- Home

- »

- Consumer F&B

- »

-

Artisanal Ice Cream Market Size, Share, Industry Report 2030GVR Report cover

![Artisanal Ice Cream Market Size, Share & Trends Report]()

Artisanal Ice Cream Market (2024 - 2030) Size, Share & Trends Analysis Report By Flavor (Fruits & Nuts, Chocolate, Vanilla), By Type (Conventional, Lactose-free), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-399-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Artisanal Ice Cream Market Summary

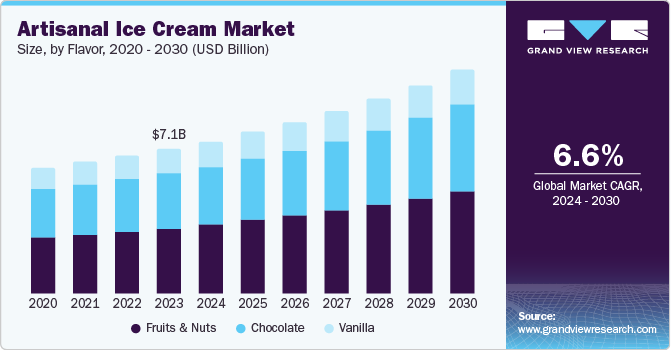

The global artisanal ice cream market size was estimated at USD 7.12 billion in 2023 and is projected to reach USD 10.98 billion by 2030, growing at a CAGR of 6.6% from 2024 to 2030. The market growth is driven by a rising consumer preference for premium and unique flavors, which artisanal ice cream makers are well-positioned to offer.

Key Market Trends & Insights

- North America dominated the artisanal ice cream market with a revenue share of 37.7% in 2023.

- The U.S. dominated the North American market in 2023.

- By flavor, the fruits & nuts segment accounted for a share of 44.9% in 2023.

- By type, the conventional segment held the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 15.75 Billion

- 2030 Projected Market Size: USD 10.98 Billion

- CAGR (2024-2030): 6.6%

- North America: Largest market in 2023

This trend is fueled by a growing interest in high-quality, natural ingredients and the desire for novel taste experiences. Additionally, the increasing awareness of health and wellness has led consumers to seek out ice creams made with organic and locally sourced ingredients, free from artificial additives.

The expansion of distribution channels, including online platforms and specialty stores, has also made artisanal ice cream more accessible to a broader audience. Furthermore, supporting small, local businesses has strengthened the market, as consumers are more inclined to purchase from independent ice cream makers who emphasize craftsmanship and sustainability.

Artisanal ice cream makers are increasingly tailoring their flavors to reflect local tastes and cultural influences, creating unique and regionally inspired offerings. For instance, Indian ice cream makers are incorporating traditional flavors such as kokum, basil, and durian into their ice creams. These flavors cater to local palates and evoke a sense of nostalgia and cultural pride. In the U.S., some brands have gained popularity by offering flavors inspired by local ingredients and culinary traditions, such as honey lavender and pear with blue cheese. Similarly, in Italy, gelaterias offer innovative flavors, such as saffron and pine nuts, which highlight regional specialties.

Flavor Insights

The fruits & nuts segment accounted for a share of 44.9% in 2023 attributed to the increasing consumer preference for healthier and more natural dessert options. Fruits and nuts provide unique flavors and enhance ice cream's nutritional profile, appealing to health-conscious consumers. Incorporating fresh fruits including strawberries, mangoes, and blueberries, along with nuts such as almonds and pistachios, aligns with the growing trend toward clean-label products that are free from artificial additives.

The chocolate segment is expected to grow at a CAGR of 6.7% from 2024 to 2030. Chocolate flavors are timeless favorites that resonate with many consumers, making them a staple in the ice cream market. The growing interest in premium chocolate varieties such as dark chocolate and single-origin chocolates further fuels this segment's growth. This trend is complemented by rising consumer awareness regarding the health benefits of dark chocolate, which is perceived as a more indulgent yet healthier option than traditional sugary desserts.

