy (negative predictive value; NPV) without AI support. With AI assistance, false negative diagnoses significantly decreased, raising the NPV from 94.1% to 98.2%. Similarly, abnormal studies' positive predictive value (PPV) rose from 99.3% to 100%. Near-perfect positive and negative predictive values were achievable with AI assistance. In addition, the study revealed a two-thirds reduction in false positive detections when AI-augmented radiological readings

-

Radiologists achieve up to 25% faster reporting with AI support

-

The research observed a 15.7% decrease in the time required for radiological interpretation when AI support was provided. Both experienced and inexperienced radiologists experienced time savings, particularly when reviewing regular scans. For inexperienced radiologists assessing routine scans, reporting times were reduced by 25.7%

Technology Insights

Based on technology, the deep learning segment held the largest share of 57.94% in 2023 owing to its superior ability to analyze complex medical images and provide accurate diagnostics. Deep learning algorithms, particularly convolutional neural networks (CNNs), have demonstrated exceptional performance in image recognition tasks, leading to their widespread adoption in medical imaging applications. Its approach in medical image analysis emerges as a fast-growing research as it allows for faster and more precise interpretation of medical images, leading to improved patient outcomes, personalized treatment planning, and efficient healthcare workflows. In addition, with ongoing research, interdisciplinary collaboration, and the development of more sophisticated algorithms, deep learning can revolutionize medical imaging and contribute significantly to the future of medicine.

For instance, in November 2023, OpenAI launched OpenAI Data Partnerships, partnering with various organizations to create datasets for AI training. The quality of these training files significantly influences the reliability of neural networks, enabling more accurate responses to user queries. To streamline the process, OpenAI sought external assistance to create high-quality datasets. The natural language processing (NLP) segment is expected to grow at the fastest CAGR over the forecast period due to its ability to transform unstructured textual data into actionable insights, improve workflow efficiency, and support clinical decision-making, making it an invaluable asset in modern healthcare. It extracts and analyzes unstructured data from medical records, radiology reports, and other sources, enabling more comprehensive data utilization and improved clinical decision-making.

The growth of machine learning and artificial intelligence (AI) has led to new trends in healthcare, where NLP plays a crucial role in tasks like diagnosis and drug discovery. Integrating computer vision into NLP healthcare is significant, as it aids in processing and interpreting complex medical images that may be challenging for humans to analyze accurately. For instance, in September 2023, Clearpath Technology launched PatientConnect, a patient-centric solution developed in collaboration with healthcare institutions. Utilizing AI and NLP simplifies radiology reports into easily understandable language. The platform, accessible via Clearpath's web platform and iOS and Android apps, allows patients to request, store, and share records and imaging from any provider, enhancing engagement and facilitating communication with trusted healthcare providers and family members.

Application Insights

Based on application, the neurology segment held the largest market share in 2023 owing to the increased use of AI in neurology, as it provides better patient care and enables higher accuracy and high efficiency. The use of AI for detecting neurological conditions holds great promise in addressing the ever-increasing imaging volumes and providing timely diagnoses. Brain tumors, for instance, are among the most commonly misdiagnosed illnesses in neuro-oncology. Misdiagnoses can occur due to various factors, including the incorrect interpretation of symptoms and inaccuracies in analyzing medical reports. The adoption of AI can significantly improve the diagnosis and detection of brain tumors and other neurological cancers, offering high accuracy and consistency, thus driving the segment growth.

Studies show that optical imaging combined with deep convolutional neural networks can accurately predict brain tumors in less than 150 seconds, further boosting the adoption of AI solutions in medical imaging of neurological disorders. The breast screening segment is expected to grow at the fastest CAGR over the forecast period. The increasing incidence of breast cancer cases and the growing patient preference for early-stage detection, enabling prompt and precise treatment initiation, are significant drivers propelling the demand for breast screening. According to WHO, in 2022, breast cancer caused 6,70,000 deaths globally. Early detection is crucial for improving survival rates, and AI can significantly enhance the accuracy and efficiency of screening processes.

Innovations in AI, particularly in machine learning and deep learning, have led to the development of sophisticated algorithms that can analyze mammograms and other imaging modalities with high precision. These technologies can detect subtle signs of cancer that human radiologists may miss. For instance, in November 2023, GE HealthCare launched MyBreastAI Suite, an AI-based platform designed to aid clinicians in breast cancer detection and workflow productivity. The suite includes three AI applications: PowerLook Density Assessment, SecondLook for 2D Mammography, and ProFound AI for DBT, which improve patient outcomes and operational efficiency.

