- Home

- »

- Advanced Interior Materials

- »

-

Ceramic Tiles Market Size & Share, Industry Report, 2033GVR Report cover

![Ceramic Tiles Market Size, Share & Trends Report]()

Ceramic Tiles Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Glazed Ceramic Tiles, Porcelain Tiles, Scratch free Ceramic Tiles), By Application (Wall Tiles, Floor Tiles), By End-use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: 978-1-68038-201-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceramic Tiles Market Summary

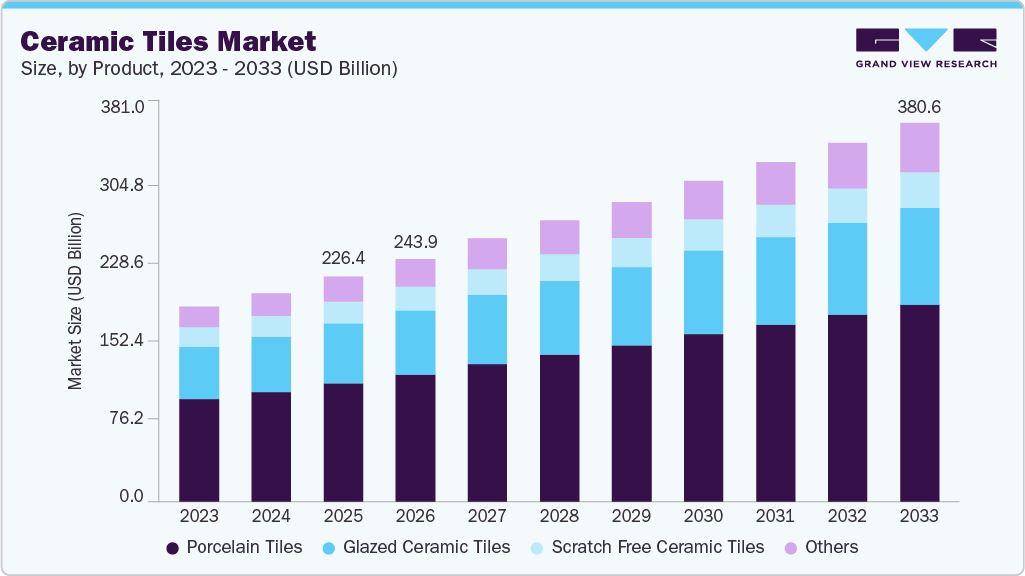

The global ceramic tiles market size was estimated at USD 226.41 billion in 2025 and is projected to reach USD 380.61 billion by 2033, growing at a CAGR of 6.6% from 2026 to 2033. The market is driven by rapid urbanization and continuous infrastructure expansion across residential, commercial, and public sectors.

