- Home

- »

- Consumer F&B

- »

-

Ashwagandha Supplements Market, Industry Report, 2033GVR Report cover

![Ashwagandha Supplements Market Size, Share & Trends Report]()

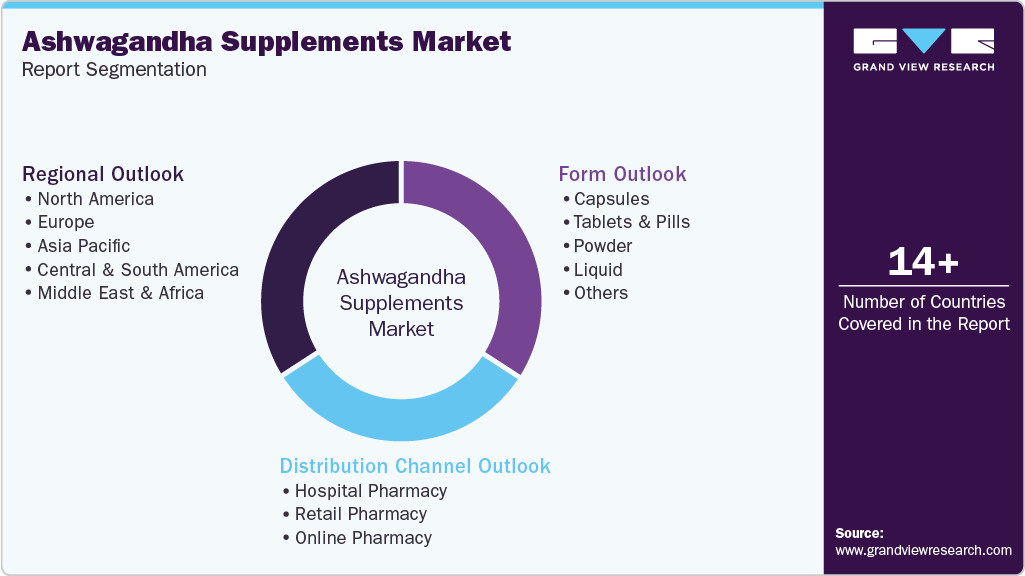

Ashwagandha Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Capsules, Tablets & Pills, Powder, Liquid), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-358-8

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ashwagandha Supplements Market Summary

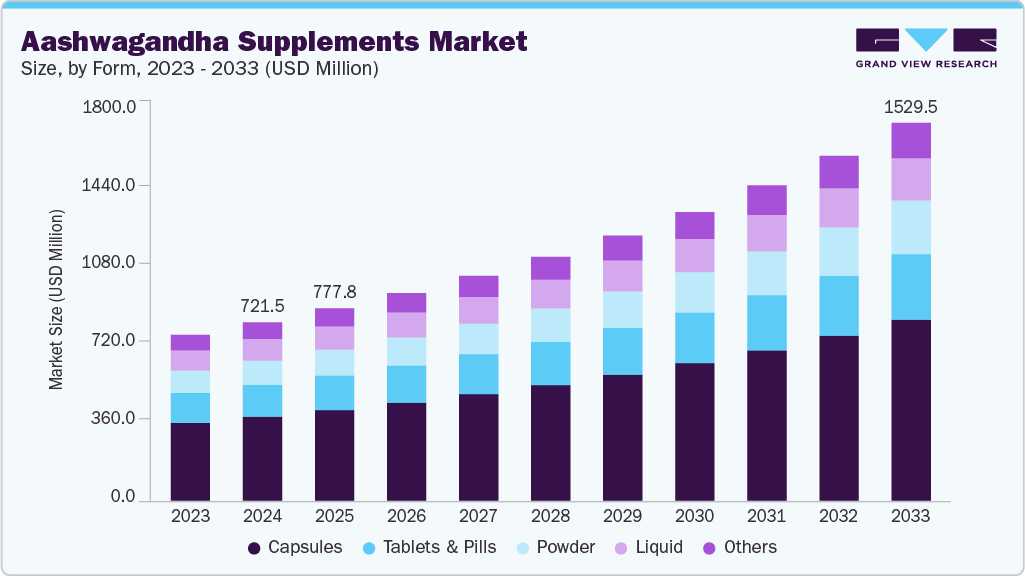

The global ashwagandha supplements market size was estimated at USD 721.5 million in 2024 and is projected to reach USD 1,529.5 million by 2033, growing at a CAGR of 8.8% from 2025 to 2033. This can be attributed to the rising consumer demand for natural remedies for sleep, stress, immunity, and overall wellness.

