- Home

- »

- Communication Services

- »

-

Asia Pacific Business Process Outsourcing Market Report, 2030GVR Report cover

![Asia Pacific Business Process Outsourcing Market Size, Share & Trends Report]()

Asia Pacific Business Process Outsourcing Market Size, Share & Trends Analysis Report By Service (Finance & Accounting, Human Resource), By End-use (BFSI, Healthcare), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-126-9

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

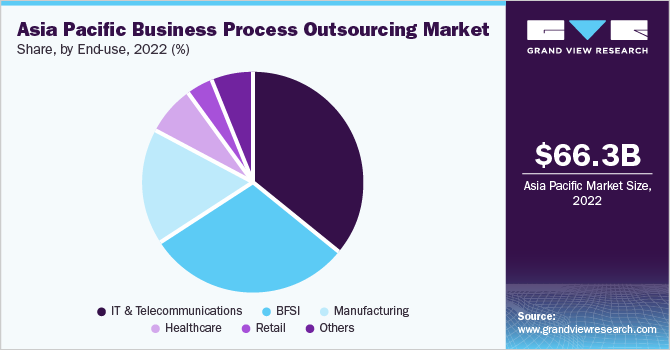

The Asia Pacific business process outsourcing market size was estimated at USD 66.27 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 10.7% from 2023 to 2030. Back-office operations and management are vital for any organization. Various transactional processes, such as order fulfillment, application processing, and collection and billing, contribute toward a large accumulation of data and enhanced back-office solutions necessary to process all the accumulated data. Growing volumes of data prompt enterprises to opt for cloud computing in business process outsourcing (BPO). Rapid proliferation of service delivery platforms and rising demand for outsourcing BPO services across various end-use industries is also expected to boost the regional market growth.

The BPO market participants provide dependable and cost-effective services to a variety of industries and sectors, including banking, financial services, insurance (BFSI), manufacturing, retail, IT and telecommunications, and healthcare, among others. Companies in these industries desire to incorporate BPO as part of their business plan to boost profitability. Over the next few years, BFSI is predicted to grow at a rapid rate in the coming years. BPO in BFSI overcomes industry difficulties by assuring data management and data integrity, as well as providing accurate, relevant, and timely data delivery to improve decision-making.

Companies are placing greater emphasis on core activities to maintain their market position and expand their customer base, which results in the outsourcing of resources for non-core activities. Companies engaging in business process outsourcing can choose to outsource specific services or business functions based on their individual requirements, including payroll, IT, logistics, and legal services. Reduction of labor costs as well as reducing and/or eliminating overheads arising from human resources and equipment are some of the potential benefits of outsourcing.

Services such as training and recruitment require additional effort and time. As a result, some companies opt for outsourcing human resources services. For instance, Accenture is one of the pioneers engaged in offering human resources and finance and accounting services. The company’s human resource service includes workforce performance, recruitment, payroll, benefits and compensation, and other learning and employee services. The company’s human resource services cater to clients, such as Microsoft, General Motors, IBM, and Goodyear, among others.

Services Insights

Based on service, the market has been segmented into finance & accounting, human resources, knowledge process outsourcing, procurement, customer services, and others. The customer service segment held the largest market share of 33.13% in 2022 and is anticipated to grow at the fastest CAGR of 12.6% during the forecast period. The rising establishment of service centers that necessitate online and offline technical support has been fueling the segment growth. Interaction with customers opens an opportunity for strengthening the brand and developing customer relationships.

The finance and accounting segment is anticipated to witness significant growth over the forecast period. This can be ascribed to the rising presence of banking facilities and stringent regulatory requirements in the banking sector, thereby resulting in a need for outsourcing services as outsourcing permits a significant reduction i.e. operating costs. Moreover, the human resource service segment is also anticipated to register a substantial CAGR of over 11.1% over the forecast period, ascribed to the rising need for resources across different sub-segments including payment processing, recruitment and relocation, administration, and other employee benefit services.

Knowledge process outsourcing (KPO) includes research and analytical outsourcing, such as competitive analysis, quantitative research and analytics, strategy and business development research, and risk management and analytics, among others. Rising demand for project management, market research, remote education, legal processes, data search, and data integration is anticipated to spur the segment growth. In addition, the availability of experienced and skilled professionals abroad, the adoption of global standards for qualification, and improved remote project management capabilities are some of the additional factors anticipated to fuel the segment's growth.

End-use Insights

Based on end-use, the market has been segmented into BFSI, healthcare, manufacturing, IT and telecommunications, retail, and others. The IT & Telecommunications segment held the largest market share of 35.59% in 2022 owing to the growth of IT companies and rapid industrialization. In addition, the government's support to improve the economy by encouraging sectors such as banking and healthcare is projected to boost their investments in technology. This factor is anticipated to fuel the market in Asia Pacific. Telecom companies in the region are leveraging business process outsourcing and are adopting telecommunications outsourcing to reduce costs. They outsource various business functions from call center outsourcing to billing operations to finance and accounting outsourcing. Outsourcing solutions help telecom companies establish a flexible strategy to acquire and retain more customers, access specialized resources, optimize current investments, and manage cost pressures.