Key Market Trends & Insights

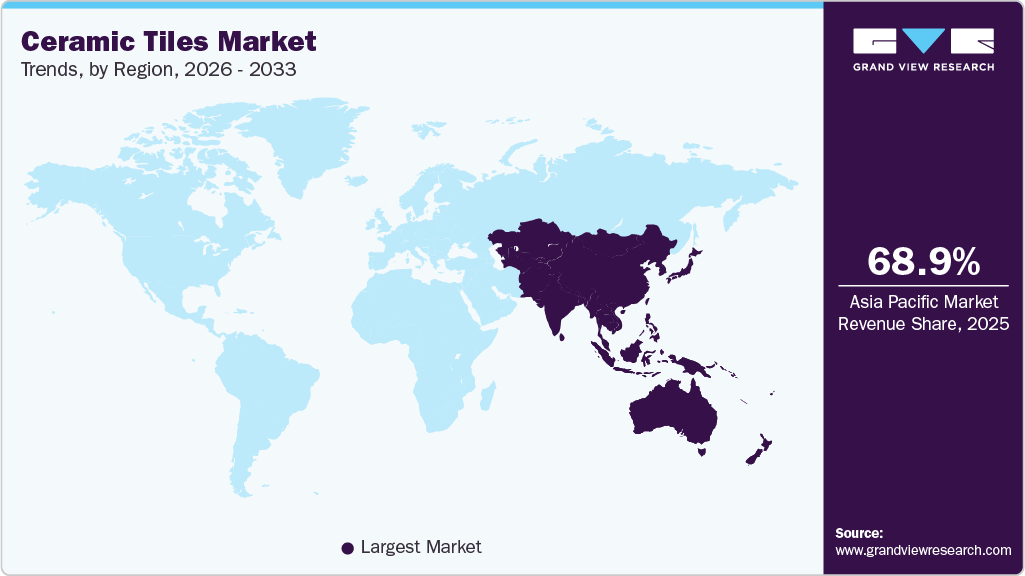

- Asia Pacific dominated the ceramic tiles market with the largest revenue share of 68.9% in 2025.

- The ceramic tiles market in China is one of the largest globally, owing to the country’s booming construction industry.

- By product, porcelain tiles segment dominated this market and accounted for a share of 52.4% in 2025.

- By application, wall tiles is expected to grow at the fastest CAGR of 6.8% over the forecast period.

- By end use, residential is expected to grow at the fastest CAGR of 6.8% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 226.41 Billion

- 2033 Projected Market Size: USD 380.61 Billion

- CAGR (2026-2033): 6.6%

- Asia Pacific: Largest market in 2025

Growing investments in housing projects, smart cities, and transportation facilities increase demand for durable flooring and wall materials. Ceramic tiles are widely adopted due to their suitability for high-traffic environments. Government-backed construction initiatives further accelerate market growth. This trend is particularly prominent in emerging economies.Consumer preference for visually appealing interiors has significantly influenced the market. Advances in digital printing allow manufacturers to offer a wide range of designs, textures, and finishes. Ceramic tiles that replicate natural stone, wood, and concrete are increasingly popular. Designers and architects favor tiles for their flexibility in modern and traditional spaces. This aesthetic versatility continues to expand application areas.

The increase in home renovation and remodeling projects is a major driver of ceramic tile demand. Homeowners prefer ceramic tiles due to their longevity, ease of maintenance, and cost-effectiveness. Replacement of traditional flooring materials with tiles is common in kitchens, bathrooms, and living areas. Aging housing stock in developed regions supports steady replacement demand. Commercial renovations also contribute to market expansion.

Market Concentration & Characteristics

The market growth stage is high, and the pace of this industry's growth is accelerating. The ceramic tiles industry is characterized by a high degree of innovation owing to rapid technological advancements. The industry is characterized by developments in technology to produce advanced products used in construction applications.

Advancements in inkjet technology have enabled manufacturers to replicate the intricate veining patterns and color depth of natural stones such as marble, travertine, slate, and limestone. Marble-styled tiles are witnessing a growing adoption rate due to their minimalist looks and elegance. These tiles are primarily preferred for bathrooms and corridors in commercial buildings such as shopping malls, hotels, restaurants, and religious buildings.

The ceramic tiles industry is also characterized by a high level of merger and acquisition (M&A) activity by leading players. This is due to several factors, including shifting focus towards expansion of production capabilities and strengthening their position in the industry.

The ceramic tiles industry is governed by several regulations and standards on its use and production. Several agencies, such as the American Society for Testing and Materials, European Standard, and the International Organization for Standardization, have imposed regulations on the production of Ceramic Tiles. The regulations have also been implemented on raw materials required for Ceramic tile production. Stringent environmental regulations have led to an increase in R&D activities and the development of eco-friendly Ceramic Tiles, which are expected to increase market penetration of industry players in the near future. In addition, initiatives taken by the Government of Italy to promote the ceramic industry are expected to open new industry avenues over the next seven years. Demand for durability in building structures is expected to promote demand for rubber, glass, and quarry tiles, thus posing a challenge for the industry over the forecast period.

End-user concentration is a significant factor in this industry, as there are a number of end-user industries that are driving demand for Ceramic Tiles. Ceramic tiles are distributed through direct channels, which include the direct sales network of the manufacturers, including commercial agents. In addition, it is also supplied through intermediaries that include the commercial companies that only deal with sales to distributors.

