- Home

- »

- Medical Devices

- »

-

Insulin Pens Market Size, Share And Growth Report, 2030GVR Report cover

![Insulin Pens Market Size, Share & Trends Report]()

Insulin Pens Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Reusable Insulin Pens, Disposable Insulin Pens), By End-use (Hospitals & Clinics, Homecare, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-302-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Insulin Pens Market Summary

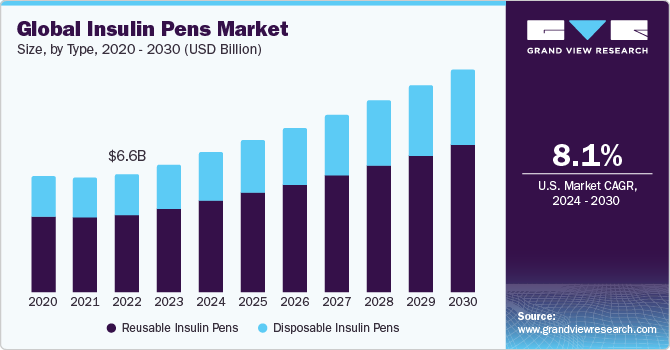

The global insulin pens market size was estimated at USD 7,176.0 million in 2023 and is projected to reach USD 12,414.3 million by 2030, growing at a CAGR of 8.1% from 2024 to 2030. The rise in the prevalence of diabetes globally has led to an increased demand for easy-to-use insulin delivery devices, such as insulin pens.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Kuwait is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, reusable accounted for a revenue of USD 4,700.9 million in 2023.

- Reusable is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 7,176.0 Million

- 2030 Projected Market Size: USD 12,414.3 Million

- CAGR (2024-2030): 8.1%

- North America: Largest market in 2023

These devices are preferred over traditional syringes and vials for their convenience, accuracy, and less painful injections. Furthermore, advancements in technology have led to the development of smart insulin pens, which can track dosage and timing, further enhancing patient compliance and control over their condition.

Growing awareness and education about diabetes management is encouraging patients to adopt more efficient and effective ways of insulin administration. In addition, government initiatives and support in various countries aim to make diabetes care more accessible and affordable, which includes the availability of insulin pens. These factors collectively contribute to the growth of the insulin pens market.

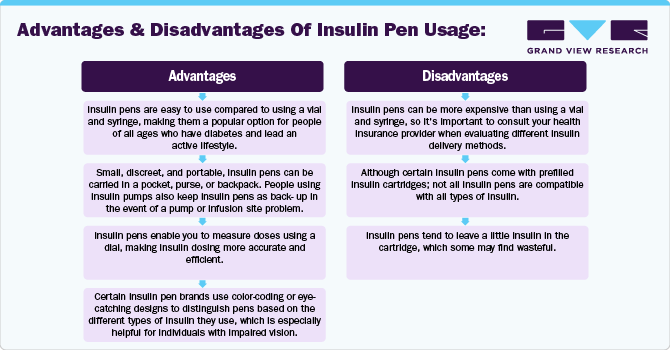

Insulin pens are preferred for managing diabetes as they offer several advantages over traditional insulin syringes and vials, including convenience, accuracy, improved quality of life, and better adherence to insulin therapy. These special characteristics have made them a preferred choice for many diabetes patients. Insulin pens are compact and discreet, making them easier to carry and use while on the go. Unlike drawing insulin from a vial with a syringe, which can be cumbersome and require a steady hand, insulin pens are ready to use and simplify the process of administering insulin. This is particularly beneficial for individuals with limited dexterity or visual impairments. Furthermore, insulin pens are designed to deliver precise doses, with adjustable settings that allow users to fine-tune their insulin intake. This precision reduces the risk of dosing errors, a common concern with traditional syringes where small measurement mistakes can lead to significant blood sugar fluctuations.

For instance, in March 2023, Diabeloop announced a partnership with Novo Nordisk during the Société francophone du diabète (SFD) congress in Montpellier, which took place from March 21-24. The collaboration initially focused on integrating Novo Nordisk's NovoPen 6 and NovoPen Echo Plus, the latest connected insulin pens, with Diabeloop's DBL-4penTM. This app provided personalized basal and bolus insulin recommendations for Type 1 and Type 2 diabetes patients on multiple daily injections. The NovoPen models, featuring dose memory and displaying last injection details, transferred data via NFC and were uniquely covered by France's public health insurance. The common dedication of both companies to deliver innovative diabetes management solutions to patients was the driving force behind the conclusion of this agreement.

