- Home

- »

- Pharmaceuticals

- »

-

Nutritional Supplements Market Size, Industry Report, 2033GVR Report cover

![Nutritional Supplements Market Size, Share & Trends Report]()

Nutritional Supplements Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Sports Nutrition, Dietary Supplements, Fat Burners), By Formulation, By Consumer Group, By Sales Channel, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-884-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nutritional Supplements Market Summary

The global nutritional supplements market size was estimated at USD 517.09 billion in 2025 and is projected to reach USD 862.51 billion by 2033, growing at a CAGR of 6.62% from 2026 to 2033. Market growth is driven by rising health awareness, increasing demand for preventive healthcare, and growing adoption of functional foods and dietary supplements across all age groups.

Key Market Trends & Insights

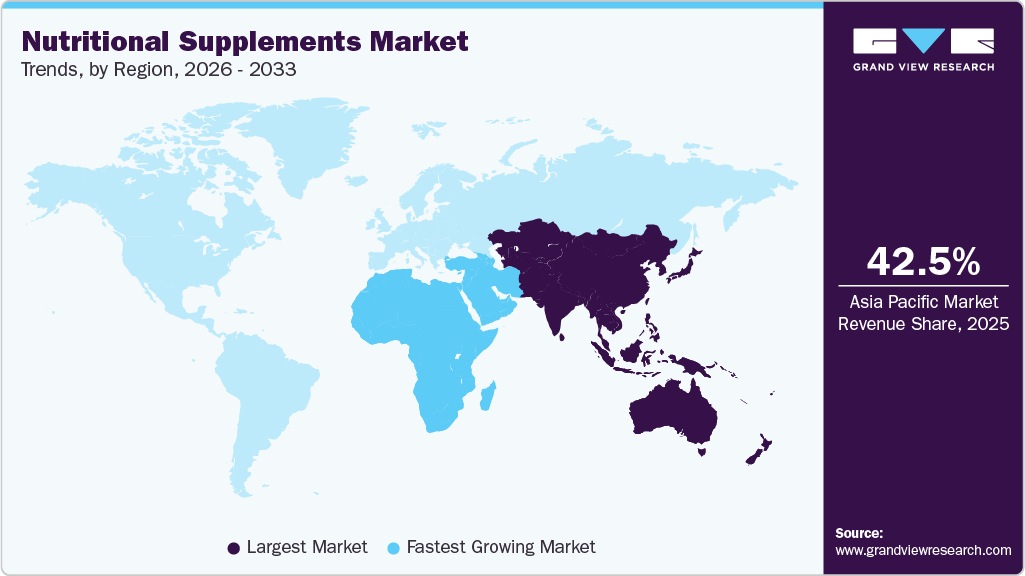

- The Asia Pacific nutritional supplements market held the largest share of 42.46% in 2025.

- The nutritional supplements industry in China is expected to grow from 2026 to 2033.

- By consumer group, the adult segment dominated the global market in 2025 with a revenue share of 51.92%.

- By product, the dietary supplements segment dominated the market in 2025.

- By formulation, the powder segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 517.09 Billion

- 2033 Projected Market Size: USD 862.51 Billion

- CAGR (2026-2033): 6.62%

- Asia Pacific: Largest market in 2025

- Middle East & Africa: Fastest growing market

Growing health consciousness and increasing emphasis on fitness and nutrition

Increasing adoption of sedentary lifestyles and growing consumption of unhealthy diets have increased the risk of various diseases, including diabetes, cardiovascular diseases, obesity, & cancer. The latest International Diabetes Federation (IDF) Diabetes Atlas (2025) reports that 11.1%, or approximately 1 in 9 of the global adult population aged 20-79 years is living with diabetes, with more than 40% of affected individuals unaware of their condition.

The changing lifestyle trend has increased the adoption of nutritional supplements. Many people are focused on self-care & preventive medication. Consumers are increasingly recognizing the benefits of a healthy lifestyle and dietary supplements, becoming more health-conscious and embracing active lifestyles, which is expected to positively impact the nutritional supplements industry in the near future.