Modalities Insights

The CT scan segment held the largest market share in 2023 due to their ability to provide detailed cross-sectional images of the body making them indispensable in medical diagnostics. CT scans are a widely used imaging modality for diagnosing various conditions, including cancers, cardiovascular diseases, trauma, and musculoskeletal disorders. AI algorithms can automatically detect and quantify abnormalities in CT images, such as tumors, lesions, and fractures, reducing the workload on radiologists and increasing diagnostic accuracy. This is achieved by automating and optimizing various data acquisition processes, such as patient positioning and setting acquisition parameters. After the data collection phase, AI continues to play a crucial role in optimizing image reconstruction parameters, implementing advanced reconstruction algorithms, and applying image denoising techniques.

These advancements collectively enhance image quality, mainly by reducing image noise, thereby allowing the use of lower radiation doses during data acquisition. The growth of this segment is also fueled by market initiatives, such as CGI's partnership with Planmeca and Helsinki University Hospital to develop an AI-powered solution for radiologists in May 2023. The solution interprets brain CT scans and detects common non-traumatic brain hemorrhages, demonstrating the potential of AI in improving diagnostic accuracy and efficiency in medical imaging. The X-ray segment is anticipated to expand at the fastest CAGR over the forecast period. This rapid growth can be attributed to several factors that highlight the critical role of X-ray imaging in healthcare and the transformative impact of AI technologies.

The primary factor propelling this segment is the rising utilization of interventional X-ray equipment for surgeries guided by imaging, including C-arms and similar devices. AI algorithms can automatically detect fractures, infections, tumors, and other abnormalities in X-ray images, improving diagnostic accuracy and reducing the burden on radiologists. In October 2023, Koninklijke Philips N.V. introduced the new X-ray system, Philips Image Guided Therapy Mobile C-arm System 3000 (Zenition 30), which offers real-time image guidance for various clinical procedures, including orthopedics, trauma, spine interventions, pain management, and surgical processes, specifically designed for operating rooms.

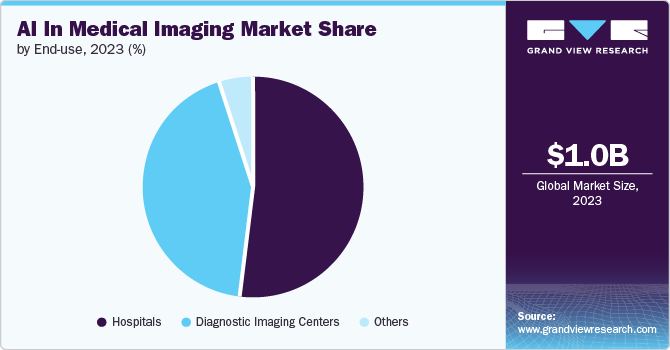

End Use Insights

The hospitals segment dominated the market with the largest share in 2023 and is expected to grow at the fastest CAGR of over the forecast period. According to the survey published by Definitive Healthcare in 2020, about one-third of hospitals and imaging centers report using AI, machine learning (ML), or deep learning to aid tasks associated with patient care imaging. In addition, the segment growth is observed due to the availability of cutting-edge medical imaging equipment in hospitals with a solid infrastructure.

The growing adoption of AI in medical imaging solutions, especially for cancer diagnostics, is impelling the segment growth. Furthermore, hospitals partnering with the market players to deploy AI in medical imaging solutions is expected to drive market growth over the forecast period. For instance, in May 2022, Atlantic Health System and Aidoc formed a partnership to implement an AI imaging solution to help physicians expedite care and enhance health outcomes.

Regional Insights

The AI in medical imaging market in North America dominated the global industry in 2023 and accounted for the largest revenue share of over 43.00% in 2023. The region's advanced healthcare infrastructure and significant investment in healthcare technology provide a solid foundation for integrating AI solutions. Extensive R&D activities, particularly in the U.S., foster innovation and the development of cutting-edge AI applications in medical imaging. In addition, the increasing prevalence of chronic diseases and the rising demand for early and accurate diagnosis fuel the need for advanced imaging technologies. Regulatory support and favorable policies also encourage the adoption of AI in healthcare. Furthermore, the presence of major market players and numerous collaborations between technology companies and healthcare providers drive the continuous enhancement of AI-based imaging tools. This confluence of factors is propelling the regional market growth.

