- Home

- »

- Renewable Energy

- »

-

Hydrogen Energy Storage Market Size & Share Report, 2030GVR Report cover

![Hydrogen Energy Storage Market Size, Share & Trends Report]()

Hydrogen Energy Storage Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Compression, Liquefaction), By Physical State (Solid, Liquid, Gas), By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-711-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrogen Energy Storage Market Summary

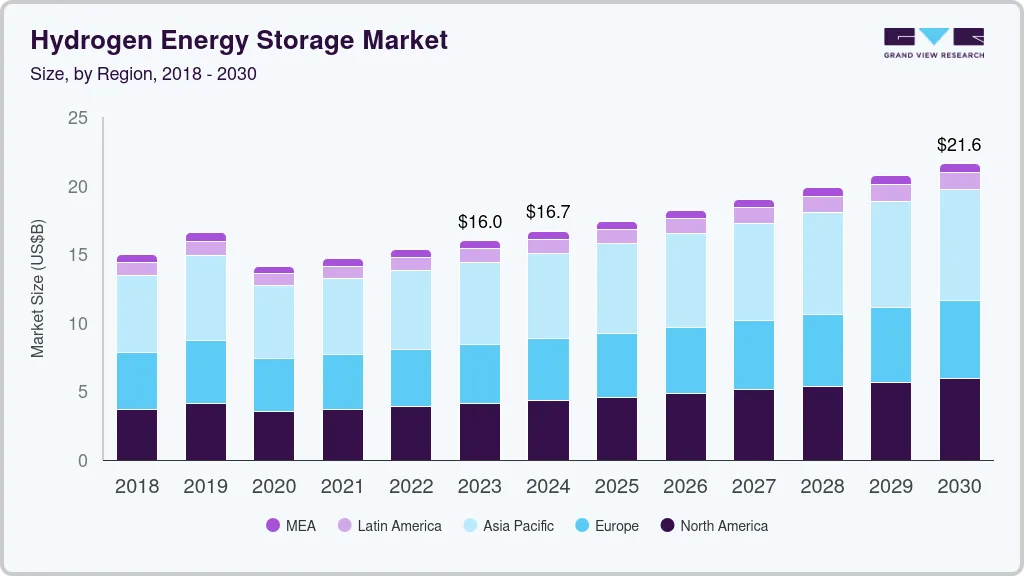

The global hydrogen energy storage market size was estimated at USD 15.9 billion in 2023 and is projected to reach USD 21.66 billion by 2030, growing at a CAGR of 4.5% from 2024 to 2030. The growth can be primarily attributed to the swift industrialization of developing countries and the increasing acceptance of alternative forms of energy.

Key Market Trends & Insights

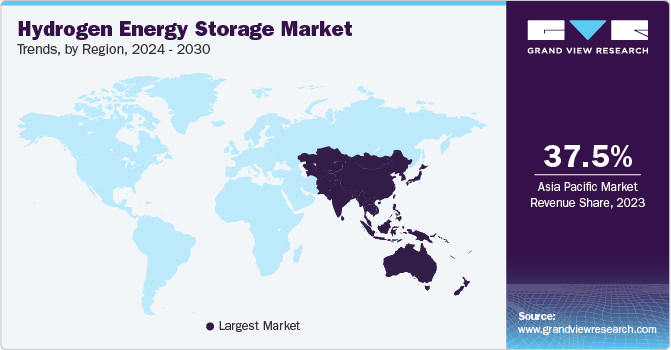

- Asia Pacific region held the largest revenue share of over 37.48% in 2023.

- By technology, the compression storage technology segment accounted for the largest revenue share of over 40.0% in 2023.

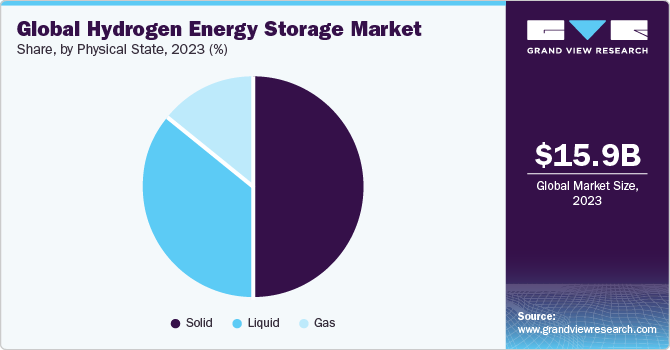

- By physical state, the solid segment held the largest revenue share of around 50.0% in 2023.

