- Home

- »

- Healthcare IT

- »

-

Asia Pacific Digital Pathology Market, Industry Report, 2030GVR Report cover

![Asia Pacific Digital Pathology Market Size, Share & Trends Report]()

Asia Pacific Digital Pathology Market Size, Share & Trends Analysis Report By Application, By Product (Software, Device), By End-use (Diagnostic Labs, Hospitals), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-205-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Asia Pacific Digital Pathology Market Trends

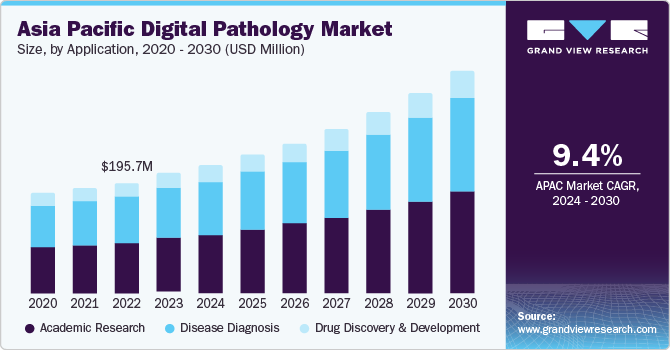

The Asia Pacific digital pathology market was valued at USD 210.4 million in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.7% from 2024 to 2030. This is owing to factors such as growing awareness of digital pathology and its benefits, rise in personal disposable income, collaborative efforts by health departments, and market players encouraging the use of digital pathology to improve the quality of cancer diagnosis in this region.

The market is driven by favorable government reforms and organizations that provide support to digital information systems. The urgent need for the development of new systems and the replacement & upgradation of medical infrastructure are also among the factors anticipated to present the market with lucrative growth opportunities over the forecast period. Furthermore, increasing medical expenditure and growth in insurance coverage are also contributing to market growth.

Key players operating in the market are focusing on capitalizing on opportunities owing to the growing patient pool and unmet medical needs in the region. Due to the rise in penetration of medical imaging systems in countries such as China, an increase in investments in the healthcare industry, the presence of untapped opportunities, and high R&D activities by major market players, the Asia Pacific digital pathology market is expected to witness a high growth rate.

Increasing demand for novel treatment options, better patient care facilities, and reduction in laboratory expenses are further expected to drive the market growth over the coming seven years. The economic development in emerging markets, such as India and China, along with the presence of several big medical device companies in this region drives the demand for digital pathology systems. Regionally, Asia Pacific has highly influenced the digital pathology market due to high incidences of cancer affecting a large population base.

Market Concentration & Characteristics

The digital pathology market is driven by factors such as the rising prevalence of chronic diseases and rapid technological advancements. With the introduction of AI-based tools, the market is currently experiencing significant growth. The market is experiencing a high growth rate and the pace of the market growth is accelerating.

The use of artificial intelligence in digital pathology has gained momentum in the past years. The growing need for lowering healthcare costs, increasing importance of big data in healthcare, rising adoption of precision medicine, and declining hardware costs are some factors driving the market. In addition, the increasing applicability of AI-based tools in medical care and the rise in venture capital investments can be attributed to the surge in demand for this technology. The AI-based tools, such as clinical decision support systems, aid in streamlining workflow processes in hospitals and improving medical care, thereby enhancing patient experience. In addition, the advantage of these diagnostic laboratories is the availability of funds for innovation. The process encourages further innovation by encouraging pathologists to become specialized, giving scientists access to better resources & knowledge, and exchanging practices with wider geographies.

To reach customers in the Asia Pacific region, especially China and India, local distributors are crucial. Many participants in the digital pathology industry are collaborating with regional existing distributors that are more familiar with Asia Pacific countries to establish a local presence. A few well-known companies have also started using distributors to benefit from the well-established sales networks and local reputations that these distributors have built. For instance, JiNan Danjier and Visiopharm signed a partnership agreement in August 2021. By entering into this agreement, Visiopharm, a pioneer in AI-based digital pathology, would be able to use JiNan Danjier's decades of expertise in providing digital pathology solutions to China's national clinical, diagnostics, and scientific research domains. This experience may enhance the company's market presence.

Digital pathology is currently observing relatively little investment compared to areas such as AI in drug development and medical imaging majorly due to the regulations implemented by the government. The implementation of the Nation Wide Information Network (NHIN) that facilitates secure digital pathology systems is anticipated to encourage hospitals and acute care providers to adopt these systems.

The key companies are strategically concentrating on expanding products in the Asia Pacific region. In addition, the expansion of product portfolios of key market players has also enabled buyers to choose from a wide range of solutions catering to specific requirements, which is anticipated to boost the bargaining power of buyers in the coming years. In May 2020, this product was launched in Asia Pacific. This product launch strategy is predicted to enhance the company’s regional footprint as well.

