- Home

- »

- Pharmaceuticals

- »

-

Atopic Dermatitis Drugs Market Size, Industry Report, 2030GVR Report cover

![Atopic Dermatitis Drugs Market Size, Share & Trends Report]()

Atopic Dermatitis Drugs Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (Corticosteroids. Biologics), By Route Of Administration (Topical, Parenteral), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-546-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Atopic Dermatitis Drugs Market Summary

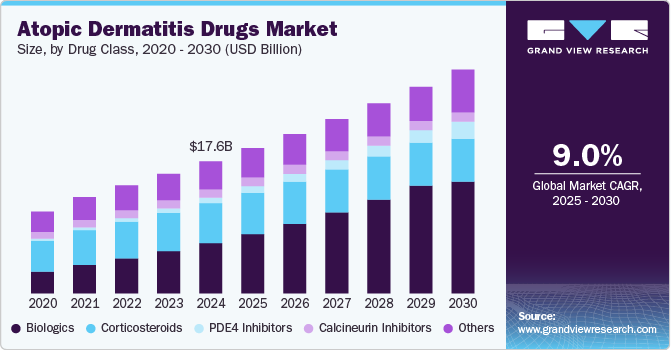

The global atopic dermatitis drugs market size was estimated at USD 17.64 billion in 2024 and is projected to reach USD 29.88 billion by 2030, growing at a CAGR of 9.02% from 2025 to 2030. This growth can be attributed to the prevalence of atopic dermatitis, especially in children and adults, which is on the rise globally.

Key Market Trends & Insights

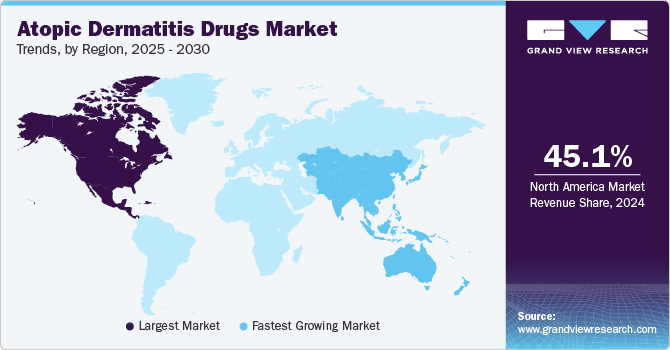

- The North America atopic dermatitis drugs market accounted for 45.12% share in 2024.

- The atopic dermatitis drugs market in the U.S. is anticipated to dominate North America in 2024.

- The Asia Pacific atopic dermatitis drugs market is expected to experience the fastest growth in the global market.

- By drug class, the biologics segment dominated the market and accounted for 38.07% of the global revenue in 2024.

- By route of administration, topical segment dominated the market with a market share of 39.73% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.64 Billion

- 2030 Projected Market Size: USD 29.88 Billion

- CAGR (2025-2030): 9.02%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Factors like environmental changes, pollution, and urban lifestyles contribute to this increase, leading to higher demand for effective treatments. Atopic dermatitis is a chronic condition that often requires long-term management, creating a consistent demand for therapeutic solutions. Atopic dermatitis, a persistent inflammatory skin disorder, is estimated to affect over 200 million people globally, including around 20% of children and 10% of adults, according to the American Academy of Dermatology's 2023 data. While it predominantly occurs in childhood and can extend into adulthood, approximately 25% of adult cases are identified as adult onset. This trend is likely to drive the development of innovative therapeutic options, including biologics and targeted therapies, as existing treatments may not fully address the needs of all patient segments.

In addition, according to the European Academy of Dermatology & Venereology 2023 estimate, it affected roughly 10-15% of children and 3-5% of adults in Europe, although prevalence rates can differ across regions. It tends to be more common in urban and industrialized areas than in rural locations, likely due to environmental and lifestyle influences. However, the exact causes are still not fully understood. This could expand treatment pipelines, including non-steroidal options and therapies targeting the underlying immune mechanisms. This would position the atopic dermatitis treatment market for significant growth in the coming years.

Atopic dermatitis (AD) is typically managed with a combination of emollients and topical anti-inflammatory treatments, which are effective for most patients. However, severe cases often require systemic therapies for better disease control. For instance, Cyclosporin A, a fast-acting immunosuppressive drug, is approved in several European countries and is often used for more severe cases. In contrast, slower-acting immunosuppressive agents such as Methotrexate, Azathioprine, and Mycophenolate are reserved for more complex cases and are typically prescribed by specialists. Furthermore, Dupilumab, a biologic recently approved in the EU, represents a novel treatment approach. It specifically targets the overactive parts of the immune system in AD patients, offering a more targeted and potentially safer option for disease management.