Type Insights

The conventional segment held the largest revenue share in 2023 owing to the widespread consumer preference for traditional ice cream flavors and formulations. Many artisanal brands emphasize high-quality, locally sourced ingredients, appealing to the desire for authenticity and craftsmanship. In addition, the growing trend of indulgence in comfort foods post-pandemic has further boosted sales within this segment, as consumers seek familiar treats that evoke positive emotions and memories.

The lactose-free segment is expected to register the fastest growth during the forecast period. This rapid expansion is driven by the increasing prevalence of lactose intolerance and the rising demand for dairy-free alternatives. Consumers are becoming more health-conscious and actively seeking products that cater to their dietary restrictions without compromising taste and quality. The segment growth is further supported by the expanding availability of these products in mainstream retail channels, making them more accessible to a larger consumer base.

Distribution Channel Insights

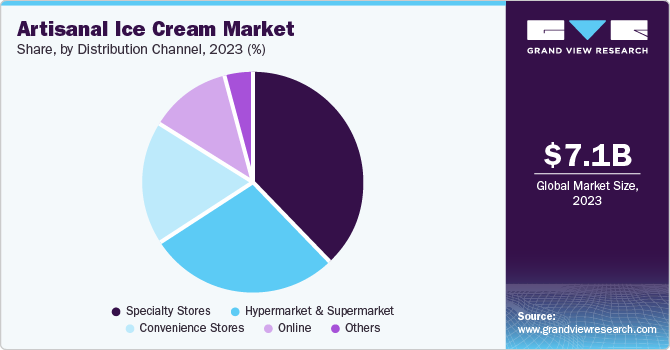

Specialty stores dominated the market in 2023 due to the unique shopping experience these stores offer, which aligns well with the artisanal ice cream market’s emphasis on quality and exclusivity. Specialty stores often provide a curated selection of high-quality, handcrafted ice creams, allowing consumers to explore a variety of unique and innovative flavors that are not typically available in mainstream retail outlets. For instance, stores such as Salt & Straw in the U.S. and Gelateria Dondoli in Italy have built strong reputations for their artisanal offerings, attracting local customers and tourists. The personalized service and the ability to sample different flavors before purchasing also enhance the consumer experience, contributing to the popularity of specialty stores in this market segment.

The online segment is projected to grow fastest over the forecast period driven by the increasing penetration of the internet and mobile devices, which makes online shopping more accessible to a broader audience. In addition, the convenience of ordering ice cream online and having it delivered directly to one’s doorstep appeals to modern consumers who value time-saving solutions. Online platforms such as Goldbelly and Amazon have expanded their offerings to include a wide range of artisanal ice creams from various local producers, making it easier for consumers to access these products regardless of geographical location. The COVID-19 pandemic also accelerated the shift towards online shopping, as consumers sought safe and convenient ways to purchase their favorite treats.

Regional Insights

North America dominated the artisanal ice cream market with a revenue share of 37.7% in 2023, driven by a strong consumer preference for premium and high-quality products. The region’s market is characterized by a high level of innovation and a diverse range of flavors that cater to various consumer tastes. The presence of well-established brands that emphasize artisanal quality and unique flavor profiles has significantly contributed to the market growth.

U.S. Artisanal Ice Cream Market Trends

The U.S. dominated the North American market in 2023 attributed to the country’s robust food culture and the high disposable income of its consumers, which allows for greater spending on premium food products. The U.S. market is also characterized by a high level of competition among artisanal ice cream makers, leading to continuous innovation and the introduction of new and exotic flavors.

Europe Artisanal Ice Cream Market Trends

Europewas identified as a lucrative region for artisanal ice cream market in 2023. Europe was identified as a lucrative region for the artisanal ice cream market in 2023, with a strong tradition of artisanal food production and a high demand for premium products. Consumers’ preference for authentic, high-quality ice creams made with natural ingredients drives the regional market. Countries such as Italy and France, known for their rich culinary heritage, have a strong presence of artisanal gelaterias that attract locals and tourists. The emphasis on traditional methods and locally sourced ingredients has helped European artisanal ice cream makers maintain a competitive edge in the market.

