- Home

- »

- Digital Media

- »

-

Asia Pacific Video Streaming Market, Industry Report, 2030GVR Report cover

![Asia Pacific Video Streaming Market Size, Share & Trends Report]()

Asia Pacific Video Streaming Market (2025 - 2030) Size, Share & Trends Analysis Report By Streaming, By Solution, By Platform, By Service, By Revenue Model, By Deployment, By User, By Country, And Segment Forecasts

- Report ID: GVR-3-68038-394-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Video Streaming Market Trends

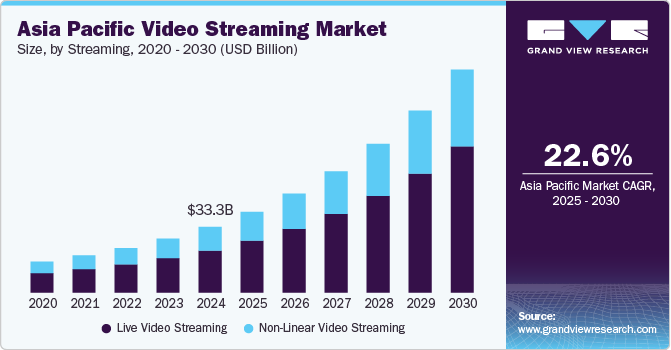

The Asia Pacific video streaming market size was estimated at USD 33.32 billion in 2024 and is projected to grow at a CAGR of 22.6% from 2025 to 2030. The Asia Pacific video streaming market is growing rapidly due to the increasing penetration of high-speed internet and the widespread use of smartphones. Affordable subscription plans and free ad-supported models have made streaming services accessible to a broader audience. The rollout of 5G technology is enhancing streaming quality, ensuring seamless viewing experiences even in remote areas. AI-driven content recommendations and personalized interfaces are also improving user engagement. Furthermore, the popularity of live-streaming events, such as sports and concerts, is contributing to the rising adoption of these platforms. These factors collectively drive substantial market expansion across the region.

A significant trend in the Asia Pacific market is the growing focus on local content production to appeal to diverse linguistic and cultural groups. Platforms are investing heavily in region-specific content, including movies, series, and reality shows, to attract subscribers. Countries such as India, China, and Indonesia have become key markets, given their large populations and high engagement with digital entertainment. Moreover, collaborations between streaming platforms and telecom operators are proving effective in offering affordable bundled services. These partnerships enable providers to tap into vast customer bases while improving accessibility. As a result, localized strategies and partnerships are central to the competitive sector.

The market's competitive dynamics are evolving, with global giants facing stiff competition from regional players. Local platforms use their understanding of regional preferences, giving them an edge in creating relatable content. Meanwhile, international players are incorporating advanced features such as ultra-HD streaming, interactive user experiences, and exclusive content to retain subscribers. Regulatory compliance and data privacy concerns are becoming increasingly important as the market grows. Intellectual property challenges and licensing agreements also shape the strategies of streaming platforms. Moving forward, technological innovations and consumer-centric approaches will determine the success of players in this highly dynamic market.

Streaming Insights

The Live Video Streaming segment dominated the market in 2024 with a market share of 64.1%, due to its growing popularity for broadcasting real-time events such as sports, concerts, and corporate webinars. This format engages audiences with interactive features such as live chats and polls, making it highly attractive for entertainment and business applications. Advancements in 5G and low-latency streaming technology have further enhanced live streaming experiences, ensuring smooth broadcasts. Its appeal lies in its immediacy and ability to connect users to real-time happenings, driving widespread adoption.

The Non-Linear Video Streaming segment has also gained significant traction, offering flexibility for users to consume content on-demand at their convenience. This segment benefits from the popularity of binge-watching culture and personalized recommendations driven by AI algorithms. The availability of a vast library of shows and movies across diverse genres enhances its appeal to a wide audience. Its success is driven by the shift toward customized viewing experiences that prioritize user control and accessibility.

