- Home

- »

- Renewable Chemicals

- »

-

Asphalt Release Agents Market Size, Industry Report, 2033GVR Report cover

![Asphalt Release Agents Market Size, Share & Trends Report]()

Asphalt Release Agents Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Bio-based, Petroleum-based), By Application (Truck Beds, Pavers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-817-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asphalt Release Agents Market Summary

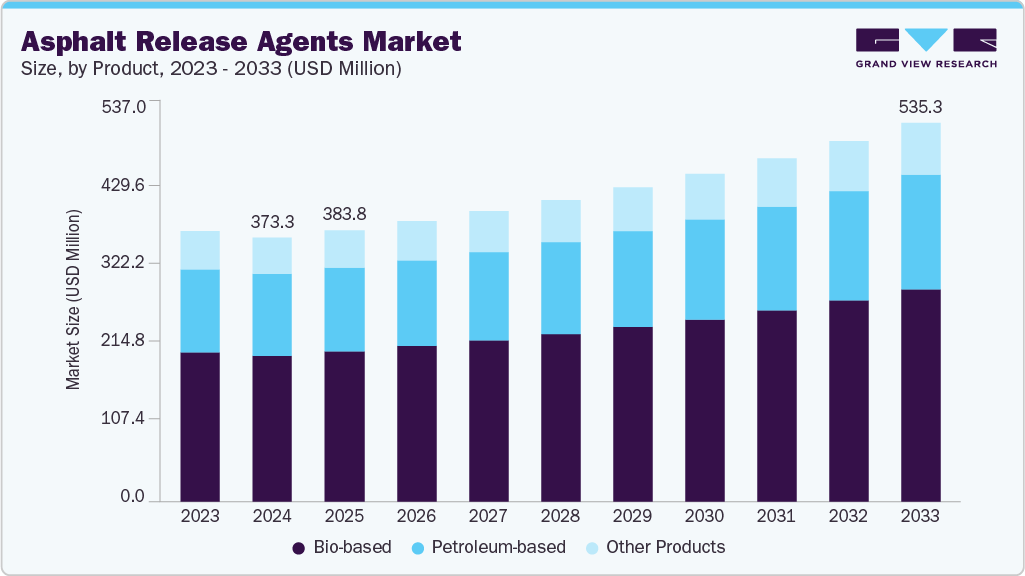

The global asphalt release agents market size was estimated at USD 373.3 million in 2024 and is projected to reach USD 535.3 million by 2033, growing at a CAGR of 4.2% from 2025 to 2033. The market is primarily driven by the strong growth in road construction and maintenance activities, supported by public infrastructure spending and urban expansion projects across emerging and developed economies.

Key Market Trends & Insights

- Asia Pacific dominated the asphalt release agents market with the largest revenue share of 34.5% in 2024.

- The market in China is expected to grow at the fastest CAGR of 4.7% from 2025 to 2033.

- By product, the bio-based segment is expected to grow at the fastest CAGR of 4.4% from 2025 to 2033 in terms of revenue.

- By product, the bio-based segment held the largest revenue share of 55.3% in 2024 in terms of value.

