- Home

- »

- Conventional Energy

- »

-

Asia Pacific Drill Pipe Market Size, Industry Report, 2033GVR Report cover

![Asia Pacific Drill Pipe Market Size, Share & Trends Report]()

Asia Pacific Drill Pipe Market (2025 - 2033) Size, Share & Trends Analysis Report By By Grade (E-75, X-95, G-105, S-135), By Outside Diameter, By Connection Type (API Connections, Premium Connections), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-778-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Drill Pipe Market Summary

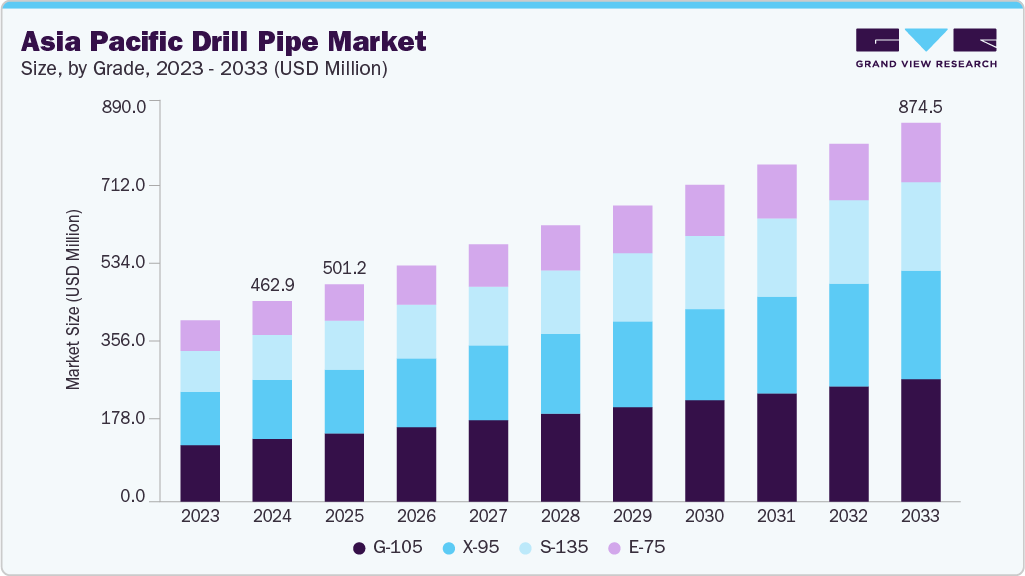

The Asia Pacific drill pipe market size was estimated at USD 462.91 million in 2024 and is projected to reach USD 874.51 million by 2033, growing at a CAGR of 7.2% from 2025 to 2033. This growth is largely driven by the rising exploration and production (E&P) activities across onshore and offshore oil and gas fields in countries such as China, India, Australia, and Indonesia.

Key Market Trends & Insights

- Based on grade, the G-105 segment held the largest market share in 2024.

- Based on outside diameter, the 3 1/2" - 4"segment captured the largest market share in 2024.

- Based on connection type, the API Connections segment held the largest market share in 2024.

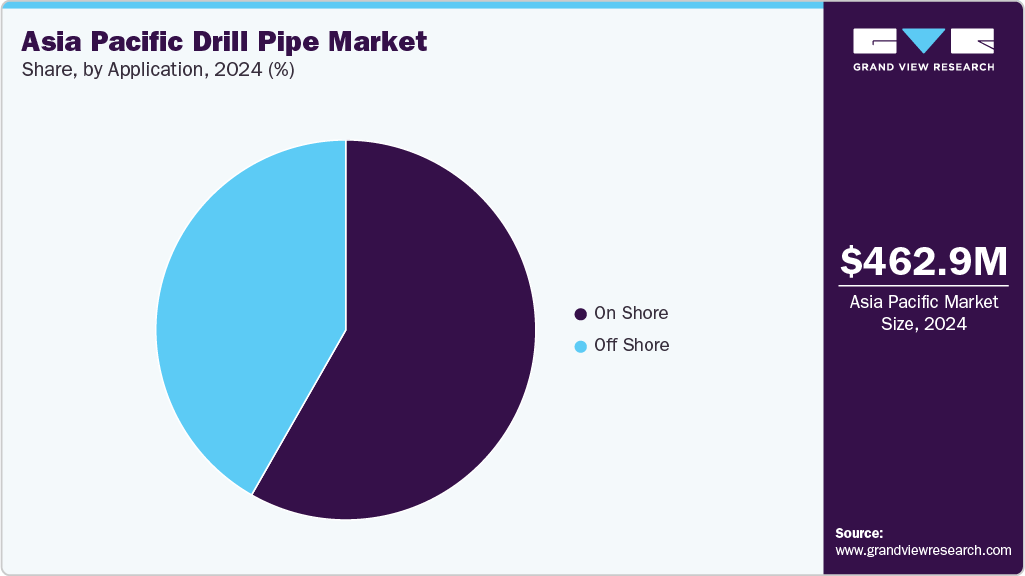

- By application, the On Shore segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 462.91 Million

