- Home

- »

- Clinical Diagnostics

- »

-

Liquid Biopsy Market Size And Share, Industry Report, 2033GVR Report cover

![Liquid Biopsy Market Size, Share & Trends Report]()

Liquid Biopsy Market (2026 - 2033) Size, Share & Trends Analysis Report By Biomarker (Exosomes, Circulating Nucleic Acids, CTC), By Technology, By Sample Type, By Application, By Clinical Application, By End Use, By Product, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-105-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Biopsy Market Summary

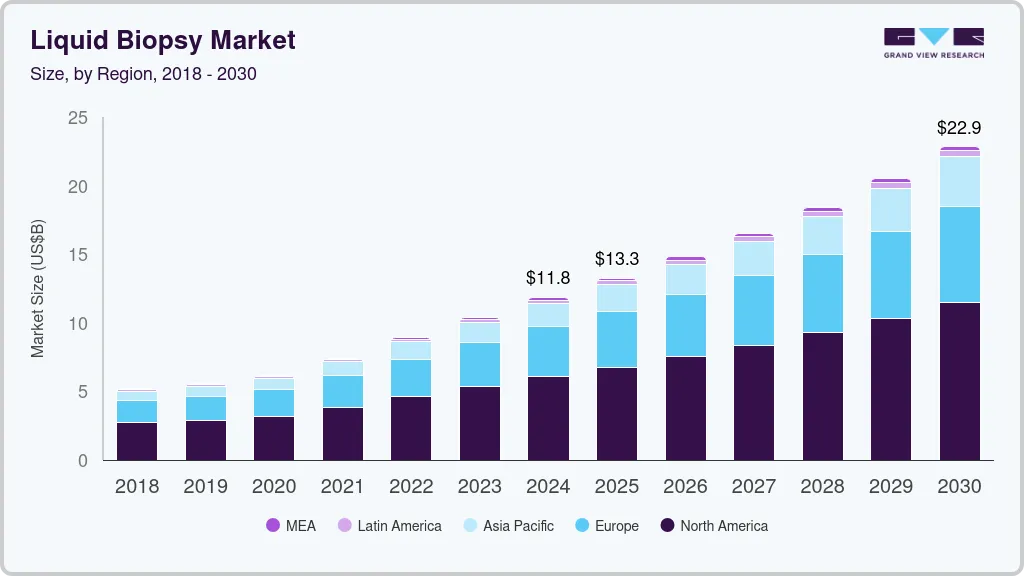

The global liquid biopsy market size was estimated at USD 13.60 billion in 2025 and is projected to reach USD 32.57 billion by 2033, growing at a CAGR of 11.52% from 2026 to 2033. The industry is witnessing growth due to factors such as the growing prevalence of cancer, technological advancements in cancer diagnostics, and rising preference for minimally invasive cancer diagnostics.

Key Market Trends & Insights

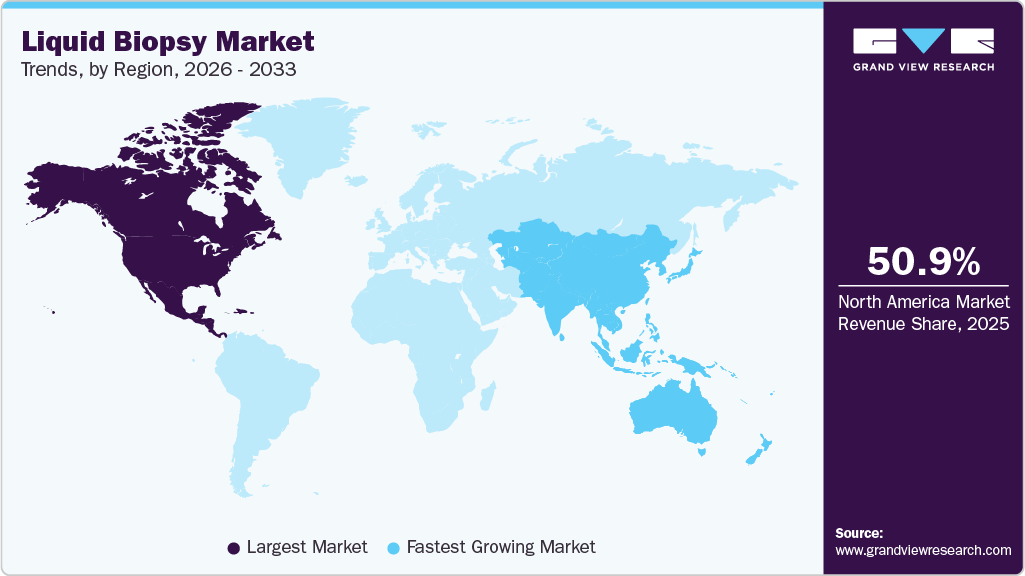

- North America dominated the liquid biopsy market with the largest revenue share of 50.99% in 2025.