Key Market Trends & Insights

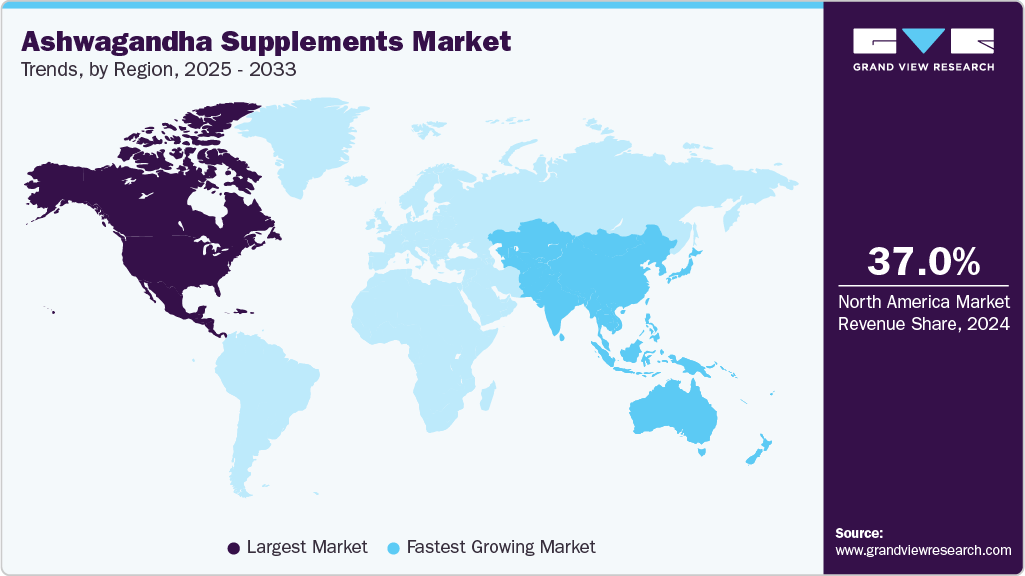

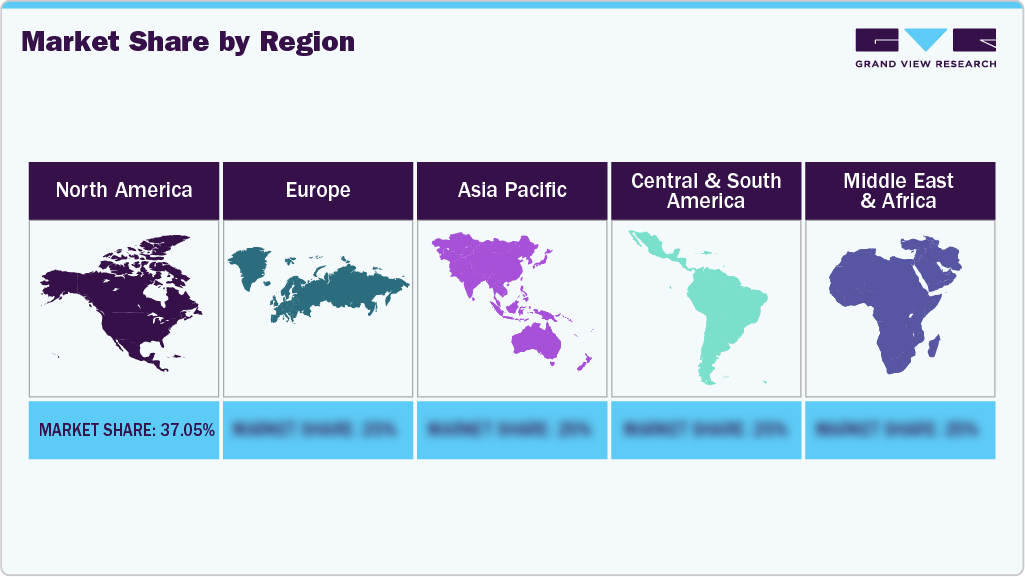

- The North America ashwagandha supplements market held over 37.05% of the global revenue in 2024.