- 2033 Projected Market Size: USD 874.51 Million

- CAGR (2025-2033): 7.2%

- South East Asia: Largest market in 2024

- South Asia: Fastest growing market

The region’s growing energy demand and increased investments in unconventional reserves and deepwater projects fuel the need for durable and high-performance drill pipes.Furthermore, the ongoing transition toward cleaner fuels and energy security initiatives is prompting state-owned and private energy companies to optimize domestic hydrocarbon production. Major regional oilfield service providers invest in lightweight, corrosion-resistant, high-tensile drill pipes to enhance drilling performance in challenging environments.

However, fluctuating crude oil prices and environmental regulations may restrain market expansion. Despite these challenges, government-backed upstream investments, new offshore licensing rounds, and regional collaboration in E&P technology development will strengthen the Asia Pacific drill pipe market outlook over the coming years.

Drivers, Opportunities & Restraints

The Asia Pacific drill pipe market is primarily driven by the region’s growing oil and gas exploration and production (E&P) activities, supported by rising energy demand and government initiatives to strengthen domestic output. Countries such as China, India, Indonesia, and Australia are increasing drilling operations across conventional and unconventional reserves, including shale and coal-bed methane. The growing focus on deepwater and ultra-deepwater projects, particularly in offshore basins, has intensified the demand for high-strength, fatigue-resistant drill pipes capable of withstanding extreme pressure and temperature conditions. Additionally, advancements in drilling technologies such as extended-reach, directional, and horizontal drilling boost productivity and drive the adoption of premium-grade drill pipes with enhanced torsional and tensile properties.

Opportunities in the Asia Pacific emerge from the rapid technological evolution and material innovation in pipe manufacturing, including composite and aluminum alloys that improve performance and reduce weight. Increasing foreign direct investments (FDI) in offshore projects and rising collaborations between national oil companies (NOCs) and international service providers create a favorable business environment. Furthermore, government-led initiatives to enhance energy independence and expand upstream exploration licenses offer long-term prospects for market expansion. However, the market faces notable restraints such as volatile crude oil prices, environmental regulations limiting new drilling activities, and the high costs associated with premium drill pipe grades. Supply chain disruptions, especially for specialty steel and alloy components, pose challenges. Addressing these issues through localized production, technological partnerships, and sustainable drilling practices will be crucial for maintaining steady growth across the Asia Pacific drill pipe market.

Grade Insights

The Asia Pacific drill pipe industry is segmented based on grade into E-75, X-95, G-105, S-135, and others. Among these, G-105 accounted for the largest market share of 31.29% in 2024, owing to its optimal balance between strength, durability, and cost-effectiveness. G-105 grade drill pipes are widely used in onshore and offshore drilling operations across the region, particularly in medium-depth wells and challenging geological formations. Their superior fatigue resistance and high tensile strength make them a preferred choice for directional and horizontal drilling applications, which are increasingly adopted in countries such as China, India, and Indonesia to maximize resource recovery.

The growing number of offshore exploration projects in the South China Sea, the Bay of Bengal, and Australian basins further drives demand for G-105 grade pipes due to their ability to withstand high torque and bending stresses. In addition, their compatibility with various drill string components and cost advantages over higher-grade alternatives like S-135 make them a practical choice for operators seeking to optimize drilling efficiency without incurring excessive expenditure. As regional E&P activities expand and drilling operations move toward more complex environments, the demand for G-105 grade drill pipes will remain robust, maintaining their dominant position throughout the forecast period.

Outside Diameter Insights

Based on outside diameter, the market is segmented into <3", 3"-3 1/2", 3 1/2"-4", 4"-4 1/2", and >4 1/2". Among these, the 3 1/2"-4" segment accounted for the largest market share of 45.33% in 2024, primarily due to its extensive use in both onshore and offshore drilling applications. This diameter range offers the ideal balance between strength, weight, and flexibility, making it well-suited for a wide range of drilling depths and well types, including directional and horizontal wells. The segment’s dominance is also attributed to its compatibility with a variety of drilling rigs and tools, allowing operators to achieve higher drilling efficiency and lower operational costs.