Solution Insights

The Over the Top (OTT) dominated the market in 2024, due to its ability to deliver on-demand content directly to users across multiple devices, including smartphones and smart TVs. Its affordability and diverse subscription models, ranging from ad-supported to premium tiers, have driven widespread adoption in the region. The availability of region-specific content and original productions in local languages has further boosted its popularity among diverse audiences. Moreover, the increasing penetration of high-speed internet and mobile connectivity in countries such as India and Indonesia has accelerated OTT growth.

The Internet Protocol TV (IPTV) segment utilizes broadband infrastructure to deliver real-time television and video-on-demand content. Telecom operators in the region have supported IPTV growth by bundling services with internet and voice packages. Features such as high-definition streaming, interactive content, and time-shifted viewing appeal to tech-savvy users. However, its reliance on stable broadband networks limits growth in areas with underdeveloped infrastructure. Despite these challenges, IPTV remains a strong contender in markets with advanced internet penetration, such as China, South Korea, and Singapore.

Platform Insights

Smartphones & Tablets dominated the market in 2024, due to their widespread adoption and portability, making them ideal for on-the-go content consumption. Increasing the affordability of devices and expanding internet accessibility, particularly in emerging markets, have further driven their usage for streaming services. Platforms optimized for mobile devices, offering features such as offline downloads and adaptive streaming, have enhanced the user experience. The growing popularity of short-form video content and mobile-friendly interfaces has also contributed to their dominance.

The Smart TV segment is rapidly growing in the Asia Pacific video streaming market as consumers shift toward larger screens for an immersive viewing experience. The integration of streaming apps directly into Smart TVs allows users to access their favorite platforms without additional devices. Falling prices and the availability of high-quality displays, such as 4K and OLED, are making Smart TVs more accessible to a broader audience. Smart TV adoption is particularly rising in urban areas where high-speed internet connections are readily available.

Service Insights

The Training & Support segment dominated the market in 2024, as video streaming platforms increasingly rely on these services to ensure smooth onboarding and usage for both individuals and businesses. Comprehensive training programs and 24/7 support help users understand platform functionalities, enhancing their overall experience. This segment's growth is driven by the need to address technical issues, optimize platform performance, and improve user retention. In Asia Pacific, the diversity of languages and technological literacy levels further increases the demand for localized training and customer support services. As platforms expand their user bases, the importance of training and support remains integral to maintaining customer satisfaction.

The Consulting segment is growing in the Asia Pacific video streaming market as companies seek strategic guidance to navigate this competitive space. Consulting services assist businesses in adopting advanced technologies such as AI, 5G, and data analytics to improve streaming efficiency and user engagement. Demand is also fueled by the need to understand region-specific regulations, consumer behavior, and content localization. Providers help platforms optimize monetization strategies, including subscription models and advertising. With the rapid evolution of the video streaming landscape, consulting services are becoming essential for businesses to meet emerging market demands.

Revenue Model Insights

The Subscription dominated the market in 2024, due to its convenience, affordability, and the value it offers to consumers. Subscription-based models provide users with unlimited access to a vast library of content for a fixed monthly or yearly fee, making them highly attractive. The availability of multiple tiers, including ad-supported and premium options, ensures affordability for a wide range of audiences. Platforms are also utilizing exclusive content, such as original series and movies, to drive subscriptions and retain users. The growing penetration of high-speed internet has further solidified the dominance of subscription-based streaming in the region.

Rental models allow users to pay for individual titles rather than committing to a subscription, appealing to occasional viewers. This segment is particularly popular for new movie releases and niche content that may not be included in subscription libraries. Enhanced accessibility, such as renting through mobile apps and Smart TVs, has further boosted its adoption. As more platforms expand their rental offerings, this model is becoming an attractive alternative for diverse audience segments.