“We are proud to be able to further expand our DBL-4penTM interoperability strategy with this collaboration with Novo Nordisk. Our collaboration aims to bring more automated solutions to people with diabetes, optimizing their outcomes and improving their quality of life. With DBL-4penTM, we have developed an efficient self-learning algorithm for insulin dose recommendation, a significant step forward for MDI therapy, and we are excited to explore this with the innovative generation of NovoPen®6 and NovoPen Echo® Plus connected insulin pens”

-Cécile Ferracci, CCO of Diabeloop.

Innovations in technology, including the development of smart insulin pens, caps, attachments, and digital platforms, present opportunities to address challenges in insulin management, such as adherence issues, inaccurate dosing, and medication errors. The integration of these advanced devices could see broader acceptance pending evidence from clinical trials demonstrating their cost-effectiveness over time. For instance, The German-based Pendiq Intelligent Diabetes Care developed an advanced digital insulin pen, Pendiq 2.0.

This product is designed to work with U-100 (3 mL) lispro and aspart rapid-acting insulin cartridges. It can log the latest 1,000 injections, recording the date, time, and amount. These logs are accessible through an OLED screen. Its Bluetooth functionality also facilitates data synchronization with the exclusive smartphone application, dialife, which is compatible with Android and iOS platforms. The device is accompanied by a USB cable, serving dual purposes such as data transfer to computers and battery recharge. Furthermore, Pendiq 2.0 incorporates a safety alert system that warns users of critical conditions such as depleted insulin reserves, low battery, or operational faults. Additionally, The YpsoMate SmartPilot by YpsoMed is a reusable part designed to complement the YpsoMate injection pen, facilitating a simplified two-step injection process. Equipped with sensors and memory capabilities, this device integrates with a dedicated application to monitor and display the timing and dosage of injections. The device includes a single-use sleeve designed for disposal. This product focuses on enhancing the injection procedure, offering auditory and visual feedback to the user.

In addition, the associated application serves as a reminder for scheduled injections. When shared with healthcare professionals, the data can be utilized to evaluate patient adherence and injection techniques, identifying any potential mishandling or incorrect administration of insulin. In conclusion, the innovation of insulin delivery mechanisms, including pens, caps, and attachments, presents significant opportunities for enhancing diabetes treatment practices. These innovations have the capacity to elevate patient compliance, streamline administration processes, and enhance the overall quality of care. Moreover, the integration of smart technology in these devices can play a crucial role in reducing the long-term financial burdens and health complications associated with diabetes, thereby optimizing the management of the condition.

Unlocking Affordable Diabetes Care: A Guide to Saving on Insulin Pens

Saving on insulin pens is crucial for those managing diabetes, as the cost can significantly impact one's budget. Insulin, a life-saving medication, is necessary for the daily management of diabetes. However, its high cost can burden individuals and families, making finding ways to reduce expenses vital. Several strategies to save on insulin pens include utilizing manufacturer savings programs, exploring insurance options, and considering pharmacy or retailer discounts. Manufacturer savings programs are a significant way to reduce insulin costs. Many pharmaceutical companies that produce insulin offer savings cards or discount programs for those who qualify. For instance,

“Novo Nordisk NovoCare Patient Support Program”: A global healthcare company with a significant focus on diabetes care, aimed at providing support and assistance programs to help patients manage the costs of their medications, including insulin. NovoCare aims to improve access to Novo Nordisk's medications through savings cards, patient assistance programs, and other resources. The key elements include:

-

Savings Cards: For eligible patients with commercial insurance, NovoCare offers savings cards that can reduce co-pays to as little as USD 25 per month for some of Novo Nordisk's insulin products. These savings cards are designed to make insulin more affordable for people who have insurance but still face high out-of-pocket costs.

-

Patient Assistance Program (PAP): This program is aimed at providing free medication to people who do not have insurance or who are underinsured and meet certain income and eligibility criteria. The PAP helps ensure that financial constraints do not prevent patients from accessing necessary medications.

-

My$99Insulin: Recognizing the need for more predictable insulin costs, Novo Nordisk offers a program where patients can purchase up to three vials or two packs of FlexPen/FlexTouch/PenFill cartridges for a flat fee of $99 per month, regardless of insurance status.

-

Human Drug Program: For patients who require medication that is not insulin, NovoCare's Human Drug Program offers assistance for other Novo Nordisk medications, ensuring comprehensive support beyond just diabetes care.

