- Home

- »

- Pharmaceuticals

- »

-

Asia Pacific Multi Cancer Early Detection Market Report, 2030GVR Report cover

![Asia Pacific Multi Cancer Early Detection Market Size, Share & Trends Report]()

Asia Pacific Multi Cancer Early Detection Market Size, Share & Trends Analysis Report By Type (Liquid Biopsy, Gene Panel, LDT & Others), By End Use (Hospitals, Diagnostic Laboratories), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-107-6

- Number of Report Pages: 102

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

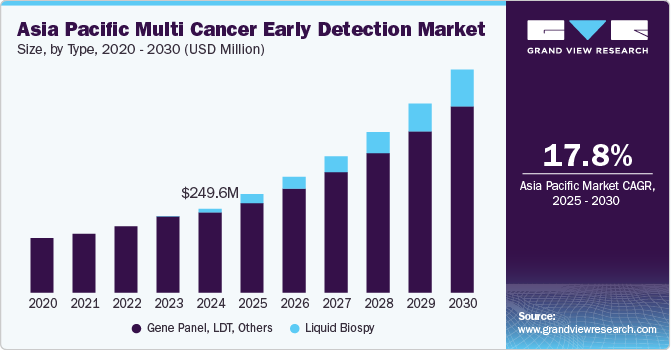

The Asia Pacific multi cancer early detection market size was estimated at USD 249.62 million in 2024 and is projected to grow at a CAGR of 17.76% from 2025 to 2030. The market growth is attributed to the growing healthcare reforms, improvement in infrastructure, a rising prevalence of cancer, and the increasing presence of local companies. Government initiatives offering free screening for cancers such as breast, lung, and cervical have significantly contributed to this growth. Moreover, an increase in collaborations between research institutions, corporations, and government entities to ensure the distribution and accessibility of these screening tests is further propelling the growth of the overall market.

In the Asia-Pacific region, the rising incidence of cancer is being driven by demographic shifts, including urbanization, aging populations, and economic growth. These changes, coupled with an increase in health risk factors such as alcohol and tobacco consumption, poor diets, and sedentary lifestyles, have led to a higher prevalence of various cancers. This surge in cancer cases is fueling the need for innovative and advanced diagnostic solutions. For instance, in June 2022, MGI partnered with MiRXES to enhance access to advanced spatial multi-omics research in the region, which could help advance liquid biopsy applications and expand their reach. In countries such as Singapore and Taiwan, high regulatory support and government funding are further driving the growth of the healthcare sector, including the adoption of cutting-edge diagnostic technologies. However, challenges such as low affordability, inadequate healthcare infrastructure, and a shortage of trained professionals are anticipated to restrain the market’s growth.

Government initiatives, such as grants to research institutions and private companies developing innovative cancer solutions, are expected to drive significant growth in the MCED market. For instance, the Strategic International Collaborative Research Program (SICORP) demonstrates a global effort to address critical global challenges, including cancer diagnostics and treatments. This program strengthens Japan's scientific capabilities by fostering international cooperation while promoting solutions like liquid biopsy-based companion diagnostics. These partnerships often involve pharmaceutical companies to develop cancer treatments more efficiently, integrating diagnostics with therapy for personalized medicine. This collaborative framework speeds up drug development and enhances the adoption of advanced diagnostic tools, such as liquid biopsies, as part of comprehensive cancer care strategies.

The rising prevalence of cancer in Japan is closely linked to its rapidly aging population, with a median age of 44 years, one of the highest globally. This demographic trend highlights the importance of proactive healthcare measures, such as Japan’s comprehensive nationwide cancer screening programs, which provide screening access to over 94% of the population. These programs have been involved in early detection and management, contributing to better health outcomes within the Asia-Pacific region. However, stringent regulatory policies challenge the rapid adoption of innovative cancer diagnostic technologies. Lengthy approval processes and complex compliance requirements delay the introduction of advanced solutions, including liquid biopsy technologies, into the market.

