- Home

- »

- Pharmaceuticals

- »

-

Aspergillosis Treatment Market Size & Share Report, 2030GVR Report cover

![Aspergillosis Treatment Market Size, Share & Trends Report]()

Aspergillosis Treatment Market Size, Share & Trends Analysis Report By Type (Allergic, Chronic, Invasive), By Drug Class (Antifungal), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-123-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global aspergillosis treatment market size was estimated at USD 4.25 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.99% from 2023 to 2030. The increasing prevalence of target disease and increasing focus on the development of novel drugs is expected to positively contribute to market growth. Aspergillosis, a serious fungal infection, poses a major respiratory risk, especially for immunocompromised individuals, and can result in a spectrum of symptoms from mild shortness of breath to severe pneumonia and invasive fungal growth in the lungs. With the increasing number of patients with compromised immune systems, there is an increasing need for advanced therapy to treat this challenging disease. The market expansion demonstrates the healthcare industry's commitment to meeting the urgent medical needs of those affected by aspergillosis as an ongoing effort focused on developing innovative treatments.

To address the challenges posed by aspergillosis, the pharmaceutical industry has shifted its focus toward developing novel drugs and therapies. Existing antifungal agents may have limitations in terms of efficacy and safety, prompting a need for innovative solutions. Companies are actively investing in research and development (R&D) efforts to discover new antifungal compounds and treatment modalities that offer improved efficacy and reduced side effects. For instance, in February 2023, Pulmatrix took a significant step forward by administering the first patient with PUR1900 in a Phase 2b clinical trial. This study aims to evaluate PUR1900's efficacy in treating Allergic Bronchopulmonary aspergillosis (ABPA) in individuals with asthma. This milestone underscores Pulmatrix's commitment to advancing potential therapeutic solutions for ABPA, providing hope for better management of this challenging respiratory condition.

The increasing prevalence of aspergillosis and the growing focus on developing novel treatments is expected to contribute to the market growth. As pharmaceutical companies continue to explore and invest in advanced therapies, there is a promising outlook for improved patient care and better outcomes in managing this serious fungal infection. As research and development (R&D) efforts progress, the market is likely to witness a transformation in the management of aspergillosis, benefiting patients worldwide.

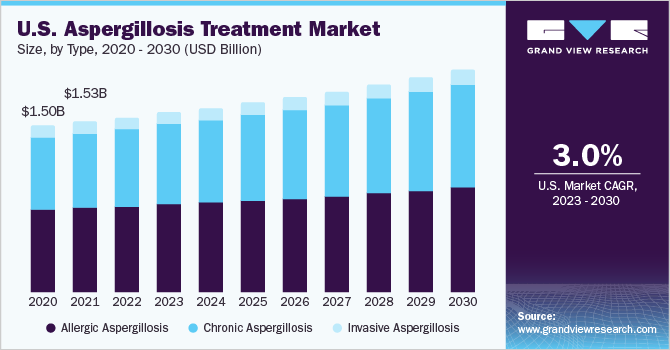

Type Insights

Based on type, the market is classified into allergic, chronic, and invasive aspergillosis. The allergic segment dominated the market with a share of over 49.07% in 2022. The allergic segment's dominance in the aspergillosis treatment market can be attributed to its higher prevalence and milder disease presentation compared to other types. Conditions such as ABPA, affecting asthma, and cystic fibrosis patients, result from an allergic reaction to aspergillus antigens in the lungs, leading to respiratory symptoms and inflammation.

Studies indicate ABPA likely affects 1% to 15% of cystic fibrosis patients and about 2.5% of adults with asthma, with an estimated 4.8 million people worldwide affected. A significant proportion of ABPA cases may progress to chronic pulmonary aspergillosis (CPA), estimated to be approximately 400,000 cases. Heightened awareness and early detection of allergic respiratory diseases have further bolstered the prominence of this segment in the market.

The CPA segment is anticipated to witness the highest CAGR of 4.74% during the forecast period. This growth can be attributed to several factors, such as an increasing prevalence of chronic aspergillosis cases, advancements in diagnostic techniques leading to early detection, and the development of targeted therapies to address this persistent form of fungal infection.