-

Online Resources and Tools: NovoCare.com provides a suite of online tools and resources to help patients understand their coverage options, find out which savings programs they might be eligible for, and apply for assistance.

Similarly, Eli Lilly has a savings program “Lilly Cares Foundation Patient Assistance Program”. It is a is a philanthropic initiative designed to assist patients in financial need to access their prescribed Eli Lilly and Company medications at no cost. The program operates by offering a 12-month supply of prescribed Lilly medications to eligible U.S. residents. This initiative is particularly beneficial for patients who lack insurance coverage or are underinsured and face financial difficulties. By alleviating the cost burden of medication, Lilly Cares helps ensure that patients can continue their treatment without financial stress interfering with their healthcare.

Furthermore, “Sanofi-Aventis Insulins Valyou Savings Program” is designed to help patients with diabetes manage their insulin costs more effectively. Under this program, eligible patients can purchase one or more Sanofi insulin products at a fixed price of USD 99 per month. This price applies regardless of the quantity of insulin used or needed, making it a valuable option for people requiring higher doses of insulin to manage their diabetes. This initiative reflects an effort to address the high cost of insulin in the U.S., providing a more affordable option for people living with diabetes.

Market Concentration & Characteristics

The insulin pens industry is relatively concentrated, with a few major pharmaceutical and medical device companies, such as Novo Nordisk A/S, Sanofi, Eli Lilly and Company, among others, dominating this space. These companies are characterized by their robust research and development capabilities, extensive distribution networks, and strong brand recognition. The industry is driven by the growing prevalence of diabetes globally, technological advancements, and the increasing preference for insulin pens over traditional methods due to their convenience and efficacy.

Innovation is a key driver in the insulin pens industry. Companies are continually developing new features and technologies to enhance the functionality of insulin pens. This includes improvements in dosing accuracy, ease of use, and the integration of digital technologies such as Bluetooth connectivity, allowing for data sharing with healthcare providers and better diabetes management. These innovations aim to improve the quality of life for people with diabetes by making insulin therapy more manageable and less intrusive. For instance, In November 2022, Eli Lilly and Company started rolling out its first connected platform, the Tempo Personalized Diabetes Management Platform, in the U.S. The technology aimed to assist adults living with type 1 or type 2 diabetes and clinicians in making informed, data-backed decisions to manage treatment with Lilly insulins. The platform consisted of three key components - the Tempo Smart Button, a compatible app, TempoSmart, and a prefilled insulin pen, Tempo Pen, which worked together to deliver personalized guidance for adults with diabetes. The U.S. Food and Drug Administration cleared the Smart Button on September 16. The compatible app was developed in partnership with Welldoc. It was a private-label iteration of the company's BlueStar, a diabetes management app customized to receive insulin dose-related data from the Tempo Smart Button.

"Lilly has over a century of knowledge of insulin and its complexities, and recognizes the emotional impact of managing diabetes1,2. Launching this platform is an opportunity for us to more broadly support those who rely on our insulins."

-said Kevin Cammack, Head of Connected Care, Lilly Diabetes.

The insulin pens industry has seen a fair level of merger and acquisition (M&A) activities as companies seek to strengthen their market position, expand their product portfolios, and leverage synergies. These activities enable companies to accelerate growth, enter new markets, and gain access to new technologies and expertise. M&A activities are also driven by the need to address the increasing competition and pricing pressures in the healthcare sector. For instance, in March 2024, MTD (Medical Technology and Devices) has declared its acquisition of the pen needle and blood glucose monitoring (BGM) divisions from Ypsomed. This key acquisition reinforces MTD's global leadership in the production of pen needles and broadens its extensive range of diabetes care solutions. As the world's second-largest pen needle producer, MTD will integrate Ypsomed's offerings, which include a pen needle and BGM portfolio. Ypsomed has been a prominent player in creating and manufacturing self-medication injection and infusion systems for four decades.

“This acquisition enables MTD to open new, strategic markets, such as Germany, expand into high growth markets like China and India and strengthen our position in other important markets such as North America and France, reinforcing our commitment to supporting millions of diabetic patients, caregivers, and healthcare professionals worldwide.”

-Charles Bouaziz, CEO of MTD

Regulations significantly impact the insulin pens industry. Regulatory bodies across different regions such as United States Food and Drug Administration (U.S. FDA), European Medicines Agency (EMA), Health Canada, Central Drugs Standard Control Organization (CDSCO) India impose stringent requirements on product approvals, manufacturing, and marketing. These regulations ensure the safety, efficacy, and quality of insulin pens. Furthermore, changes in regulatory policies can affect market dynamics, influencing factors such as market entry, competition, and product pricing.

