- Home

- »

- Alcohol & Tobacco

- »

-

Asia Pacific Rum Market Size & Share, Industry Report, 2030GVR Report cover

![Asia Pacific Rum Market Size, Share & Trends Report]()

Asia Pacific Rum Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dark & Golden Rum, White Rum, Flavored & Spiced Rum), By Distribution Channel (Off-trade, On-trade), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-590-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Rum Market Size & Trends

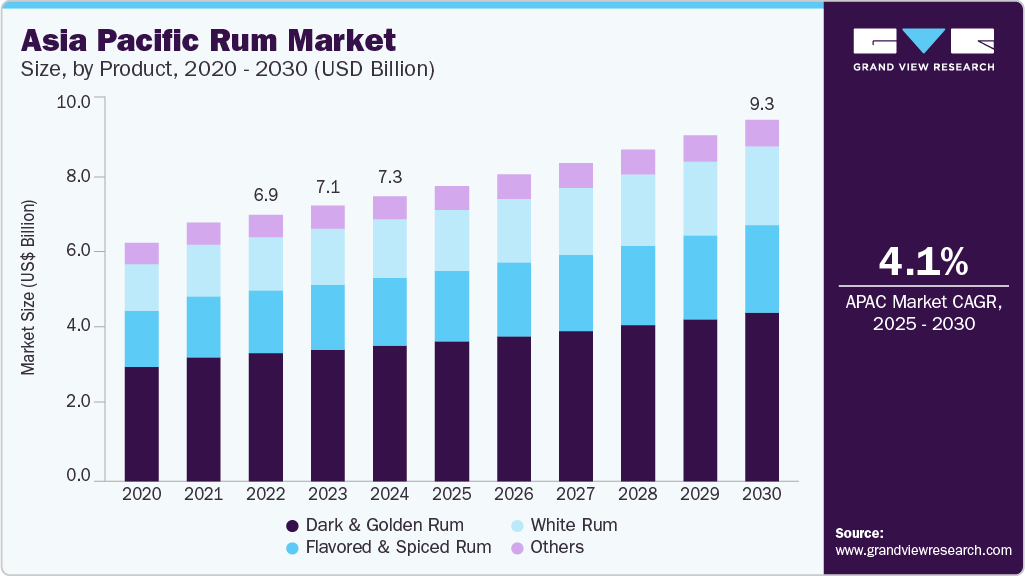

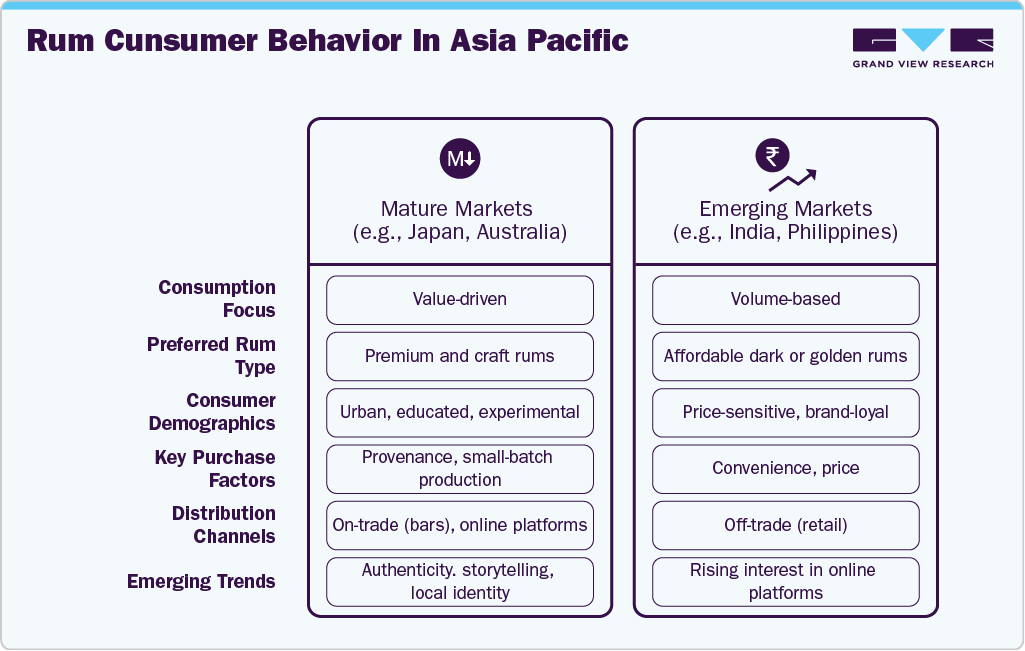

The Asia Pacific rum market size was estimated at USD 7.31 billion in 2024 and is expected to grow at a CAGR of 4.1% from 2025 to 2030. The industry is driven by a blend of rising disposable incomes, shifting consumer preferences toward premium and craft spirits, and the increasing influence of Western drinking culture among urban millennials and Gen Z consumers. Countries like India and the Philippines have long-standing rum consumption traditions, while markets such as Japan and Australia are experiencing heightened interest in imported and artisanal spirits due to evolving palates and experimentation in cocktail culture. The growth of organized retail, e-commerce platforms, and a broader on-trade landscape, including pubs and lounges, also contributes to the sustained expansion of rum across the region.

One of the most significant drivers behind the growth of the rum industry in Asia Pacific is the demographic shift toward younger, urban, and socially active consumers. These consumers are more experimental in their drinking choices and often seek spirits that offer both versatility and story-led branding. Countries such as India and Australia are seeing a surge in demand for cocktail-ready spirits, with rum being favored for its compatibility with tropical ingredients and creative mixology. Australian craft producers like Brix Distillers and Husk Distillers have tapped into this trend by offering small-batch, locally sourced rums with strong provenance stories. In India, the shift is more dramatic: traditional dark rums such as Old Monk still dominate volume sales, but premium entrants like Maka Zai and Camikara are carving out niche followings in Tier 1 cities by appealing to consumers seeking authenticity, luxury, and craft.