- The liquid biopsy market in the U.S. accounted for the largest market revenue share in North America in 2025.

- Based on technology, the multi-gene-parallel analysis (NGS) segment led the market with the largest revenue share of 76.67% in 2025.

- Based on biomarker, the circulating nucleic acids segment led the market with the largest revenue share of 35.38% in 2025.

- Based on application, the cancer segment led the market with the largest revenue share of 86.47% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 13.60 Billion

- 2033 Projected Market Size: USD 32.57 Billion

- CAGR (2026-2033): 11.52%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Moreover, ongoing research for the development of liquid biopsy assays and tests, aided by the rising adoption and development of multi-cancer early detection tests, is providing a major opportunity for the growth of the overall market. Liquid biopsy is an advanced testing technology for the detection of genetic alterations related tumor. It has also been utilized to stratify tumors and deliver precise cancer treatment. For instance, in January 2023, Guardant Health received FDA approval for Guardant360 CDx, its liquid biopsy assay as companion diagnostics for ESR1 mutant breast cancer diagnosis. These recent innovations, advancements, and expansions in the industry promoting the use of liquid biopsy are driving the market.

For various applications, such as breast, colorectal, ovarian cancer, non-small-cell lung, and prostate cancer, liquid biopsy is used for diagnostic & screening, making it an important tool. After various studies and speculations, it has been determined that the liquid biopsy technique may provide an improved diagnosis outcome. Data show that screening techniques should be used on high-risk patients who have an ancestral history of cancer. Moreover, over the past several years, studies have shown positive outcomes of liquid biopsy platforms. The government and various regulatory bodies have also shown interest in the area by promoting multiple breakthrough devices for the rapid development of the technology.

