- Home

- »

- Power Generation & Storage

- »

-

Asia Pacific Hydrogen Energy Storage Market, Industry Report, 2030GVR Report cover

![Asia Pacific Hydrogen Energy Storage Market Size, Share & Trends Report]()

Asia Pacific Hydrogen Energy Storage Market Size, Share & Trends Analysis Report By Technology (Compression, Liquefaction), By Physical State (Solid, Liquid, Gas), By Application (Residential, Commercial), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-254-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

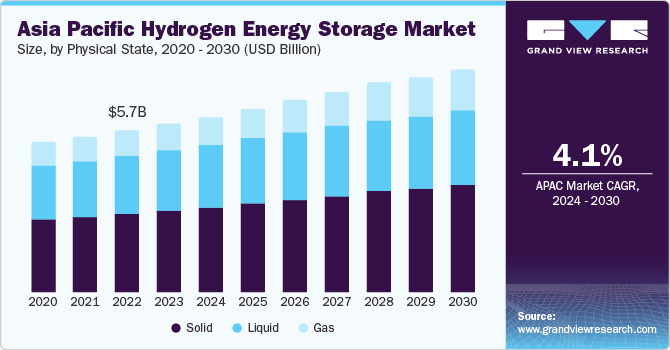

The Asia Pacific hydrogen energy storage market size was estimated at USD 5.98 billion in 2023 and is expected to grow at a CAGR of 4.1% from 2024 to 2030. This growth is attributed to the surge in demand for hydrogen production from a variety of industrial users in several key countries in this region is noteworthy. The high concentration of refineries in China and India has propelled the use of hydrogen energy storage in these areas. Moreover, the government of Japan and Australia are exploring more environmentally friendly and cleaner methods for hydrogen production, which is fueling market growth.

Hydrogen energy storage is an alternative form of chemical energy storage where electrical power is transformed into hydrogen. This stored energy can be released by using hydrogen gas as fuel in a combustion engine or a fuel cell. Hydrogen can be generated from electricity through the electrolysis of water, a straightforward process that can be executed with relatively high efficiency if inexpensive power is available. The produced hydrogen then needs to be stored, potentially in underground caverns for large-scale energy storage, while steel containers can be utilized for smaller-scale storage. Hydrogen storage is a crucial technology for the progression of hydrogen and fuel cell technologies in applications such as stationary power, portable power, and transportation. Hydrogen possesses the highest energy per mass of any fuel; however, its low density at ambient temperature results in a low energy per unit volume, thus necessitating the development of advanced storage methods with higher energy density potential.

In addition, the government's increased spending on various technologies aimed at enhancing the efficiency of hydrogen extraction is anticipated to propel market growth. The market's growth is expected to be spurred by a growing focus on distributed power and utility projects. Over the forecast period, the demand for electricity in the region is expected to rise to about two-thirds of its current level.

Furthermore, the rapidly increasing demand for fuel cell electric vehicles (FCEVs), including passenger vehicles, buses, trucks, and other heavy-duty vehicles, is expected to stimulate industry demand. In addition, the introduction of various incentive programs designed to lower sulfur levels in engine oil, diesel-powered vehicles, and gasoline will contribute to the demand in the automotive sector.

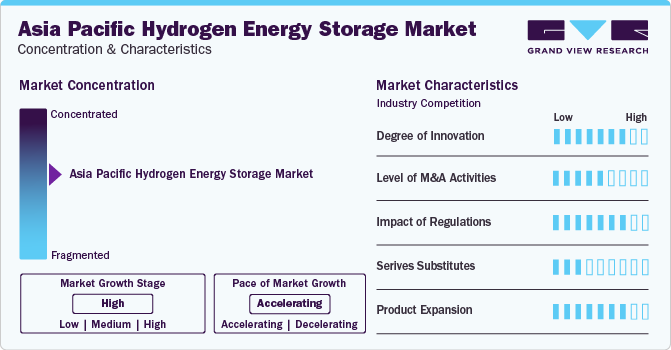

Market Concentration & Characteristics

The Asia Pacific hydrogen energy storage market is marked by a high level of innovation. Due to continuous technological developments and research activities targeted at enhancing the efficiency, scalability, and cost-effectiveness of hydrogen storage solutions, the market exhibits a high degree of innovation. The industry is expanding due to innovations such as cutting-edge electrolysis technologies, unique storage materials, and integrated systems.