Increasing Disposable Income In Emerging Economies

Rising disposable incomes in emerging economies are driving consumer spending on dietary supplements, particularly in health, wellness, and preventive care. Increased purchasing power is another factor that is influencing the demand for the premium segment of the market, which includes higher-priced supplements with specialized formulations, superior ingredients, innovative delivery systems, and scientifically validated benefits, hence supporting the growth of the premium segment.

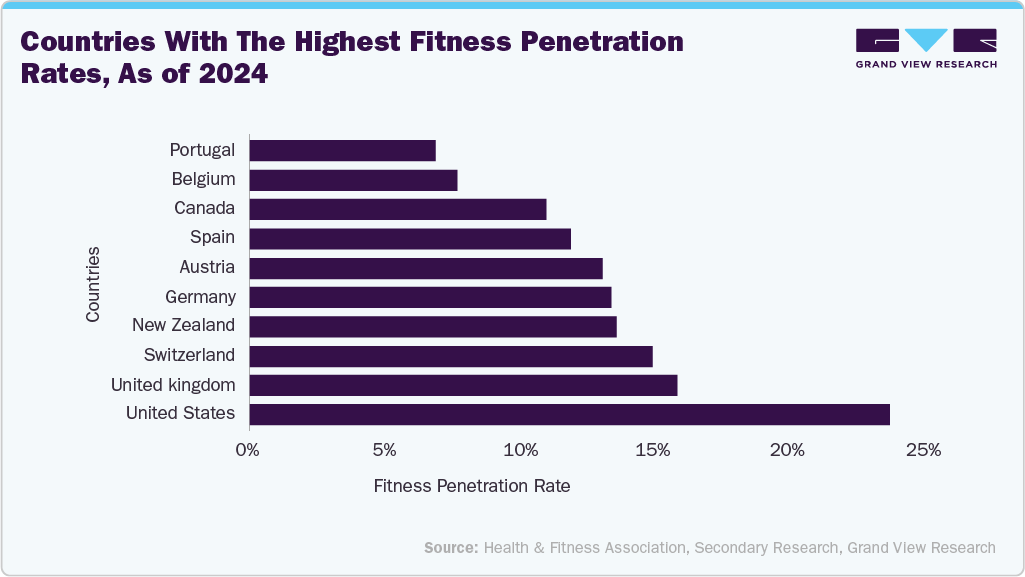

Moreover, rising incomes have enabled consumers to adopt complementary healthy lifestyle behaviors, such as gym memberships, fitness classes, and personalized nutrition plans, which further fuel demand for sports nutrition, weight management, and immunity-enhancing supplements.

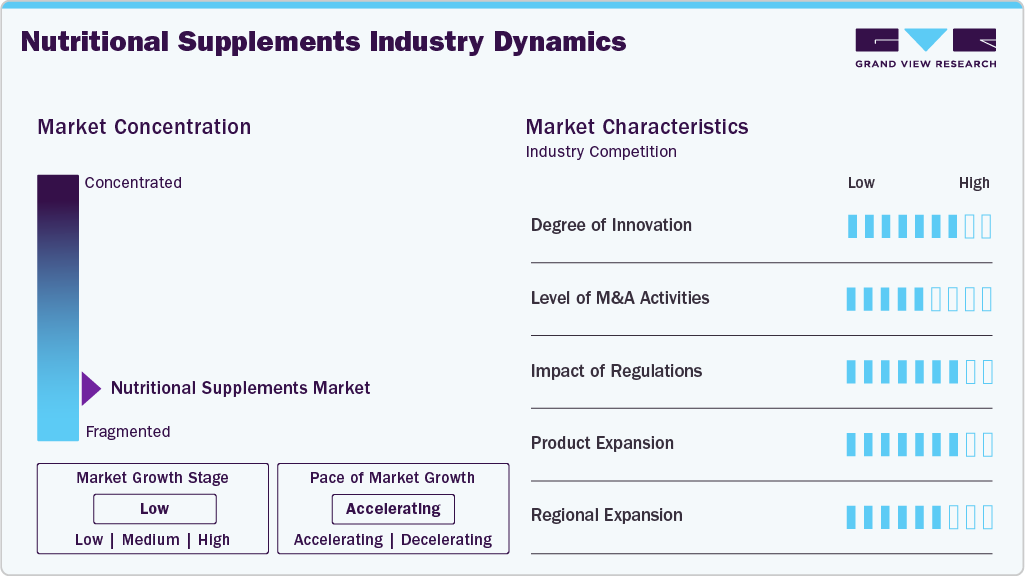

Market Concentration & Characteristics

The nutritional supplements industry has experienced substantial innovation, including advanced formulations, personalized nutrition, plant-based alternatives, and improved delivery methods such as gummies and powders. These innovations cater to evolving consumer preferences for health-focused, convenient, and effective wellness solutions.