- By application, the industrial application segment held the largest revenue share of over 40.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 15.9 Billion

- 2030 Projected Market Size: USD 21.66 Billion

- CAGR (2024-2030): 4.5%

- Asia Pacific: Largest market in 2023

The U.S. market is projected to witness significant growth over the forecast period owing to ongoing research & development and construction of full-scale storage projects. The Hydrogen Fueling Infrastructure Research and Station Technology (H2FIRST) is a part of the initiative undertaken by the Fuel Cell Technologies Office, based on prevalent and upcoming technologies at national labs.

The development and construction of cost-effective and energy-saving hydrogen stations across the U.S. are among the key objectives planned by the government. Such factors are expected to boost market growth in the U.S. Increased hydrogen applications across a variety of industries are predicted to fuel market expansion. Hydrogen, for example, can be used for industrial applications in oil refineries, power generation in stationary fuel cells, as a fuel in fuel cell vehicles, and stored as a cryogenic liquid, compressed gas, or loosely bonded hydride chemical compound.

According to the International Renewable Energy Agency (IRENA), for renewable hydrogen to be competitive with fossil fuel-produced hydrogen, it should be generated at less than USD 2.5 per kg. Cost is determined by a number of factors, including the location of production, market segment, renewable energy power tariffs, future electrolyzer investments, and others. Because of the low cost of hydrogen manufacturing, more energy storage systems will be deployed. Industry participants are substantially forward-integrated. The demand for stored hydrogen in a variety of applications, including fuel cell automobiles, grid services, and telecommunications, is forcing market players to integrate their facilities with end-use industries.

Market Dynamics

Various government policies are ongoing to support hydrogen as a fuel. The European Commission announced its strategy for the development of green hydrogen. The European Commission has approved green hydrogen production, which reforms H2 from natural gas and captures carbon dioxide emissions through carbon capture and storage. In 2020, Engie successfully refueled its first renewable hydrogen passenger train for a pilot test in the Netherlands. Hydrogen-fueled train is expected to be introduced by 2024, wherein Engie and Alstom are expected to collaborate to develop hydrogen-fueled trains across the Netherlands. With this success, the company is likely to expand its solution further across other countries, wherein hydrogen trains can be deployed, leading to a high demand for hydrogen energy and its storage.

However, the slow development of distribution channels for transporting hydrogen in developing countries is a major hindrance to market growth. Merchant distribution channels are yet to witness growth in developing regions including Africa and parts of the Middle East. Scarce availability of hydrogen distributors in these regions has impacted the expansion of industries significantly, thereby, limiting packaging and supply of industrial gases. Irregular and uncertain supply of hydrogen deeply impacts industries dependent on it, thereby hampering numerous end-use industries.

Technology Insights

The compression storage technology segment accounted for the largest revenue share of over 40.0% in 2023. This can be attributed to the wide applications of compressed hydrogen in various sectors. Compressed hydrogen is utilized in on-site stationary power generation, hydrogen filling stations, and road transportation fuel cell vehicles. Furthermore, the compression technique is utilized to store hydrogen in cylinders for industrial applications in manufacturing and chemical industries.

Bulk industrial gas suppliers such as Linde, Air Liquide, and Air Products & Chemicals Inc. prefer liquefaction technology to deliver hydrogen in bulk to industrial end-users such as oil and gas and chemical industries. Liquefaction technology is used by industrial end-users who demand bulk hydrogen in their processes. Over the projection period, material-based storage technology segment is predicted to increase at a high rate. In comparison to other storage technologies, this technology includes hydride storage systems, liquid hydrogen carriers, and surface storage systems, all of which have a high volumetric storage density.

Physical State Insights

The solid segment held the largest revenue share of around 50.0% in 2023. Storage of hydrogen in solid form, i.e., stored in another material, is one of the emerging areas in the market. Methods for storing hydrogen in solid form include techniques involving absorption or adsorption mechanisms of hydrogen by a material.

Currently, storage of hydrogen in liquid form is being reserved for certain special applications, i.e., in high-tech areas such as space travel and for bulk storage applications at industrial levels. For example, tanks on the Ariane launcher, which are designed and manufactured by Air Liquide, contain 28 tons of liquid hydrogen, which provides fuel to the central engine.

Application Insights

The industrial application segment held the largest revenue share of over 40.0% in 2023. The use of hydrogen energy storage for residential applications is limited around the world. Countries such as Japan, Germany, France, and Belgium are strengthening their legislative frameworks, which are likely to catalyze the utilization of fuel cells in the residential applications for micro combined heat and power. For instance, Japan’s ENE-FARM program has fueled the adoption of fuel cell-based systems for use as fuel cell micro-cogeneration in residential sector.

