- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Asia Pacific Pea Protein Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Pea Protein Market Size, Share & Trends Report]()

Asia Pacific Pea Protein Market Size, Share & Trends Analysis Report By Product (Isolates, Concentrates), By Form (Dry, Wet), By Source, By Application (Food & Beverages, Animal Feed), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-318-5

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Asia Pacific Pea Protein Market Trends

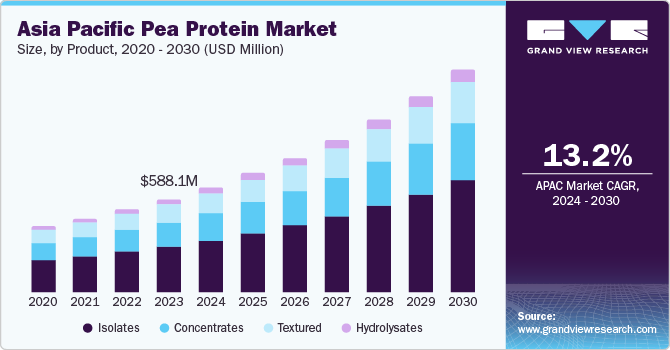

The Asia Pacific pea protein market size was estimated at USD 588.1 million in 2023 and is expected to grow at a CAGR of 13.2% from 2024 to 2030. Increased consumer focus on fit and active lifestyle, substantial presence of the vegan population in India, and growing penetration of organized and e-retail are a few factors augmenting the growth of the market. Moreover, growing competition among processed food & beverage companies is driving them to incorporate novel or healthy ingredients in their product to appeal to health conscious consumer base.

The Asia Pacific pea protein market accounted for a share of 27.7% of the global pea protein market in 2023. Pea protein is a clean-label, plant-based, and lactose-free protein source, unlike whey and casein proteins. Therefore, the growing consumption of dietary supplements, as well as functional foods due to changing lifestyles, is likely to favor market growth in the coming years. Moreover, a positive outlook toward the dietary supplements market in China, India, and Japan is expected to remain a favorable factor for market growth over the forecast period.

Product Insights

The pea protein isolates segment accounted for a revenue share of 49.9% in 2023. Pea protein isolates have good emulsification and non-allergic characteristics. Growing importance following workout routines in countries, such as India, China, and Indonesia, is expected to boost market growth from 2024 to 2030.

The pea protein concentrates segment is expected to grow at a CAGR of 12.9% from 2024 to 2030. The growing occurrence of gastrointestinal disorders has led to a greater emphasis on calorie-free and weight-reduction diets. This trend, combined with the lower cost of pea protein concentrate compared to isolate, is anticipated to encourage the use of pea protein concentrates in beverages, baked goods, and meat products in the coming years.

Source Insights

The yellow split peas segment dominated the market with a revenue share of 76.8% in 2023.A high protein content is widely found in yellow split peas, which makes them ideal for extracting pea protein. They are widely available, and offer favorable functional properties, ensuring a consistent supply, and a neutral flavor, making them versatile for various food applications. The fact that consumers are familiar with it and accept yellow split peas contributes to their prominence in the market.

The other sources segment, including lentils, green peas, chickpeas, and fava beans, is expected to grow at a CAGR of 11.3% from 2024 to 2030. They offer different amino acid compositions or micronutrient profiles, providing consumers with more options to meet their specific dietary requirements.

Application Insights

The food & beverages segment dominated the market with a revenue share of 37.28% in 2023. Food & beverage manufacturers use pea protein as nutritional supplements in energy drinks, fruit mixes, and bakery items. Moreover, the growing popularity of meat substitutes and increasing concern towards lactose intolerance among adults coupled with rising demand for gluten-free products are some of the key factors expected to drive market growth.

The personal care & cosmetics segment is expected to grow at a CAGR of 12.4% from 2024 to 2030. The growing demand for vegan and cruelty-free products as well as natural and plant-based ingredients is expected to drive the segment’s growth. Pea protein offers skin & hair benefits and is derived from plant sources, making it a perfect fit for the growing clean & sustainable beauty trend. Its natural origin and perceived benefits make it attractive for consumers seeking natural and plant-based ingredients in their personal care and cosmetics products.

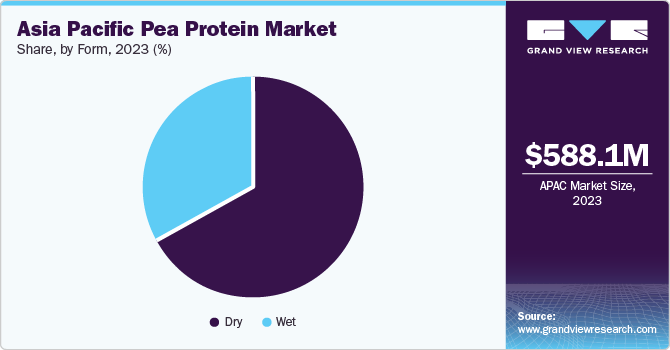

Form Insights

The dry pea protein segment accounted for a revenue share of 67.0% in 2023. The manufacturing of pea protein through dry milling in combination with air classification helps retain the native functionality of protein ingredients. This type of process also results in providing utility savings in terms of reduced water & power usage. In this process, yellow or red peas are ground through an impact-driven method and jet milling process at numerous levels of classifier wheel speeds for providing pea flours with different particle distribution, protein content, and damaged starch levels. In addition, the removal of 97-98% of fiber content is done by using the dehulling process.

