- Home

- »

- Pharmaceuticals

- »

-

Asia Pacific Insulin Market Size, Share, Industry Report 2030GVR Report cover

![Asia Pacific Insulin Market Size, Share & Trends Report]()

Asia Pacific Insulin Market (And Segment Forecasts 2024 - 2030) Size, Share & Trends Analysis Report By Product (Rapid-acting, Long-acting), By Type (Human Insulin, Insulin Analog), By Application (Type I Diabetes, Type II Diabetes), By Distribution, By Country

- Report ID: 978-1-68038-135-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Insulin Market Size & Trends

“2030 Asia Pacific insulin market value to reach USD 7.09 billion”

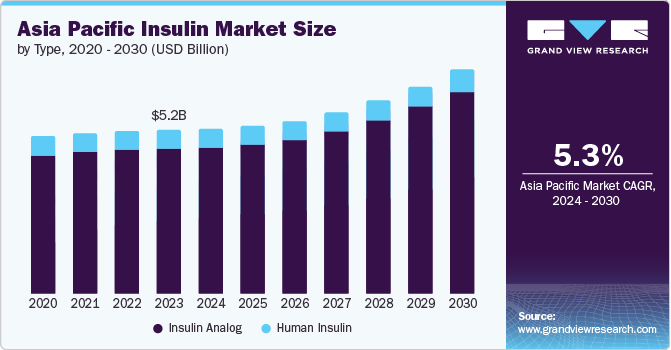

The Asia Pacific insulin market size was estimated at USD 5.18 billion in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. The rising prevalence of diabetes and increasing incidence of lifestyle-related disorders, such as obesity, are stimulating market growth in the region. Inadequate self-monitoring of blood sugar levels underscores the necessity for diabetic individuals to utilize insulin pumps and continuously monitor blood glucose levels for optimal disease management.

Over the last few decades, Asia has witnessed a sharp rise in the prevalence of diabetes, particularly in underdeveloped countries where more than 60% of diabetic patients are located. The International Diabetes Federation (IDF) reports that there are roughly 537 million diabetes patients aged between 20 and 79 years. By 2045, this number is forecasted to reach 783 million.

Technological advancements play a crucial role in driving market growth. A prime example is Medtronic, which has solidified its dominance in the Asia Pacific market by continuously innovating and enhancing its technology for insulin users. By providing patients with cutting-edge solutions and forging strategic partnerships, Medtronic has successfully positioned itself as the market leader. As a result, the Asia Pacific insulin market is expected to experience accelerated growth over the forecast period, fueled by intense competition from local market players.

Product Insights

“The other products segment is expected to witness growth at 52.2% CAGR”.

The long-acting segment dominated the regional market in 2023 with a share of 53.07%. This growth is primarily driven by the rising need for long-acting insulin due to applications in Type I diabetes and II diabetes across the region and the globe. However, geopolitical instability may affect the segment growth in several ways. With the emergence of political tensions and economic uncertainties in various parts of Asia, the healthcare budgets of many countries could face pressure. Consequently, the sales and adoption of newer and advanced insulin treatments may be negatively impacted. In addition, long-acting insulin will continue to be an indispensable treatment for diabetes patients worldwide due to its ease of usage.

The rapid-acting insulin segment held the second-largest share of 29.6% in 2023. The segment is experiencing significant growth due to the rising prevalence of diabetes in Asia Pacific. Moreover, increased R&D investments for human recombinant insulin are anticipated to fuel demand for insulin in diabetes management, thereby driving market growth.

Type Insights

“The insulin analog segment is expected to witness growth at 5.5% CAGR”.

In 2023, the insulin analog segment held the largest revenue share of 88.6%. Insulin analog is created to mirror the pancreas' natural insulin release pattern, effectively regulating the body's blood sugar levels. With multiple brands available, consumers have choices that offer flexibility and convenience. Moreover, they are associated with fewer serious side effects.

In 2023, the human insulin segment held a share of 11.34%. Human insulin is of utmost importance in attaining the desired level of glycemic control among elderly individuals. China and India have a large geriatric population, which is expected to be a positive driving factor for the market. Human insulin usage enables personalized treatment and accurate dosage modifications to cater to the unique requirements of aging patients, taking into account factors like age, medical background, kidney function, and overall well-being.

Continuous advancements in the manufacturing process, composition, and distribution techniques of synthetic human insulin have enhanced human insulin efficiency, safety, and ease of use. Innovative delivery systems like insulin pens and pumps have contributed to better patient adherence and results.

Application Insights

“The type II diabetes segment is expected to witness growth at 11.1% CAGR”

The market share for type I diabetes in the Asia Pacific region reached 79.03% in 2023. Type I diabetes application is further projected to experience substantial expansion as a result of the increasing incidence of type I diabetes in children and teenagers. This surge in prevalence is fueling the need for innovative treatment solutions and devices like insulin pens, pumps, and syringes, which offer greater convenience and efficacy in disease management.