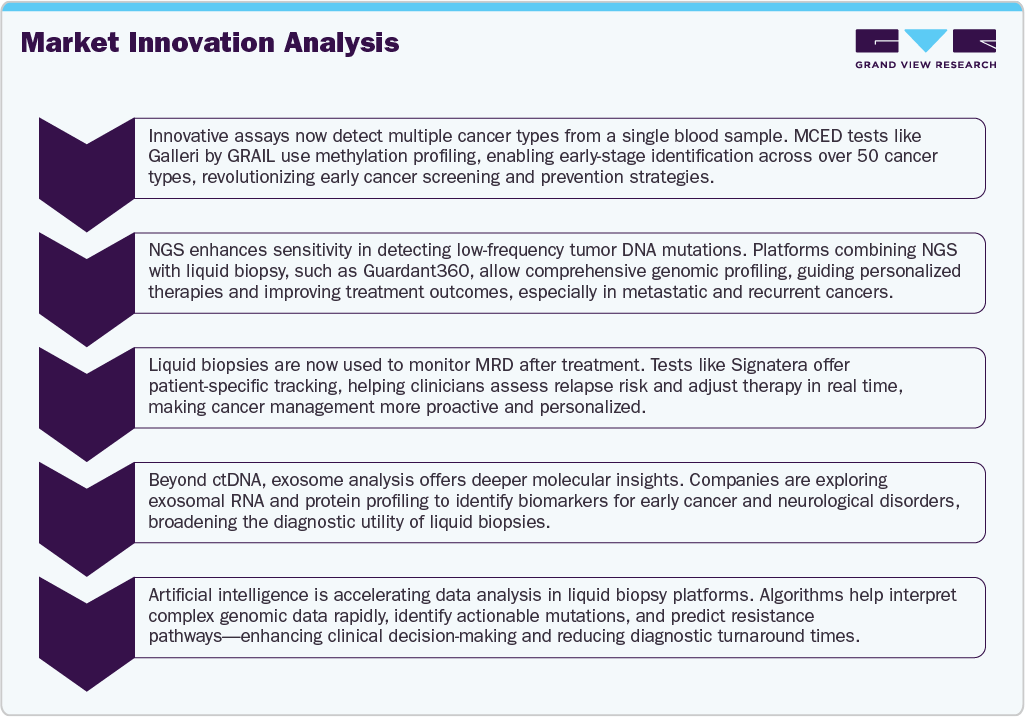

Furthermore, Multi Cancer Early Detection (MCED) provides major opportunities for the growth of the liquid biopsy market. The MCED market represents an emerging field of interest for the diagnostics industry, which not only enables early detection of cancer but also facilitates early treatment of these patients by saving time and minimizing the risk of requiring invasive medical procedures. There are several limitations to single cancer tests, including high false-positive rates and reduced sensitivity. In addition, diagnosis is usually conducted with a focus on just one type of cancer; hence, other cancers are left undiagnosed. Hence, these single cancer detection tests are failing to meet the changing needs of the consumers. Thus, opportunities presented by these MCED tests are significant.

Liquid biopsies are progressively being studied as a tool that can determine tumor evolution and guide systemic treatment. According to a study by ASCO, it is insufficient to prove the clinical utility for most of the ctDNAs in advanced-stage cancers and early-stage disease screening. For ctDNA and CTC, there is a requirement to regulate preanalytical variables for cross-platform comparison studies. However, to address these challenges, initiatives are being undertaken in the U.S and Europe. A low concentration of ctDNA and CTCs in biological samples is expected to limit the use of liquid biopsy in early-stage cancer diagnosis. Moreover, increasing ctDNA or CTC volume by drawing a large amount of blood from the patients is not clinically advisable. Such challenges in early-stage diagnosis are expected to restrain growth to a certain extent.

Market Concentration & Characteristics

The liquid biopsy industry exhibits high innovation, driven by advanced technologies such as ctDNA and exosome analysis. New diagnostic platforms, such as NGS-based tests, are improving cancer detection and monitoring. Companies like Guardant Health and Foundation Medicine are leading in innovation, enhancing test sensitivity and specificity, which is crucial for early cancer intervention and personalized treatment.

Mergers and acquisitions are robust in the liquid biopsy space, aimed at enhancing technological capabilities and market reach. For instance, Illumina’s acquisition of GRAIL in 2021 sought to integrate early cancer detection tools into mainstream diagnostics. Such activities accelerate product commercialization, facilitate regulatory navigation, and allow access to wider patient populations, strengthening competitive positions.

Regulations significantly shape the market, ensuring test accuracy and safety. Agencies such as the FDA and EMA are increasingly involved, particularly in approving companion diagnostics. The FDA’s 2020 guidance on liquid biopsy for minimal residual disease detection marked a pivotal step, fostering trust but also necessitating rigorous clinical validation, which can slow down market entry for newer players.

Companies are diversifying their offerings to cover more cancer types and stages. From non-small cell lung cancer to colorectal and breast cancer, tests are becoming tumor-agnostic. Examples include Guardant360 and Signatera expanding indications across solid tumors. This broadening of applications drives demand, especially in recurrence monitoring and therapy selection, aiding long-term market sustainability.

North America leads in adoption due to strong R&D and reimbursement infrastructure. However, the Asia Pacific is emerging fast, driven by rising cancer incidence and growing healthcare investments. Firms are partnering locally to meet regulatory norms and cost sensitivities. For example, Chinese firms are developing cost-effective assays, widening access, and boosting the market’s global footprint.

Technology Insights

The multi-gene-parallel analysis (NGS) segment held the largest market revenue share of 76.67% in 2025 and is anticipated to grow at the fastest rate over the forecast period. NGS technology allows the detection of various tumor-causing mutations and the identification of potential emergence of post-treatment resistance mechanisms from pre-existing clones. Rapid developments in NGS technology have led to significant cost reductions in sequencing with high accuracy. Furthermore, key players operating in the market are focusing on developing innovative products to meet the growing demand for diagnosis and maintain their position with an expanded product portfolio, thus driving the market. For instance, in January 2023, Agilent Technologies collaborated with Quest Diagnostics to provide access to Agilent Resolution ctDx FIRST, an NGS liquid biopsy test in the U.S.