Product approvals and new product launches are crucial for the growth and dynamism of the insulin pens industry. Companies invest heavily in research and development to bring innovative products to market that meet the evolving needs of patients. Regulatory approval is a key milestone that enables the commercialization of new insulin pens, and frequent product launches help companies maintain competitive advantage and market share. For instance, Sanofi (India) has obtained marketing approval from the CDSCO for its diabetes medication, Soliqua, available in pre-filled pens in March 2023. Designed for adults with type 2 diabetes and obesity who haven't seen sufficient control with other therapies, Soliqua enhances blood sugar levels alongside diet and exercise. It's administered once daily in a set combination (10-40 and 30-60) of insulin glargine and lixisenatide.

Regional expansion is a strategic focus for companies in the insulin pens industry as they aim to tap into emerging nations with growing diabetic populations. Expansion strategies often involve adapting products to meet local regulatory requirements and patient preferences, establishing local partnerships, and investing in marketing and distribution networks. Emerging markets present significant growth opportunities due to the rising prevalence of diabetes and increasing healthcare spending.

Type Insights

The reusable insulin pen segment dominated the market by capturing the largest revenue shares in 2023 owing to several benefits. These pens allow individuals to inject insulin more conveniently, accurately, and painlessly than traditional syringe and vial methods. In addition, technological advancements have led to the development of more sophisticated and user-friendly insulin pens, further boosting their adoption. Moreover, reusable pens are cost-effective. Unlike disposable pens, reusable pens can be used for several years, with only the insulin cartridge needing replacement, making them an economical choice for long-term diabetes management. They are also environmentally friendly, generating less waste than their disposable counterparts. Furthermore, these pens offer a higher degree of dosing accuracy, which is critical in managing blood glucose levels effectively and reducing the risk of complications associated with diabetes. The convenience and discreetness of using insulin pens also support better adherence to insulin therapy, ultimately leading to improved health outcomes for individuals with diabetes. Some of the commercially available reusable insulin pens include AllStar, ClikSTAR, JuniorSTAR, and TouStar by Sanofi.

The disposable insulin pen segment is expected to grow at a significant growth rate of 7.70% during the forecast period 2024 to 2030. It is widely recognized for its role in simplifying daily diabetes management, influenced by several key growth drivers and advantages such as the global increase in diabetes prevalence, alongside a push for more patient-friendly and compliance-enhancing solutions, has significantly contributed to the popularity of disposable insulin pens. These pens offer unparalleled convenience as they come pre-filled with insulin, eliminating the need for patients to manually draw insulin from vials, thereby reducing the risk of dosing errors. This feature is particularly beneficial for those with visual or fine motor skill impairments.

The disposable nature of these pens ensures that each new pen provides a sterile needle, reducing the risk of infection associated with needle re-use. This aspect is crucial in healthcare settings and for individual users to maintain high hygiene standards. Additionally, the ease of use and portability of disposable insulin pens support better adherence to insulin therapy, especially for patients who are often on the move or who wish to maintain discretion about their diabetes management. Some of the commercially available disposable insulin pens include FlexTouch and FlexPen by Novo Nordisk A/S; ADMELOG SoloStar pen and Apidra SoloSTAR Pen by Sanofi.

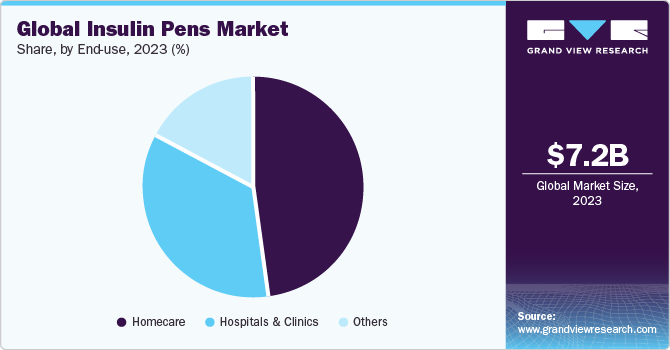

End-use Insights

The hospitals and clinics segment is expected to witness the fastest growth rate of 8.62% during the forecast period. The growth of this segment can be attributed to factors such as the widespread adoption of treatments, the presence of skilled staff, and favorable reimbursement policies. Insulin pens ensure accurate dosing and improve patient compliance. They are especially beneficial for inpatient care, where precise insulin delivery is critical. For example, a study demonstrated that insulin pens reduce dosing errors by up to 30% compared to traditional vial and syringe methods.