Drug Class Insights

The biologics segment dominated the market and accounted for 38.07% of the global revenue in 2024. The growth of the biologics segment is augmented by rising demand for biologics due to high efficacy, rising product approvals, and availability of a robust pipeline of biologic drugs for atopic dermatitis. Biologics has a significant clinical advantage over conventional topical treatments, as they target the inflammatory mechanisms fostering the disease rather than just addressing the symptoms. The high specificity of these drugs gives them a competitive edge. For instance, in February 2024, Galderma announced that the U.S. FDA had accepted its Biologics License Applications (BLA) for nemolizumab, a first-in-class investigational monoclonal antibody. Nemolizumab inhibits IL-31 signaling, providing safe and rapid relief from itch, the most distressing symptom of both prurigo nodularis and moderate to severe atopic dermatitis (AD) in adolescents and adults. Accepting BLA licenses for products is anticipated to open new avenues in the market.

The PDE4 segment is expected to register significant market growth during the forecast period owing to growing research and development in PDE4 drugs for treating atopic dermatitis. For instance, in September 2024, Arcutis Biotherapeutics, Inc. announced that JAMA Dermatology Journal published positive Phase 3 trial results from INTEGUMENT-1 and INTEGUMENT-2, showing that ZORYVE (roflumilast) cream significantly improved outcomes for mild to moderate atopic dermatitis (AD), including a statistically significant improvement in IGA Success. These results validate the efficacy and safety of ZORYVE in treating mild to moderate atopic dermatitis (AD), potentially increasing its adoption among dermatologists and boosting drug sales.

Route Of Administration Insights

Topical segment dominated the market with a market share of 39.73% in 2024. The high prescription rates and affordability of medications, combined with the safety and efficacy of topical treatments, contribute significantly to their widespread use. According to a study published in the Dermatology and Therapy Journal in June 2022, there were 176,458 pediatric patients diagnosed with atopic dermatitis (AD). Among these patients, 99.2% were treated with topical corticosteroids, while 5.1% were prescribed topical calcineurin inhibitors. In addition, 37.1% received potent topical corticosteroids, and 2.1% were administered systemic corticosteroids. These statistics highlight the dominance of topical corticosteroids in the treatment landscape for AD, underscoring their critical role in managing this condition effectively.

The parenteral segment is projected to experience the fastest growth in the atopic dermatitis drugs industry during the forecast period. This can be attributed to the increasing adoption of biologics, particularly for patients with severe disease, and the growing need for effective treatments in moderate to severe cases. In March 2024, Chugai Pharmaceutical Co., Ltd. announced that Maruho Co., Ltd. received regulatory approval from the Ministry of Health, Labour and Welfare (MHLW) for Mitchga (Nemolizumab) Subcutaneous Injection 30 mg. This humanized monoclonal antibody is indicated for treating pruritus associated with atopic dermatitis in children aged 6 to under 13 years and prurigo nodularis in adults and children aged 13 years and older, specifically when existing treatments are insufficiently effective in Japan. Thus, the approval of new parenteral administration drugs of AD is expected to boost the atopic dermatitis drugs industry growth.

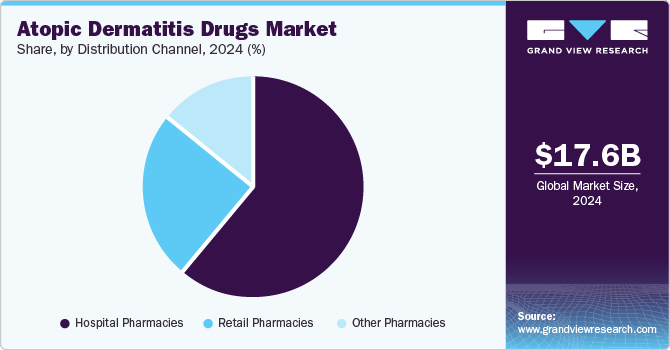

Distribution Channel Insights

The hospital pharmacies segment held a considerable market share of 61.11% in 2024. Many patients with moderate to severe atopic dermatitis require prescription medications, which are often more readily available through hospital pharmacies. This includes systemic treatments and newer biologics that retail pharmacies may not stock. Furthermore, patients with chronic conditions such as atopic dermatitis often seek specialized care, which is more readily available in hospitals and specialized clinics. Thus, patients with severe symptoms are more likely to be treated in hospitals, leading to increased usage of hospital pharmacies.

The other pharmacies segment is projected to witness a significant growth rate over the forecast period. Other pharmacies such as online pharmacies boost the adoption of drugs by increasing accessibility to essential medications, such as topical and oral AD drugs, particularly for families in remote or underserved areas. They offer convenience, discreet delivery, and often lower costs, making it easier for parents to obtain and manage their AD care consistently. In addition, the integration of telemedicine has made it easier for patients to consult healthcare providers and receive prescriptions online, further driving the growth of other pharmacies.

Regional Insights

The North America atopic dermatitis drugs market accounted for 45.12% share in 2024. This can be attributed to the high adoption rates of biologics and topical treatments. The region's leadership in this sector is primarily attributed to the comprehensive healthcare system, extensive research and development initiatives, and the introduction of personalized medicine approaches. However, challenges such as rising drug costs and insurance coverage limitations may impede growth.

