- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Interior Building Materials Market Report, 2033GVR Report cover

![Asia Pacific Interior Building Materials Market Size, Share & Trends Report]()

Asia Pacific Interior Building Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Glass, Aluminum, Drywall, Composite Panels), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-775-7

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Interior Building Materials Market Summary

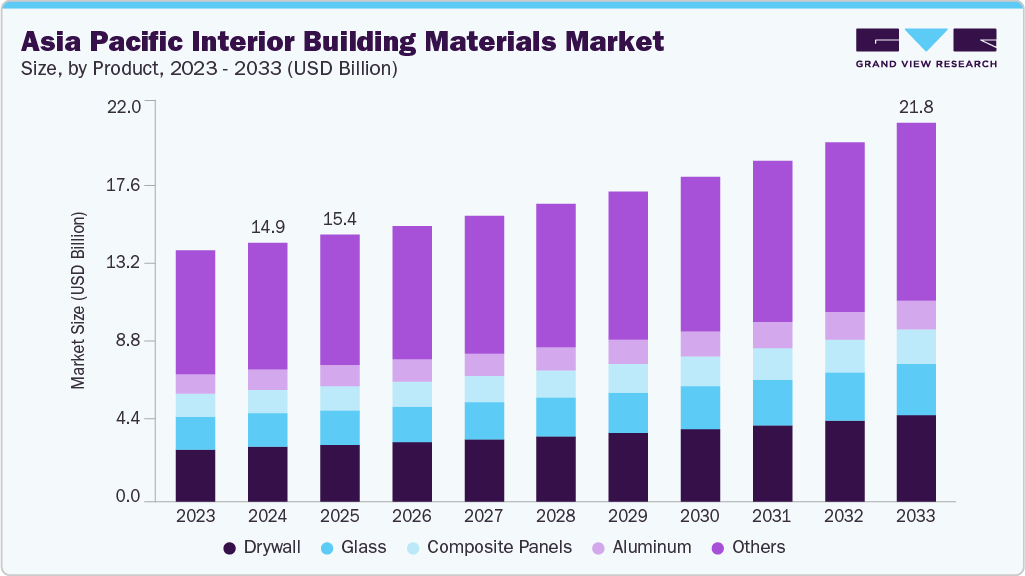

The Asia Pacific interior building materials market size was estimated at USD 14.9 billion in 2024 and is projected to reach USD 21.8 billion by 2033, growing at a CAGR of 4.8% from 2025 to 2033. The demand for interior building materials across the Asia Pacific is rising as workplaces evolve toward flexible, collaborative, and wellness-oriented environments.

Key Market Trends & Insights

- China dominated the Asia Pacific interior building materials market with the largest revenue share of 45.5% in 2024.

- By product, the drywall segment is expected to grow at the fastest CAGR of 5.5% over the forecast period.

- By application, the office partition segment is expected to grow at the fastest CAGR of 4.7% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 14.9 Billion

- 2033 Projected Market Size: USD 21.8 Billion

- CAGR (2025-2033): 4.8%

Companies are redesigning office spaces to accommodate hybrid work cultures, leading to higher demand for modular partitions and adaptable components. Rapid urbanization and the expansion of the commercial real estate sector across emerging economies are further fueling new office construction and fit-out activities. Post-pandemic emphasis on hygiene, safety, and ventilation has strengthened the need for reconfigurable and easy-to-clean partitions. Moreover, organizations are increasingly investing in aesthetic and functional interiors to enhance productivity and brand perception.

Several factors are driving the growth of the Asia Pacific office partition and interior materials industry. The expansion of the IT, finance, and services sectors has led to rising office occupancy and refurbishment cycles. Increasing preference for open yet private workspaces has boosted the popularity of glass, acoustic, and operable partitions. The trend toward green buildings and LEED certifications has encouraged the use of eco-friendly materials. Growing adoption of modular construction and prefabrication methods is making interior fit-outs faster and more efficient. Local manufacturing bases in key countries like China, India, and Malaysia are improving product availability and reducing costs.