The market is experiencing a moderate amount of merger and acquisition activity. Even while there have been some noteworthy alliances and joint ventures amongst businesses to capitalize on complementary advantages and broaden their market penetration, overall M&A activity is not as high as it may be in certain other sectors of the economy. This is caused in part by the market's infancy as well as the emphasis on technological advancement and market penetration.

The market is highly impacted by regulations. Market dynamics are significantly influenced by government policies, incentives, and laws on carbon emissions reduction, targets for renewable energy, and support for the development of hydrogen infrastructure. While regulatory uncertainty or impediments might obstruct progress, the establishment of supportive legislation can stimulate market growth.

There aren't many alternatives to hydrogen energy storage services. While there are alternative energy storage technologies, such as pumped hydro storage and lithium-ion batteries, they might not be as versatile, scalable, or long-lasting as hydrogen storage options. As a result, there is less direct competition from alternatives in the market.

The market is characterized by several major trends, including product expansion as businesses work to develop and commercialize a wide range of storage solutions that are suited to various applications and market segments. To meet the various needs of businesses including transportation, power generation, and industrial sectors, this comprises developments in hydrogen production, storage, distribution, and use technologies.

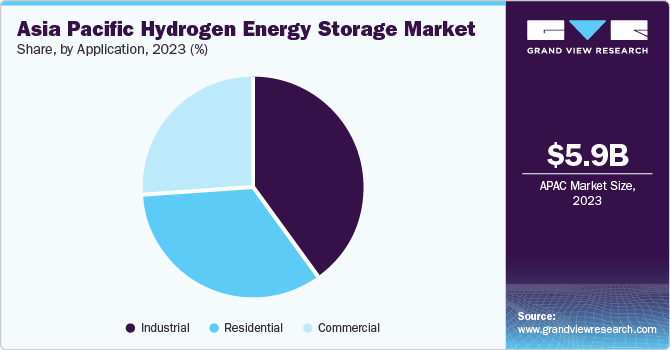

Application Insights

The industrial segment accounted for the largest market share of 40.6% in 2023. Hydrogen is increasingly being utilized in various industrial sectors such as petroleum refining, methanol production, and metal treatment. The need for hydrogen is particularly high in petroleum refining to reduce sulfur content in fuels. The expansion of these industrial applications is anticipated to significantly propel the market growth. Moreover, due to rising environmental concerns over the use of oil & gas, which contribute to carbon emissions, hydrogen is being adopted as a fuel for industrial applications, thus stimulating the growth of this segment and the market as a whole.

The residential segment accounted for a substantial market share in 2023, due to the existence of favorable policies and subsidy programs for the installation of fuel cell systems in residential settings in the region. In addition, the market is being driven by the launch of innovative hydrogen energy storage systems for residential use. For instance, Doosan Bobcat, a subsidiary of Doosan Group, unveiled its first hydrogen forklift at an event at its Incheon forklift factory. This 3-ton model hydrogen fuel cell forklift from Doosan Bobcat, equipped with a 20-kW fuel cell, is scheduled for delivery to the Korea Zinc’s Onsan refinery in Ulsan, Korea. While hydrogen fuel cell forklift prototypes have been showcased in the industry before, Doosan Bobcat is the first to finalize development and have a market-ready product for shipment.