The UK artisanal ice cream market is expected to grow rapidly in the coming years. The UK artisanal ice cream market is expected to grow rapidly in the coming years, driven by increasing consumer awareness of health and wellness and a growing preference for premium products. The market is characterized by a rising number of small, independent ice cream makers focusing on creating unique and innovative flavors. Brands such as Jude’s and Northern Bloc have gained popularity by offering a range of artisanal ice creams made with natural and locally sourced ingredients. The trend of supporting local businesses and the increasing availability of artisanal ice creams in supermarkets and specialty stores are expected to drive market growth in the UK further.

Asia Pacific Artisanal Ice Cream Market Trends

The artisanal ice cream market in the Asia Pacific is anticipated to witness the fastest growth with a CAGR of 7.6% over the forecast period, driven by the region’s expanding middle class and increasing disposable incomes. Consumers in countries such as Japan, South Korea, and Australia are growing interested in premium and high-quality food products, including artisanal ice creams. The market is also characterized by a high level of innovation, with local ice cream makers incorporating traditional Asian flavors such as matcha, black sesame, and lychee.

China’s artisanal ice cream market held a substantial market share in 2023, driven by the country’s large population and growing middle class. The market is characterized by a strong demand for premium and high-quality products, with consumers willing to pay a premium for artisanal ice creams made with natural and locally sourced ingredients. Local brands such as Zhong Xue Gao (Chicecream) have gained popularity by offering unique flavors that cater to Chinese tastes, such as durian and black sesame.

Key Artisanal Ice Cream Company Insights

Some key companies in the artisanal ice cream market include Unilever, Nye’s Cream Sandwiches, Van Leeuwen Ice Cream, and others.

-

Nye's Cream Sandwiches has successfully differentiated itself in the artisanal ice cream market through its handcrafted ice cream sandwiches, which combine chef-inspired flavors and homemade, chewy cookies.

-

McConnell’s Fine Ice Creams offers unique flavors such as Eureka Lemon & Marionberries and Turkish Coffee. The brand has also expanded its offerings to include organic and dairy-free options, catering to a broader range of consumer preferences.

Key Artisanal Ice Cream Companies:

The following are the leading companies in the artisanal ice cream market. These companies collectively hold the largest market share and dictate industry trends.

- Unilever

- Nye’s Cream Sandwiches

- Van Leeuwen Ice Cream

- Nestlé

- Carmela Ice Cream

- Toscanini’s

- McConnell’s Fine Ice Creams

- L'Artisan des Glaces

- Gelato Messina

Recent Developments

-

In June 2024, Bidcorp UK expanded its manufacturing footprint with the acquisition of Northern Bloc Ice Cream Ltd. The independently owned ice cream manufacturer is set to join Bidcorp UK's existing network of manufacturing businesses, including Simply Food Solutions and Yarde Farm.

-

In May 2024, Van Leeuwen announced a strategic partnership with Ollie, a leading provider of gourmet dog food. The collaboration resulted in the launch of a new line of premium dog-friendly ice creams. Crafted with high-quality ingredients such as real peanut butter, bananas, coconut cream, and oat milk, the Peanut Butter and Banana flavor is now available to Ollie members at Van Leeuwen Scoop Shops and on Petco.

Artisanal Ice Cream Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.50 billion

Revenue forecast in 2030

USD 10.98 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia

Key companies profiled

Unilever; Nye’s Cream Sandwiches; Van Leeuwen Ice Cream; Nestlé; Carmela Ice Cream; Toscanini’s; McConnell’s Fine Ice Creams; L'Artisan des Glaces; Gelato Messina

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artisanal Ice Cream Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global artisanal ice cream market report based on flavor, type, distribution channel, and region.

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruits & Nuts

-

Chocolate

-

Vanilla

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Lactose-free

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Specialty Stores

-

Hypermarket & Supermarket

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.