- The ashwagandha supplements market in the U.S. is expected to grow at a CAGR of 8.8% from 2025 to 2033.

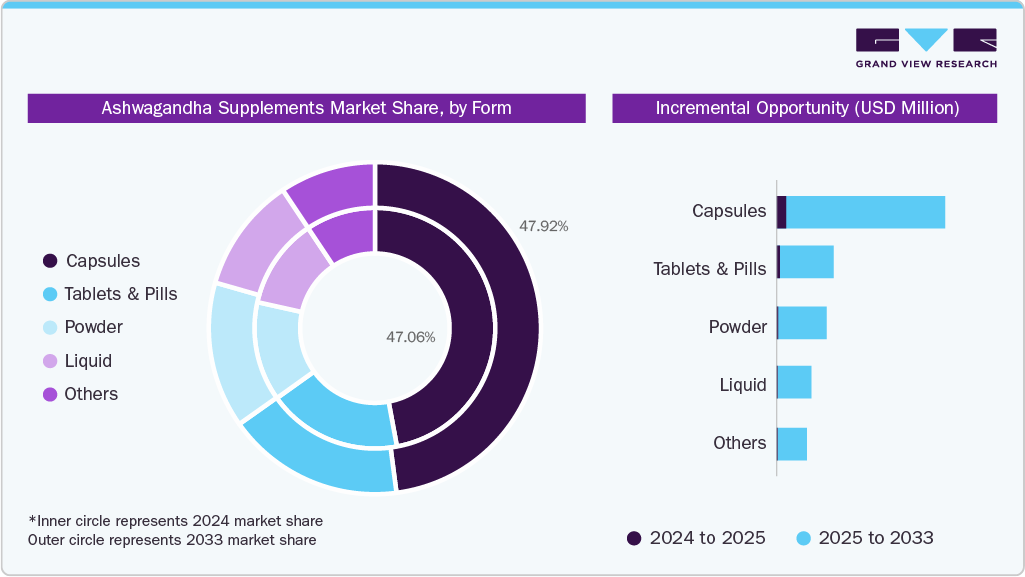

- By form, the capsule supplements segment led the market and accounted for a share of 47.06% in 2024.