Technology Insights

The compression segment held the largest market share of 45.3% in 2023. This growth is attributed to the broad use of compressed hydrogen across various sectors. Compressed hydrogen is used in stationary power generation on-site, hydrogen refueling stations, and fuel cell vehicles for road transport. In addition, compression technology is employed to store hydrogen in cylinders for industrial use in the manufacturing and chemical sectors. The demand for compression technology is projected to increase in the coming years due to the growing deployment of hydrogen refueling stations and fuel cell vehicles, including passenger cars, trucks, buses, and material-handling vehicles.

The liquefaction segment experienced significant growth in 2023. Liquefaction technology is favored by major industrial gas suppliers such as Linde, Air Liquide, and Air Products & Chemicals Inc. for transporting hydrogen in bulk to industrial end-users such as the oil & gas and chemical industries. Industrial end-users who need large quantities of hydrogen for their industrial processes choose liquefaction technology.

Physical State Insights

The solid state accounted for the largest market share of 48.8% in 2023 owing to current research and development efforts underway to enhance the viability of solid-state hydrogen storage for large-scale hydrogen storage in the future. Solid-state hydrogen storage, where hydrogen is stored within another substance, is a burgeoning field in the hydrogen energy storage sector. This storage method involves hydrogen being absorbed or adsorbed by a material.

Liquid state storage held a substantial portion of the market in 2023 due to its advanced technique of storing hydrogen in compact containers and transforming hydrogen gas into a liquid state through intense cooling. The application of liquid hydrogen storage is primarily limited to specialized high-tech areas such as large-scale industrial storage and space exploration.

Country Insights

China Hydrogen Energy Storage Market Trends

The China hydrogen energy storage market dominated the Asia Pacific market and accounted for the largest revenue share of 37.7% in 2023. China is currently experiencing a significant shift in its fuel and petroleum sector to address various issues, including environmental pollution and the economic gap between urban and rural communities. The country is also grappling with the challenges of air pollution and rising levels of sulphur in the environment.

Japan Hydrogen Energy Storage Market Trends

The hydrogen energy storage market in Japan held a substantial share in 2023, due to the country's long-term objective of reducing CO2 emissions by 80% from 2013 levels by 2050. Japan is also making strides in the development and commercialization of fuel-cell trucks and the conversion of passenger ships into fuel-cell-powered vessels. Moreover, the widespread use of the household fuel cell, ENE-FARM, is largely due to government subsidies. These advancements are expected to propel the growth of the hydrogen energy storage market in the country in the coming years.

India Hydrogen Energy Storage Market Trends

The India hydrogen energy storage market saw considerable growth in 2023, largely due to the numerous refineries that use hydrogen in various processes. In addition, the Indian government is focused on enhancing the country's hydrogen infrastructure, and it is anticipated that several government initiatives related to hydrogen infrastructure will be launched in the future. These factors are expected to drive the growth of the hydrogen energy storage market in India.

Key Asia Pacific Hydrogen Energy Storage Company Insights

A complex ecosystem of stakeholders with varying degrees of expertise and market presence characterizes the entire market landscape. Even though certain significant businesses dominate certain segments or areas, there are also few startups and small players in the sector focusing on innovation and growth.

Key players in the market include Taiyo Nippon Sanso Corporation, and Adani Green Energy Ltd.

-

Taiyo Nippon Sanso Corporation is a multifaceted company that operates in four key areas: industrial gases, electronics-related products, medical, and energy. It is known for its wide array of industrial gases, including but not limited to carbon dioxide, hydrogen, helium, LPG, and acetylene.

-

Adani Green Energy Ltd., one of India's largest renewable energy companies, boasts a project portfolio of 20,434 MW. As part of the Adani Group's commitment to a cleaner, greener future for India, AGEL adheres to the Group's philosophy. The company is involved in the development, construction, ownership, operation, and maintenance of utility-scale grid-connected solar and wind farm projects.

Iwatani Corporation, and Japan Suiso Energy, Ltd are other participants operating in the Asia Pacific Hydrogen Energy Storage market.