Deployment Insights

The Cloud segment dominated the Asia Pacific video streaming market in 2024, driven by its scalability, flexibility, and cost-efficiency for content delivery. Cloud-based solutions enable seamless streaming across various devices by utilizing Content Delivery Networks (CDNs) to reduce latency and improve quality. The ability to handle fluctuating viewer demand without requiring significant infrastructure investments has made the cloud the preferred choice for providers. Moreover, cloud platforms support advanced features such as AI-driven recommendations, analytics, and real-time data processing, enhancing the overall user experience. As more companies adopt cloud infrastructure, its dominance in the market continues to grow.

The On-Premises segment in the Asia Pacific video streaming market is favored by businesses requiring greater control over their data and infrastructure. This model is particularly suited for organizations that prioritize data security and compliance with strict regional regulations. On-premises solutions are also preferred by companies with consistent viewer traffic and the resources to manage their own servers. While less flexible than cloud options, advancements in hybrid models combine on-premises control with cloud-based scalability, offering a balanced approach.

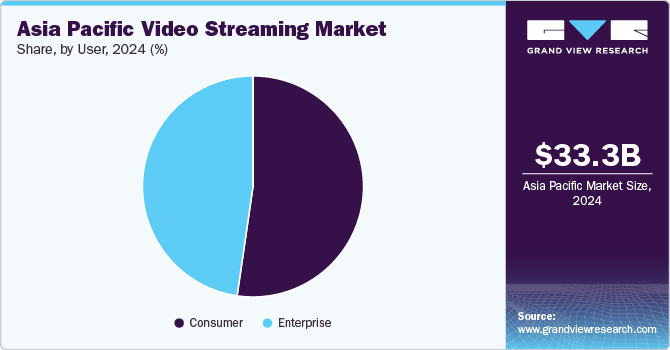

User Insights

The Consumer segment dominated the Asia Pacific video streaming market due to its widespread adoption for personal entertainment and leisure. The increasing availability of affordable streaming services and mobile internet plans has significantly contributed to its growth. Consumers are drawn to the convenience of accessing a vast library of content, including movies, TV shows, and live events, across multiple devices. The popularity of personalized recommendations and localized content has further strengthened the appeal of consumer-focused streaming platforms. With advancements in technology and changing viewing habits, this segment remains a key driver of market expansion.

The Enterprise segment is growing as businesses adopt video streaming for corporate communication, training, and marketing purposes. Enterprises use streaming platforms to host live events, webinars, and virtual conferences, catering to the growing demand for remote interactions. The ability to deliver high-quality, secure video content at scale has made streaming a valuable tool for employee engagement and skill development. Moreover, businesses leverage streaming for brand promotion and customer engagement through targeted campaigns. As organizations recognize the benefits of video streaming, this segment is poised for significant growth in the Asia Pacific region.

Country Insights

China Video Streaming Market Trends

China leads the Asia Pacific Video Streaming market accounting for leading share of 27.0% in 2024. The country's large population, high internet penetration, and strong consumer demand for streaming content have contributed to its leadership position. Chinese platforms are expanding rapidly, offering a wide range of content, including local and international titles, to cater to diverse tastes. The government's support for digital infrastructure and e-commerce further fuels the growth of video streaming services in the region. Moreover, innovations in technology and content delivery continue to solidify China's position in the market.

India Video Streaming Market Trends

India is experiencing significant growth in the video streaming market, driven by the increasing adoption of smartphones, affordable internet access, and a young, tech-savvy population. The demand for localized content, including regional languages and culturally relevant shows, has been a key factor in its expansion. The rise of affordable OTT platforms and growing middle-class disposable income have made streaming more accessible to a wider audience. As India continues to embrace digital transformation, the video streaming market is poised for continued growth, making it an attractive opportunity for global and local players alike.