U.S. AI In Medical Imaging Market Trends

The U.S. AI in medical imaging marketheld the largest market share in 2023. This can be attributed to the growing adoption of AI technologies to revolutionize the healthcare landscape and support healthcare professionals in reshaping the diagnosis and treatment of diseases like cancer. This demand is not only driven by the potential for AI to enhance diagnostic accuracy but also by its ability to manage increasing workloads efficiently. Moreover, increasing consumer confidence and trust in AI technologies are pivotal drivers for the domestic market growth. A study published by New Intelerad Research in May 2022, revealed that approximately 64% of U.S. consumers highly trust AI for medical imaging applications. This growing confidence underscores the increasing acceptance and adoption of AI-driven solutions among healthcare providers and patients alike, further propelling market growth.

Europe AI In Medical Imaging Market Trends

AI in medical imaging market in Europe is expected to grow significantly over the forecast period. Europe is home to numerous collaborative research projects and consortia, such as the European Organization for Nuclear Research (CERN) and various Horizon 2020 projects, which focus on advancing AI in medical imaging. The European Union's Medical Device Regulation (MDR) has set clear guidelines for the approval and use of AI in medical imaging, ensuring safety and efficacy. This regulatory environment encourages innovation and adoption of AI technologies across Europe.

The UK AI in medical imaging market is expected to grow profitably over the forecast period. The UK government has been actively promoting the use of AI in healthcare through initiatives like the AI Sector Deal and funding from Innovate UK. The National Health Service (NHS) is a significant player in adopting AI to improve diagnostic accuracy and operational efficiency. Strong collaboration between academic institutions and industry players, exemplified by partnerships like those between leading universities and tech companies, drives innovation in AI medical imaging.

Asia Pacific AI In Medical Imaging Market Trends

The AI in medical imaging market in the Asia Pacific is expected to experience significant growth in the coming years. This growth can be attributed to increasing investments in AI within the healthcare sector, enabling businesses to enhance their revenue share through AI-driven medical imaging. For example, China aims to lead the world in artificial intelligence by 2030, supported by substantial government funding and investments to accelerate the adoption of AI technologies across various industries.

The Japan AI in medical imaging market held the largest market share of the APAC market revenue in 2023. This can be attributed to the increasing focus on technologies, such as AI, to improve diagnostic capabilities and manage healthcare demands. Key companies like Fujifilm and Canon are leading the way in developing sophisticated AI algorithms for medical imaging. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) supports AI innovations, streamlining approval processes for AI-based medical devices. The increasing number of startups in Japan proactively launching novel AI-driven technologies in medical imaging would likely drive the market over the forecast period. For instance, in May 2024, NOVIUS, a healthcare startup, launched its innovative AI-driven technology, N-Vision 3D, which converts two-dimensional imagery to three-dimensional in real time, and helps in enhance surgical procedures. N-Vision 3D has the potential to revolutionize imaging for X-ray fluoroscopy equipment, endoscopes, and angiography. Notable advancement includes the existing 2D endoscopes (monocular cameras) that can be used with N-Vision 3D without any modifications.

AI in medical imaging market in China is expected to grow at the fastest CAGR over the forecast period. China's healthcare system faces significant challenges in meeting the rapidly growing medical demand driven by an aging population and rising patient expectations amid constrained medical resources. A critical issue is the shortage of high-quality healthcare professionals. Moreover, the increasing rate of misdiagnosis in the region for complex cases, particularly in basic medical facilities, also drives the demand for advanced technologies. AI applications can help alleviate daily administrative tasks for healthcare professionals and support clinical decision-making, thus improving patient outcomes. These challenges present a significant opportunity for the integration of AI in China's healthcare sector. Furthermore, significant initiatives by government and healthcare agencies in the country fuel the market. For instance, in July 2017, the State Council of China unveiled the New Generation AI Development Plan. This policy outlines a strategy to build an AI industry valued at over USD 62 billion, with a broader industry impact exceeding USD 774 billion by 2025.

Key AI In Medical Imaging Company Insights

The AI in medical imaging market is highly competitive. Leading companies and industry stakeholders deploy strategic initiatives, such as portfolio expansion, product launches & upgrades, partnerships, regional expansions, and mergers & acquisitions, to gain higher market shares.

Key AI In Medical Imaging Companies:

The following are the leading companies in the AI in medical imaging market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Microsoft

- Digital Diagnostics Inc.

- TEMPUS

- Butterfly Network, Inc.