The Asia Pacific office partition and interior materials industry is witnessing a surge in innovative design and material trends. Smart partitions equipped with integrated lighting, acoustic insulation, and sensors are gaining attention in premium office projects. Modular glass and aluminum systems are becoming popular due to their flexibility and aesthetic appeal. The use of bio-based panels, recycled cores, and water-based coatings reflects the region’s growing focus on sustainability. Digital fabrication and Building Information Modeling (BIM) are improving precision and reducing installation time. Flexible layouts and quick reconfiguration options are now essential features as companies prioritize agility in workspace planning. Acoustic comfort and daylight optimization are key design goals influencing new product development.

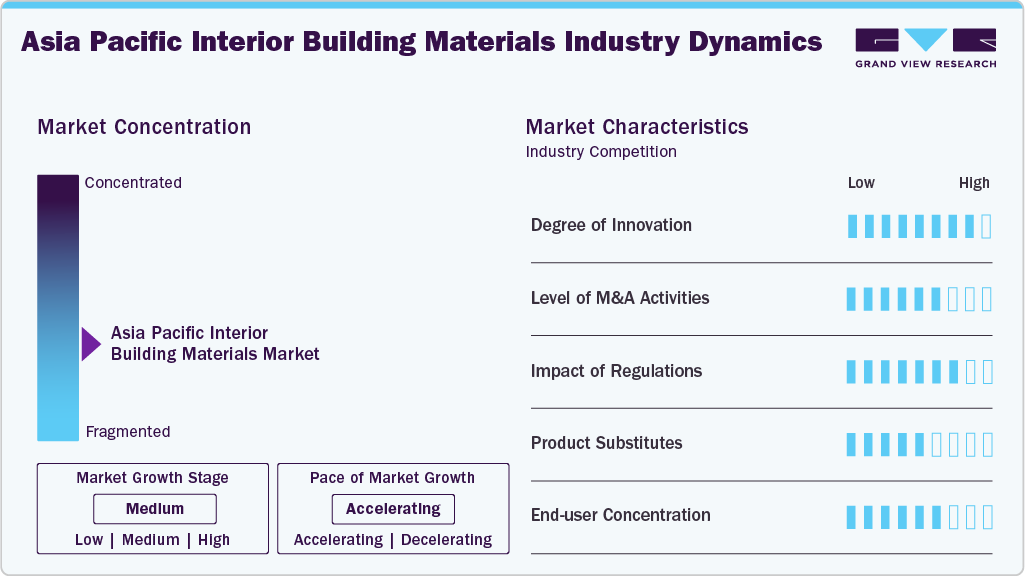

Market Concentration & Characteristics

The Asia Pacific office partition and interior materials industry is moderately fragmented, with both multinational brands and strong regional players active in the segment. Countries like China and India host numerous small and mid-sized manufacturers catering to local projects, while global companies dominate high-end, specification-driven spaces. The competitive landscape is shaped by design differentiation, certification standards, and distribution networks rather than pure pricing. Strategic partnerships between manufacturers, architects, and contractors are increasingly common to provide integrated fit-out solutions. While consolidation is gradually taking place in urban markets, localized customization remains a major advantage for smaller firms.

Permanent drywall, brick, and wood partitions act as substitutes to modular and movable systems, particularly in cost-sensitive markets. However, these traditional solutions lack flexibility and often result in higher long-term renovation costs. The rising need for space optimization, acoustics, and easy maintenance is gradually reducing the use of conventional walls in commercial interiors. Open-plan layouts with acoustic furniture and glass dividers can also compete with traditional partitioning systems in some designs. Despite this, modular partitions maintain an edge due to their sustainability credentials and adaptability to changing workspace needs. The growing corporate emphasis on mobility and design agility continues to limit the threat posed by permanent or low-cost substitutes.

Product Insights

The drywall segment led the market with the largest revenue share of 21.0% in 2024, due to its cost-effectiveness, versatility, and ease of installation. It remains a preferred choice in commercial and office spaces for creating partitions, ceilings, and wall linings. The material’s adaptability to diverse design requirements and its fire-resistant and acoustic insulation properties make it highly practical. With the growing trend of flexible office layouts, drywall systems allow for quick remodeling without heavy structural changes. Moreover, manufacturers are introducing eco-friendly and moisture-resistant variants, reinforcing drywall’s leadership position in the regional market.