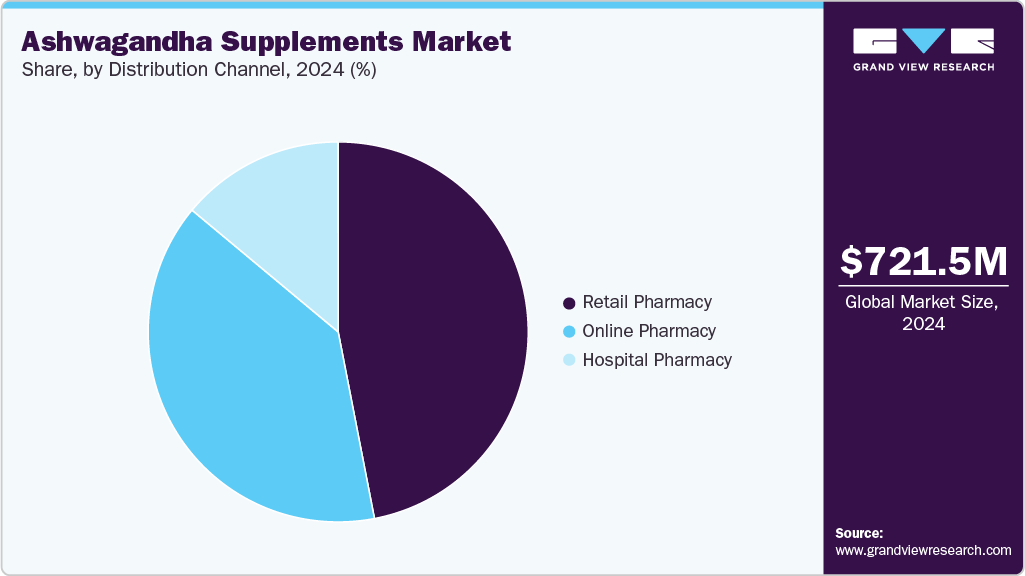

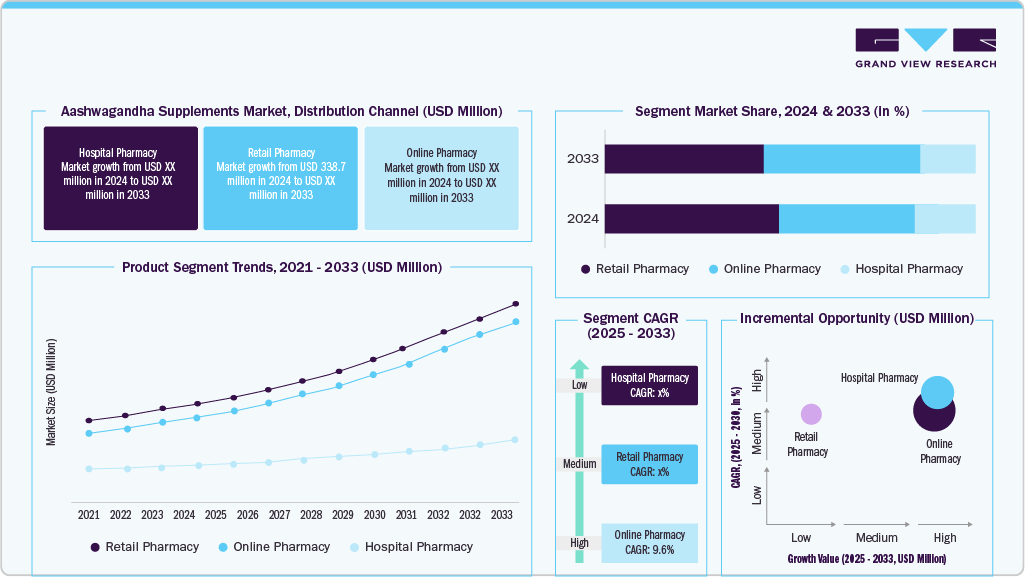

- By distribution channel, the sale of ashwagandha supplements through retail pharmacies held the largest market share of 46.95%, in 2024.

Market Size & Forecast

- 2024 Market Size: USD 721.5 Million

- 2033 Projected Market Size: USD 1,529.5 Million

- CAGR (2025-2033): 8.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Significant market trends support this demand, including growing scientific validation of traditional uses, which leads to trusted and standardized extract formulations (e.g., KSM-66, Sensoril). Moreover, continuous product innovation also includes diverse formats such as gummies, powders, and functional beverages.A notable trend in the Ashwagandha market is the focus on transparency and quality. Consumers now prefer supplements with standardized extracts, third-party testing, and certifications such as organic or non-GMO. Rising awareness of adulteration and inconsistent potency is driving brands to ensure clear labeling and reliable sourcing, giving high-quality products a competitive advantage.

There is a growing trend among consumers toward natural remedies for managing stress, sleep disturbances, anxiety, and cognitive health, with Ashwagandha increasingly recognized as a safe and effective alternative to traditional medications. In addition, the rising prevalence of chronic health conditions has boosted demand for Ashwagandha supplements, which have potential wellness benefits. Ashwagandha has gained attention for its anti-inflammatory, antioxidant, and immune-supporting properties. Besides, consumers are actively seeking natural alternatives to traditional online pharmacies to manage these conditions, leading to a surge in demand for herbal supplements.

Moreover, Ashwagandha has demonstrated the ability to reduce inflammation, boost immune function, and protect against oxidative stress, making it a valuable component of a wellness routine. Its growing reputation as a natural performance enhancer is also driving demand within the sports nutrition sector. Athletes are increasingly turning to Ashwagandha for benefits such as improved muscle recovery, reduced exercise-induced fatigue, and enhanced strength and endurance, leading to its wider integration into training programs across all levels of athletic performance.