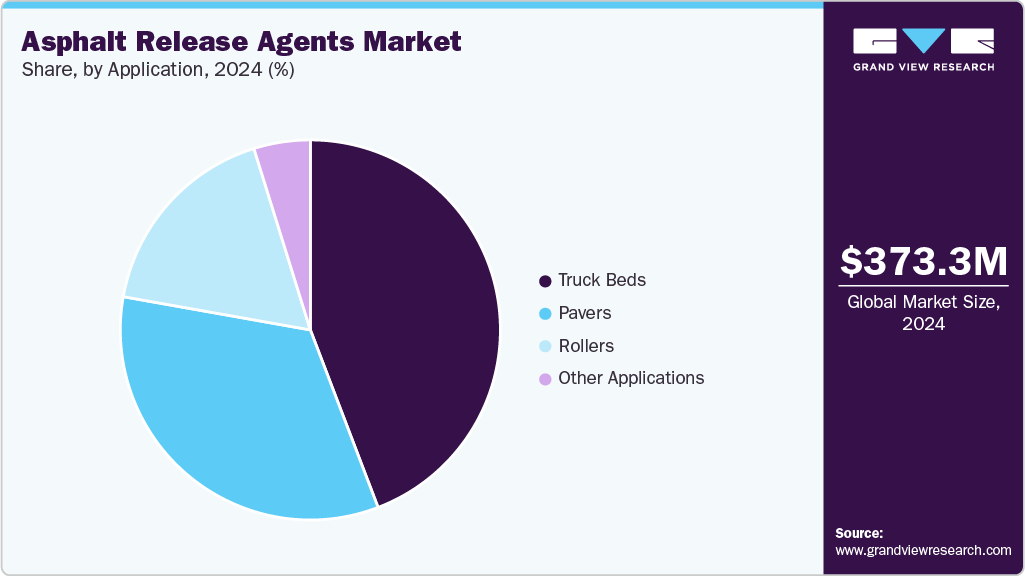

- By application, the truck beds segment held the largest revenue share of 44.2% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 373.3 Million

- 2033 Projected Market Size: USD 535.3 Million

- CAGR (2025-2033): 4.2%

- Asia Pacific: Largest market in 2024

The rising emphasis on equipment efficiency and lifecycle cost reduction is prompting contractors and municipalities to adopt high-performance release agents that prevent asphalt build-up, reduce downtime, and lower maintenance costs. The stringent environmental and occupational safety regulations in North America and Europe are accelerating the shift from petroleum-based to biodegradable, water-based formulations, thereby boosting demand for eco-friendly solutions. Continuous innovation by manufacturers, such as the development of non-hazardous emulsions and bio-solvent blends, further supports market expansion.

Significant market opportunities lie in the rapid adoption of bio-based and non-label formulations aligned with green procurement policies and sustainability targets of road agencies and contractors. Manufacturers offering customized, ready-to-use concentrates designed for specific asphalt mixtures, temperature ranges, and equipment types are well-positioned to gain a competitive advantage. The infrastructure modernization programs in Asia Pacific, Latin America, and the Middle East, driven by national highway and smart-city initiatives, are expected to create strong long-term demand for asphalt release solutions. The integration of digital monitoring and automated spraying systems in paving equipment also opens avenues for premium, high-margin products tailored to next-generation construction technologies.

Despite growth prospects, the market faces challenges related to raw material price volatility, particularly for petroleum derivatives and certain bio-solvents, which can affect product margins. The lack of standardized performance benchmarks for biodegradable formulations leads to variability in product efficacy, occasionally limiting end-user confidence. Furthermore, low awareness and cost sensitivity among small and mid-sized contractors in developing regions often result in the continued use of unregulated or locally blended agents, restraining the penetration of compliant commercial formulations. Lastly, stringent chemical labeling and transportation regulations (such as REACH and EPA guidelines) add to compliance costs and complexity for international suppliers.