-

Iwatani Corporation is primarily an energy company that supplies industrial gases such as hydrogen, portable gas stoves, LPG, among others. It has diversified its operations into several other sectors such as agri-bio & foods, materials, machinery, welding, and electronic equipment.

Key Asia Pacific Hydrogen Energy Storage Companies:

- Taiyo Nippon Sanso Corporation

- Iwatani Corporation

- Adani Green Energy Ltd.

- GAIL

- Sunshine Hydro.

- Japan Suiso Energy, Ltd

- Toshiba Fuel Cell Power Systems Corporation.

- LG Energy Solutions.

- Doosan Fuel Cell Co., Ltd.

- SPIC Hydrogen Energy Tech

Recent Development

-

In March 2024, According to three internal sources, GAIL (India) Ltd, a government-owned natural gas corporation, declared its intention to launch its first green hydrogen initiative in the heart of India by April. The venture is situated at the Vijaipur facility in Madhya Pradesh and will be equipped with a 10-megawatt proton exchange membrane electrolyzer imported from Canada. The goal of this unit is to generate around 4.3 metric tons of hydrogen each day, with a volume purity level of approximately 99.999%, using renewable energy resources.

-

In October 2023, Taiyo Nippon Sanso and Toho Gas Co., Ltd. joined forces in the hydrogen sector to advance carbon neutrality goals. Toho Gas is establishing a hydrogen production facility at its Chita-Midorihama site to create a hydrogen supply network supporting carbon neutrality. This partnership encompasses using infrastructure for hydrogen distribution and procuring hydrogen during plant inspections. Toho Gas is strategically positioning itself to become a local hydrogen provider. Taiyo Nippon Sanso will acquire a portion of the hydrogen from the plant, collaborating with Chita Kouatsu Gas Co., Ltd. to enhance hydrogen sales outreach. This collaboration aims to drive initiatives for carbon neutrality and foster a sustainable society.

Asia Pacific Hydrogen Energy Storage Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.24 billion

Revenue forecast in 2030

USD 7.93 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, physical state, application, country

Regional Coverage

Asia Pacific

Country Coverage

China; India; Japan; South Korea; Australia

Key companies profiled

Taiyo Nippon Sanso Corporation; Iwatani Corporation; Adani Green Energy Ltd.; GAIL; Sunshine Hydro.; Japan Suiso Energy, Ltd; Toshiba Fuel Cell Power Systems Corporation.; LG Energy Solutions.; Doosan Fuel Cell Co., Ltd.; SPIC Hydrogen Energy Tech.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Hydrogen Energy Storage Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific hydrogen energy storage market report based on technology, physical state, and application.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Compression

-

Liquefaction

-

Material Based

-

-

Physical State Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid

-

Liquid

-

Gas

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific hydrogen energy storage market was valued at USD 5.98 billion in the year 2023 and is expected to reach USD 6.24 billion in 2024.

b. The Asia Pacific hydrogen energy storage market is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 7.93 billion by 2030.

b. The Solid state accounted for the largest market share of 48.8% in 2023 owing to current research and development efforts underway to enhance the viability of solid-state hydrogen storage for large-scale hydrogen storage in the future.

b. The key market player in the Asia Pacific hydrogen energy storage market includes TAIYO NIPPON SANSO CORPORATION; Iwatani Corporation; Adani Green Energy Ltd.; GAIL; Sunshine Hydro.; Japan Suiso Energy, Ltd; Toshiba Fuel Cell Power Systems Corporation.; LG Energy Solutions.; Doosan Fuel Cell Co., Ltd.; SPIC Hydrogen Energy Tech.

b. The key factors that are driving the Asia Pacific hydrogen energy storage market include, the surge in demand for hydrogen production from a variety of industrial users in several key countries in this region is notable. The high concentration of refineries in China and India has propelled the use of hydrogen energy storage in these areas.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."