The Single Gene Analysis (PCR Microarrays) segment is anticipated to show significant growth during the forecast period. Technological advancements in PCR are expected to propel market growth over the coming years. The recently introduced Droplet Digital PCR (ddPCR) is an advanced technology that allows absolute quantification of nucleic acids with high sensitivity and precision. This PCR technique has been developed as a rapid & precise tool for detecting and monitoring several types of cancers. For instance, Bio-Rad’s ddPCR technology detects cancer subtypes, monitors residual disease, optimizes drug treatment plans, and studies tumor evolution. ddPCR assays have advantages when used in liquid biopsies, enabling measurement of Circulating Tumor Cells (CTCs) and Circulating Nucleic Acids (cfDNA) in blood samples.

Biomarker Insights

The circulating nucleic acids segment held the largest market share of 35.38% in 2025. The growth of the segment is attributed to widespread applications of circulating tumor DNA (ctDNA) in liquid biopsy of cancer. Translational cancer researchers are identifying ctDNA from tumors using liquid biopsy. The discovery of ctDNA presents new opportunities for future liquid biopsy applications in cancer diagnosis, serving as a potential biomarker. CtDNA has been suggested as an alternative source in cancer patients for molecular profiling of tumor DNA, as opposed to invasive techniques. A new technique for early detection of cancer and monitoring of disease has been made possible by the identification of aberrant ctDNA from cancer cells.

The exosomes/microvesicles segment is anticipated to grow at the fastest rate over the forecast period with a CAGR of 13.71% over the forecast period. Exosomes show significant advantages in liquid biopsy. Exosomes are present in almost all body fluids, including plasma, cerebrospinal fluid, and urine. They possess high stability and are encapsulated by lipid bilayers. Exosomes act as a common central participant between cells during cancer progression and metastasis. The complex signaling pathway network between exosome-mediated cancer cells and the tumor microenvironment acts as a crucial factor in the cancer progression at all stages.

Application Insights

The cancer application segment dominated the overall market with a revenue share of 86.47% in 2025, owing to the rising adoption of liquid biopsy in the detection of cancer, aided by the rising prevalence of cancer globally. Liquid biopsy technology is one of the most evolving technologies in diagnostics and has made considerable headway in recent years, showing a significant growth in adoption in clinical applications. This approach is a fast-emerging precision oncology tool that allows for longitudinal monitoring and less invasive molecular diagnostics for therapy purposes. Furthermore, in June 2022, Elypta raised USD 21 million for the development of the MCED test with the LEVANTIS-0087A study in progress for MCED.

The reproductive health segment is anticipated to show the fastest growth over the forecast period with a CAGR of 12.69% owing to the promising R&D in the field of liquid biopsy is being considered for treating and maintaining reproductive health. Furthermore, alliances and partnerships among reproductive health industry actors promote segment expansion.

End Use Insights

The hospitals and laboratories segment dominated the market with a revenue share of 42.66% in 2025. Hospitals are preferred for care due to the availability of various services under one roof. The biggest benefit of hospitals conducting cancer diagnoses is that they can provide results for tests even in emergency situations. Liquid biopsy is helping the doctors by giving them a highly precise cancer diagnosis in a shorter turnaround time, thereby reducing the treatment lag time. Cancer patients in the hospital undergo routine monitoring for analysis of treatment resistance. Chemotherapy has long been a successful and dependable cancer treatment. Chemotherapy may be used to treat cancer or to improve quality of life by symptom management. In addition, chemotherapy can improve the efficacy of other treatments such as surgery or radiation therapy.

The specialty clinics segment is anticipated to grow at the fastest CAGR of 12.16% over the forecast period. An increase in awareness of personalized medicine, technological advancements, and a rise in demand for affordable services are some of the key factors expected to drive the growth of the specialty clinics segment. Another major factor expected to drive market growth is the increase in government initiatives to provide various facilities, such as compensation for diagnostic tests. Moreover, several healthcare institutions are collaborating with laboratories to integrate various clinical tests, including microbiology testing.