According to a March 2025 article by The Turmeric Co., a 28-day study on 30 professional female footballers found that daily supplementation with 600 mg of Ashwagandha root extract improved recovery and sleep quality compared to a placebo. The benefits of these supplements became more noticeable with consistent use over eight weeks, and pairing them with magnesium further supported stress reduction and sleep quality, underscoring their role in improving athletic performance and overall wellness.

Furthermore, the growing availability of Ashwagandha supplements in multiple forms-capsules, tablets, powders, and gummies-has driven consumer demand, offering convenience and ease of incorporation into daily routines. Established brands' presence and expansion of online retail channels have further supported market growth. Companies are also using social media, influencer partnerships, and content marketing to educate consumers about the benefits of Ashwagandha.

For instance, in July 2025, GNC India launched Ayurvedic Honeysticks that blend traditional ingredients with modern convenience. The single-serve 8g sticks combine natural honey with 400mg of Shilajit and saffron or 400mg of Ashwagandha, offering a portable energy, endurance, and stress relief solution. Designed for busy consumers, these products are available on GNC India’s website and major online platforms.

Innovation in product development remains a key focus, with new delivery formats and formulations being introduced to cater to diverse consumer preferences. This includes blends combining Ashwagandha with other adaptogens and complementary ingredients, such as turmeric, Rhodiola, and magnesium, targeting specific health concerns and enhancing overall efficacy. Alongside these developments, Pricing remains an essential factor in consumer decision-making, with the Ashwagandha market price particularly influencing purchases in premium segments.