A few well-known businesses have begun working with distributors to take advantage of their well-established sales networks and local reputation. JiNan Danjier and Visiopharm, for instance, formed a partnership with China in August 2021. By engaging in this arrangement, JiNan Danjier would be able to utilize Visiopharm's decades of experience in offering digital pathology solutions to end users in China. Visiopharm is a pioneer in AI-based digital pathology. This knowledge could also further improve the company’s market position and eventually help it gain market share.

Product Insights

The device segment held the largest revenue share of 52.17% in 2023. These devices are used to detect tissue abnormalities and are expected to gain a substantial share over the coming years owing to the increased adoption of continuous automated scanning, the massive storage capacity of these systems, and thorough integration with laboratory information systems. Moreover, intuitive user interfaces and high bandwidth connectivity are factors expected to boost usage rates. The device segment is further divided into scanners and slide management systems.

The software segment is expected to witness the fastest CAGR over the forecast period. Digital pathology software is simple to install & use, easy to obtain specific patient information, and efficiently & quickly sends reports digitally to pathologists & clinicians. Furthermore, government initiatives to constantly encourage the adoption of advanced pathology software and recommend them as standardized approaches are factors expected to boost demand for digital pathology.

Application Insights

The academic research segment held the largest revenue share of 45.78% in 2023, due to the growing adoption of digital pathology in various research studies, such as tumor morphological research. Digital pathology research supports innovation by providing technically advanced devices to create high-quality and accurate whole-slide images. These whole slide images are further used to quantify, identify, and record key features and responses within a specific set of samples. The recorded data is further used to track the response to disease treatment.

The disease diagnosis segment is expected to witness the fastest CAGR over the forecast period. This is due to the rising number of cancer and diabetes cases. Whole Slide Imaging (WSI) technology development has significantly impacted the market. This is a microscopic device that employs software to merge individually captured images into a whole new digital image. However, WSI technology systems are expected to gain rapid market share once the FDA approvals gain impetus for primary diagnosis.

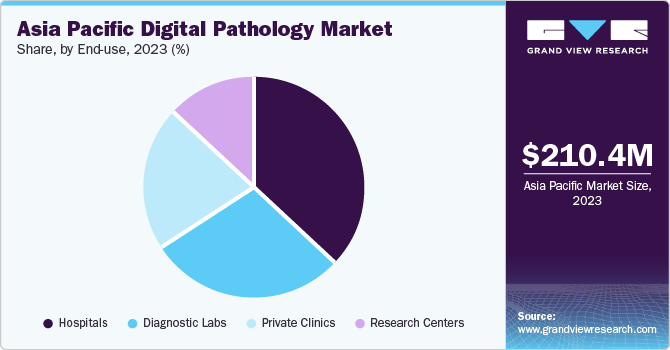

End-use Insights

The hospitals segment held the largest revenue share of 36.55% in 2023. The dominant share is a result of the presence of well-developed infrastructure, the availability of well-trained & skilled staff, and a high number of procedures performed in a hospital. Furthermore, hospitals work closely with government bodies and suppliers, which is expected to boost segment growth. The scarcity of histotechnologists and pathologists in hospitals is also expected to fuel market growth.

The diagnostic lab segment is expected to witness the fastest CAGR over the forecast period. Advancements in whole-slide imaging technology in digital pathology for educational, diagnostic, and research purposes have positively impacted the overall market. Moreover, digital pathology offers opportunities for error eradication as there is a reduction in error identification due to synchronization between images and LIS. In addition, the advantage of these diagnostic laboratories is the availability of funds for innovation.

Country Insights

The Asia Pacific accounted for 20.40% of the global digital pathology market in 2023. The presence of key market players plays a significant role in the region’s market growth. Strategies such as M&A activities keep the market competitive, leading to constant developments. The growing number of collaborative agreements to expedite the adoption of digital pathology in cancer diagnostics serve as key growth contributing factors of the market.

Japan Digital Pathology Market Trends

Japan digital pathology market held a substantial share of the Asia Pacific region. Approval of novel technologies will further fuel the uptake of advanced digital pathology platforms, fueling market growth. In addition, the hospitals and laboratories in Japan that have enough technicians to operate fully automated systems & small hospitals accommodating less than 100 beds are also planning to incorporate such automated systems. The aforementioned factors are driving the digital pathology market growth in this region. Furthermore, upward shifts in medical expenditure and greater insurance coverage are key contributing growth factors of the market.

China Digital Pathology Market Trends

Digital pathology market in China is anticipated to grow at a CAGR of 8.9% rapidly in the coming years. Key players operating in the market are focusing on capitalizing on opportunities owing to the growing patient pool and unmet medical needs in the country. Moreover, strategic alliances to develop novel solutions are expected to boost market growth. The increase in the number of government initiatives to raise awareness and deliver advanced technology to customers is anticipated to further drive the market in China.