The glass segment is expected to grow at the fastest CAGR of 4.9% over the forecast period, due to the increasing preference for open, bright, and energy-efficient office designs. Glass partitions enhance natural light flow, improve aesthetic appeal, and promote collaborative environments while maintaining acoustic privacy. With technological advancements in tempered and laminated glass, durability and safety standards have improved significantly. In addition, the rise of smart glass solutions offering energy control and privacy functions further boosts demand. Growing corporate investments in modern office renovations and sustainability initiatives are accelerating the adoption of glass in interior building materials.

Application Insights

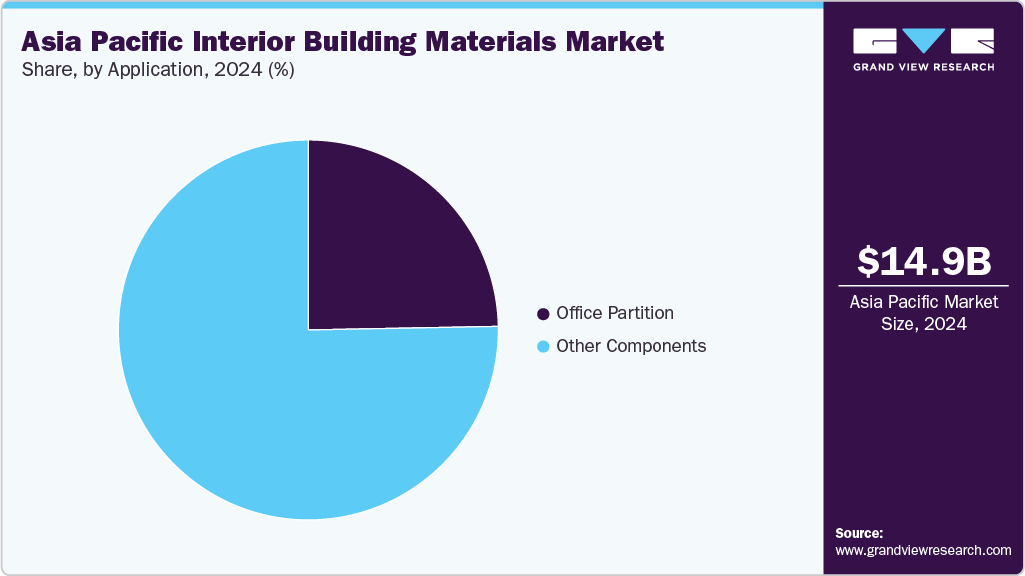

The other components segment, such as ceiling systems, flooring, and decorative panels, led the market with the largest revenue share of 75.3% in 2024, due to their integral role in the functional and aesthetic enhancement of office environments. These components contribute to acoustic control, lighting efficiency, and visual harmony in modern office interiors. The dominance is supported by continuous innovation in surface finishes, eco-friendly materials, and modular installation techniques. As companies increasingly focus on wellness and energy-efficient design, these components remain indispensable in achieving high-performance interiors. The steady demand from both new constructions and refurbishments ensures that this segment maintains its market leadership.

The office partition segment is expected to grow at the fastest CAGR of 4.7% over the forecast period, as businesses prioritize flexible workspace solutions that foster productivity and adaptability. Open-plan offices are increasingly integrating movable and modular partition systems to balance collaboration with privacy. The rise in co-working spaces and hybrid work models has further amplified the demand for operable and acoustic partitions. Companies are also investing in design-centric solutions that align with corporate branding and wellness standards. With advancements in materials like glass, metal, and sustainable composites, the office partitions segment is evolving into a key growth driver within interior building materials.

Country Insights

China Interior Building Materials Market Trends

China dominated the Asia Pacific interior building materials market with the largest revenue share of 45.5% in 2024. Rapid urban expansion and consistent commercial construction activity sustain a strong base of demand. The government’s focus on sustainable and smart building development is encouraging the adoption of modular and eco-friendly materials. Domestic manufacturers are heavily investing in technology and automation to increase precision and quality. Key cities such as Beijing, Shanghai, and Shenzhen are witnessing high renovation activity as corporates modernize their office spaces. Growing emphasis on acoustics, natural lighting, and indoor air quality further supports demand for advanced partitions.