The home care segment has captured the largest revenue share of 48.21% in 2023. The growth of this segment is attributed to factors such as the insulin pens empowering patients by offering them the freedom to manage their diabetes with greater independence. These devices are designed to be discreet, portable, and user-friendly, which significantly enhances the quality of life for individuals managing their condition outside of a clinical setting. Many insulin pens include memory features that log the time and dose of the last injection, a function especially beneficial for elderly patients or those who may face challenges with memory. This feature, along with the overall ease of use, has been associated with higher adherence rates to prescribed insulin regimens among patients, leading to more stable glucose control and a reduction in the risk of diabetes-related complications.

Regional Insights

North America insulin pens market held the largest share of 40.73% in 2023. The North America insulin pens market has dominated the global market by capturing 40.73% of total revenue share in 2023. Primarily, the rising prevalence of diabetes in the region, spurred by factors such as obesity, sedentary lifestyles, and unhealthy dietary habits, is significantly fueling the demand for insulin pens. These devices offer a convenient and less painful way to administer insulin, making them highly preferred by individuals with diabetes. Additionally, advancements in technology have led to the development of more sophisticated and user-friendly insulin pens, further boosting their adoption. The increasing awareness and education about diabetes management among the population also play a crucial role in the market's expansion. Moreover, the supportive healthcare policies and the reimbursement scenario in North America encourage the use of insulin pens, contributing to the overall market growth.

U.S. Insulin Pens Market Trends

The insulin pens market in U.S. held the largest market share in 2023 in the North America region. In recent times, the U.S. has seen a concerning rise in diabetes cases, reaching unprecedented levels primarily because of shifts in lifestyle habits. The Division of Metabolism and Endocrinology Products at the FDA's Center for Drug Evaluation and Research has noted, "Patients are in search of efficient diabetes treatments that impact their daily lives as little as possible. The FDA is supportive of the development of innovative treatment solutions that simplify the management of diabetes for patients”.

Europe Insulin Pens Market Trends

The insulin pens market in Europe held a significant market share in 2023. Current estimates indicate that the European Union (EU) is home to approximately 31.6 million individuals living with diabetes, a number projected to increase to 33.2 million by 2030. This anticipated rise can be attributed to several factors, including population aging, an uptick in obesity rates, and societal shifts. From an economic perspective, the implications of diabetes are unequivocal: proactive investment in the prevention and management of diabetes could yield substantial financial savings by mitigating healthcare system and economic burdens. Presently, the EU incurs an annual expenditure of approximately USD 113 (€104) billion on diabetes-related healthcare. In addition, the economic impact of diabetes extends to productivity losses, estimated at USD 70 (€65) billion annually. Notably, a significant portion of these costs could be avoided. The Mobilising for Diabetes (MMD) intergroup within the European Parliament has played a pivotal role in highlighting the criticality of diabetes, leading to the adoption of a landmark resolution in October 2022, a century following the pivotal discovery of insulin. This resolution advocates for enhanced national and EU-level initiatives aimed at the prevention, management, and improved treatment of diabetes. As of 2024, the European Union Diabetes Forum (EUDF) and its affiliates are spearheading a year-long campaign to capitalize on this momentum, advocating for advanced policy measures to address diabetes more effectively.

The insulin pens market in the UK is expected to exhibit the fastest growth rate during the forecast period owing to factors such as rising burden of diabetes, well-established healthcare infrastructure, and growing healthcare expenditure on diabetes disease and its treatment. According to the data provided by Diabetes UK, the UK's diabetes prevalence has reached a new peak, with over 5.6 million individuals affected. Specifically, current data indicates that approximately 4.4 million people are living with diagnosed diabetes. Furthermore, it's estimated that an additional 1.2 million individuals may have undiagnosed type 2 diabetes. The year-on-year registration data for 2022-23 shows an increase of 167,822 cases compared to the previous year. The distribution within the diabetes population includes about 8% with type 1 diabetes and a significant 90% with type 2 diabetes.

Notably, over 3.2 million individuals are identified at heightened risk for type 2 diabetes based on their glucose levels, with an estimated 1.2 million of these cases yet to be diagnosed. Financially, diabetes represents a substantial burden on the National Health Service (NHS), consuming at least USD 13 (£10) billion annually, accounting for roughly 10% of its total budget. This equates to an expenditure of over USD 1.9 (£1.5) million per hour, or more than USD 31,900 (£25,000) every minute, on diabetes management within England and Wales. The overall annual expenditure on diabetes and its associated complications is estimated at around USD 17.80 (£14) billion, with a significant portion attributed to the management of complications.

