- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

ASEAN Ceramics Market Size & Share, Report, 2030GVR Report cover

![ASEAN Ceramics Market Size, Share & Trends Report]()

ASEAN Ceramics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Traditional, Advanced), By Application (Sanitary Ware, Abrasives, Bricks & Pipes, Tiles, Pottery), By End Use, By Country, And Segment Forecasts

- Report ID: GVR-2-68038-001-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

ASEAN Ceramics Market Size & Trends

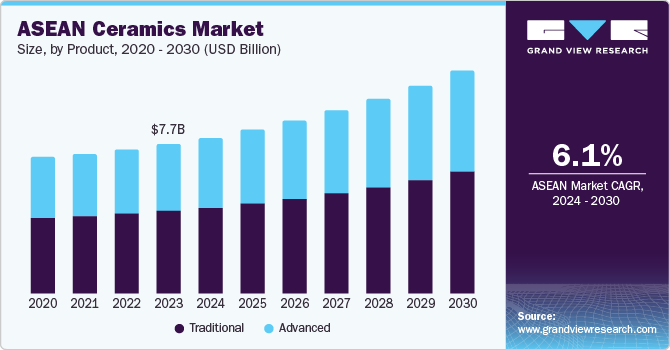

The ASEAN ceramics market size was valued at USD 7.68 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. The expanding economy and increasing disposable incomes in ASEAN countries are leading to infrastructural development and urbanization. The significant growth in construction and infrastructure development activities, particularly in rapidly emerging economies within the region, such as Indonesia and Malaysia, is anticipated to drive product demand for ceramics, particularly in tiles, bricks, sanitary ware, and other sectors. In addition, the application of ceramics is expanding in the medical sector due to their durability and biocompatibility, further propelling the market growth.

In developing economies, ceramics are increasingly being used instead of metal for roofing due to their superior strength. Indonesia's consistent need for industrial, residential, and infrastructural development continues to drive new construction projects. Strong economic growth is projected to further increase the demand for ceramics in the construction sector over the next eight years.

Beyond construction, ceramic coatings are increasingly employed in drug delivery systems. Moreover, the adoption of ceramic materials in implant devices has surged in recent years. The exceptional properties of zirconium-based products, such as toughness, strength, and biocompatibility, are propelling their demand in applications such as femoral heads for hip replacements.

Moreover, with the rise of ceramic materials in various applications, there's a growing focus on ensuring their safety, especially when they come into contact with food. The ASEAN Guidelines on Specific Measures for Ceramic Articles Intended to Come into Contact with Foodstuffs reflect this focus. These guidelines are crafted for competent authorities and manufacturers to guarantee the safety of ceramic articles used in food-related contexts. They advocate for the implementation of a traceability system. This system is designed to help relevant business operators identify and manage the critical parameters that determine whether ceramic articles comply with the necessary safety requirements.

Product Insights

The traditional segment dominated the market and accounted for a share of 55.5% in 2023. This dominance can be attributed to the widespread use of traditional ceramics in various applications due to their versatility and cost-effectiveness. Traditional ceramics are composed of common minerals, including clay, silica, and feldspar, which are abundantly available. These ceramics have found extensive use in a variety of applications, ranging from pottery and bricks to sanitary ware and tiles. Despite the emergence of advanced ceramics, the traditional product segment continues to hold a substantial market share due to its established presence and broad range of applications.

The advanced segment is anticipated to witness the fastest growth at a CAGR of 6.3% from 2024 to 2030. The growth of the segment is influenced by the surging demand for advanced ceramics in various sectors, such as semiconductors, automotive, medical devices, aerospace, and other devices. In addition, the rapid innovations in technology are manufacturing products with thermal stability, enhanced strength, corrosion resistance, and other features thus increasing the reliability of the products and surging their demand. With issues such as environmental sustainability, increasing research & development on the products are expected, thus being a major factor in the growth of the segment in the forecasting year.

Application Insights

The tiles segment accounted for the largest market revenue share in 2023 with a share of 61.7%. The expanding construction industry and increasing government projects on large-scale infrastructure are expected to drive the segment's growth. Shifting commercial preferences towards durable flooring, especially in offices, hotels, retail spaces, and healthcare facilities, are driving the segment significantly.

Theabrasives segment is anticipated to grow at the fastest CAGR of 5.7% over the forecast period influenced by the surging demand for high-quality finishing in infrastructures, which is increasing the demand for abrasive materials due to its superior surface quality features. Increasing awareness for adopting sustainable practices is encouraging manufacturers to enhance their production process with eco-friendly materials such as abrasives which are made from recycled materials. Moreover, the increasing automotive industry is also impacting the sales of abrasives due to the vital role of abrasives applications in manufacturing brake pads and other wear-resistant products. As industries such as manufacturing, automotive, and construction continue to expand, the demand for ceramic abrasives is expected to rise.

End Use Insights

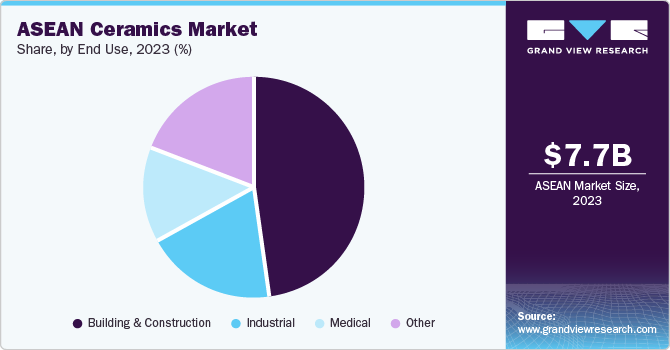

The building and construction segment dominated the market in 2023 with a revenue share of 47.5% attributed to the extensive use of ceramics in various construction applications, including flooring, wall coverings, bathroom and kitchen fixtures, and decorative elements. Ceramics' superior properties, such as durability, resistance to heat and moisture, and aesthetic appeal, make them ideal choices for these applications. The rapid urbanization and infrastructural development in the ASEAN region have further fueled the demand for ceramics in this segment.