The BFSI segment is anticipated to grow at the fastest CAGR of 12.4% during the forecast period. BPO has long been seen by financial institutions as a tool for increasing cost-effectiveness. Asset management and investment management are just two examples of BFSI industry verticals that are choosing to outsource key activities and incorporate them into their business strategies. In addition to higher cost-effectiveness, increased flexibility, and improved service quality, BPO also provides innovative, specially designed solutions to address the difficulties the sector is currently facing. BFSI organizations have long viewed BPO as a tool to increase productivity and save operating costs. The BFSI sector is anticipated to experience the fastest growth throughout the forecast period despite the market's maturity. BFSI is anticipated to increase significantly in the upcoming years because of the availability of new, modified solutions meant to address the current digitization requirements as well as offering new value-added services.

Regional Insights

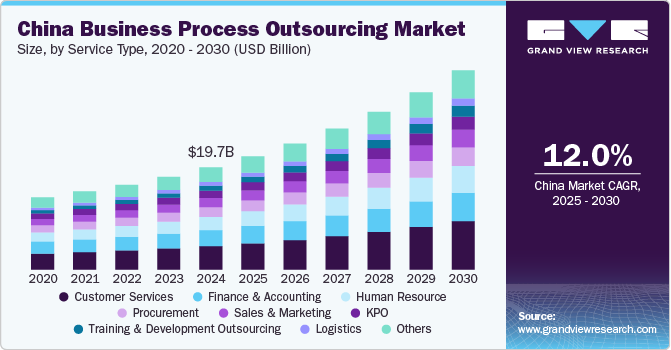

China dominated the market in 2022 with the largest revenue share of 24.67% and is projected to grow at the fastest CAGR of 11.5% during the forecast period. Factors such as the availability of labor, increasing government investments in the BPO industry, BPO-centric education, focus on enhancing the communication skills of employees, and improved infrastructure are expected to drive market growth in China. In collaboration with the Shanghai Zhanjiang Institute of Education and the Beijing Jade Bird Information Technology Training Centre, M&Y Global Services, a Chinese outsourcing firm, trains students in BPO skill sets. Such efforts by major corporations are expected to pave the way for market expansion over the forecast period.

Suitable geographic location and investor-friendly tax structure have made India a popular outsourcing destination. In addition, several BPO companies in India are expanding their presence in Tier 2 and Tier 3 cities and are not just limiting to contact centers or call center services but are moving toward gaining high-end knowledge and providing several other finance and accounting, and IT services. Furthermore, rising support from the government is anticipated to drive the BPO market in India. For instance, the Indian BPO Promotion Scheme (IBPS) under the Digital India Programme is focused on creating job opportunities for the growth of skilled workforce in the BPO industry.

Key Companies & Market Share Insights

The market is highly fragmented and competitive in nature. A diverse range of services allows companies to gain a competitive edge. For instance, Capgemini, one of the pioneers in the BPO industry, is engaged in offering multiple BPO services, such as financial services, supply chain and procurement, and business analytics, among others. Companies are focusing on setting up new BPO centers globally to expand their market presence and augment their existing customer base. For instance, in June 2023, Accenture, the multinational professional services, strengthened its footprint in Australia by acquiring Bourne Digital, a Melbourne-based firm specializing in the SAP Business Technology Platform.

The major players focus on partnerships and collaborations with the objective of consolidating their market presence. For instance, in January 2023. Amdocs and Macau's CTM collaborated to launch commercial 5G services across the region. A coordinated effort has been made to speed up the city's digital transition, as evidenced by the commercial debut of CTM 5G. Some prominent players in the Asia Pacific business process outsourcing market include:

-

Accenture

-

Infosys Limited

-

HCL Technologies Limited

-

CBRE Group, Inc.

-

Wipro Corporation

-

Capgemini

-

TTEC Holdings, Inc.

-

Sodexo

-

Amdocs

-

Tata Consulting Services Limited

-

IBM Corporation

Asia Pacific Business Process Outsourcing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 147.0 billion

Growth rate

CAGR of 10.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-use, region

Regional scope

Asia Pacific

Country scope

China; Japan; India; Australia; South Korea

Key companies profiled

Accenture; Infosys Limited; HCL Technologies Limited; Capgemini; Wipro Limited; TTEC Holdings, Inc.; Sodexo; Amdocs; Tata Consulting Services Limited; IBM Corporation; Accenture

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Business Process Outsourcing Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific business process outsourcing market report based on service, end-use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Finance & Accounting

-

Human Resource

-

KPO

-

Procurement

-

Customer services

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare

-

Manufacturing

-

IT & Telecommunications

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific business process outsourcing market size was estimated at USD 66.27 billion in 2022 and is expected to reach USD 71.96 billion in 2023.

b. The Asia Pacific business process outsourcing market is expected to grow at a compound annual growth rate of 10.7% from 2023 to 2030 to reach USD 147.06 billion by 2030.

b. Customer care services dominated the Asia Pacific BPO market with a share of 33.5% in 2022. This is attributable to rising establishments of service centers that necessitate online and offline technical support and interaction with customers.

b. Some key players operating in the Asia Pacific BPO market include Accenture, Infosys Limited, HCL Technologies Limited, CBRE Group, Inc., Wipro Limited, Capgemini, Tata Consultancy Services Limited, IBM Corporation, Genpact, and Aegis Limited.

b. Key factors that are driving the market growth include rapid proliferation of service delivery platforms and rising demand for outsourcing BPO services across various end-use industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."