The France insulin pens market is closely linked to the country's diabetes landscape, marked by a significant number of individuals affected by the condition. Recent statistics indicate that approximately 4 million people in France have been diagnosed with diabetes, with type 2 diabetes accounting for most cases. The market is further amplified by several factors, including France's robust healthcare infrastructure, widespread awareness and education about diabetes management, and comprehensive reimbursement policies supporting innovative diabetes care technologies.

The insulin pens market in Germany is experiencing significant growth, largely driven by the country's aging population. As people grow older, the prevalence of chronic conditions such as type 2 diabetes increases, necessitating effective and user-friendly methods of insulin delivery. Smart insulin pens, a part of this market, are increasingly becoming necessary for this demographic. These devices offer numerous advantages over traditional insulin delivery methods, including the ability to accurately dose insulin, track usage history, and sometimes sync with digital health platforms to monitor blood glucose levels in real-time. This technological innovation is not just about convenience; it's about empowering the aging population in Germany to manage their diabetes more effectively and maintain a higher quality of life. The demand for smart insulin pens is expected to rise as awareness grows and healthcare providers recognize the benefits of integrating digital health solutions into diabetes management.

Asia Pacific Insulin Pens Market Trends

The insulin pens market in Asia Pacific is projected to grow at the fastest CAGR of 8.8% during the forecast period. The rising prevalence of diabetes in this region and increasing awareness about the advantages of insulin pens over traditional syringe methods are major growth drivers. These devices offer convenience, ease of use, and improved dosing accuracy, making them increasingly preferred by patients and healthcare providers. Additionally, technological advancements in insulin pens, including smart pens that can track dosage and timing, further propel the market. Opportunities in this sector are abundant, as countries such as China and India, with their large diabetic populations, present significant market potential. Key players in the market are focusing on innovation, regional expansion, and partnerships to tap into this growing demand. Companies such as Novo Nordisk, Sanofi, and Eli Lilly are leading the way, investing heavily in R&D to develop more advanced and user-friendly products. Overall, the Asia Pacific insulin pens market is poised for robust growth, offering substantial opportunities for stakeholders in the forecast period.

The China insulin pens market is expected to experience the highest growth rate in the Asia Pacific region, driven by an increasing number of diabetes cases and rising costs associated with diabetes treatment and management. According to the Lancet Journal Forecast analysis, among Chinese adults aged 20-79, the prevalence of diabetes is expected to rise from 8.2% to 9.7% between 2020 and 2030. Concurrently, diabetes-associated costs are projected to escalate from USD 250.2 billion to USD 460.4 billion, marking an annual growth rate of 6.32%. This increase will elevate diabetes-related expenses from 1.58% to 1.69% of China's GDP within the same timeframe, underscoring an acceleration in the economic impact of diabetes relative to the nation's economic expansion. Additionally, the average economic burden per capita is set to grow from USD 231 to USD 414, at an annual rate of 6.02%. Notably, regions in Northeast and North China are identified as bearing significant disease and economic strain.

The insulin pen market in Japan is anticipated to expand at a CAGR of 8.9% from 2024 to 2030. This growth is attributed to the healthcare sector's increased adoption of insulin pens due to their accuracy and user-friendliness in managing diabetes. Japan's aging demographic also plays a significant role in this market's expansion. Current statistics indicate that over 10% of the nation's populace is aged 80 or above, while approximately one-third, or roughly 36.23 million people, are aged 65 and over. Insulin pens are increasingly crucial for individuals aged 65 and above due to their ease of use, which is particularly beneficial for those with decreased dexterity. Moreover, the precise dosage control provided by insulin pens helps effectively manage blood sugar levels, reducing the risk of underdosing and overdosing. This is especially important for the elderly population, who may have varying insulin sensitivities and require consistent, accurate dosing to maintain optimal health.