India Interior Building Materials Market Trends

TheIndia interior building materials market is expanding rapidly, driven by strong economic growth, urbanization, and rising office space demand. The surge in the IT, finance, and start-up ecosystem is leading to continuous office expansions and renovations. Hybrid work trends are pushing corporates toward modular and movable partition systems that enable flexible layouts. Government-led initiatives such as Smart Cities Mission and GRIHA certifications are encouraging use of sustainable and certified materials. Domestic manufacturers are improving production capabilities to meet rising standards of design and performance. Tier-1 cities like Bengaluru, Mumbai, and Delhi NCR account for a large share of demand, while tier-2 cities are emerging as new growth centers.

Australia Interior Building Materials Market Trends

Theinterior building materials market in Australia is highly developed, characterized by an emphasis on quality, sustainability, and design innovation. The Green Star certification framework has made eco-friendly, low-VOC, and recyclable materials a market standard. Australian architects and designers prefer open, well-lit workspaces, which has led to increased use of glazed and demountable partition systems. Renovation and refurbishment projects account for a large portion of demand as companies modernize aging office infrastructure. With strong labor costs, there is high demand for modular systems that reduce installation time and disruption. Major cities such as Sydney and Melbourne remain hotspots for design-forward office interiors with a focus on acoustics, energy efficiency, and aesthetics.

Singapore Interior Building Materials Market Trends

The Singapore interior building materials market serves as a regional hub for high-end office design and innovation, with strong emphasis on sustainability and space optimization. The Building and Construction Authority’s (BCA) Green Mark Scheme continues to guide material selection and design practices toward low-emission and recyclable products. Limited real estate availability encourages the use of movable and multifunctional partitions that maximize usable space. Multinational corporations based in Singapore prefer modular systems that combine luxury aesthetics with easy maintenance. The city’s advanced regulatory framework and concentration of design consultancies make it a testbed for emerging interior technologies, such as sensor-integrated smart partitions.

Malaysia Interior Building Materials Market Trends

Theinterior building materials market in Malaysia is steadily growing due to robust commercial development in Kuala Lumpur, Penang, and Johor Bahru. The government’s sustainability push through the Green Building Index (GBI) and National Construction Policy promotes eco-friendly materials. The increasing presence of co-working spaces and multinational offices has created consistent demand for modular and acoustic partitions. Local manufacturers are forming partnerships with foreign companies to introduce advanced, cost-efficient designs.

Indonesia Interior Building Materials Market Trends

The Indonesia interior building materials market is driven by the country’s expanding urban population and rapid commercial real estate development, which are fueling demand for office partitions and related materials. Rapid construction activity in Jakarta, Surabaya, and Bali is creating large opportunities for fit-out and refurbishment projects. The government’s infrastructure investments and focus on economic zones have spurred demand for commercial interiors. As businesses seek modern, collaborative, and energy-efficient offices, modular partitions are becoming a preferred choice. Growing awareness about sustainable design and international exposure among developers are improving standards for material quality. Local manufacturers are increasingly incorporating imported components to enhance design flexibility and meet global performance benchmarks.

Hong Kong Interior Building Materials Market Trends

The interior building materials market in Hong Kong is witnessing strong demand for movable and demountable partition systems, as the city’s high-density commercial environment makes efficient space planning increasingly essential. The market leans toward premium finishes, glass systems, and acoustic partitions tailored for multinational offices. Continuous renovation cycles due to short lease durations contribute to recurring demand for flexible, quick-install interior materials. Strict fire safety and energy efficiency regulations further encourage the use of certified and modular products. Hong Kong also acts as a regional gateway for the import and distribution of high-quality interior materials across Southeast Asia. The preference for sleek, space-saving designs aligns with global trends in minimalist and tech-integrated office environments.

Thailand Interior Building Materials Market Trends

The Thailand interior building materials market is expanding due to the country’s growing service sector and increasing foreign investments in commercial real estate. Developers and design firms are increasingly integrating sustainable practices under the Thai Green Building Institute (TGBI) framework. Bangkok, Chiang Mai, and Phuket are key centers witnessing strong demand for modular and design-driven partitions. The tourism, retail, and finance industries are investing in aesthetically appealing, efficient, and acoustically enhanced office environments. The growing influence of international architectural styles is boosting the use of glass, metal, and hybrid partitions.