The tourism and hospitality industries play a crucial role in supporting rum consumption across markets like the Philippines and Japan. In the Philippines, Tanduay’s deep-rooted cultural significance, combined with its aggressive export strategy, has maintained its leadership both domestically and in select foreign markets. Local players such as Don Papa Rum have found international success by positioning themselves as premium, small-batch producers rooted in Filipino heritage, appealing to tourists and high-end consumers. In Japan, although rum consumption is still modest relative to whisky or sake, the influence of global bar culture and Tokyo’s reputation for craft cocktail experiences is creating pockets of demand for premium rums. Imported labels such as Bacardi, Diplomatico, and Plantation are increasingly featured in high-end bars, supported by distributors like Asahi Breweries and Kirin Group.

E-commerce penetration, premiumization, and regional trade liberalization are also shaping the competitive dynamics. Platforms like Dan Murphy’s in Australia, Amazon Japan, and BigBasket in India are expanding the availability of imported and boutique rum labels, facilitating trial and discovery. Meanwhile, the rise of home mixology—accelerated during the pandemic—has sustained consumer interest in versatile spirits like white and flavored rum. Strategic partnerships between international brands and local distributors enable stronger market access, while regulatory relaxation in India’s state-controlled markets further opens up opportunities. Together, these structural tailwinds are creating a favorable ecosystem for volume expansion, brand diversification, and category upgrading in the Asia Pacific rum industry.