However, gathering extensive efficacy and safety data for regulatory approval is a significant challenge hindering market growth. Clinical studies, such as randomized controlled trials (RCTs), are crucial to validate the clinical efficacy and mortality benefits of these screening technologies across diverse cancer types. However, these trials are logistically complex, requiring carefully designed studies, large-scale participant enrollment (often tens of thousands of individuals), and considerable resources. In addition, longitudinal follow-up for years or more is often necessary to demonstrate meaningful reductions in cancer-specific mortality in the target population.

Type Insights

Based on type, the gene panel, LDT, & other segments led the market with the largest revenue share of 95.62% in 2024. The growth of the segment is driven by the ability of LDTs to overcome the traditional regulatory approval processes, allowing for faster commercialization. LDTs are designed, developed, and utilized within the same laboratory, enabling their market launch without FDA clearance or independent regulatory assessment. This advantage has facilitated the rapid introduction of innovative tests like Guardant Health's Shield in May 2022 for the early detection of colorectal cancer in adults over 45 years. Such tests meet the growing demand for early cancer diagnostics with minimal delays, addressing an urgent public health need. Moreover, companies like GRAIL are advancing the clinical validation of MCED technologies to enhance their adoption. GRAIL's PATHFINDER study, completed in December 2021, enrolled 6,600 participants under a U.S. FDA Investigational Device Exemption (IDE). The study assessed the integration of Galleri, a groundbreaking MCED test, into clinical practice. This dual strategy leveraging the advanced pathways of LDTs while pursuing comprehensive clinical studies, has positioned LDTs as a basis of the MCED market, enabling immediate impact and long-term validation.

The liquid biopsy segment is expected to grow at the fastest CAGR over the forecast period,driven by the expected launch of FDA-approved products that are currently available as lab-developed tests (LDTs). Liquid biopsy technology has emerged as one of the most transformative advancements in diagnostics, offering non-invasive and highly accurate methods for early cancer detection. A growing number of players are receiving significant funding to develop innovative and accessible MCED solutions. For example, Delfi Diagnostics, Inc. raised USD 225 million in July 2022 to advance the development of a high-performance MCED test, focusing on affordability to make it accessible to broader populations. Moreover, liquid biopsy technologies have seen remarkable progress, with an increasing uptake in clinical applications. This growth is bolstered by technological advancements and investments, enabling the development of tests with improved sensitivity, specificity, and scalability.

End Use Insights

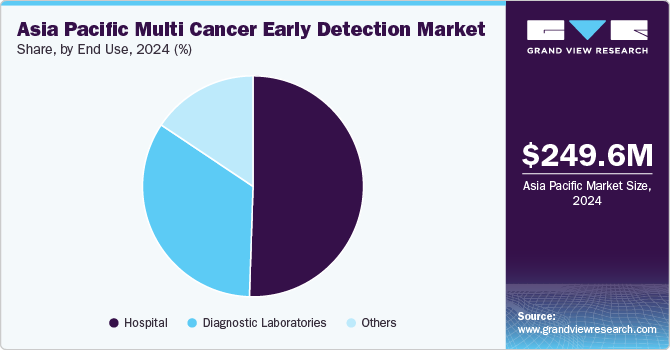

Based on end use, the hospitals segment led the market with the largest revenue share of 50.52% in 2024 and is anticipated to grow at the fastest growth rate over the forecast period. Hospitals are increasingly the preferred setting for multi-cancer early detection (MCED) due to their ability to offer a comprehensive range of services in one location. Many hospitals are enhancing their laboratory capabilities and adopting cutting-edge technologies to meet the growing demand for advanced diagnostic solutions. For instance, in September 2022, Henry Ford Health became the first medical center in Michigan to offer GRAIL’s Galleri MCED test, significantly enhancing early cancer detection efforts and improving public health outcomes. This adoption emphasizes hospital's critical role in integrating innovative tools to deliver accessible and efficient care. By adopting advanced MCED tests, hospitals are placing themselves as leaders in cancer care, improving patient outcomes through early intervention. These developments reflect a broader trend of healthcare facilities prioritizing state-of-the-art diagnostics to address the evolving needs of patients while advancing public health objectives.