Clinical Application Insights

The therapy selection segment dominated the overall market in 2025 with a revenue share of 33.72%. The market's growth is attributed to the selection of treatment options that can be affected by liquid biopsies to improve patient outcomes. Cancer is the second leading cause of mortality in the U.S. and the most expensive disease to cure. Several advancements in cancer detection and biomarkers have been developed to aid in the study of cancer progression and the creation of successful treatment options. Liquid biopsies can assist in improving cancer therapies by enabling early intervention, enhancing treatment control, and moving decision-making away from reactionary acts and toward more proactive early interventions. Early detection is also facilitating market growth.

The early screening segment is expected to show the fastest growth with a CAGR of 12.34% over the forecast period. The growth of the segment is attributed to the rise in prevalence of multiple cancers and the increase in need to provide efficient methods to detect them at early stages to enable timely, appropriate treatment, is anticipated to drive the market. The need to develop diagnostic options that can detect cancer at an early stage, which can help improve disease management & reduce mortality, is likely to propel the overall market.

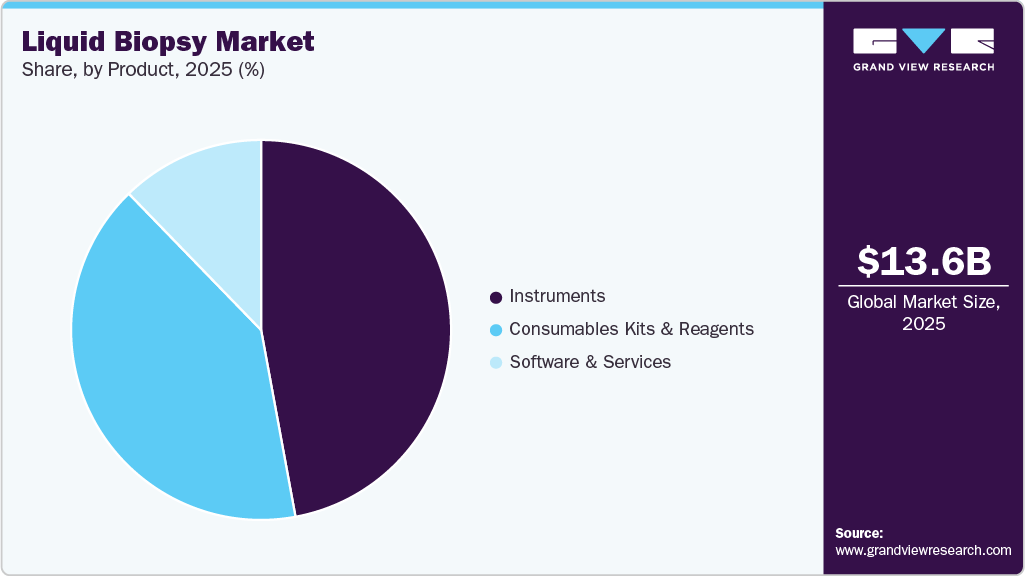

Product Insights

The instruments product segment dominated the market for liquid biopsy in 2025, with a revenue share of 47.10%. The dominance of the segment is attributed to the launch of new instruments and the advancement of existing products. For instance, in May 2025, Guardant Health introduced new features for the Guardant 360 liquid test, expanding its cancer subtyping capabilities & biomarker identification to help clinicians identify optimal treatment plans. These applications are enabled through the Guardant Infinity smart liquid biopsy platform and its AI learning engine.

The kits and reagents segment is expected to witness significant growth during the forecast period, owing to the increasing research and development activities by key market players for the development of advanced forms of kits and reagents. The recurring cost associated with kits and reagents further propels the growth of the market segment.

Sample Type Insights

The blood sample segment held the largest market share of 72.76% in 2025 and is projected to maintain its dominance over the forecast period. Blood-based liquid biopsy has remarkable advantages over traditional biopsy methods. Blood-based liquid biopsies are noninvasive, painless, and have no risk. In addition, it reduces the time taken and the cost of diagnosis. Exomes, CTCs, and cfDNAs, as well as microvesicles, in a blood sample can be detected, thus increasing the adoption of blood-based liquid biopsy. Circulating biomarkers play a vital role in the understanding of tumorigenesis and metastasis, which can further help determine tumor dynamics at the time of treatment and disease progression. Moreover, the concentration of biomarkers in blood may allow for the quick detection of cancer stage and enable more favorable predictions regarding prognosis in patients.