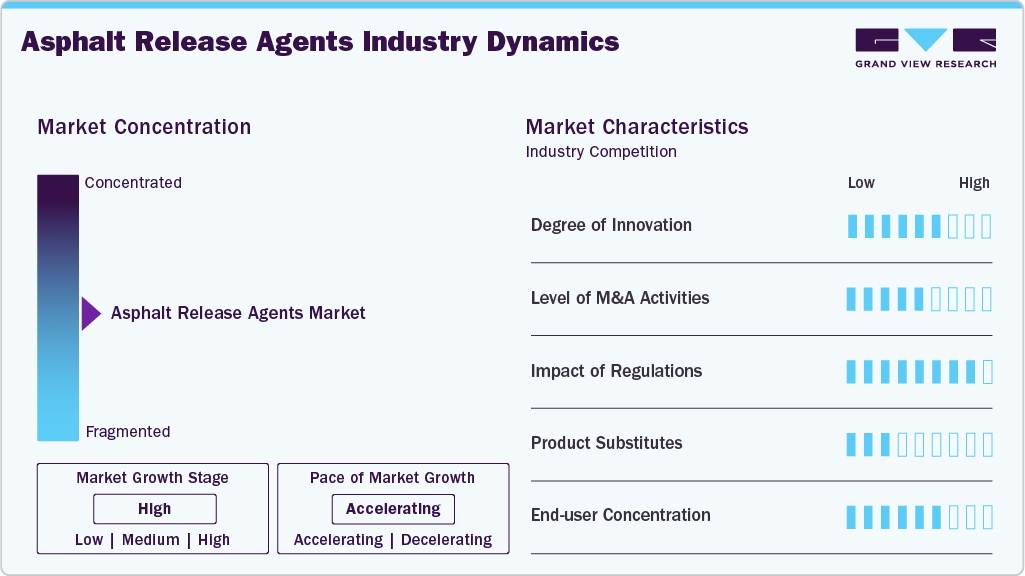

Market Concentration & Characteristics

The market is moderately consolidated, with leading players such as FUCHS, Zeller+Gmelin, ArrMaz, and Quaker holding a significant share, while regional specialists like Zep, SoySolv, Rhomar Industries, Meyer Lab, and Miller-Stephenson cater to localized demand. The top companies collectively account for around half of global revenues, leveraging strong R&D, established distribution networks, and long-term supply partnerships with asphalt plant OEMs and road construction contractors. Product portfolios span petroleum-based, bio-based, and water-emulsion formulations, reflecting a strategic shift toward sustainable and compliant chemistries.

Competition centers on formulation performance, environmental compliance, and pricing efficiency. Vendors are increasingly focusing on low-VOC, biodegradable products, ready-to-use concentrates, and OEM-integrated solutions to differentiate in a price-sensitive market. However, smaller players face pressure from raw material cost fluctuations, limited standardization, and high regulatory compliance costs. To strengthen competitiveness, leading manufacturers are investing in green chemistry innovation, regional expansion through partnerships, and digitalized application systems that enhance operational efficiency and customer retention.

Product Insights

The bio-based segment dominated the market with the largest revenue share of 55.3% in 2024, primarily due to the rapid shift toward environmentally sustainable and non-toxic formulations across road construction and maintenance industries. Growing regulatory emphasis on reducing volatile organic compound (VOC) emissions, combined with the increasing enforcement of EPA and REACH compliance standards, has accelerated the adoption of bio-based and water-emulsion agents. These formulations, derived from vegetable oils, soy derivatives, and biodegradable esters, offer comparable performance to petroleum-based counterparts while eliminating environmental hazards associated with hydrocarbon residues. Major producers such as FUCHS, Zeller+Gmelin, and SoySolv have expanded their eco-friendly product portfolios, supporting large-scale procurement by municipalities and contractors prioritizing green certifications and worker safety.

In contrast, petroleum-based agents continue to serve a substantial share of the market, particularly in cost-sensitive applications where performance under extreme temperatures and availability are key factors. However, this segment is gradually declining as end users transition toward sustainable solutions to align with ESG objectives and regional emission targets. The “Other Products” category, comprising hybrid blends, silicone-based concentrates, and specialty emulsions, is expected to gain traction over the forecast period as manufacturers innovate to bridge the performance gap between traditional and bio-based solutions. Collectively, this product diversification reflects a structural market transition, with bio-based asphalt release agents positioned as the primary growth engine driving long-term market expansion.

Application Insights

The truck beds segment held the largest revenue share of 44.2% in 2024, driven by its critical role in preventing asphalt adhesion during the transportation of hot mix materials. Continuous movement of asphalt between mixing plants and paving sites creates a strong need for effective release agents to ensure clean discharge, reduce material wastage, and minimize equipment downtime. Contractors and fleet operators increasingly prefer ready-to-use, water-based bio formulations that provide superior release performance while complying with environmental and worker safety regulations. The segment’s dominance is further supported by the high volume of truck utilization in large-scale road construction and maintenance projects across North America, Europe, and the Asia Pacific, making it the most consistent and recurring point of consumption for asphalt release agents.

The pavers and rollers segments also represent significant portions of the market, driven by the demand for surface finishing and compaction operations that require continuous application of release agents to prevent asphalt build-up on equipment surfaces. The pavers segment is experiencing notable growth owing to increased adoption of automated spray systems and temperature-resistant formulations that enhance operational efficiency. Meanwhile, other applications, including plant equipment, conveyor systems, and rubber-tired rollers, are witnessing steady adoption as manufacturers develop multi-functional emulsions suited for diverse paving conditions. Overall, the market’s application landscape is evolving toward high-performance, environmentally compliant solutions that optimize both equipment longevity and asphalt quality across the paving value chain.