The commercial application segment includes hydrogen refueling stations and micro-CHP fuel cell-based installation for commercial applications. A total number of hydrogen refueling stations around the world has more than doubled in the last five years from 181 in 2014 to more than 540 as of 2020. Continuous growth in deployment is led by the European and Asian regions.

Regional Insights

Asia Pacific region held the largest revenue share of over 37.48% in 2023. Asia Pacific market consists of major countries such as China, Japan, South Korea, India, Australia, and other Southeast Asian countries. Major countries such as Russia, Spain, Germany, Italy, UK, and smaller Eastern and Central European countries make up the European hydrogen energy storage industry. Enormous demand for hydrogen generation from a variety of end users, including industrial and commercial institutions, is to blame.

Large-scale hydrogen energy storage projects are being built across Europe, which is increasing market demand. For example, Orsted, a Danish corporation, plans to use excess wind farm electricity in the North Sea to manufacture renewable hydrogen energy via electrolysis and sell it to large commercial users. Due to rigorous pollution control rules, the use of cleaner fuels, and an increase in fuel cell applications, the market in North America is predicted to rise at a high rate.

Key Companies & Market Share Insights

Enhanced level of forward integration, strong research and development, security of renewable energy power supply, and cost of storage are among the significant factors driving the competitiveness of the hydrogen energy storage industry. In September 2023, India is expected to launch 100 MW of green hydrogen storage pilot project for round-the-clock power supply. The proposed project is set for an investment of USD 250 billion and shall offer significant economic development opportunities.

Key Hydrogen Energy Storage Companies:

- Air Liquide

- Air Products Inc.

- Cummins Inc.

- Engie

- ITM Power

- Iwatani Corporation

- Linde plc

- Nedstack Fuel Cell Technology BV

- Nel ASA

- Steelhead Composites Inc.

Hydrogen Energy Storage Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.67 billion

Revenue forecast in 2030

USD 21.66 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, physical state, application, region

Regional scope

North America; Europe; Asia Pacific; Central And South America; Middle East And Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; UK; Spain; Italy; France; China; Japan; South Korea; India; Australia; Brazil; Colombia; Paraguay; Saudi Arabia; UAE; South Africa; Egypt

Key companies profiled

Taiyo Nippon Sanso Corporation; Iwatani Corporation;Cummins Inc.; Nel ASA; Steelhead Composites Inc.; Air Products Inc.; Linde plc; Air Liquide; ITM Power; Nedstack Fuel Cell Technology BV; Engie; GKN Sinter Metals Engineering GmbH; PlugPower Inc.; Hygear

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

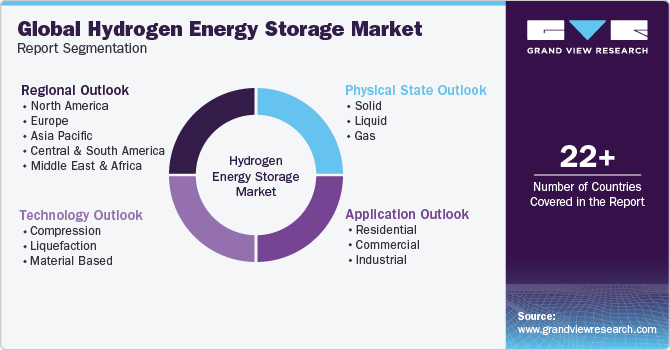

Global Hydrogen Energy Storage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hydrogen energy storage market report based on technology, physical state, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Compression

-

Liquefaction

-

Material Based

-

-

Physical State Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid

-

Liquid

-

Gas

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Colombia

-

Paraguay

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global hydrogen energy storage market size was estimated at USD 15.97 billion in 2023 and is expected to reach USD 16.67 billion in 2024.

b. The global hydrogen energy storage market is expected to grow at a compounded annual growth rate of 4.5% from 2024 to 2030 to reach USD 21.66 billion by 2030.

b. The Asia Pacific dominated the hydrogen energy storage market with the highest share of 37.48% in 2023. The presence of large market players, along with favorable government policies providing subsidies and financial incentives to PV projects are among the key factors contributing to the industry growth in China.

b. Some key players operating in the hydrogen energy storage market include Air Liquide, Linde, Air Products and Chemicals, ITM Power, Cummins, Chart Industries, Nel ASA, Plug Power among others.

b. Key factors driving the hydrogen energy storage market growth include wide application in mobile applications including vehicles for road transportation, stationary application for dispensing hydrogen at refueling stations, and at sites for stationary power generation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.