The others segment is anticipated to grow at the fastest growth rate over the forecast period with a CAGR of 12.43%. The segment includes urine, saliva, and Cerebrospinal Fluid (CSF)-based tests. Urine has also been used extensively for urinalysis and has proven applications in medical diagnosis. While it is not as commonly used in liquid biopsy studies, a few companies focus on developing urine-based liquid biopsy products. Collection of urine samples in large quantities is noninvasive, easier, and inexpensive.

Regional Insights

The North America liquid biopsy industry led with a revenue share of 50.99% in 2025, owing to high cancer prevalence, rapid technological advancements, and growing government initiatives. Moreover, the market is led by the U.S. owing to greater investments and the presence of several biotechnology companies that are developing advanced tests. Various organizations, including the American Society of Clinical Oncology (ASCO), are working to support the deployment of liquid biopsy, which is expected to increase revenue in this market. The market is expected to grow during the forecast period due to intense competition between biotechnology companies and increasing government investments in healthcare institutions to develop more sophisticated tests.

U.S. Liquid Biopsy Market Trends

The U.S. liquid biopsy industry accounted for the major revenue share of the North America market in 2025. Rapid technological advancements, recent FDA approvals for liquid biopsy tests, and intense competition between companies are expected to boost market growth over the forecast period. For instance, in November 2023, Illumina, Inc. announced the launch of the next generation of its distributed liquid biopsy, TruSight Oncology 500 ctDNA v2 (TSO 500 ctDNA v2). The research assay enables non-invasive, comprehensive genomic profiling of ctDNA from blood to complement tissue-based testing. Thus, the need for the implementation of liquid biopsy tests is growing to diagnose and eradicate cancer in the target population.

Europe Liquid Biopsy Market Trends

The liquid biopsy industry in Europe is expected to grow exponentially during the forecast period owing to an increase in the number of approvals by regulatory bodies, intense competition between companies to increase market share, government initiatives, and an improving reimbursement scenario. Collaborations among payers, hospitals, and companies are contributing to market growth. Moreover, it is believed that this technique can effectively replace solid tumor tests in most cancer screenings.

The UK liquid biopsy industry has gained ground due to the presence of sophisticated healthcare infrastructure, collaborations between key market players, and the launch of novel products. Government support & initiatives are expected to further propel the country’s cancer diagnostics market in the coming years. Commercial partnerships between the government and key players for the routine use of liquid biopsy in the country are anticipated to drive market growth.

The liquid biopsy industry in Germany is expected to witness growth owing to increasing number of companies striving to enter the market and government-sponsored aid for developing these tests. Moreover, government negotiations with payers to improve reimbursement scenarios, as these tests are expensive, are expected to drive the adoption of liquid biopsy tests. In Germany, Merck and Sysmex Inostics received the first CE approval for liquid biopsy tests for patients with colorectal cancer. Furthermore, intense competition between various biotechnology companies, such as Epigenomics and Roche, is expected to boost market growth. Increasing collaborations between key market players in this region are expected to fuel market growth by increasing research opportunities and developing better test procedures.

Asia Pacific Liquid Biopsy Market Trends

The liquid biopsy industry in the Asia Pacific is expected to grow at the fastest rate over the forecast period with a CAGR of 12.96% due to various factors, such as improving healthcare reforms. Some of the other factors contributing to market growth are increasing population, improving healthcare infrastructure, and entry of new players. The Asia Pacific has a large population and a high prevalence of cancer. Government initiatives, such as free screening for breast cancer, cervical cancer, & lung cancer, and improved collaborations between the government, research institutes, & companies for distribution & supply of these tests for screening cancers, have increased in the past few years.

The Japan liquid biopsy industry is expected to grow rapidly over the forecast period owing to high government spending to reduce cancer prevalence. Many initiatives, such as government grants to various research institutes and companies, can help develop practical solutions to battle cancer. Multiple companies have collaborated with regional private universities to establish and provide liquid biopsy techniques.

The liquid biopsy industry in China is expected to grow significantly over the forecast period. Lung cancer is the leading cause of mortality in China. On the other hand, prostate cancer is the fastest-growing cancer type in the country and the second leading cause of cancer mortality in the Western world. According to the NIH, in 2024, China is expected to report approximately 3,246,625 new cancer cases and 1,699,066 cancer-related deaths, highlighting a significant disease burden in the country. The government has undertaken various initiatives, such as free cervical cancer screening campaigns for women of all ages and collaborations with nonprofit organizations to improve the accessibility of the tests. Multiple companies have entered into alliances and partnership agreements to provide liquid biopsy tests in the country.