Consumer Insights

Product Insights

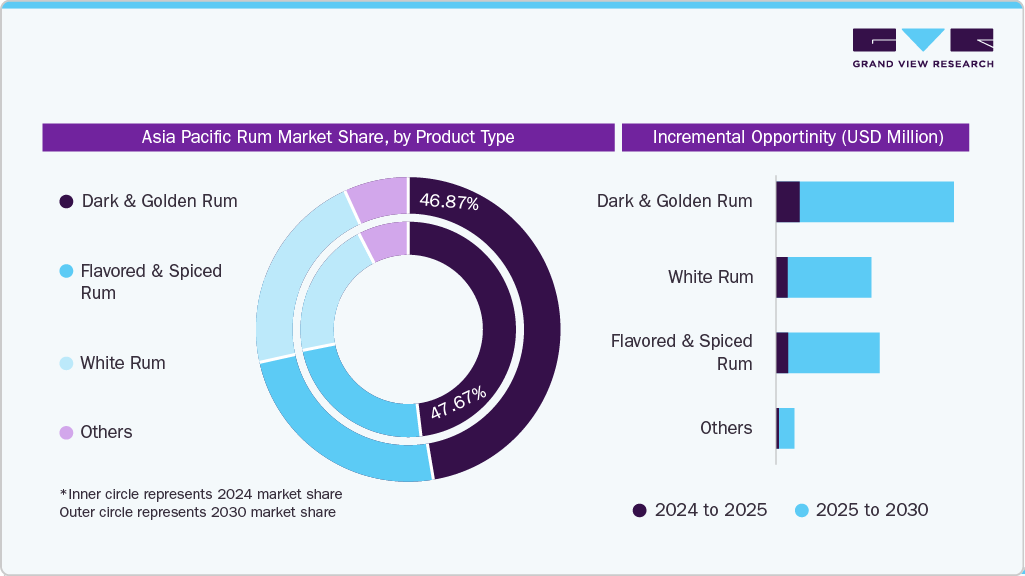

Dark and golden rum accounted for the largest share of 47.67% in 2024, reflecting their entrenched popularity in markets like the Philippines and India, where legacy brands such as Tanduay, Old Monk, and McDowell’s No. 1 continue to dominate. These variants benefit from deep-rooted consumer loyalty, favorable price points, and wide availability in both rural and urban areas. Moreover, in premium segments, golden rum’s barrel-aged characteristics are increasingly appreciated by connoisseurs and cocktail bars in Australia and Japan, enhancing their share in revenue terms despite lower volume contribution compared to value rum segments.

For instance, in April 2024, Rampur Distillery, owned by Radico Khaitan, launched The Kohinoor Reserve Indian Dark Rum, which is produced through small-batch distillation using fresh cane juice harvested during the North Indian winter.

The white rum segment is expected to grow at a CAGR of 5.1% from 2025 to 2030, driven by its increasing adoption in cocktail menus and rising appeal among younger consumers seeking lighter, mixable spirits. The growth is particularly pronounced in Australia and Japan, where on-trade channels, home mixology trends, and bar-led innovations are fueling demand. Brands such as Bacardi and local entrants like Beenleigh (Australia) are leveraging this momentum through strategic product positioning, emphasizing versatility, tropical freshness, and approachable flavor profiles, thereby solidifying white rum’s role as an entry point for new consumers.

For instance, in February 2024, in February 2024, Love Drinks announced the launch of a new white rum sourced from Japan's oldest distillery, Kōbō Distillery, which has been producing spirits since 1868. The product aims to introduce consumers to a different style of rum that emphasizes purity and craftsmanship, aligning with the growing trend for premium spirits.