Mergers and acquisitions (M&A) in the nutritional supplements industry have been robust, driven by increasing demand for health and wellness products. Companies are merging to expand product portfolios, enhance distribution channels, and access new markets.

Regulations in the nutritional supplements market ensure product safety, quality, and efficacy by preventing the use of harmful ingredients and misleading claims. Although they increase compliance costs, clear regulatory standards build consumer trust, support market growth, and encourage innovation in product development and labeling.

Product expansion in nutritional supplements has accelerated market growth by diversifying offerings to address specific health needs. Broader portfolios, including plant-based, organic, and personalized supplements, expand market reach, attract new consumers, and intensify competition, thereby driving innovation and alignment with evolving health trends.

The regional growth in the nutritional supplements industry permits the firms to reach new customers with different health requirements. The entrance into the developing markets like Asia and Latin America not only brings the firm more money but also makes the brand more visible and more competitors, thus forcing the companies to come up with more localized products and marketing strategies according to their target customers.

Product Insights

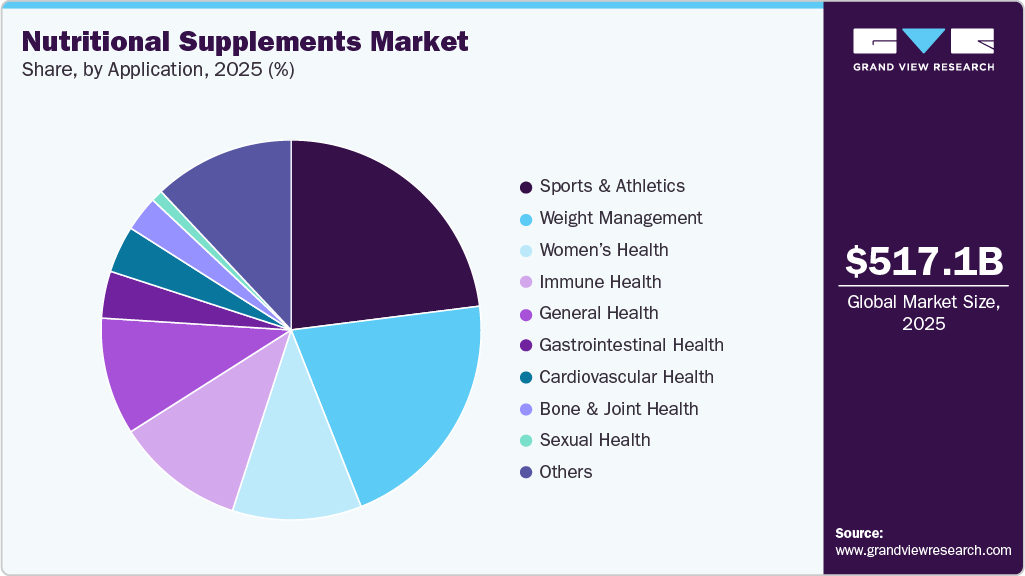

The dietary supplements segment led the nutritional supplements market, accounting for the largest share of 41.36% in 2025. Increasing health awareness, aging populations, and rising demand for immunity, digestive, and metabolic health solutions have supported sustained demand.

The sports nutrition products segment is anticipated to grow at the fastest CAGR from 2026 to 2033. The growing emphasis on fitness and health to live a healthy life can be cited as the main reason for this. Professional athletes and sports enthusiasts have continuously supported the use of sports nutrition products, and as a result, this segment has grown.

Formulation Insights

The powder segment dominated the nutritional supplements industry, accounting for a 37.72% share in 2025. The increase in demand for powdered supplements in sports nutrition, protein, and meal-replacement products is largely responsible for their widespread adoption, driven by easy dosing, affordable pricing, and long shelf life.