Latin America Liquid Biopsy Market Trends

The liquid biopsy industry in Latin America has exhibited significant growth in the past few years owing to increased prevalence of various types of cancer in the region. Several surveys by various government and nonprofit organizations revealed that overall cancer mortality in Latin America is almost twice that of high-income countries. Moreover, according to the data published by the European Society for Medical Oncology, there have been approximately 1.5 million new cancer cases and 700,000 deaths reported in Latin America and the Caribbean region annually.

The Brazil liquid biopsy industry is expected to grow significantly over the forecast period. In LATAM, Brazil has the largest population. Thus, cancer incidence in the country is high, which has led to increased usage of various biopsy techniques. However, it may take time for liquid biopsy to be used widely in the country, owing to the expensive testing procedure and limited availability of skilled professionals. Many professionals in Brazil still consider solid tumor biopsy the gold standard, as it offers a deep analysis of cancer mutation. Moreover, according to data published by the European Society for Medical Oncology, there have been approximately 1.5 million new cancer cases and 700,000 deaths reported in Latin America and the Caribbean annually. These factors are expected to contribute to market growth during the forecast period.

Middle East and Africa Liquid Biopsy Market Trends

The liquid biopsy industry in the Middle East and Africa is one of the regions with tremendous growth opportunities, as the majority of the market is untapped due to the unavailability of organized cancer screening programs in this region, especially in underdeveloped African countries. In recent years, countries such as the UAE, Morocco, & South Africa have implemented organized cancer screening programs. Collaborations of various companies with government institutes to supply these tests are also expected to boost the market. These initiatives are anticipated to lead to the development of newer liquid biopsy tests.

Key Liquid Biopsy Company Insights

The market is driven by a mix of established leaders and emerging innovators, each employing distinct strategies to enhance their market footprint. Major players such as ANGLE plc, Oncimmune Holdings PLC, Guardant Health, and Thermo Fisher Scientific, Inc., among others, have maintained dominance through continuous test innovations, acquisitions, and strategic partnerships aimed at expanding service offerings and reinforcing their global presence. For instance, in August 2025, Exact Sciences Corp. and Freenome, a biotechnology company pioneering an early cancer detection platform, announced they had entered into an agreement granting Exact Sciences exclusive U.S. rights to Freenome’s blood-based colorectal cancer screening tests. This collaboration strengthens Exact Sciences’ leadership in CRC screening by adding a liquid biopsy-based option to complement its Cologuard platform, with the potential to close critical gaps among unscreened populations.

Key Liquid Biopsy Companies:

The following are the leading companies in the liquid biopsy market. These companies collectively hold the largest market share and dictate industry trends.

- ANGLE plc

- Oncimmune Holdings PLC

- Guardant Health

- Myriad Genetics, Inc.

- Biocept, Inc.

- Lucence Health Inc.

- Freenome Holdings, Inc.

- F. Hoffmann-La Roche Ltd.

- QIAGEN

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Epigenomics AG

Recent Development

-

In April 2025, Labcorp announced the expansion of announced the expansion of its precision oncology portfolio with two new offerings. The first is Labcorp Plasma Detect, a clinical test designed to help evaluate the risk of disease recurrence in patients with stage III colon cancer. The second is PGDx elio plasma focus Dx, the first and only FDA-authorized kitted liquid biopsy test for pan-solid tumors, which supports the identification of patients who may be eligible for targeted therapies.

-

In April 2025, Guardant Health, a leading precision oncology company, announced a strategic agreement with Bayshore HealthCare, one of Canada’s largest home and community healthcare providers. Through this collaboration, Guardant’s portfolio of precision oncology tests will be made available across Bayshore’s national clinic network, expanding access to advanced blood-based cancer testing and supporting patients throughout the cancer care continuum in Canada.

-

In June 2025, QIAGEN and GENCURIX entered a strategic partnership under the new QIAcuityDx Partnering Program to develop digital PCR IVD assays for oncology. GENCURIX will act as the legal manufacturer responsible for assay development and regulatory approvals, while QIAGEN will market and distribute the products globally through its QIAcuityDx Four platform. This alliance expands the menu of assays available for digital PCR, supports both tissue and liquid biopsy applications, and supports QIAGEN’s strategy to build a broader ecosystem for clinical diagnostics.