The industrial segment is anticipated to witness a fastest CAGR of 6.5% over the forecast period. Ceramics are increasingly being used in various industrial applications due to their high-temperature stability, hardness, and resistance to wear and corrosion. These properties make ceramics ideal for use in harsh industrial environments. Industries such as automotive, aerospace, electronics, and energy are increasingly adopting ceramics for various applications, including insulation, abrasion-resistant linings, seals, and bearings. The growth of this segment can be attributed to the increasing industrialization in the ASEAN region and the rising demand for high-performance materials in various industries.

Countries Insights

Indonesia Ceramics Market Trends

The Indonesia Ceramics market dominated the ASEAN market with a share of 28.4% in 2023 and is expected to grow fastest with a CAGR of 6.7% from 2024 to 2030. This growth is primarily driven by factors such as accelerated urbanization, population expansion, and the consequent surge in construction expenditure across commercial, public, and residential sectors, directly influencing the demand for ceramics. In addition, the increasing disposable income of the population is leading to a shift in their construction material preferences, with a greater emphasis on aesthetics and durability. Furthermore, government-led large-scale public infrastructure initiatives are also playing a pivotal role in shaping the market dynamics.

Singapore Ceramics Market Trends

Singapore Ceramics market was identified as a lucrative region in 2023. Government-backed initiatives, including R&D grants and subsidies for tile manufacturing, have stimulated substantial investment in the sector. Moreover, the influx of foreign direct investment into Singapore's commercial infrastructure development has been a key catalyst for market growth in recent years.

Malaysia Ceramics Market Trends

Malaysia Ceramics market is anticipated to grow at a CAGR of 6.5% from 2024 to 2030. This growth can be attributed to the adoption of advanced manufacturing techniques that have bolstered product performance. Malaysia's advantageous geographical location presents expanded export prospects for ceramics in the global market, thereby providing local industries with opportunities to broaden their market presence. The rising utilization of ceramics in the medical and industrial sectors, driven by their cost-effectiveness and high durability, is also expected to fuel demand growth throughout the forecast period.

Key ASEAN Ceramics Company Insights

Some key companies in the ASEAN ceramics market include Saint-Gobain, SNKO, Royal Ceramics Thailand, Taicera, and others companies. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

SCG is a ceramics company especially recognized in Southeast Asia as SCG Ceramics Company, a subsidiary of the Siam Cement Group (SCG) specializing in ceramic product manufacturing. Tiles and sanitary wares, specifically for bathrooms, are two of their specialty product lines, along with tableware. They supply both residential and commercial uses and, therefore, play a major role in increasing the ceramics production volume for ASEAN countries.

-

Royal Ceramics Thailand is one of the well-known ceramics producers in ASEAN. It specializes in producing ceramic tiles and sanitary wear suitable for domestic and commercial use. The firm holds a portfolio of products, including floor and wall tiles, decorative ceramics, and bathroom items relevant to current trends in architectural and interior design.

Key ASEAN Ceramics Companies:

The following are the leading companies in the ASEAN ceramics market. These companies collectively hold the largest market share and dictate industry trends.

- Kenzai Ceramics Industry Co.,Ltd.

- Niro Ceramic (M) Sdn. Bhd.

- Royal Ceramics Thailand

- Saint-Gobain

- SCG CERAMICS

- SNKO

- Sunward Ceramics Corp

- Taicera.

- TOKO VIETNAM CO., LTD

- VIGLACERA THĂNG LONG

Recent Developments

-

In November 2023, Niro Ceramic Group’s retail division, Creative Lab launched its e-commerce platform. This digital channel enhances accessibility to the company's Swiss-quality tile and home renovation products, streamlining customers' purchasing process.

-

In June 2024, the Indonesian Ceramic Industry Association (Asaki) petitioned the government to levy an anti-dumping duty of up to 100% on ceramic imports originating from China. The association alleged that Chinese exporters were engaging in unfair trade practices.

ASEAN Ceramics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.02 billion

Revenue forecast in 2030

USD 11.42 billion

Growth Rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, applications, end use, country

Regional scope

ASEAN

Country scope

U.S., Indonesia, Malaysia, Singapore, Thailand, Vietnam

Key companies profiled

Kenzai Ceramics Industry Co.,Ltd.; Niro Ceramic (M) Sdn. Bhd.; Royal Ceramics Thailand; Saint-Gobain; SCG CERAMICS; SNKO; Sunward Ceramics Corp; Taicera.; TOKO VIETNAM CO., LTD; VIGLACERA THĂNG LONG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

ASEAN Ceramics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the ASEAN Ceramics market report based on product, application, end use, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional

-

Advanced

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sanitary Ware

-

Abrasives

-

Bricks and Pipes

-

Tiles

-

Pottery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Industrial

-

Medical

-

Other

-

-

Countries Outlook (Revenue, USD Million, 2018 - 2030)

-

Indonesia

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.