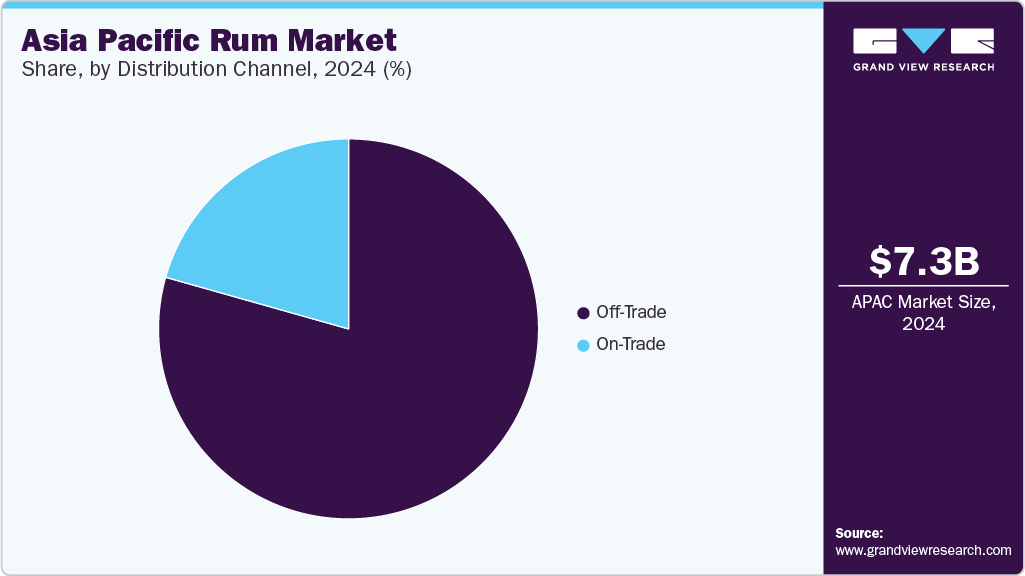

Distribution Channel Insights

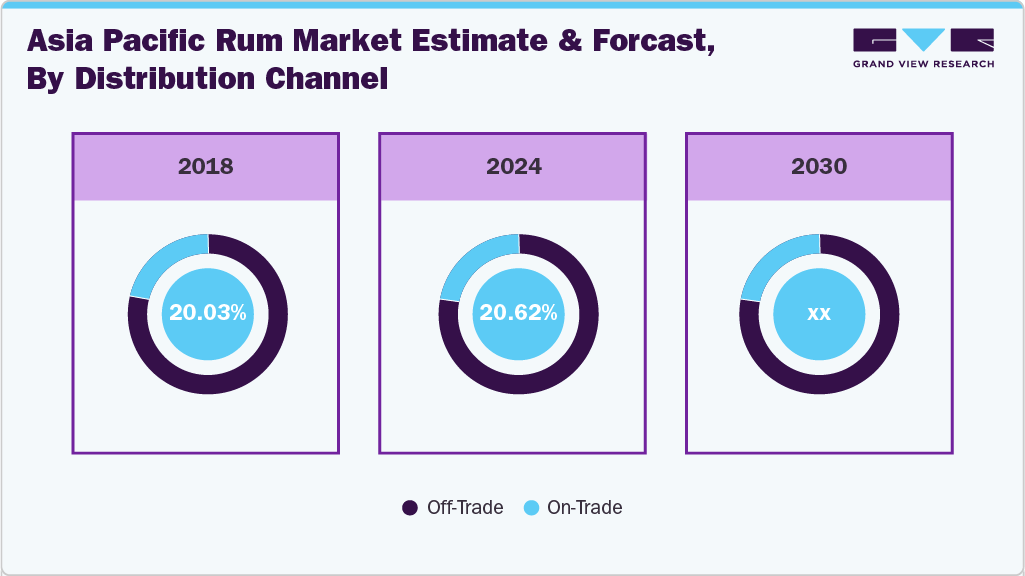

Sales of rum through the off-trade distribution channel accounted for the largest share of 79.38% in 2024, underlining the continued importance of retail outlets, liquor stores, and e-commerce platforms in driving volume. Countries like India and the Philippines, where state-regulated or franchised liquor stores dominate, have historically leaned heavily on off-trade sales due to price sensitivity and ease of access. Additionally, online channels such as Amazon, Dan Murphy’s, and BoozeBud in Australia have expanded consumer reach, particularly for mid-to-premium rum segments, further consolidating the off-trade’s lead in the distribution mix.

Sales through the on-trade distribution channel are projected to grow at a CAGR of 4.7% from 2025 to 2030, driven by the rapid recovery and expansion of the hospitality, nightlife, and premium bar sectors in urban hubs. Major cities like Mumbai, Manila, Sydney, and Tokyo are seeing renewed investment in mixology-driven venues, where rum-based cocktails such as mojitos, dark ‘n’ stormy, and spiced rum punches are regaining popularity. This channel is becoming particularly important for brand building and premium positioning, as both global players and boutique distillers use experiential marketing and bartender engagement to strengthen consumer loyalty and premium perception.