In 2023, type II diabetes held a market share of 20.97% in the Asia Pacific region. Metabolism disorders and obesity are strongly linked to the widespread occurrence of type II diabetes, a common metabolic problem. Managing type II diabetes typically involves adopting lifestyle modifications, utilizing oral medications, and administering insulin. It is noteworthy that around 90% of people diagnosed with diabetes have type II diabetes. The World Health Organization (WHO) predicts that by 2030, type II diabetes will rank as the seventh leading cause of death.

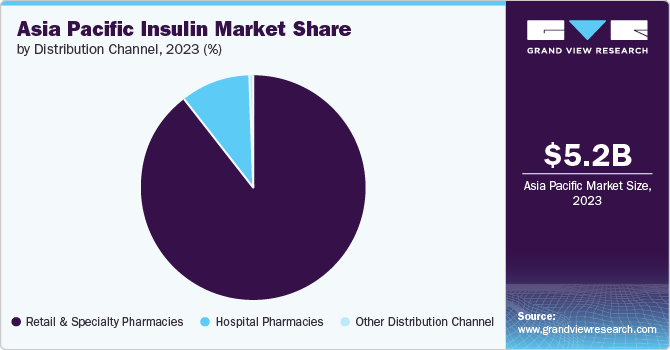

Distribution Channel Insights

“The other distribution channel segment is expected to witness growth at 7.8% CAGR”

The retail & specialty pharmacies segment led the market and accounted for a revenue share of 89.9% in 2023. Looking toward the future, these pharmacies are projected to experience substantial growth. The online pharmacies segment is forecasted to see an increase in activity due to the entry of large companies, such as Amazon and Walmart, and the introduction of more affordable insulin options.

The hospital pharmacies segment held the second-highest market share at 9.75% in 2023. The other distributional channels segment is also expected to gain significant market share in the coming years.

Country Insights & Trends

“China is expected to witness growth at 6.5% CAGR”.

Japan Insulin Market Trends

Japan dominated the Asia Pacific insulin market and held a share of 10.5% in 2023. This can be attributed to the substantial consumption of innovator brands within the country. The International Diabetes Federation (IDF) states that 11.8% of Japan's adult population is living with diabetes. To address this issue, the Japanese government has implemented several awareness campaigns and other health promotion programs.

China Insulin Market Trends

In 2023, China demonstrated its prominence by capturing a market share of 10.29%. Moreover, China bears the burden of housing the world's largest population affected by diabetes. The rising prevalence of diabetes, coupled with the avoidable morbidity, mortality, and substantial economic burden associated with the disease and its complications, presents a significant health challenge within the nation.

Key Asia Pacific Insulin Company Insights

In the Asia Pacific market, major players like Novo Nordick A/S, Sanofi, and Bicon Limited are actively working towards growing their customer base to stay ahead in the industry competition. This has led to the adoption of strategic initiatives, such as mergers, acquisitions, and collaborations, with other key companies. Multiple market players are prioritizing countries in Asia Pacific for geographic expansion and other business strategies. Consequently, the region boasts immense potential for insulin market players.

Key Asia Pacific Insulin Companies:

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi

- Biocon

- Boehringer Ingelheim International GmbH

- The United Laboratories International Holdings Ltd.

- Tonghua Dongbao Pharmaceutical Co. Ltd.

- Gan & Lee Pharmaceuticals

Recent Developments

-

In October 2023, Novo Nordisk, a pharmaceutical company headquartered in Denmark, released a statement regarding carrying out phase-III trials for their newest insulin injection, IcoSema, in India. The Drug Controller General of India (DCGI) authorized the company to assess the efficacy and safety of the new medication, which was designed to regulate blood sugar levels in individuals with type-two diabetes

-

In March 2023, Sanofi (India) received marketing approval from the Central Drugs Standard Control Organization (CDSCO) for its innovative long-acting insulin diabetes treatment, Soliqua

-

In April 2022, Biocon Biologics Ltd. (BBL), a subsidiary of Biocon Ltd. announced the successful acquisition of a three-year contract by its subsidiary, Biocon Sdn. Bhd. in Malaysia. This contract, valued at USD 90 million (MYR 375 million), was awarded by the Ministry of Health (MoH), Malaysia, for their highly regarded recombinant human insulin brand, Insugen

Asia Pacific Insulin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.21 billion

Revenue forecast in 2030

USD 7.09 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment coverage

Product, type, application, distribution, region

Country scope

China; Japan; India; South Korea; Australia; Singapore; Malaysia; Philippines; Thailand; Rest of Asia Pacific

Companies profiled

Novo Nordisk A/S; Eli Lilly and Company; Sanofi; Biocon; Boehringer Ingelheim International GmbH; The United Laboratories International Holdings Ltd.; Tonghua Dongbao Pharmaceutical Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Asia Pacific Insulin Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific insulin market report based on product, type, application, distribution, and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Insulin Analog

-

Human Insulin

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Type1 Diabetes

-

Type II Diabetes

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Rapid-acting Insulin

-

Long-acting Insulin

-

Combination Insulin

-

Biosimilar

-

Other Products

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail & Specialty Pharmacies

-

Other Distribution Channel

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Singapore

-

Philippines

-

Malaysia

-

Thailand

-

Rest of Asia Pacific

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.