Drug Class Insights

Based on drug class, the market is classified into antifungal drugs and others. The antifungal drug segment dominated the market with a share of over 79.52% in 2022 and is anticipated to witness the highest CAGR of 4.44% during the forecast period. The dominance of antifungal drugs in the market can be attributed to their effectiveness against infections and widespread utilization as a primary treatment option. Healthcare providers' focus on developing improved and targeted antifungal therapies is expected to sustain the segment's prominence, driving overall market growth. F2G, a key player in the market, has achieved a significant milestone with the U.S. Food and Drug Administration's acceptance of its New Drug Application (NDA) for Olorofim in December 2022, a groundbreaking antifungal drug tailored for invasive fungal infections, including aspergillosis. This development marks a significant advancement in antifungal therapies and offers promising prospects for patients battling life-threatening fungal infections in the market.

The antifungal drug segment is sub-segmented into azoles, echinocandins, polyenes, allylamines, and others. The azoles sub-segment dominated the market in 2022, it is a class of antifungal medications, exhibiting broad-spectrum activity against aspergillus species, making them effective for various aspergillosis infections. Their efficacy and relatively low toxicity have established them as a first-line therapy for both invasive and non-invasive cases. With good tolerability and ease of administration, azoles are preferred by healthcare providers and patients alike, especially due to their oral formulations, enabling convenient self-administration at home, and reducing the burden on patients and healthcare facilities during prolonged treatment.

Route of Administration Insights

Based on route of administration, the market is classified into oral drugs, ointments, powders, and others. The oral drug segment dominated the market with a share of 48.59% in 2022. This growth is due to its convenience and patient-friendly administration, making it preferred by both healthcare providers and patients. Notably, the drug Fosmanogepix (APX001) has garnered fast-track designation from the FDA for treating invasive candidiasis and invasive aspergillosis, as highlighted in a research study by the Journal of Infection and Public Health in September 2022. Oral medications offer easy compliance and self-administration at home, easing the burden on patients and healthcare facilities during prolonged therapy. Furthermore, continuous advancements in oral antifungal medications have resulted in improved formulations, contributing to their enhanced efficacy in managing the condition.

The ointment segment is anticipated to witness the fastest CAGR during the forecast period. This growth can be attributed to its localized treatment, making it effective for skin and superficial infections. Ongoing research efforts have led to improved formulations, enhancing their antifungal properties and patient outcomes. Moreover, the rising prevalence of skin-related cases, especially in immunocompromised individuals, has boosted the demand for effective topical treatment options, contributing to the growth of the ointment segment.

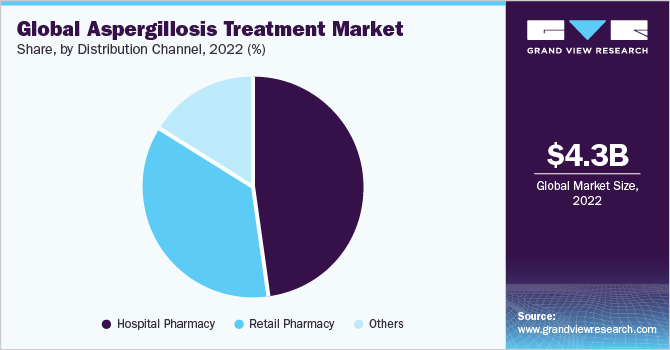

Distribution Channel Insights

Based on distribution channels, the market is classified into hospital pharmacy, retail pharmacy, and others. The hospital pharmacy segment dominated the aspergillosis treatment market with a share of 47.59% in 2022. This growth is due to the pivotal role that hospital-based distribution channels play in the effective delivery and accessibility of treatment. The preference for hospital pharmacies reflects the trust placed in these settings for addressing the complex medical requirements associated with treatment, thus shaping the market landscape.

The other segment is anticipated to witness a CAGR of 4.51% during the forecast period. This rapid expansion is indicative of evolving distribution channels and emerging avenues that aren't strictly confined to hospitals or retail pharmacies. The "others" segment likely encompasses novel distribution methods, such as online pharmacies or specialized clinics, which are gaining traction due to their convenience and targeted approach.