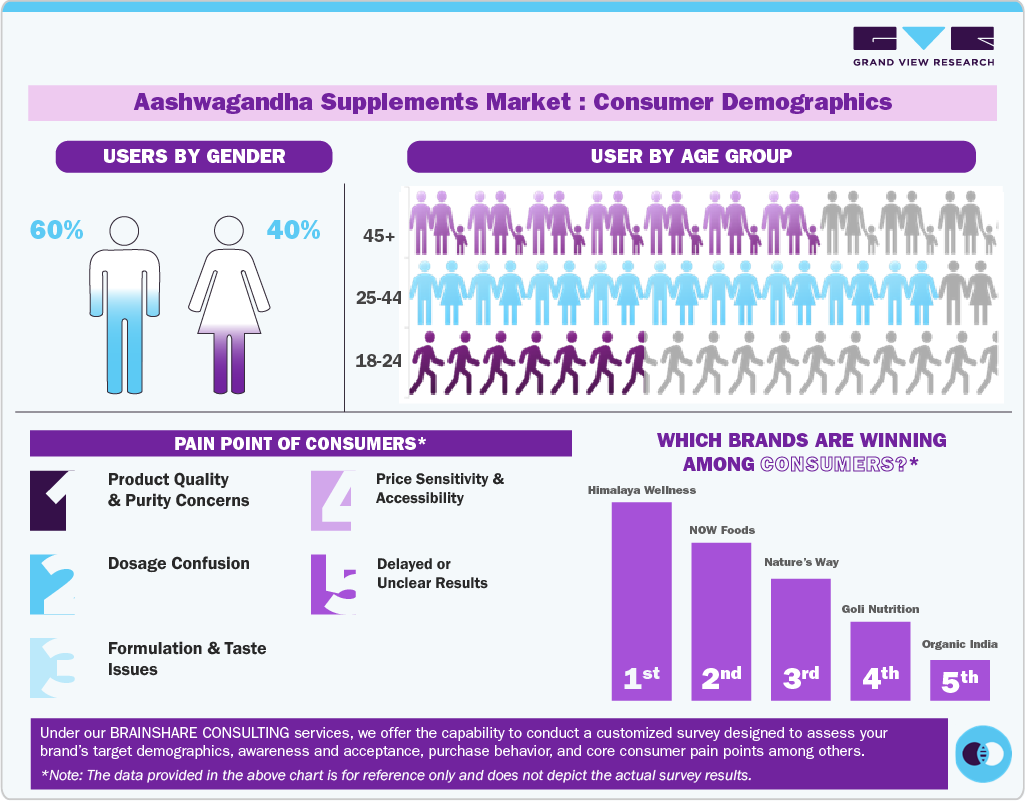

Consumer Insights

The user base for Ashwagandha supplements is predominantly male, comprising about 60% of consumers, while women make up approximately 40%. This indicates that Ashwagandha’s appeal as a supplement for stress relief and vitality aligns strongly with male consumers, particularly those focused on fitness, energy, and hormonal support. At the same time, the notable female users highlight growing adoption among women, who increasingly use Ashwagandha for stress management, hormonal balance, and holistic wellness.

When looking at age demographics, the largest segment of users falls in the 25-44 years bracket. This age group represents working professionals and urban consumers who are actively seeking natural solutions to manage stress, sleep issues, and energy levels. The 45+ age group constitutes the next largest segment, indicating that middle-aged and older adults are also adopting Ashwagandha for vitality, memory, and overall wellness. The youngest group, 18-24 years, makes up the smallest share, likely because of lower disposable income and limited awareness, though this group shows potential growth through trend-driven formats like gummies.

The pain points of consumers highlight several key challenges in the Ashwagandha market.

-

The top concerns include product quality and purity, as users are cautious about adulteration and inconsistent potency.

-

Dosage confusion is another significant pain point, with uncertainty about adequate daily intake and standardized extracts.

-

Formulation and taste issues also affect adoption, as powders can be bitter and capsules difficult to swallow.

-

Price sensitivity and accessibility are among the most common pain points, particularly concerning the Ashwagandha market price, as consumers weigh perceived value against product cost, especially in the premium extract segment.

The leading brands in the market, as recognized and preferred by consumers, showcase a diverse landscape of trust and innovation. Himalaya Wellness ranks first, demonstrating strong brand loyalty in the Ayurvedic and herbal segment. NOW Foods and Nature’s Way occupy second and third positions, owing to their widespread availability and established presence across North America. Goli Nutrition and Organic India are popular too, reflecting the rising popularity of lifestyle-oriented products such as gummies and certified organic formulations.

The ranking of brands favored by consumers highlights a delicate balance between heritage credibility and innovative product formats, shaping consumer choices in the growing market, where Ashwagandha market price considerations continue to influence purchase decisions.

Form Insights

The capsules segment accounted for a revenue share of 47.06% in 2024. The capsule form of ashwagandha supplements offers several advantages over other forms, such as ease of consumption and dosage control. Capsules provide a convenient and standardized way to incorporate ashwagandha into daily routines, ensuring consistent intake and optimal benefits. Moreover, the controlled dosage in capsules helps avoid overconsumption and potential side effects associated with excessive ashwagandha intake. Key players are investing in research and development to develop novel capsule formulations that cater to the evolving needs of consumers seeking natural and effective stress management solutions.

The powder segment is anticipated to witness a growth rate of 9.6% from 2025 to 2033. Powdered ashwagandha supplements are a convenient and affordable way to get the benefits of this herb. They are also highly concentrated so that they can be taken in smaller doses than other forms of ashwagandha. Consumers can easily add the powder to smoothies and yogurt or even incorporate it into their cooking, making it a convenient and discreet way to obtain its therapeutic benefits. Additionally, powder supplements often offer a higher concentration of active ingredients, providing a more potent dose compared to other forms.

Distribution Channel Insights

The retail pharmacy segment accounted for a revenue share of 46.95% in 2024. Retail pharmacies provide a readily accessible and trusted platform for consumers seeking ashwagandha supplements. Their physical presence in communities’ fosters convenience and immediate availability, appealing to consumers who prefer in-person shopping and interaction with pharmacists. Pharmacists, with their expertise in health and wellness, play a crucial role in educating customers about the benefits, dosages, and potential interactions of ashwagandha supplements.