Regional Insights

Asia Pacific dominated the global asphalt release agents market with a 34.5% revenue share in 2024, underpinned by massive investments in transportation and urban infrastructure across China, India, Japan, and Southeast Asia. Expanding highway construction programs, rising government spending on public works, and the adoption of mechanized paving technologies have significantly increased the use of release agents in the region. The transition toward bio-based and low-VOC formulations is accelerating, supported by emerging environmental regulations and the presence of local manufacturers offering cost-effective alternatives. With ongoing infrastructure modernization and large-scale public-private partnerships, the Asia Pacific is expected to remain the fastest-growing regional market during the forecast period.

China Asphalt Release Agents Market Trends

The asphalt release agents market in China accounted for 58.7% of the Asia Pacific market in 2024, driven by its extensive road-building agenda under the 14th Five-Year Plan and continuous upgrades to expressways and municipal roads. The country's high asphalt consumption and rapidly expanding construction equipment fleet sustain robust demand for both petroleum-based and bio-based release agents. Local producers dominate the market through competitive pricing and product availability, while multinational firms are investing in localized production and distribution to capture the growing demand for environmentally compliant products. The government’s emphasis on green construction materials and VOC reduction policies is expected to stimulate further adoption of bio-based release agents in the coming years.

North America Asphalt Release Agents Market Trends

The asphalt release agents market in North America held a 30.3% market share in 2024, supported by strong demand from road maintenance and resurfacing projects across the United States and Canada. Stringent environmental standards, advanced paving technologies, and the widespread use of ready-to-use biodegradable formulations drive the region’s market growth. Federal and state-level infrastructure funding under initiatives like the Infrastructure Investment and Jobs Act (IIJA) has further accelerated product consumption. The region also benefits from the presence of leading global players such as FUCHS, Zep, and Rhomar Industries, which emphasize product innovation and regulatory compliance, positioning North America as one of the most mature and innovation-driven markets worldwide.

The U.S. asphalt release agents market accounted for 83.8% of the North American market in 2024, reflecting its extensive road network and high volume of asphalt paving activity. Federal and state investments in highway rehabilitation, urban development, and maintenance programs continue to drive consistent demand for release agents. The U.S. market is characterized by strong adoption of bio-based and non-hazardous formulations, propelled by EPA regulations and contractor preference for eco-certified solutions. Major domestic and international suppliers have established deep distribution networks and offer application-specific concentrates tailored for diverse climatic and operational conditions, reinforcing the country’s position as a key revenue generator within the global market.

Europe Asphalt Release Agents Market Trends

The asphalt release agents market in Europe captured a 24.1% share in 2024, driven by the region’s commitment to sustainable road construction practices and strict chemical-use regulations under REACH. Countries such as Germany, France, and the UK are leading adopters of bio-based and water-emulsion formulations, supported by government sustainability targets and infrastructure renewal programs. European manufacturers emphasize high-performance, non-label products with strong biodegradability and low environmental impact. The increasing investment in smart mobility and green infrastructure under EU frameworks continues to drive steady demand for eco-compliant release agents across the region.

Germany asphalt release agents market represents one of the most mature markets in Europe, supported by its robust road maintenance programs and high awareness of environmental compliance. The country has been at the forefront of adopting biodegradable and low-VOC release agents, driven by stringent national standards and active government support for sustainable construction materials. Local and regional suppliers, including Zeller+Gmelin and FUCHS, play a pivotal role in product innovation, emphasizing formulations that deliver superior performance while meeting eco-certification norms. Germany’s continuous investment in road rehabilitation and transport infrastructure modernization ensures sustained demand and reinforces its position as a key contributor to the European market.