-

In February 2025, Lucence and Agilus Diagnostics entered a strategic collaboration to advance cancer testing services across India. Under this agreement, Agilus, the country’s largest diagnostics provider, will integrate Lucence’s cutting-edge LiquidHALLMARK liquid biopsy technology into its expansive laboratory network. LiquidHALLMARK, an ultra-sensitive next-generation sequencing assay, analyzes both circulating tumor DNA (ctDNAand circulating tumor RNA (ctRNA), profiling 80 targeted ctDNA genes and 37 ctRNA fusions for actionable cancer biomarkers. This collaboration aims to expand access to liquid biopsy-based testing for early cancer detection, treatment monitoring, and therapy personalization throughout India, supporting precision oncology accessibility via Agilus’s nationwide reach.

-

In January 2025, Tempus AI, Inc. announced the launch of its FDA-approved next-generation sequencing (NGS)-based in vitro diagnostic test, xT CDx. The test is available to all ordering clinicians across the U.S. xT CDx provides comprehensive genomic insights through one of the largest FDA-approved gene panels currently on the market.

Liquid Biopsy Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 15.18 billion

Revenue forecast in 2033

USD 32.57 billion

Growth rate

CAGR of 11.52% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sample type, biomarker, technology, end use, application, clinical application, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

QIAGEN; Myriad Genetics, Inc; BIOCEPT, Inc; Guardant Health; F. Hoffmann-La Roche Ltd; Illumina, Inc; ANGLE plc; Oncimmune Holdings PLC; Thermo Fisher Scientific, Inc.; Lucence Health, Inc.; Freenome Holdings, Inc.; Epigenomics AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Liquid Biopsy Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global liquid biopsy market report based on sample type, biomarker, technology, application, end use, clinical application, product, and region:

-

Sample Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Blood Sample

-

Others

-

-

Biomarker Outlook (Revenue, USD Billion, 2021 - 2033)

-

Circulating Tumor Cells (CTCs)

-

Circulating Nucleic Acids

-

Exosomes/Microvesicles

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Multi-gene parallel Analysis (NGS)

-

Single Gene Analysis (PCR Microarrays)

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cancer

-

Lung Cancer

-

Prostate Cancer

-

Breast Cancer

-

Colorectal Cancer

-

Leukemia

-

Gastrointestinal Cancer

-

Others

-

-

Reproductive Health

-

Others

-

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hospitals and Laboratories

-

Specialty Clinics

-

Academic and Research Centers

-

Others

-

-

Clinical Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Therapy Selection

-

Treatment Monitoring

-

Early Cancer Screening

-

Recurrence Monitoring

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Instruments

-

Consumables Kits and Reagents

-

Software and Services

-

-

Regional Outlook (Revenue, USD Billion, 2021- 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global liquid biopsy market size was estimated at USD 13.60 billion in 2025 and is expected to reach USD 15.18 billion in 2026.

b. The global liquid biopsy market is expected to grow at a compound annual growth rate of 11.52% from 2026 to 2033 to reach USD 32.57 billion by 2033.

b. North America dominated the liquid biopsy market with a share of 50.99% in 2025. This is attributable to high cancer prevalence, rapid technological advancements, and growing government initiatives. Moreover, the market is led by U.S. owing to greater investments and presence of several biotechnology companies that are developing advanced tests.

b. Some key players operating in the liquid biopsy market include QIAGEN; Myriad Genetics, Inc; BIOCEPT, Inc; Guardant Health; F. Hoffmann-La Roche Ltd; Illumina, Inc; ANGLE plc; Oncimmune Holdings PLC; Thermo Fisher Scientific, Inc.; Lucence Health, Inc.; Freenome Holdings, Inc.; Epigenomics AG

b. Key factors that are driving the market growth include factor such as the growing prevalence of cancer, technological advancements in cancer diagnostics, and rising preference for minimally invasive cancer diagnostics. Moreover, ongoing research for the development of liquid biopsy assays and tests aided with the rising adoption and development of multi-cancer early detection tests is providing a major opportunity for growth of overall market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.