Key Asia Pacific Interior Building Materials Company Insights

Some of the key players operating in the market include OperableWallHongKong, Ozone Overseas.

-

Operable Wall Hong Kong is a leading supplier of movable wall and partition systems, offering high-quality acoustic and space-efficient solutions tailored for commercial, hospitality, and institutional interiors. The company is known for its premium finishes, precision engineering, and commitment to flexible workspace design across Hong Kong and nearby regions.

-

Ozone Overseas is an India-based architectural hardware and interior solutions provider specializing in glass fittings, partition systems, and space management products. With a strong presence across Asia Pacific, the company emphasizes innovation, sustainability, and contemporary design in its modular interior solutions.

Portable Partitions Australia Pty. Ltd. and WATTANA COMPANY LIMITED are some of the emerging market participants in the Asia Pacific interior building materials industry.

-

Portable Partitions Australia Pty. Ltd. is a prominent manufacturer and distributor of mobile and folding room dividers designed for offices, schools, and healthcare facilities. The company focuses on lightweight, durable, and acoustic solutions that provide versatility and quick space reconfiguration for modern interiors.

-

Wattana Company Limited, based in Thailand, is an established provider of interior building materials and office partition systems. The company delivers customized modular wall and ceiling solutions that balance functionality, aesthetics, and acoustic performance for a wide range of commercial projects.

Key Asia Pacific Interior Building Materials Companies:

- OperableWallHongKong

- Megamark Systems (FE) Pvt Ltd.

- Portable Partitions Australia Pty. Ltd.

- Ozone Overseas

- Onmuse Office Furniture Co. Ltd.

- Artmatrix Technology Sdn Bhd,

- WATTANA COMPANY LIMITED

- Indo Balau Ume, PT.

- JEB Group

- Ray-On Glass Pte Ltd

- Rilmax Industries

- CFO Furniture

- The Partition Company

Recent Developments

- In 2024, Portable Partitions Australia Pty. Ltd. introduced a product, “Afford-A-Wall Sliding Mobile Room Divider” with a new sliding mechanism, heights, and color variants.

Asia Pacific Interior Building Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.4 billion

Revenue forecast in 2033

USD 21.8 billion

Growth rate

CAGR of 4.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

Asia Pacific

Country scope

China; India; Australia; Singapore; Malaysia; Indonesia; Hong Kong; Thailand

Key companies profiled

OperableWallHongKong; Megamark Systems (FE) Pvt Ltd.; Portable Partitions Australia Pty. Ltd.; Ozone Overseas; Onmuse Office Furniture Co.Ltd; Artmatrix Technology Sdn Bhd; WATTANA COMPANY LIMITED; Indo Balau Ume; PT.; JEB Group; Ray-On Glass Pte Ltd; Rilmax Industries; CFO Furniture; The Partition Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Interior Building Materials Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Asia Pacific interior building materials market report based on the product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021-2033)

-

Glass

-

Aluminum

-

Drywall

-

Composite Panels

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021-2033)

-

Office Partition

-

Other Components

-

-

Country Outlook (Revenue, USD Million, 2021-2033)

-

Asia Pacific

-

China

-

India

-

Australia

-

Singapore

-

Malaysia

-

Indonesia

-

Hong Kong

-

Thailand

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific interior building materials market size was estimated at USD 14.9 billion in 2024 and is expected to reach USD 15.4 billion in 2025.

b. The Asia Pacific interior building materials market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2033 to reach USD 21.8 billion by 2033.

b. The drywall segment held the highest revenue market share of 21.0% in 2024, due to its cost-effectiveness, versatility, and ease of installation.

b. Some of the key players operating in the Asia Pacific interior building materials market include OperableWallHongKong, Megamark Systems (FE) Pvt Ltd., Portable Partitions Australia Pty. Ltd., Ozone Overseas, Onmuse Office Furniture Co.Ltd, Artmatrix Technology Sdn Bhd, WATTANA COMPANY LIMITED, Indo Balau Ume, PT., JEB Group, Ray-On Glass Pte Ltd, Rilmax Industries, CFO Furniture, and The Partition Company.

b. The key factors driving the Asia Pacific interior building materials market include rapid commercial construction, growing adoption of modular and sustainable materials, evolving workspace designs, and supportive government initiatives promoting green and smart buildings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.