The wet pea protein segment is expected to grow at a CAGR of 12.4% from 2024 to 2030. The production of pea protein isolates employs wet processing technology using the acid or alkali solubilization technique. This stage is followed by the process of ultrafiltration or soelectric precipitation to extract higher protein content from a fraction of protein.

Country Insights

China Pea Protein Market Trends

The China pea protein market accounted for a revenue share of 25.1% in 2023. Rising income and rapid urbanization in China have led to changes in lifestyle, which, in turn, have promoted the change in food consumption trends in the country. China has witnessed a significant increase in per capita consumption of proteins. Although animal protein constitutes a major part of the overall protein consumption in the country, growing awareness regarding the availability and environmental and health benefits of plant-based protein products is expected to benefit the market growth.

India Pea Protein Market Trends

The pea protein market in India is projected to grow at a CAGR of 14.6% over the forecast period. Rising health awareness among people coupled with an increasing number of fitness clubs in India is anticipated to drive the market growth. Augmented demand for nutritional food & beverages among consumers in India is projected to positively impact market growth over the forecast period.

Key Asia Pacific Pea Protein Company Insights

Some of the key players operating in the market include Shandong Jianyuan Foods Co., Ltd., Yantai Oriental Protein Tech Co., Ltd., and FENCHEM

-

Shandong Jianyuan Foods Co., Ltd. produces and distributes vermicelli, rice noodles, pea proteins, fibers, and starch

-

Headquartered in Zhaoyuan, China, Yantai Oriental Protein Tech Co., Ltd.’s product portfolio comprises pea fiber, pea protein isolates, pea protein concentrates, and pea starch. The company processes yellow peas into raw materials to manufacture finished goods

Key Asia Pacific Pea Protein Companies:

- Shandong Jianyuan Foods Co., Ltd.

- Yantai Oriental Protein Tech, Co., Ltd.

- FENCHEM

- Martin & Pleasance

- Cargill, Inc.

- Archer Daniels Midland Company

- Ingredion Inc.

- International Flavors & Fragrances Inc.

- Foodchem International Corp.

- Kerry Group PLC

- Roquette Frères

Recent Developments

- In June 2022, Roquette Frères announced the launch of a new range of organic textured proteins made from fava and pea namely, NUTRALYS. This launch aimed to strengthen Roquette Frère's position in the overall protein industry

Asia Pacific Pea Protein Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1,393.6 million

Growth rate

CAGR of 13.2% from 2024 to 2030

Historical period

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, source, application, country

Country scope

India; China; Japan; Australia & New Zealand; South Korea

Key companies profiled

Shandong Jianyuan Foods Co., Ltd.; Yantai Oriental Protein Tech, Co., Ltd.; FENCHEM; Martin & Pleasance; Cargill, Inc.; Archer Daniels Midland Company; Ingredion Inc.; International Flavors & Fragrances Inc.; Foodchem International Corp.; Kerry Group PLC; Roquette Frères

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Asia Pacific Pea Protein Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific pea protein market report based on product, form, source, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Isolates

-

Concentrates

-

Textured

-

Hydrolysates

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry

-

Wet

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Yellow Split Peas

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Meat Substitutes

-

Bakery Goods

-

Dietary supplements

-

Beverages

-

Others

-

-

Personal Care & Cosmetics

-

Animal Feed

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

India

-

China

-

Japan

-

Australia & New Zealand

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific pea protein market size was estimated at USD 588.1 million in 2023.

b. The pea protein market is expected to grow at a compound annual growth rate of 13.2% from 2024 to 2030 to reach USD 1,393.6 million by 2030.

b. Yellow split peas dominated the market with a revenue share of over 76.8% in 2023. Yellow split peas have a high protein content, making them ideal for pea protein extraction. Additionally, they are widely available, ensuring a consistent supply. They also possess favorable functional properties and a neutral flavor, making them versatile for various food applications. Consumer familiarity and acceptance of yellow split peas contribute to their prominence in the market.

b. Some of the key market players in the pea protein market are Burcon Nutrascience; Roquette Freres; The Scoular Company; DuPont; Cosucra Groupe Warcoing SA; Nutri-Pea; Shandong Jianyuan Group; Sotexpro SA; Ingredion, Inc.; Axiom Foods, Inc.; Fenchem, Inc.; Martin & Pleasance; The Green Labs LLC, among others.

b. The growth factors such as increasing demand for plant-based protein, health and fitness trends, and the growing vegan and vegetarian population are being projected to augment demand over the forecast period. Furthermore, the versatility of pea protein and its ability to provide functional properties like emulsification, texture enhancement, and foaming have widened its market potential

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."