The capsules segment is expected to grow at the fastest CAGR throughout the forecast period. The availability of products in multiple encapsulations is driving an increase in the bioavailability of active ingredients. Multi-membrane encapsulations or multilayered, extended-release capsules for minerals, vitamins, and omega-3 fatty acids are now available in capsules, which have propelled the growth of the market.

Consumer Group Insights

The adults segment dominated the nutritional supplements market with a 51.92% share in 2025 and is anticipated to grow at the fastest CAGR over the forecast period. This dominance can be attributed to increasing health consciousness among the working-age population, rising prevalence of lifestyle-related conditions, and higher adoption of preventive healthcare practices.

The geriatric segment is expected to grow at a significant CAGR during the forecast period. The growing interest in fitness and wellness among the geriatric population is expected to drive the demand in the segment. According to the article published by Glanbia Nutritionals in February 2021, people in their 50s, 60s, and 70s are the top consumers of nutritional supplementation products in the U.S. market.

Sales Channel Insights

The brick & mortar segment dominated the nutritional supplements industry in 2025. The segment is experiencing growth driven by strong consumer preference for in-store consultations, immediate product availability, and greater trust in pharmacies, specialty nutrition stores, and supermarkets.

The E-commerce segment is expected to register the fastest CAGR during the forecast period. The online sales channel has increased significantly during the COVID-19 pandemic. As a plan to expand its geographical reach, players in the industry have been partnering with e-commerce platforms to make their products available online, which has positively influenced the growth of the market.

Application Insights

The sports & athletics segment dominated the nutritional supplements market with a 22.79% share in 2025 and is anticipated to grow at the highest CAGR over the forecast period. Rising engagement in fitness and endurance sports, a stronger focus on performance and recovery, and greater consumption of protein, amino acid, and energy supplements by both professionals and casual users are the main factors behind this growth.

The sexual health segment is expected to register a significant CAGR during the forecast period, driven by rising awareness of sexual wellness, increasing prevalence of lifestyle-related disorders, and growing acceptance of preventive and therapeutic solutions. Expanding product availability, targeted marketing, and improved access through online and retail channels are further supporting sustained market growth.

Regional Insights

The North American nutritional supplements market has grown steadily, driven by rising health awareness, demand for personalized fitness and immunity-focused products, and an aging population. Growth is further supported by the growing popularity of plant-based and natural supplements, as well as the expansion of e-commerce and direct-to-consumer channels.

U.S. Nutritional Supplements Market Trends

The U.S. nutritional supplements industry is expanding, driven by health-conscious millennials and Gen Z, rising fitness culture, and strong demand for sports and mental health supplements. Advances in biotechnology and precision medicine are also supporting the growth of targeted and personalized formulations.

Europe Nutritional Supplements Market Trends

The Europe nutritional supplements industry is growing due to increased focus on preventive health, strong demand for plant-based and sustainable products, and an aging population seeking longevity, cognitive, and joint health solutions.

The nutritional supplements market in the UK held a significant share in 2025. Rising interest in mental and digestive health, along with the popularity of plant-based alternatives, is driving demand for targeted supplements, while e-commerce and subscription services are improving accessibility and convenience.

The Germany nutritional supplements market is anticipated to grow significantly over the forecast period. German consumers prioritize high-quality, science-backed products, particularly plant-based and natural supplements.

Asia Pacific Nutritional Supplements Market Trends

The Asia Pacific nutritional supplements industry accounted for the largest share of 42.46% in 2025, driven by low raw material costs, widespread availability of functional foods, and high awareness of supplement benefits. Countries such as Japan and China lead in nutritionally enriched foods, with the region serving as a major production and export hub. Ongoing market entry by global players, including USANA Health Sciences’ expansion into India, is further supporting growth.

China’s nutritional supplements market is expected to grow steadily, driven by rising health awareness, the adoption of preventive healthcare, and rising disposable incomes. The demand for such products is backed by a combination of traditional Chinese herbal medicine products and Western supplements, an increasing number of older adults, rapid adoption of e-commerce, and the presence of better regulatory supervision that boosts consumer confidence.

The nutritional supplements market in Japan is growing steadily, driven by strong demand for functional foods that blend traditional ingredients with modern nutrition science and by an aging population seeking joint, cognitive, and vitality-supporting solutions.