Product Insights

The porcelain tiles segment dominated this market and accounted for a share of 52.4% in 2025. Porcelain tiles are developed from fine, dense clay. They are fired at extreme temperatures to make them highly durable. These are heavy and hard-like stones; however, they are free from pores that make them highly resistant to moisture. Moreover, mold and bacteria resistance offered by impervious porcelain tiles leads to their long-term value for use in flooring applications. In addition, these tiles are free from fading and are easy to maintain.

Glazed ceramic tiles is expected to grow significantly at a CAGR of 6.1% over the forecast period. These are used in general and wet areas, such as kitchens, bathrooms, and laundry areas. These have an extra glass-based protective layer, which is not given in unglazed tiles, making them water and stain-resistant. Scratch-resistant tiles are primarily utilized in high-footfall areas, such as landscapes, pathways, parking, and shop floors with stressed usage conditions.

End Use Insights

The commercial segment accounted for the largest revenue share in 2025. Rising demand for highly durable and cost-efficient ceramic flooring for use in high-traffic commercial and industrial sectors is projected to drive the industry growth over the forecast period. The development of new products and hassle-free installation techniques has considerably driven the industry growth of Ceramic Tiles. In addition, Ceramic Tiles are emerging as cost-effective and eco-friendly solutions used in various sectors, including healthcare, office, institution, retail, and other commercial areas, owing to anti-bacterial, anti-slip, and water-resistant properties offered by the product.

Rising preference for ceramic floorings by designers and architects is expected to boost their demand in the commercial application segment over the projected period. Moreover, the expansion of modern offices and workspaces, growing renovation activities in commercial spaces, and rapid industrialization in developing economies are expected to propel industry growth over the forecast period.

Application Insights

Floor tiles application accounted for the largest revenue share of 61.3% in 2025 and is the major demand-driving segment for this market. Consumers are rapidly shifting from traditional marble and stone floors to low-cost and maintenance-free ceramic tiles. Ceramic Tiles are stain-resistant and maintain their appearance for a longer period. Technological advancements, such as the enhancement of digital printing processes, are further aiding in driving industry demand. Newly developed printers offer excellent features such as high resolution and nanometre-grade and multi-layer printing on flat, curved, or textured surfaces.

Ceramic wall tiles is expected to grow at the fastest CAGR of 6.8% over the forecast period. These tiles are emerging as a cost-effective alternative to conventional stone materials that are used in commercial settings such as corporate offices, hotel lobbies, and museums. These trends are, therefore, projected to drive the overall demand for global ceramics wall tiles over the forecast period.

Regional Insights

The Asia Pacific region held the largest revenue market share of 68.9% in 2025, driven by urbanization and increasing construction activities. This region has seen a significant rise in demand for high-quality and aesthetically pleasing ceramic tiles, fueled by the growth in residential, commercial, and industrial projects. Countries like China, India, and Japan are major contributors to this market, with consumers focusing on both functionality and design in their purchasing decisions. Technological advancements in tile production have also supported market expansion by offering more durable and sustainable products. The region’s growing middle class and infrastructure development are expected to further boost market demand.

China Ceramic Tiles Market Trends

The ceramic tiles market in China is one of the largest globally, owing to the country’s booming construction industry. As the world’s most populous nation, China is investing heavily in both urban and rural infrastructure, creating substantial demand for ceramic tiles in residential and commercial buildings. The demand for tiles in the country is also driven by a growing trend toward modern interiors, where design, quality, and texture are highly valued. The Chinese government’s initiatives to encourage urbanization and economic development also play a significant role in boosting the market. Technological innovations in tile production and the focus on sustainability are expected to continue to shape the market’s future trajectory.

Europe Ceramic Tiles Market Trends

The ceramic tiles market in Europe is marked by a preference for premium products and innovative designs. The demand is driven by the high standards of construction and the trend toward eco-friendly building materials. Germany, being one of the leading European economies, has witnessed steady growth in the ceramic tile sector, especially in the residential and commercial construction markets. German consumers and businesses prioritize quality and durability in their purchasing decisions, which has led to the rise of technologically advanced and environmentally conscious tile options. With stringent environmental regulations, there is an increasing demand for tiles that offer long-lasting performance and minimal environmental impact.