- Advanced Micro Devices, Inc.

- HeartFlow, Inc.

- Enlitic, Inc.

- Canon Medical Systems USA, Inc.

- Viz.ai, Inc.

- EchoNous, Inc.

- HeartVista Inc.

- Exo Imaging, Inc

- Nano-X Imaging Ltd.

Recent Developments

-

In January 2024, GE HealthCare announced an acquisition agreement with MIM Software from Cleveland, a global provider of medical imaging analysis and AI solutions in molecular radiotherapy, radiation oncology, urology, and diagnostic imaging. The acquisition aims to integrate MIM Software's imaging analytics and digital workflow capabilities across diverse care areas, enhancing innovation and distinguishing GE HealthCare's solutions to positively impact patients and healthcare systems globally

-

In November 2023, GE HealthCare announced its AI suite named MyBreastAI at the RSNA 2023 conference. This innovative product helps streamline radiologists' workflows, offering them advanced tools to identify and diagnose breast cancer at earlier stages, ultimately contributing to improved patient outcomes

-

In November 2023, Canon Medical Systems introduced two out of four new computed tomography scanners, utilizing the upgraded Aquilion CT platform and incorporating artificial intelligence algorithms for improved image quality and simplified scanner workflows

-

In September 2023, COTA, a company working on real-world oncology data and analytics, introduced Vista, a vast automated EHR dataset, to expedite cancer research and implement reliable generative artificial intelligence in cancer care. Vista utilizes automated data abstraction, machine learning algorithms, and medical expert oversight to extract clinically pertinent information from electronic medical records, providing biopharmaceutical companies with timely insights for the accelerated development of life-saving therapies

-

In July 2022, the FDA gave Philips SmartSpeed AI-based software its 510(k) approval, enabling it to offer ground-breaking high-speed, high-resolution MR imaging. Its broad compatibility enables quicker and higher-quality scans for almost all patients with various illnesses, including those with implants (97% of clinical protocols). In addition, the intelligent MR acceleration software offers three times quicker scans, which increases MR department efficiency with high-quality picture resolution

AI In Medical Imaging Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 1.36 billion

The revenue forecast in 2030

USD 8.18 billion

Growth rate

CAGR of 34.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, modalities, end use, and region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Norway; Sweden; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE HealthCare; Microsoft; Digital Diagnostics Inc.; TEMPUS; Butterfly Network, Inc.; Advanced Micro Devices, Inc.; HeartFlow, Inc.; Enlitic, Inc.; Canon; Medical Systems USA, Inc.; Viz.ai, Inc., EchoNous, Inc.; eartVista Inc.; Exo Imaging, Inc.; Nano-X Imaging Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Medical Imaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the AI in medical imaging market report on the basis of technology, application, modalities, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Deep Learning

-

Natural Language Processing (NLP)

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurology

-

Respiratory and Pulmonary

-

Cardiology

-

Breast Screening

-

Orthopedics

-

Others

-

-

Modalities Outlook (Revenue, USD Million, 2018 - 2030)

-

CT Scan

-

MRI

-

X-rays

-

Ultrasound

-

Nuclear Imaging

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global AI in medical imaging market size was estimated at USD 1.01 billion in 2023 and is expected to reach USD 1.36 billion in 2024.

b. The global AI in medical imaging market is expected to grow at a compound annual growth rate of 34.8% from 2024 to 2030 to reach USD 8.18 billion by 2030.

b. North America dominated the AI in medical imaging market, with a share of over 43.00% in 2023, owing to the technologically advanced infrastructure and significant investment in healthcare technology, which provide a solid foundation for integrating AI solutions. In addition, increasing research and development activities, particularly in the U.S., foster innovation and develop cutting-edge AI applications in medical imaging.

b. Some key players operating in the AI in medical imaging market are GE HealthCare, Microsoft, Digital Diagnostics Inc., TEMPUS, Butterfly Network, Inc., Advanced Micro Devices, Inc., HeartFlow, Inc., Enlitic, Inc., Canon, Medical Systems USA, Inc., Viz.ai, Inc., EchoNous, Inc., eartVista Inc., Exo Imaging, Inc, and NANO-X IMAGING LTD.

b. Key factors driving the AI in medical imaging market growth include the rising number of diagnostic procedures, shortage of radiologists, increased funding for AI-based start-ups by private players, government initiatives to endorse the use and benefits of AI-based tools and technologies in the medical industry, and growing cross-industry collaborations and partnerships are some of the factors driving this market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."