This trusted guidance enhances consumer confidence and encourages informed purchasing decisions. Moreover, retail pharmacies often offer private-label or store-brand ashwagandha supplements, providing consumers with competitive pricing and alternative options.

The online pharmacy segment is estimated to grow at a CAGR of 9.6% from 2025 to 2033. The convenience and accessibility offered by online platforms are key factors contributing to their success. Consumers can easily browse a wide variety of ashwagandha products from different brands, compare prices, read customer reviews, and make informed purchase decisions comfortably from their homes. This eliminates the need for physical store visits, saving time and effort. Moreover, online pharmacies often provide detailed product information, including dosage recommendations and potential side effects, helping consumers make well-informed choices.

Regional Insights

The North America ashwagandha supplements market held 37.05% of the global revenue in 2024, driven by the growing awareness of potential health benefits associated with botanical supplements and the increasing demand for natural and herbal remedies. The region is experiencing a surge in the popularity of Ashwagandha, an ancient medicinal herb traditionally used in Ayurvedic medicine. Consumers in North America are actively seeking holistic approaches to well-being, fueling the demand for supplements that support overall health and wellness.

U.S. Ashwagandha Supplements Market Trends

The ashwagandha supplements market in the U.S. is expected to grow at a CAGR of 8.8% from 2025 to 2033, driven by theincreasing consumer demand for natural and herbal remedies and a growing interest in natural remedies for stress, anxiety, and overall well-being. Moreover, the growing popularity of yoga and meditation, along with the rising awareness about holistic health practices, is further fueling the demand for herbal supplements.

Europe Ashwagandha Supplements Market Trends

The ashwagandha supplements market in Europe is expected to grow at a CAGR of 8.4% from 2025 to 2033. Germany, the UK, and France are leading markets within Europe, fueled by high consumer demand for adaptogenic herbs and a growing interest in stress management and cognitive enhancement. The market is witnessing a strong shift towards organic and sustainable sourcing practices, driven by consumer preference for ethically produced products. Furthermore, the increasing availability of ashwagandha supplements in mainstream supermarkets and pharmacies is making them more accessible to a wider consumer base.

Asia Pacific Ashwagandha Supplements Market Trends

The ashwagandha supplements market in the Asia Pacific is set to grow at the fastest CAGR of 9.3% from 2025 to 2033. The growth of the middle-income population with increased disposable income and rising awareness of the herb's traditional medicinal benefits is driving demand for products in the Asia Pacific. This region, particularly India, is a prominent producer of Ashwagandha, resulting in a robust supply chain and cost-effectiveness. Moreover, the burgeoning wellness and preventative healthcare consciousness in countries like China, Japan, and South Korea is creating a favorable environment for herbal supplements.