Germany ceramic tiles market is driven by the country’s focus on high-quality, durable building materials and a preference for modern interior design. Germany’s robust construction industry, particularly in residential and commercial sectors, continues to stimulate demand for premium ceramic tiles. The market is influenced by consumer trends favoring eco-friendly and energy-efficient products, as well as the increasing adoption of ceramic tiles in luxury homes and commercial establishments. German manufacturers are known for their innovation, producing tiles with unique textures, colors, and sustainable properties. With stringent environmental regulations, there is also a growing demand for tiles that meet green building standards, which is expected to fuel the market’s growth further.

North America Ceramic Tiles Market Trends

The ceramic tiles market in North America is expected to grow significantly over the forecast period. The consumers have become more inclined toward sustainable and energy-efficient products, which has led to the development of eco-friendly tile options. The trend of incorporating ceramic tiles in kitchens, bathrooms, and flooring applications is also fueling market growth. In addition, with a rising demand for customizable and high-performance tiles, manufacturers are exploring advanced production techniques to meet consumer needs and preferences.

The ceramic tiles market in the U.S. has experienced steady growth, fueled by a strong demand from both residential and commercial construction projects. Homeowners are increasingly opting for ceramic tiles due to their versatility, durability, and aesthetic appeal in kitchens, bathrooms, and flooring applications. The trend towards home renovation, coupled with a preference for sustainable and low-maintenance materials, has significantly influenced the market. The rise of modern and minimalist interior design also favors ceramic tiles, as they can be customized to meet a variety of style preferences. Moreover, technological advancements in tile production, such as the development of larger tiles and digital printing techniques, are expected to continue driving the market in the U.S.

Latin America Ceramic Tiles Market Trends

The ceramic tiles market in Latin America is experiencing growth due to increasing urbanization, infrastructure development, and rising disposable income in countries like Brazil and Argentina. The construction boom in both residential and commercial sectors has created significant demand for ceramic tiles, particularly in cities undergoing rapid expansion. Consumers in the region are showing a greater preference for high-quality, stylish tiles for home and office interiors. The growing middle class is driving demand for premium products with innovative designs, while developers are increasingly incorporating ceramic tiles in large-scale real estate projects. However, challenges such as fluctuating raw material costs and political instability in some countries may affect market stability, but the overall outlook remains positive as the region continues to develop.

Middle East & Africa Ceramic Tiles Market Trends

The ceramic tiles market in the MEA is driven by the region’s rapid urbanization, infrastructure development, and rising construction activities. The demand for ceramic tiles is particularly high in the Gulf Cooperation Council (GCC) countries, where large-scale construction projects, such as residential complexes, hotels, and commercial spaces, are underway. The region’s high-end real estate projects often require luxury tiles with advanced designs and durable features. In addition, a growing preference for sustainable and water-resistant products in the MEA market is influencing tile production trends.

Key Ceramic Tiles Company Insights

Some of the key players operating in this industry include Mohawk Industries, Inc., SCG Ceramics, Grupo Lamosa, Grupo Cedasa, and RAK Ceramics:

-

Mohawk Industries, Inc., is headquartered in Georgia, U.S., and is primarily engaged in the production of flooring components. It designs, sources materials, manufactures, and distributes different types of flooring materials to markets including residential new construction, residential replacement, and commercial construction. This company operates its business through segments: Global Ceramics, Flooring North America, and Flooring Rest of the World.

-

RAK Ceramics designs and manufactures Ceramic Tiles and sanitary ware for residential & commercial purposes. It majorly serves Asia Pacific and Europe, with over 40 subsidiaries operating in tiles and bathroom fittings.

-

Kajaria Ceramics Limited designs and manufactures ceramic and vitrified tiles as well as flooring products. This company has seven manufacturing units in India and global sales operations in North America, Europe, Asia Pacific, and the Middle East & Africa. Its sales & distribution facilities in the European region are located in Spain, France, Belgium, the UK, Germany, and Eastern Europe.