MEA Nutritional Supplements Market Trends

The MEA nutritional supplements industry is projected to grow at the fastest pace, with a CAGR of 7.17% over the forecast period. Rising disposable incomes, especially in countries such as the UAE and Saudi Arabia, are fueling demand for premium supplements. There is growing interest in products for weight management, immune support, and beauty from within. In addition, the region’s young, health-conscious population is increasingly seeking plant-based and organic supplements.

Kuwait’s nutritional supplements market is expected to grow, driven by rising demand for weight management, immunity, and wellness products, particularly vitamins and minerals such as vitamin D and zinc. Fitness trends, social media influence, and increasing interest in beauty and anti-aging supplements are further supporting market expansion.

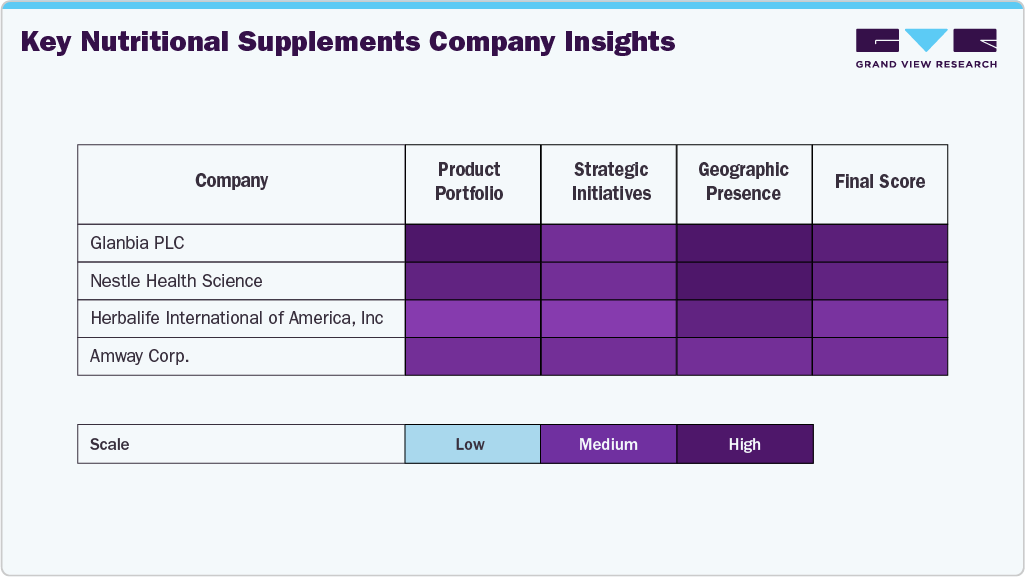

Key Nutritional Supplements Company Insights

The nutritional supplements industry is characterized by the presence of a diverse mix of multinational corporations and specialized health and wellness companies, including Glanbia PLC, Nestlé Health Science, Herbalife International of America, Inc., Amway Corp., PepsiCo, The Coca-Cola Company, GNC Holdings, LLC, Thorne, NOW Foods, and The Vitamin Shoppe.

These companies offer a wide range of products, including vitamins, minerals, proteins, amino acids, botanicals, and condition-specific supplements for preventive healthcare, sports nutrition, weight management, and general wellness. Strong brands, global distribution, and continuous innovation drive competition, while the presence of major food and beverage firms alongside specialized nutraceutical players highlights the market’s growth potential amid rising health awareness.

Key Nutritional Supplements Companies:

The following are the leading companies in the nutritional supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Glanbia PLC

- Nestlé Health Science

- Herbalife International of America, Inc.

- Amway Corp.

- PepsiCo

- The Coca-Cola Company

- GNC Holdings, LLC

- Thorne

- NOW Foods

- The Vitamin Shopee

Recent Developments

-

In December 2025, ANJAC Health & Beauty acquired Slovenia’s Health Chain Group (HCG), including its entities PharmaLinea, Hermes Consilium, and ErgoPharma, to strengthen its nutraceutical and food supplement capabilities. The acquisition enhances ANJAC’s product development, manufacturing, and global presence in the dietary supplements and functional nutrition market.