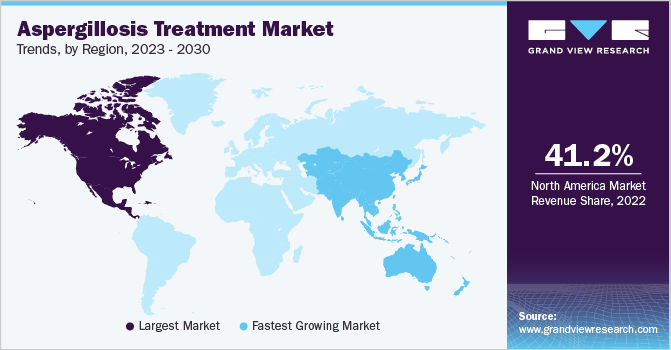

Regional Insights

North America dominated the aspergillosis treatment market and accounted for 41.2% of the total market share in 2022. This dominance can be attributed to a confluence of factors that underscore the region's advanced healthcare infrastructure, dynamic research and development (R&D) endeavors, access to cutting-edge medical technologies, and a steadfast commitment to early detection and treatment.

The noteworthy participation of Cidara therapeutics in influential conferences like the 8th Advances Against Aspergillosis (AAA) conference and the 2018 BMT Tandem Meetings further highlights North America's proactive engagement in the field. Moreover, the presence of influential pharmaceutical entities, esteemed academic institutions, and specialized healthcare facilities focusing on fungal infections collectively enhances North America's effectiveness in tackling and managing the condition, consolidating its pivotal role at the forefront of the market.

Asia Pacific is expected to witness the fastest CAGR of 5.47% over the forecast period. The growth-driven dynamic growth projection reflects the region's evolving healthcare landscape and rising awareness about fungal infections. As Asia Pacific gains momentum in addressing aspergillosis, it is poised to play a pivotal role in reshaping the global landscape of treatment and management strategies for this condition.

Key Companies & Market Share Insights

Market players are introducing advanced products at affordable prices to increase their market share. Key players are implementing strategic initiatives, such as mergers, acquisitions, and collaborations, to maximize their dominance. For instance, in June 2022, Endo's launch of the first generic Noxafil (posaconazole) Injection marks a significant development in the aspergillosis treatment market. This generic posaconazole injection is specifically formulated to address invasive aspergillosis in patients aged 13 and above, encompassing both adults and pediatric populations. Some prominent players in the global aspergillosis treatment market include:

-

Pfizer, Inc

-

Merck & Co.

-

F2G

-

Novartis AG

-

Astellas Pharma Inc

-

Bayer AG

-

Mayne Pharma Group Limited

-

PULMATRiX, Inc

Aspergillosis Treatment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.40 billion

Revenue forecast in 2030

USD 5.79 billion

Growth rate

CAGR of 3.99% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, drug class, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Pfizer, Inc.; Merck & Co. Inc.; F2G; Novartis AG; Astellas Pharma Inc.; Bayer AG; Mayne Pharma Group Limited; and PULMATRiX, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to Country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aspergillosis Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global aspergillosis treatment market report based on type, drug class, route of administration, distribution channel, and region:

-

Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Allergic Aspergillosis

-

Chronic Aspergillosis

-

Invasive Aspergillosis

-

-

Drug Class Outlook (Revenue in USD Million, 2018 - 2030)

-

Antifungal drugs

-

Azoles

-

Echinocandins

-

Polyenes

-

Allylamines

-

Others

-

-

Others

-

-

Route Of Administration Outlook(Revenue in USD Million, 2018 - 2030)

-

Oral Drugs

-

Ointments

-

Powders

-

Others

-

-

Distribution Channel Outlook (Revenue in USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others

-

-

Regional Outlook (Revenue in USD Million 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global aspergillosis treatment market size was estimated at USD 4.25 billion in 2022 and is expected to reach USD 4.40 billion in 2023.

b. The global aspergillosis treatment market is expected to grow at a compound annual growth rate of 3.99% from 2023 to 2030 to reach USD 5.79 billion by 2030 .

b. North America dominated the aspergillosis treatment market with a share of 41.2% in 2022. This is attributable to the region's advanced healthcare infrastructure, dynamic research and development endeavors, access to cutting-edge medical technologies, and a steadfast commitment to early detection and treatment

b. Some key players operating in the aspergillosis treatment market include Pfizer, Merck & Co. Inc., F2G, Novartis AG, Astellas Pharma Inc, Bayer AG, Mayne Pharma Group Limited, PULMATRiX, Inc.

b. Key factors that are driving the market growth include increasing prevalence of target disease and increasing focus on the development of novel drugs

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."