Latin America Insulin Pens Market Trends

The insulin pens market in Latin America is experiencing growth due to the increasing incidence of Type 1 and Type 2 diabetes. Data from 2021 indicates that adult diabetes prevalence in the region varied notably, from less than 5% in nations such as Ecuador and Peru to 13% in Guatemala, with an average prevalence across the region at 7.9%. This reflects a slight decrease from the 8.3% reported in 2010. In response, government authorities are formulating strategies to mitigate the impact of diabetes. These strategies encompass efforts to lower the prevalence and mortality rates associated with the condition, with a significant focus on enhancing the comprehensive management of Non-Communicable Diseases (NCDs), including diabetes, at the primary healthcare level. Regarding pediatric populations, the incidence of Type 1 diabetes in Latin America is reported to range between 0.4 to 8.3 cases per 100000 children under the age of 15, while Type 2 diabetes shows a prevalence rate of 1.2% to 8%, with urban areas exhibiting higher figures. Projections suggest a 38% surge in diabetes cases over the next decade, outpacing the estimated 14% growth in the region's total population. Consequently, the total diabetes cases are anticipated to more than double, surpassing the aggregate numbers reported in the US, Canada, and Europe by 2025.

MEA Insulin Pens Market Trends

The Middle East and Africa (MEA) insulin pens market is expected to grow significantly owing to rising prevalence of diabetes and obesity among the population. The MEA region exhibits the highest diabetes prevalence worldwide. A combination of societal, environmental, and genetic factors drives this increase. Data from the International Diabetes Federation indicates that diabetes prevalence in MEA was 18% in 2021, with projections suggesting a rise to over 135 million adults affected by the condition by 2045. Gulf Cooperation Council (GCC) countries such as Saudi Arabia, the United Arab Emirates, and Qatar demonstrate elevated diabetes rates. Several interrelated factors have contributed to this health crisis, including rapid urbanization, sedentary lifestyles, and poor dietary habits. The lifestyle changes, along with insufficient nutritional education, have led to increased obesity rates, a key contributor to Type 2 diabetes. The National Health Survey highlights that in 2023, obesity rates among Saudi Arabian women aged 55 to 59 reached 50%. Kuwait, Egypt, and Saudi Arabia are among the countries with the highest diabetes prevalence worldwide, with Kuwait experiencing rates as high as 25%. In terms of economic impact, the annual cost per individual with diabetes in MEA was approximately USD 1,400 in 2021, significantly lower than in Europe.

Key Insulin Pens Company Insights

Major companies such as Novo Nordisk, Sanofi, Eli Lilly and Company, Becton, Dickinson and Company, and Insulet Corporation are at the forefront of innovation and market expansion. These organizations are focused on enhancing their offerings by introducing cutting-edge technologies and ensuring their insulin pens are more user-friendly, accurate, and efficient. To maintain a competitive edge and increase their footprint in the market, these firms are engaging in strategic partnerships, investing in research and development for next-generation products, and pursuing mergers and acquisitions. Securing regulatory approvals across different regions remains critical for these companies to ensure their products meet the highest safety and efficacy standards, thereby providing patients with reliable diabetes management solutions.

Key Insulin Pens Companies:

The following are the leading companies in the insulin pens market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Novo Nordisk A/S

- Sanofi

- Eli Lilly and Company

- Ypsomed AG

- Insulet Corporation

- B. Braun SE

- Owen Mumford Ltd.

- Tandem Diabetes Care, Inc.

Recent Developments

-

In February 2024, Novo Nordisk has entered into an agreement to purchase three fill-finish facilities from Novo Holdings A/S, concurrent with Novo Holdings' acquisition of Catalent, Inc., a leading contract development and manufacturing organization based in New Jersey, USA. This move, part of a longstanding partnership with Catalent, supports Novo Nordisk's objective to enhance access to treatments for diabetes and obesity by expanding manufacturing capabilities efficiently. The strategy not only aims to escalate production capacity significantly but also ensures adaptability and resilience within Novo Nordisk's supply chain. The enhancements in fill-finish capacity are anticipated to commence incrementally from 2026.

“We are very pleased with the agreement to acquire the three Catalent manufacturing sites which will enable us to serve significantly more people living with diabetes and obesity in the future“

-Lars Fruergaard Jørgensen, president and chief executive officer at Novo Nordisk.

- In July 2023, Civica, Inc. entered a partnership with Ypsomed AG for the production and supply of insulin dosing injector pens, aimed at enhancing its affordable insulin offerings. The company has disclosed plans to manufacture three biosimilar insulins: glargine, lispro, and aspart, which will be distributed in both vial and prefilled pen formats. Civica is committed to introducing these insulins at prices markedly below current market rates. It has proposed a maximum retail price not exceeding USD 30 per vial and USD 55 for a pack of five pen cartridges, representing a notable reduction compared to the current costs faced by uninsured consumers. Pending regulatory approval from the FDA, Civica projects the availability of its insulin products by 2024.