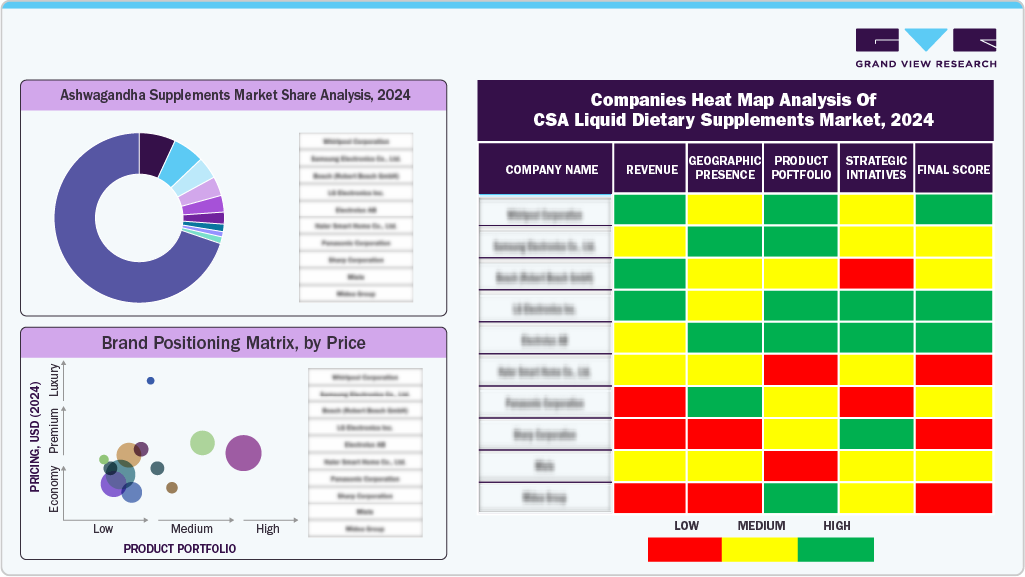

Key Ashwagandha Supplements Company Insights

NOW Foods, Swanson, KSM-66, Nature Made, Nature's Bounty, Himalaya Wellness Company, Dabur, Solaray, Gaia Herbs, and Four Sigmatic are some of the dominant players in the ashwagandha supplements market, which is characterized by intense competition.

Key players in the market are focusing on product development to cater to evolving consumer demands and preferences. They are introducing new formulations, such as organic, vegan, and sugar-free supplements, to meet the needs of health-conscious consumers.

Additionally, strategic mergers and acquisitions are shaping the market landscape, with larger companies acquiring smaller players to expand their product portfolios and strengthen their market position.

Key Ashwagandha Supplements Companies:

The following are the leading companies in the ashwagandha supplements market. These companies collectively hold the largest market share and dictate industry trends.

- NOW Foods

- Swanson

- KSM-66

- Nature Made

- Nature's Bounty

- Himalaya Wellness Company

- Dabur

- Solaray

- Gaia Herbs

- Four Sigmatic

Recent Developments

-

In June 2025, Natural Remedies introduced Ashwa.30, a new Ashwagandha extract developed to support stress relief, boost energy, and enhance endurance. Standardized to 15% withanolides, it also includes a proprietary ATP-active component designed to aid cellular energy production.

-

In May 2024, Herbochem launched +91 ASHWAGANDHA ingredients that can help formulate capsules, tablets, gummies, or any other desired form.

-

In August 2022, Swanson launched Passion Fruit Orange Ashwagandha Gummies with Vitamin D to help manage stress. This strategy helped the company expand its product portfolio and share in the ashwagandha supplements market.

-

In October 2021, Gaia Herbs launched a new line of botanical gummies, including Ashwagandha, Sleep, and Relax Gummies. The Ashwagandha Gummies are designed to support stress reduction and enhance the body's resilience to stress by leveraging Ashwagandha's adaptogenic properties.

Ashwagandha Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 777.8 million

Revenue forecast in 2033

USD 1,529.5 million

Growth rate

CAGR of 8.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

NOW Foods; Swanson; KSM-66; Nature Made; Nature's Bounty; Himalaya Wellness Company; Dabur; Solaray; Gaia Herbs; Four Sigmatic.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ashwagandha Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ashwagandha supplements market report based on form, distribution channel, and region:

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Capsules

-

Tablets & Pills

-

Powder

-

Liquid

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ashwagandha supplements market was estimated at USD 721.5 million in 2023 and is expected to reach USD 777.8 million in 2025.

b. The global ashwagandha supplements market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2033 to reach USD 1,529.5 million by 2033.

b. North America dominated the ashwagandha supplements market with a share of 37.00% in 2024. This whopping market share is mainly attributed to the growing awareness of potential health benefits associated with botanical supplements and the increasing demand for natural and herbal remedies. The region is experiencing a surge in the popularity of ashwagandha, an ancient medicinal herb traditionally used in Ayurvedic medicine.

b. Some of the key market players in the ashwagandha supplements market are NOW Foods; Swanson; KSM-66; Nature Made; Nature's Bounty; Himalaya Wellness Company; Dabur; Solaray; Gaia Herbs; and Four Sigmatic

b. The ashwagandha supplements market has experienced significant growth in recent years, driven by the increasing popularity of Ayurveda and other traditional medicine systems and the growing acceptance of adaptogenic herbs like ashwagandha, which are believed to help the body adapt to stress and maintain overall well-being. Moreover, innovation in product development is paramount, particularly the introduction of novel delivery formats and formulations is further driving the ashwagandha supplements market size.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.