India Digital Pathology Market Trends

The India digital pathology market is anticipated to grow rapidly at a CAGR of 9.4% and is driven by an increase in the number of international collaborations & partnerships and improvements in healthcare infrastructure. In addition, the presence of government organizations, such as the National eHealth Authority of India (NeHA), which aims at facilitating the integration of multiple health information systems, is accelerating their adoption. The Ministry of Health and Family Welfare plans to establish an Integrated Health Information Platform (IHIP) that aims to create standards for EHR and facilitate accessibility through a centralized HIE platform. The IHIP is also focused on preventing medical record errors and providing support for decision-making & countrywide data integration.

Key Asia Pacific Digital Pathology Market Company Insights

Asia Pacific digital pathology companies such as Danaher, Koninklijke Philips N.V., Olympus Corporation, and CellaVision are adopting several strategies mergers and acquisitions, collaborations, partnerships, product launches, and massive investments.

Key Asia Pacific Digital Pathology Companies:

- Leica Biosystems Nussloch GmbH (Danaher)

- Hamamatsu Photonics, Inc.

- Koninklijke Philips N.V.

- Olympus Corporation

- F. Hoffmann-La Roche Ltd.

- Mikroscan Technologies, Inc.

- Epredia (3DHISTECH Ltd.)

- Visiopharm A/S

- Huron Technologies International Inc.

- ContextVision AB

- CellaVision

- HANGZHOU ZHIWEI INFORMATION TECHNOLOGY CO. LTD. (MORPHOGO)

- aetherAI

- IBEX (IBEX MEDICAL ANALYTICS)

- SigTuple Technologies Private Limited

- Morphle Labs, Inc

Recent Developments

-

In June 2023, Aignostics announced the launch of a collaboration with Virchow Laboratories to advance the use of AI-powered pathology in China in both research and clinical routine. Aignostics is planning to deploy its platform in China at Virchow Laboratories’ sites and enable local AI-powered testing of samples per Chinese regulations

-

In October 2023, Intralink undertook a business expansion program for Diagnexia across Singapore, Malaysia, Thailand, Indonesia, and China. The company is strategically planning its global expansion drive with a focus on Southeast Asia and China

Asia Pacific Digital Pathology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 227.3 million

Revenue forecast in 2030

USD 395.3 million

Growth Rate

CAGR of 9.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, country

Country scope

Asia Pacific

Country scope

Japan; China; India; Singapore; South Korea; Australia; Indonesia; Malaysia; Singapore; Philippines; Thailand

Key companies profiled

Leica Biosystems Nussloch GmbH (Danaher); Hamamatsu Photonics, Inc.; Koninklijke Philips N.V.; Olympus Corporation; F. Hoffmann-La Roche Ltd.; Mikroscan Technologies, Inc.; Epredia (3DHISTECH Ltd.); Visiopharm A/S; Huron Technologies International Inc.; ContextVision AB; CellaVision; HANGZHOU ZHIWEI INFORMATION TECHNOLOGY CO. LTD. (MORPHOGO); aetherAI; IBEX (IBEX MEDICAL ANALYTICS); SigTuple Technologies Private Limited; Morphle Labs, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Digital Pathology Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the digital pathology market based on product, application, end-use, and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Integrated Software

-

Standalone Software

-

-

Device

-

Scanners

-

Brightfield Scanners

-

Fluorescence Scanners

-

Others

-

-

Slide Management System

-

-

Storage System

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drug Discovery & Development

-

Academic Research

-

Disease Diagnosis

-

Cancer Cell Detection

-

Others

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Private Clinics

-

Diagnostic Labs

-

Research Centers

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

RoAPAC

-

Frequently Asked Questions About This Report

b. The Asia Pacific digital pathology market size was estimated at USD 210.4 million in 2023 and is expected to reach USD 227.3 million in 2024.

b. The Asia Pacific digital pathology market is expected to grow at a compound annual growth rate of 9.7% from 2024 to 2030 to reach USD 395.3 million by 2030.

b. Japan dominated the digital pathology market with a share of 43.96% in 2023. This is attributable to the deployment of R&D investments, supportive government initiatives, technologically advanced systems, rising adoption of digital imaging, and the presence of major players.

b. Some key players operating in the Asia Pacific digital pathology market include Leica Biosystems Nussloch GmbH (Danaher); Hamamatsu Photonics, Inc.; Koninklijke Philips N.V.; Olympus Corporation; F. Hoffmann-La Roche Ltd.; Mikroscan Technologies, Inc.; Epredia (3DHISTECH Ltd.); Visiopharm A/S; Huron Technologies International Inc.; ContextVision AB; CellaVision; HANGZHOU ZHIWEI INFORMATION TECHNOLOGY CO. LTD. (MORPHOGO); aetherAI; IBEX (IBEX MEDICAL ANALYTICS); SigTuple Technologies Private Limited; Morphle Labs, Inc.

b. Key factors that are driving the digital pathology market growth include increasing focus on improving workflow efficiency and demand for faster diagnostic tools for chronic diseases and the prevalence of chronic conditions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."