The rising number of oil and gas projects across China, India, Indonesia, and Australia has further boosted demand for 3 1/2"-4" drill pipes, as they are commonly used in mid-depth wells that dominate the region’s exploration portfolio. In offshore environments, this diameter range provides sufficient torsional capacity to withstand harsh drilling conditions while maintaining structural integrity. Moreover, increasing adoption of high-grade materials and advanced friction-welded tool joints in this diameter range enhances durability and fatigue resistance, ensuring longer service life and reduced maintenance costs. As E&P companies continue to modernize drilling fleets and optimize well design, the 3 1/2"-4" segment is expected to maintain its leadership position in the Asia Pacific drill pipe market over the coming years.

Connection Type Insights

Based on connection type, the industry is segmented into API Connections and Premium Connections. Among these, API Connections accounted for the largest market share of 58.66% in 2024, owing to their widespread standardization, cost-effectiveness, and compatibility across a broad range of drilling applications. API (American Petroleum Institute) connections are extensively used in both onshore and offshore drilling operations due to their proven reliability, ease of maintenance, and availability. These connections meet established performance standards for tensile strength, torque capacity, and pressure handling, making them a preferred choice among operators seeking dependable and affordable solutions for conventional and mid-depth wells.

The dominance of API connections in the Asia Pacific market is further supported by the high volume of conventional drilling projects in countries such as China, India, Indonesia, and Malaysia, where cost optimization remains a key priority. Their straightforward design and ease of replacement reduce downtime, contributing to improved operational efficiency and reduced maintenance costs. While premium connections are gaining traction for deepwater and high-pressure drilling environments, API connections continue to hold a competitive edge in terms of accessibility, versatility, and lower capital requirements. As regional drilling activities expand and operators focus on maximizing cost-performance balance, the API connection segment is expected to maintain its leadership position in the Asia Pacific drill pipe market over the forecast period.

Application Insights

Based on application, the Asia Pacific market is segmented into onshore and offshore. Among these, the onshore segment accounted for the largest market share of 58.26% in 2024, driven by the extensive exploration and production activities across onshore oil and gas fields in countries such as China, India, Indonesia, and Australia. Onshore drilling operations dominate the region due to the relative ease of access, lower operational costs, and the abundance of conventional and unconventional hydrocarbon reserves. Drill pipes used in onshore applications are often designed for medium-depth wells and directional drilling, offering a balance between durability, cost-efficiency, and performance.

The prominence of the onshore segment is further supported by government initiatives to increase domestic energy production, coupled with rising energy demand in rapidly urbanizing and industrializing areas. Onshore projects allow operators to deploy standard-grade pipes like G-105 with API connections efficiently, optimizing drilling speed and minimizing downtime. While offshore projects require high-specification premium pipes to withstand deepwater and harsh marine conditions, onshore drilling continues to account for most of the pipe consumption in the Asia Pacific region. As upstream investments and land-based exploration expand, the onshore application segment is expected to maintain its leadership position in the drill pipe market over the forecast period.

Country Insights

The Southeast Asia drill pipe industry accounted for the largest share of 24.08% in 2024, driven by active exploration in countries such as Indonesia, Malaysia, and the Philippines. Offshore and onshore drilling activities, particularly in the South China Sea and the Malay Basin, create strong demand for medium—and high-grade drill pipes. Rising upstream investments, government-backed E&P incentives, and collaborations with international service providers support market growth in the region.

South Asia Drill Pipe Market Trends

The South Asia drill pipe industry growth is primarily fueled by increased onshore drilling activities in India and Bangladesh, which focus on conventional oil and gas fields. The region benefits from government initiatives to boost domestic production combined with expanding infrastructure for natural gas and petroleum development. The demand for standard-grade pipes like G-105 with API connections remains high to optimize drilling efficiency and cost-effectiveness.

Oceania Pacific Drill Pipe Market Trends

The drill pipe industry in the OceaniaPacific, particularly in Australia, is witnessing growth due to offshore and onshore hydrocarbon exploration projects, including deepwater gas fields and unconventional reserves. Investment in premium-grade drill pipes for challenging drilling conditions supports market expansion, while strong regulatory oversight ensures high safety and operational standards.

East Asia Pacific Drill Pipe Market Trends

The East Asia drill pipe industry, led by Japan and China, contributes significantly to the regional market through onshore and offshore drilling projects. China dominates with large-scale E&P projects and domestic drilling operations, while Japan focuses on deepwater exploration and the modernization of its drilling infrastructure. Adopting high-strength, corrosion-resistant drill pipes enables operators to optimize drilling performance in technically complex environments.