Middle East & Africa Asphalt Release Agents Market Trends

The asphalt release agents market in the Middle East & Africa is witnessing steady growth, supported by ongoing infrastructure development in the Gulf Cooperation Council (GCC) countries and expanding road construction projects in South Africa and Egypt. Rising government investment in national highway programs, coupled with the region’s efforts to diversify economies through large-scale infrastructure projects, is fueling demand for asphalt release agents. While petroleum-based products currently dominate due to lower cost and wide availability, growing awareness of environmental sustainability and worker safety is gradually fostering interest in bio-based alternatives. The market outlook remains positive, driven by urbanization and public sector spending on transport infrastructure.

Latin America Asphalt Release Agents Market Trends

The asphalt release agents market in Latin America is growing steadily, supported by road expansion and rehabilitation initiatives in Brazil, Chile, and Colombia. Although market penetration of advanced bio-based formulations remains limited, ongoing infrastructure modernization programs and partnerships with international chemical suppliers are expanding the availability of compliant, high-performance products. The region’s market dynamics are shaped by cost sensitivity, fluctuating government budgets, and reliance on imported materials, particularly from North America and Europe. However, the gradual implementation of environmental regulations and sustainable construction practices is expected to drive future adoption of eco-friendly asphalt release agents across key Latin American economies.

Key Asphalt Release Agents Company Insights

Key players, such as FUCHS, Zeller+Gmelin, BG Chemical, Meyer Lab, Zep, and SoySolv, are dominating the market.

- FUCHS is one of the key manufacturers of specialty lubricants and chemical solutions, with a strong presence in the market through its RENOCAST and BITEEREX product lines. The company offers a comprehensive portfolio of petroleum-based, water-based, and bio-based formulations designed to prevent asphalt adhesion in truck beds, pavers, and rollers, thereby enhancing equipment performance and operational efficiency. FUCHS differentiates itself through its commitment to sustainability and regulatory compliance, developing biodegradable and non-label products that meet stringent EU REACH and EPA standards. Its extensive global distribution network, coupled with strong relationships with road construction contractors and OEMs, positions FUCHS as a market leader in eco-friendly release solutions. The company’s continued investment in R&D and green chemistry innovation reinforces its competitive edge and aligns with the industry’s transition toward environmentally responsible asphalt handling practices.

Key Asphalt Release Agents Companies:

The following are the leading companies in the asphalt release agents market. These companies collectively hold the largest market share and dictate industry trends.

- FUCHS

- Zeller+Gmelin

- BG Chemical

- Meyer Lab

- Zep

- SoySolv

- Rhomar Industries Inc.

- Industrial Chemical Solutions

- McGee Industries, Inc.

- Miller-Stephenson Chemical Company, Inc.

Asphalt Release Agents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 383.8 million

Revenue forecast in 2033

USD 535.3 million

Growth rate

CAGR of 4.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; MEA; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

FUCHS; Zeller+Gmelin; BG Chemical; Meyer Lab; Zep; SoySolv; Rhomar Industries Inc.; Industrial Chemical Solutions; McGee Industries, Inc.; Miller-Stephenson Chemical Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Asphalt Release Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global asphalt release agents market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Bio-based

-

Petroleum-based

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Truck Beds

-

Pavers

-

Rollers

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global asphalt release agents market size was estimated at USD 373.3 million in 2024 and is expected to reach USD 383.8 million in 2025.

b. The global asphalt release agents market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2033 to reach USD 535.3 million by 2033.

b. The truck beds segment dominated the market with a 44.2% revenue share in 2024 due to its critical role in preventing asphalt adhesion during transport, minimizing material loss, and ensuring efficient unloading operations. Its dominance is further reinforced by the high frequency of truck usage in large-scale paving and maintenance projects, driving consistent demand for effective release agents.

b. Some of the key players operating in the asphalt release agents market include FUCHS, Zeller+Gmelin, BG Chemical, Meyer Lab, Zep, SoySolv, Rhomar Industries Inc., Industrial Chemical Solutions, McGee Industries, Inc., and Miller-Stephenson Chemical Company, Inc.

b. The market is driven by the surging demand for road construction and maintenance, coupled with the shift toward biodegradable, low-VOC formulations to meet stringent environmental regulations. The focus on enhancing equipment efficiency and reducing maintenance downtime is accelerating the adoption of high-performance asphalt release agents globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.