China Ceramics Co., Ltd, and Florim Ceramiche S.p.A. are some of the emerging industry participants.

-

China Ceramics Co., Ltd. is engaged in the manufacturing of Ceramic Tiles. Its products are offered in domestic as well as international markets and are used in interior flooring and exterior siding of residential and commercial buildings.

-

Florim Ceramiche S.p.A. owns a network of production units, logistic centers, and business partnerships in Europe, North America, and Asia. It manufactures tiles, porcelain stoneware, ceramic slabs, and stoneware products for architecture, interior design, and construction.

Key Ceramic Tiles Companies:

The following are the leading companies in the ceramic tiles market. These companies collectively hold the largest market share and dictate industry trends.

- Atlas Concorde S.p.A.

- MOHAWK INDUSTRIES, INC.

- Crossville, Inc.

- RAK Ceramics

- Cerámica Saloni

- Florida Tile, Inc.

- PORCELANOSA Grupo A.I.E.

- Kajaria Ceramics Limited

- GRUPPO CERAMICHE RICCHETTI S.p.A.

- China Ceramics Co., Ltd.

- Guangdong Monalisa Industry Co.

- Guangdong Newpearl Ceramics Group Co., Ltd.

- Florim Ceramiche S.p.A.

Recent Developments

-

In January 2023, H & R Johnson, a ceramic tile manufacturer under Prism Johnson Limited, introduced an extensive new product range during a launch event in Kolkata, India. The unveiling featured approximately 3,000 newly developed ceramic tile designs. These designs were created to address evolving market requirements across multiple application areas. The collection emphasizes versatility to suit residential, commercial, and specialized spaces.

Ceramic Tiles Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 243.92 billion

Revenue forecast in 2033

USD 380.61 billion

Growth rate

CAGR of 6.6% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Volume in million square meters, and revenue in USD billion/million, and CAGR from 2026 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; Spain; Romania; Czech Republic; Portugal; Ukraine; Slovakia; Hungary; China; India; Japan; South Korea; Australia; Indonesia; Philippines; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; Israel; Egypt; Qatar; South Africa; Morocco

Key companies profiled

Atlas Concorde S.p.A.; MOHAWK INDUSTRIES, INC.; Crossville, Inc.; RAK Ceramics; Cerámica Saloni; Florida Tile, Inc.; PORCELANOSA Grupo A.I.E.; Kajaria Ceramics Limited; GRUPPO CERAMICHE RICCHETTI S.p.A.; China Ceramics Co., Ltd.; Guangdong Monalisa Industry Co.; Guangdong Newpearl Ceramics Group Co., Ltd.; Florim Ceramiche S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ceramic Tiles Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ceramic tiles market report based on product, application, end use, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2021 - 2033)

-

Glazed Ceramic Tiles

-

Porcelain tiles

-

Scratch free Ceramic Tiles

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2021 - 2033)

-

Wall tiles

-

Floor tiles

-

Others

-

-

End Use Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Spain

-

Romania

-

Czech Republic

-

Portugal

-

Ukraine

-

Slovakia

-

Hungary

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Philippines

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Egypt

-

Qatar

-

South Africa

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global ceramic tiles market size was estimated at USD 226.41 billion in 2025 and is expected to reach USD 243.92 billion in 2026.

b. The global ceramic tiles market is expected to grow at a compound annual growth rate of 6.6% from 2026 to 2033 to reach USD 380.61 billion by 2033.

b. Floor tiles application accounted for the largest revenue share of 61.3% in 2025 and is the major demand-driving segment for this market. Consumers are rapidly shifting from traditional marble and stone floors to low-cost and maintenance-free ceramic tiles.

b. Some of the key players operating in the ceramic tiles market include Mohawk Industries, Inc.; SCG Ceramics, Inc.; Grupo Lamosa, Grupo Cedasa; RAK Ceramics; Ceramica Carmelo Fior; Pamesa and Kajaria Ceramics Ltd.

b. The ceramic tiles market is driven by rapid urbanization, growth in construction and renovation activities, rising demand for aesthetic interiors, technological advancements in manufacturing, and increasing focus on sustainable building materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.