The diagnostic laboratories segment is anticipated to grow at a significant CAGR during the forecast period, driven by increased testing volumes and advancements in diagnostic capabilities. Hospitals increasingly outsource evaluation and testing to specialized laboratories, enhancing efficiency and accuracy. Regulatory efforts, such as the World Health Organization’s (WHO) publication of the Essential Diagnostics List in 2021, further support this growth by emphasizing critical tests needed for early detection, even in resource-limited settings. These developments highlight the vital role of diagnostic laboratories in improving access to and the quality of cancer diagnostics globally.

Key Asia Pacific Multi Cancer Early Detection Company Insights

Key players in the Asia Pacific multi cancer early detection industry are focusing on innovating and delivering advanced diagnostic solutions to improve patient outcomes and facilitate early personalized care. For example, in May 2023, Lucence Health, Inc. launched LucenceINSIGHT, a multi-cancer early detection test that utilizes circulating tumor DNA (ctDNA) technology to identify 10 different cancers through a single blood draw. This test aims to improve the accessibility and efficiency of cancer screening for asymptomatic individuals, demonstrating a strong commitment to advancing early detection technologies.

Key Asia Pacific Multi Cancer Early Detection Companies:

- Grail, LLC

- Illumina, Inc.

- Exact Sciences Corporation

- AnchorDx

- Guardant Health

- Burning Rock Biotech Limited

- GENECAST

- Singlera Genomics Inc.

- Laboratory for Advanced Medicine, Inc.

- MiRXES Pte Ltd.

View a comprehensive list of companies in the Asia Pacific Multi Cancer Early Detection Market

Asia Pacific Multi Cancer Early Detection Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 293.22 million

Revenue forecast in 2030

USD 663.89 million

Growth rate

CAGR of 17.76% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use

Regional scope

Asia Pacific

Country scope

Japan; China; India;Thailand; South Korea; Australia; Singapore; Taiwan; Hong Kong; and Rest of APAC

Key companies profiled

Grail, LLC; Illumina, Inc.; Exact Sciences Corporation; AnchorDx; Guardant Health; Burning Rock Biotech Limited; GENECAST; Singlera Genomics Inc.; Laboratory for Advanced Medicine, Inc.; MiRXES Pte Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Multi Cancer Early Detection Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Asia Pacific multi cancer early detection market report based on the type, and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Biopsy

-

Gene Panel, LDT & Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

Singapore

-

Taiwan

-

Hong Kong

-

Rest of APAC

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific multi cancer early detection market size was estimated at USD 249.62 million in 2024 and is expected to reach USD 293.22 million in 2025.

b. The Asia Pacific multi cancer early detection market is expected to grow at a compound annual growth rate of 17.76% from 2025 to 2030 to reach USD 663.89 million by 2030.

b. Japan dominated the Asia Pacific multi-cancer early detection market with a share of 28.04% in 2024. This is attributable to high government spending to curb cancer prevalence, high per capita income, and significant demand for novel products.

b. Some key players operating in the Asia Pacific multi cancer early detection market include Grail, LLC; Illumina, Inc.; Exact Sciences Corporation; AnchorDx; Guardant Health; Burning Rock Biotech Limited; GENECAST; Singlera Genomics Inc.; Laboratory for Advanced Medicine, Inc.; MiRXES Pte Ltd.

b. Key drivers driving the Asia Pacific multi-cancer early detection market are the increasing prevalence of cancer, extensive R&D for the development of MCED and need to develop diagnostic options that can detect cancer at an early stage.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."