Key Asia Pacific Drill Pipe Company Insights

Some of the key players operating in the market include Tenaris S.A., National Oilwell Varco (NOV), TMK Group, Vallourec S.A., Hilong Group, and Jindal Saw Ltd. (Drill Pipe International), among others. These companies are recognized for their strong manufacturing capabilities, extensive regional presence, and technological expertise in producing high-strength, corrosion-resistant, and premium-grade drill pipes suitable for both onshore and offshore oil and gas operations.

- In February 2024, Tenaris S.A. launched a new line of high-strength, corrosion-resistant G-105 drill pipes designed for both onshore and offshore applications in the Asia Pacific region. The pipes feature advanced metallurgy and fatigue-resistant tool joints, enhancing durability and performance in deepwater and directional drilling operations. This launch is aimed at supporting growing exploration and production activities in countries such as China, India, and Indonesia, while improving operational efficiency and reducing downtime in challenging drilling environments.

Key Asia Pacific Drill Pipe Companies:

- Tenaris S.A.

- National Oilwell Varco (NOV)

- TMK Group

- Vallourec S.A.

- Hilong Group

- Drill Pipe International LLC (Jindal Saw Ltd.)

- Tejas Tubular Products, Inc.

- Texas Steel Conversion, Inc.

- DP Master Manufacturing Pvt. Ltd.

- Jiangyin Long Bright Drill Pipe Manufacture Co. Ltd.

Asia Pacific Drill Pipe Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 501.18 million

Revenue forecast in 2033

USD 874.51 million

Growth rate

CAGR of 7.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025-2033

Quantitative Units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

grade, outside diameter, connection type, application, country

Regional scope

Oceania; East Asia; South Asia; Southeast Asia

Country scope

Indonesia; Malaysia; Thailand; Vietnam; Singapore; Philippines; Brunei; India; Pakistan; Myanmar; Australia; New Zealand; Japan

Key companies profiled

Tenaris S.A.; National Oilwell Varco (NOV); TMK Group; Vallourec S.A.; Hilong Group; Drill Pipe International LLC (Jindal Saw Ltd.); Tejas Tubular Products, Inc.; Texas Steel Conversion, Inc.; DP Master Manufacturing Pvt. Ltd.; Jiangyin Long Bright Drill Pipe Manufacture Co. Ltd.Bottom of Form

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Drill Pipe Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Asia Pacific drill pipe market report on the basis of grade, outside diameter, connection type, application, and country.

-

Grade Outlook (Revenue, USD Million, 2021 - 2033)

-

E-75

-

X-95

-

G-105

-

S-135

-

-

Outside Diameter Outlook (Revenue, USD Million, 2021 - 2033)

-

2 3/8” - 2 7/8”

-

3 1/2” - 4”

-

4 1/2” - 6 5/8”

-

-

Connection Type Outlook (Revenue, USD Million, 2021 - 2033)

-

API Connections

-

Premium Connections

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

On Shore

-

Off Shore

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Asia Pacific

-

Indonesia

-

Malaysia

-

Thailand

-

Vietnam

-

Singapore

-

Philippines

-

Brunei

-

India

-

Pakistan

-

Myanmar

-

Australia

-

New Zealand

-

Japan

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific drill pipe market size was estimated at USD 462.91 million in 2024 and is expected to reach USD 501.18 million in 2025.

b. The Asia Pacific drill pipe market is expected to grow at a compound annual growth rate of 7.2 % from 2025 to 2033 to reach USD 874.51 million by 2033.

b. The Onshore segment accounted for the largest share of 58.26% of the Asia Pacific drill pipe market in 2024, driven by widespread exploration and production activities across countries such as India, China, and Indonesia.

b. Some of the key vendors in the Asia Pacific drill pipe market include Tenaris S.A., National Oilwell Varco (NOV), TMK Group, Vallourec S.A., Hilong Group, Drill Pipe International LLC (Jindal Saw Ltd.), Tejas Tubular Products, Inc., Texas Steel Conversion, Inc., DP Master Manufacturing Pvt. Ltd., and Jiangyin Long Bright Drill Pipe Manufacture Co. Ltd.

b. The key factors driving the growth of the Asia Pacific drill pipe market include the rising demand for domestic oil and gas production, expansion of onshore and offshore exploration activities, and the adoption of advanced drilling technologies such as directional and horizontal drilling.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.