“As a renowned injection device specialist with over 35 years’ experience, Ypsomed will help Civica make self-administered care more affordable for Americans living with diabetes, Civica will deliver affordable, high-quality insulin, in the best pen platform, utilizing our new, state of the art manufacturing technology in Petersburg, Virginia.”

-Ned McCoy, president and CEO of Civica.

- In February 2023, Glooko formed a strategic alliance with Sanofi to enhance its digital platform by incorporating a connected device designed for insulin pens. The device, named SoloSmart, is a compact, supplementary device compatible with Sanofi’s SoloStar and DoubleStar insulin pens. It is engineered to document the insulin dosage and the date and time of administration. This collaboration enables data visualization capabilities via the Glooko application, facilitating the sharing of patient data with healthcare providers to support integrated diabetes care management.

“We are very pleased to announce our partnership with Sanofi, as this agreement represents the first substantial digital health collaboration between our two companies, Glooko is the first global diabetes data management platform to launch with SoloSmart, something our team is particularly proud of. This will allow us to further expand our global reach aiming to provide best-in-class technologies that can benefit the lives of people with diabetes.”

-Russ Johannesson, CEO, Glooko.

- In November 2022, Novo Nordisk and Abbott announced their partnership aiming enhanced data integration capabilities for individuals with diabetes. This development leverages smart technology by making Novo Nordisk's connected insulin pens, specifically the NovoPen 6 and NovoPen Echo Plus, compatible with the Abbott FreeStyle LibreLink application. This compatibility facilitates a centralized view of insulin dosage and glucose levels, streamlining patient monitoring and management. Users can effortlessly sync their insulin dosing information by simply tapping their pen on a smartphone, enabling a cohesive display of insulin and glucose data. This integration aims to aid patients in analyzing how insulin dosage adjustments and timing influence their glucose trends, thereby optimizing diabetes management.

“People living with diabetes can make up to 180 additional health-related decisions a day compared to people without diabetes - the constant multi-tasking can be emotionally and physically draining. I hope that bringing glucose and insulin data together in one place will make some of these decisions a little easier, giving people living with diabetes in the UK more time and energy back for day-to-day life.”

-Pinder Sahota, general manager at Novo Nordisk UK.

Insulin Pens Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.79 billion

Revenue forecast in 2030

USD 12.41 billion

Growth rate

CAGR of 8.08% from 2024 to 2030

Actual period

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Novo Nordisk A/S; Sanofi; Eli Lilly and Company; Ypsomed AG; Insulet Corporation; B. Braun SE; Owen Mumford Ltd.; Tandem Diabetes Care, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insulin Pens Market Report Segmentation

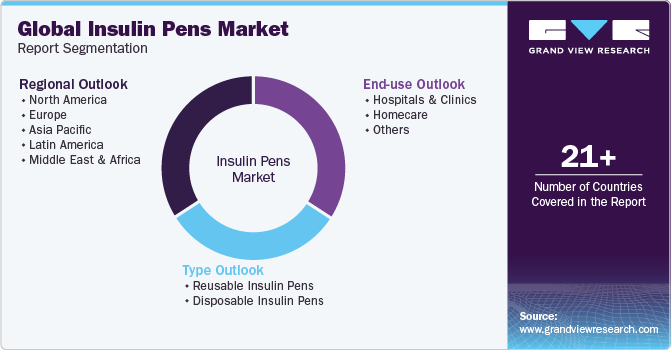

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global insulin pens market report on the basis of type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable Insulin Pens

-

Disposable Insulin Pens

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Homecare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global insulin pens market size was estimated at USD 7.18 billion in 2023 and is expected to reach USD 7.79 billion in 2024.

b. The global insulin pens market is expected to grow at a compound annual growth rate of 8.08% from 2024 to 2030 to reach USD 12.41 billion by 2030.

b. The reusable insulin pens segment dominated the insulin pens market with the highest share in 2023. This is attributable to the increasing prevalence of diabetes.

b. Some key players operating in the insulin pens market include Medtronic, Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Ypsomed AG, Insulet Corporation, B. Braun SE, Owen Mumford Ltd., and Tandem Diabetes Care, Inc.

b. Key factors driving the insulin pens market include the increasing prevalence of diabetes worldwide, advancements in insulin pen technology, growing awareness among patients about the benefits of insulin pens over traditional syringe methods, and the convenience and ease of use offered by insulin pens. Additionally, the support from various governments and health organizations for diabetes management programs is also propelling the market forward. Insulin pens offer a discreet, accurate, and convenient way to administer insulin, making them a preferred choice for many diabetics. This preference is anticipated to continue, further boosting the market's growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.