Key Asia Pacific Video Streaming Company Insights

Some of the key companies in the Asia Pacific Video Streaming market include Akamai Technologies, Amazon.com Inc., Baidu Inc., Google LLC and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Amazon.com Inc. has expanded its Amazon Prime Video service in the Asia Pacific, adding regional titles and creating local content to attract diverse viewers. Partnerships with telecom operators in countries such as India have helped grow its subscriber base through bundled offers. Amazon focuses on providing high-quality streaming, including 4K content and personalized recommendations, strengthening its position in the market.

-

Google LLC, through its YouTube platform, remains a dominant player in the Asia Pacific video streaming market, offering both user-generated and professional content to a vast audience. YouTube has capitalized on the growing demand for mobile and short-form videos, particularly through features such as YouTube Shorts. The company's investments in local content creation and its expanding YouTube Premium subscription service further strengthen its presence in the region.

Key Asia Pacific Video Streaming Companies:

- Akamai Technologies

- Amazon.com Inc.

- Baidu Inc.

- Brightcove Inc.

- Comcast Corporation

- Google LLC

- Hulu

- Kaltura Inc.

- Netflix Inc.

- Roku

- Tencent Holdings Limited

- Youtube

Recent Developments

-

In September 2024, Akamai Technologies joined the Streaming Video Technology Alliance (SVTA) as a Principal Member, following its merger with DASH Industry Forum to enhance industry standards and improve streaming experiences. The company aims to drive innovation in areas like low-latency streaming and quality measurement.

-

In September 2024, YouTube collaborated with Shopee, an e-commerce company in Singapore, to launch its first shopping feature in Southeast Asia, starting in Indonesia and expanding to Thailand and Vietnam, enabling users to make purchases directly from videos and live streams. This initiative uses YouTube's vast user base and Shopee's e-commerce capabilities, aligning with the region's growing digital economy and changing consumer habits.

Asia Pacific Video Streaming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 40.84 billion

Revenue forecast in 2030

USD 112.89 billion

Growth rate

CAGR of 22.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Streaming, solution, platform, service, revenue model, deployment, user, country

Country scope

China; Japan; India; South Korea; Australia

Key companies profiled

Akamai Technologies; Amazon.com Inc.; Baidu Inc.; Brightcove Inc.; Comcast Corporation; Google LLC; Hulu; Kaltura Inc.; Netflix Inc.; Roku; Tencent Holdings Limited; Youtube

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Video Streaming Market Report Segmentation

This report offers revenue growth forecasts at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific video streaming market report based on streaming, solution, platform, service, revenue model, deployment, user, and country:

-

Streaming Outlook (Revenue, USD Billion, 2018 - 2030)

-

Live Video Streaming

-

Non-Linear Video Streaming

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Internet Protocol TV

-

Over the Top (OTT)

-

Pay TV

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gaming Consoles

-

Laptops & Desktops

-

Smartphones & Tablets

-

Smart TV

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consulting

-

Managed Services

-

Training & Support

-

-

Revenue Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Advertising

-

Rental

-

Subscription

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Enterprise

-

Commercial

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Frequently Asked Questions About This Report

b. The Asia Pacific video streaming market size was estimated at USD 33.32 billion in 2024 and is expected to reach USD 40.84 billion in 2025.

b. The Asian Pacific video streaming market is expected to grow at a compound annual growth rate of 22.6% from 2025 to 2030 to reach USD 112.89 billion by 2030.

b. China dominated the Asia Pacific video streaming market with a share of 27.0% in 2024. This is attributable to the country's high subscriber base of video streaming platforms.

b. Some key players operating in the Asia Pacific video streaming market include AAkamai Technologies, Amazon.com Inc., Baidu Inc., Brightcove Inc., Comcast Corporation, Google LLC, Hulu, Kaltura Inc., Netflix Inc., Roku, Tencent Holdings Limited, YouTube, among others.

b. Key factors that are driving the Asia Pacific video streaming market growth include the growing adoption of cloud-based video streaming solutions, and the increasing use of smartphones with high-speed internet technologies such as 3G, 4G, and LTE.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.