-

In June 2024, Steadfast Nutrition introduced three new supplements to its lineup: Whey Protein, LIV Raw, and a vegetarian Multivitamin mega pack with 180 tablets. These products aim to address the protein and nutrient needs of health-conscious individuals and athletes. The launch took place at Asia’s largest health and fitness event, the International Health Sports and Fitness Festival (IHFF).

-

In May 2023, Launch Hydrate, a key player in the sports nutrition industry, partnered with the Perfect Game, a softball and baseball organization. This collaboration aimed to offer various sports drinks to the Perfect Games participants.

Nutritional Supplements Market Report Scope

Attribute

Details

Market size value in 2026

USD 550.75 billion

Revenue forecast in 2033

USD 862.51 billion

Growth rate

CAGR of 6.62% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, consumer group, formulation, sales channel, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Glanbia PLC; Nestlé Health Science; Herbalife International of America, Inc.; Amway Corp.; PepsiCo; The Coca-Cola Company; GNC Holdings, LLC; Thorne; NOW Foods; The Vitamin Shopee

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Nutritional Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the nutritional supplements market on the basis of product, consumer group, formulation, sales channel, application, and region:

-

Product Scope Outlook (Revenue, USD Million, 2021 - 2033)

-

Sports Nutrition

-

Sports Supplements

-

Protein Supplements

-

Egg Protein

-

Soy Protein

-

Pea Protein

-

Lentil Protein

-

Hemp Protein

-

Casein

-

Quinoa Protein

-

Whey Protein

-

Whey Protein Isolate

-

Whey Protein Concentrate

-

-

-

Vitamins

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

-

Amino Acids

-

BCAA

-

Arginine

-

Aspartate

-

Glutamine

-

Beta Alanine

-

Creatine

-

L-carnitine

-

-

Probiotics

-

Omega-3 Fatty Acids

-

Carbohydrates

-

Maltodextrin

-

Dextrose

-

Waxy Maize

-

Karbolyn

-

-

Detox Supplements

-

Electrolytes

-

Others

-

-

Sports Drinks

-

Isotonic

-

Hypotonic

-

Hypertonic

-

-

Sports Foods

-

Protein Bars

-

Energy Bars

-

Protein Gel

-

-

Meal Replacement Products

-

Weight Loss Product

-

-

Fat Burners

-

Green Tea

-

Fiber

-

Protein

-

Green Coffee

-

Others

-

-

Dietary Supplements

-

Vitamins

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

-

Minerals

-

Enzymes

-

Amino Acids

-

Conjugated Linoleic Acids

-

Others

-

-

Functional Foods and Beverages

-

Probiotics

-

Omega-3

-

Others

-

-

-

Consumer Group Scope Outlook (Revenue, USD Million, 2021 - 2033)

-

Infants

-

Children

-

Adults

-

Age group 21 to 30

-

Age group 31 to 40

-

Age group 41 to 50

-

Age group 51 to 65

-

-

Pregnant

-

Geriatric

-

-

Formulation Outlook (Revenue, USD Million, 2021 - 2033)

-

Tablets

-

Capsules

-

Powder

-

Softgels

-

Liquid

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Brick & Mortar

-

Direct Selling

-

Chemist/Pharmacies

-

Health Food Shops

-

Hyper Markets

-

Super Markets

-

-

E-commerce

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Sports & Athletics

-

General Health

-

Bone & Joint Health

-

Brain Health

-

Gastrointestinal Health

-

Immune Health

-

Cardiovascular Health

-

Skin/Hair/Nails

-

Sexual Health

-

Women’s Health

-

Anti-aging

-

Weight Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021- 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nutritional supplements market size was estimated at USD 517.09 billion in 2025 and is expected to reach USD 550.75 billion in 2026.

b. The global nutritional supplements market is expected to grow at a compound annual growth rate of 6.62% from 2026 to 2033 to reach USD 862.51 billion by 2033.

b. The functional foods and beverages segment dominated the market for nutritional supplements and held the largest revenue share of 39.28% in 2025.

b. By formulation, the powder segment dominated the nutritional supplements market and accounted for the largest revenue share of 37.72% in 2025.

b. The adults segment dominated the market for nutritional supplements and accounted for the largest revenue share of 51.92% in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.