Country Insights

India Rum Market Trends

India rum marketaccounted for 34.63% of the Asia Pacific rum market in 2024, with a market size of USD 2.53 billion, driven by the country's massive population, widespread cultural acceptance of dark spirits, and strong domestic production. Rum remains one of the most affordable and accessible alcoholic beverages across both urban and rural India, particularly in the form of mass-market dark rum brands like McDowell’s No.1 and Old Monk. Additionally, the growth of premium Indian distilleries producing craft rums such as Maka Zai and Two Indies is helping expand the category among affluent, younger consumers in metropolitan areas. The large volume consumption, coupled with an evolving premium segment, has helped India maintain its dominant share in the regional rum market.

Philippines Rum Market Trends

The rum market in the Philippinesis projected to grow at a CAGR of 4.7% from 2025 to 2030, fueled by a combination of strong domestic demand, export expansion, and rising interest in locally-produced premium rum. Filipino consumers become more discerning, there is increasing demand for flavored and higher-quality variants, supporting premiumization.

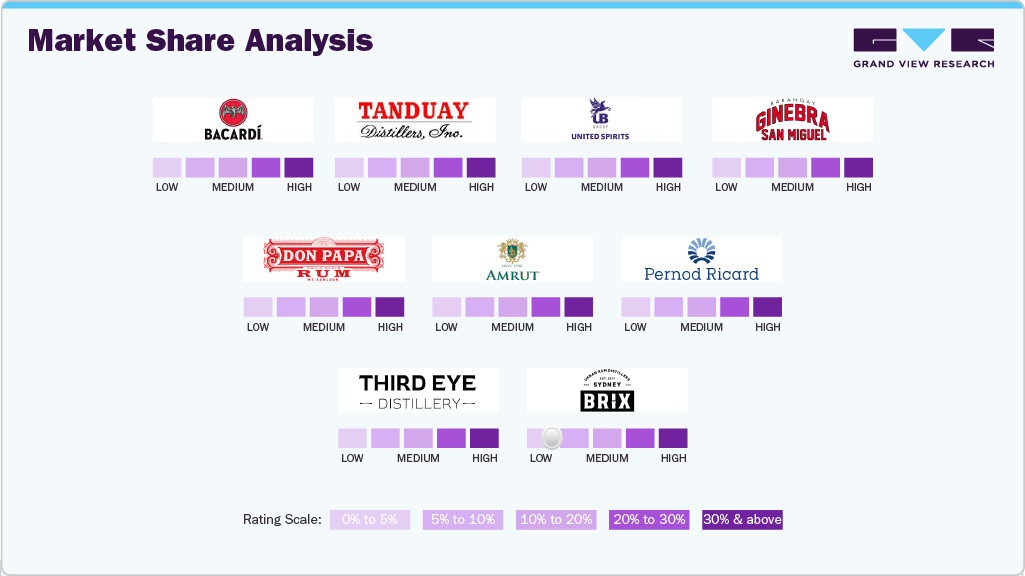

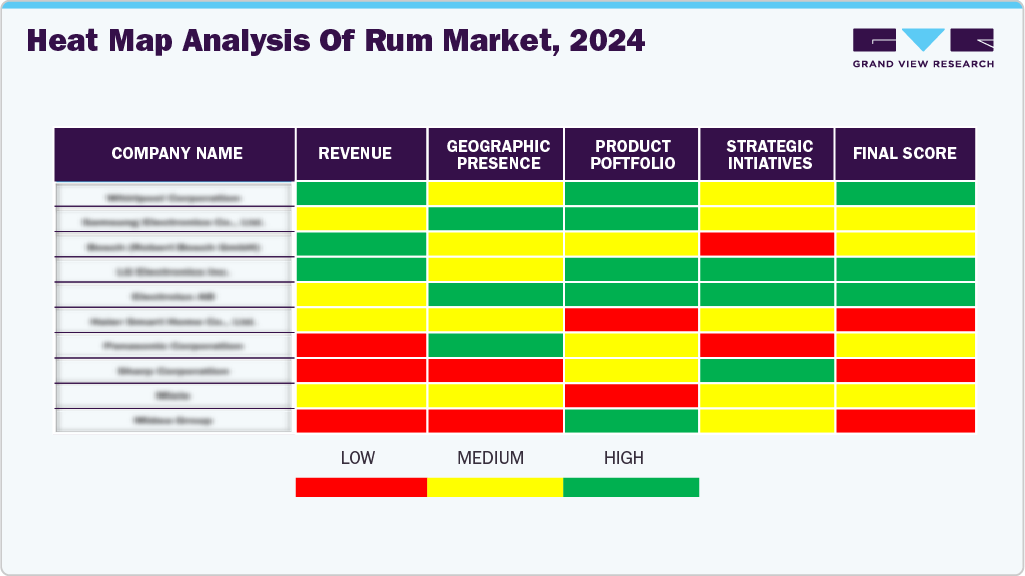

Key Asia Pacific Rum Companies Insights

Key players operating in the Asia Pacific rum market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Asia Pacific Rum Companies:

- Bacardi Limited

- Tanduay Distillers, Inc.

- United Spirits Ltd. (A Diageo Company)

- Ginebra San Miguel Inc.

- Pernod Ricard SA

- Bleeding Heart Rum Company

- Amrut Distilleries Ltd.

- Third Eye Distillery Pvt. Ltd.

- Brix Distillers Pty Ltd.

- Husk Distillers Pty Ltd.

Recent Developments

-

In January 2025, Zacapa, a renowned Guatemalan rum brand, recently launched its offerings in Singapore, marking a significant expansion into the Southeast Asian market. The launch event showcased the brand's premium rums, particularly highlighting Zacapa 23 and Zacapa Edición Negra.

-

In April 2025, Himmaleh Spirits, known for its innovative approach in the beverage industry with premium brands like Kumaon&I and Bandarful, introduced Neoli Himalayan Rum. This launch signifies a groundbreaking development in the Indian rum market.

Asia Pacific Rum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.58 billion

Revenue forecast in 2030

USD 9.26 billion

Growth rate (revenue)

CAGR of 4.1% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, country

Regional scope

Asia Pacific

Country scope

China; Philippines; India; Japan; Australia

Key companies profiled

Bacardi Limited; Tanduay Distillers, Inc.; United Spirits Ltd. (A Diageo Company); Ginebra San Miguel Inc.; Pernod Ricard SA; Bleeding Heart Rum Company; Amrut Distilleries Ltd.; Third Eye Distillery Pvt. Ltd.; Brix Distillers Pty Ltd.; Husk Distillers Pty Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Rum Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific rum market report on the basis of product, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dark & Golden Rum

-

White Rum

-

Flavored & Spiced Rum

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Off-Trade

-

On-Trade

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

Philippines

-

India

-

Japan

-

Australia

-

Frequently Asked Questions About This Report

b. The Asia Pacific rum market size was estimated at USD 7.31 billion in 2024 and is expected to reach USD 7.58 billion in 2025.

b. The Asia Pacific rum market is expected to grow at a compound annual growth rate (CAGR) of 4.1 % from 2025 to 2030 to reach USD 9.26 billion by 2030.

b. India dominated the rum market with a share of 34.63% in 2024, driven by the country's massive population, widespread cultural acceptance of dark spirits, and strong domestic production. Rum remains one of the most affordable and accessible alcoholic beverages across both urban and rural India, particularly in the form of mass-market dark rum brands

b. Some key players operating in the Asia Pacific rum market include Bacardi Limited; Tanduay Distillers, Inc.; United Spirits Ltd. (A Diageo Company); Ginebra San Miguel Inc.; Pernod Ricard SA; Bleeding Heart Rum Company; Amrut Distilleries Ltd.; Third Eye Distillery Pvt. Ltd.; Brix Distillers Pty Ltd.; Husk Distillers Pty Ltd.

b. The Asia Pacific rum market is driven by a blend of rising disposable incomes, shifting consumer preferences toward premium and craft spirits, and the increasing influence of Western drinking culture among urban millennials and Gen Z consumers. Countries like India and the Philippines have long-standing rum consumption traditions, while markets such as Japan and Australia are experiencing heightened interest in imported and artisanal spirits due to evolving palates and experimentation in cocktail culture.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.