U.S. Atopic Dermatitis Drugs Market Trends

The atopic dermatitis drugs market in the U.S. is anticipated to dominate North America in 2024, fueled by a high incidence of atopic dermatitis among both adults and children. Increasing utilization of monoclonal antibodies and newer therapies, such as Janus kinase (JAK) inhibitors, are transforming treatment paradigms. Nevertheless, the market faces hurdles, including disparities in access to advanced therapies and the need for more healthcare provider education on emerging treatments.

Europe Atopic Dermatitis Drugs Market Trends

Europe atopic dermatitis drugs market was identified as a lucrative region in this industry. Growth is fueled by increased awareness and diagnosis rates related to atopic dermatitis. The region is seeing an uptick in clinical trials for innovative treatments and a rise in the adoption of combination therapies that enhance treatment efficacy. Furthermore, increasing regulatory support for novel AD drugs and improved patient access contribute to regional expansion.

The atopic dermatitis drugs market in UK accounted for the largest share of the due to technological advancements in treatment options, particularly the introduction of systemic therapies and innovative topical formulations. Furthermore, increased patient access to specialty pharmacies and dermatology clinics has improved treatment adherence and outcomes for pediatric and adult populations alike.

The atopic dermatitis drugs market in Germany is anticipated to witness high growth in Europe in 2024. The growing incidence of moderate to severe AD has led to increased demand for biologics and corticosteroid drugs, which are essential in managing the AD disease.

The atopic dermatitis drugs market in France is set to expand, and it is supported by public health initiatives to increase awareness and treatment of chronic skin diseases. Enhanced reimbursement policies for new therapies and the promotion of dermatological care in primary healthcare settings are expected to bolster market growth.

Asia Pacific Atopic Dermatitis Drugs Market Trends

The Asia Pacific atopic dermatitis drugs market is expected to experience the fastest growth in the global market. This growth is driven by an increasing prevalence of skin conditions and rising disposable incomes. The adoption of advanced therapies and growing awareness of skincare are key factors propelling this market segment.

The atopic dermatitis drugs market in China is experiencing significant growth in the atopic dermatitis sector, supported by a rising focus on skincare products and dermatological treatments. The government’s initiatives to improve healthcare access and investment in research and development are expected to stimulate market growth further.

The atopic dermatitis drugs market in Japan held a notable revenue share in 2024, driven by innovative biologics and personalized medicine research. Increased emphasis on patient education and adherence programs is fostering better management of the disease among both adults and children.

Latin America Atopic Dermatitis Drugs Market Trends

Latin America atopic dermatitis drugs market is identified as a lucrative region, with growing investments in dermatological research and increasing patient awareness. The market benefits from a rise in disposable incomes and the introduction of new treatments targeting various patient demographics.

The atopic dermatitis drugs market in Brazil led the global market in Latin America in 2024, where an increasing number of dermatological clinics and pharmacies are improving access to treatments. Innovative healthcare initiatives addressing skin conditions among children are driving growth in this segment.

MEA Atopic Dermatitis Drugs Market Trends

The MEA atopic dermatitis drugs market is expected to grow due to increased government funding for healthcare improvements and enhanced treatment access. The demand for effective therapies is rising due to a growing awareness of skin conditions and the prevalence of atopic dermatitis.

The atopic dermatitis drugs market in Saudi Arabia is projected to be one of the fastest-growing markets in the coming years. This can be attributed to the growing population and increased healthcare expenditure. Enhanced focus on chronic disease management and patient education initiatives supports market development. As the healthcare system evolves, the availability of modern therapies is expected to improve significantly in Saudi Arabia.

Key Atopic Dermatitis Drugs Company Insights

Some of the key players such as Pfizer Inc., AbbVie Inc., Sanofi, Galderma Laboratories, L.P., Eli Lilly and Company (Dermira), Regeneron Pharmaceuticals Inc., LEO Pharma Inc., Otsuka Pharmaceutical Co., Ltd, Novartis AG, and Incyte Corporation hold significant positions in market. These companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Atopic Dermatitis Drugs Companies:

The following are the leading companies in the atopic dermatitis drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- Sanofi

- AbbVie Inc.

- Galderma Laboratories, L.P.

- Eli Lilly and Company (Dermira)

- Regeneron Pharmaceuticals Inc.

- LEO Pharma Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Novartis AG

- Incyte Corporation

Recent Developments

-

In September 2024, the U.S. FDA approved EBGLYSS (lebrikizumab-lbkz) developed by Eli Lilly and Company for the treatment of moderate to severe atopic dermatitis (eczema) adult and children aged 12 years and above who weigh at least 40kg that is not well manage by topical treatment. This approval is expected to boost market growth.

-

In August 2023, Lynk Pharmaceuticals Co., Ltd. announced positive topline results from its Phase II clinical trial of LNK01001 for adults with atopic dermatitis (AD). After 12 weeks of treatment, preliminary data indicated that patients in both the low-dose and high-dose groups demonstrated significant improvements in Eczema Area and Severity Index (EASI) scores compared to the placebo group. The successful completion of clinical trial and approval of product is anticipated to drive market growth.

-

In June 2022, the U.S. FDA approved Dupixent (dupilumab) developed by Sanofi for the treatment of moderate to severe atopic dermatitis (eczema) children aged 6 months to 5 years whose disease not controlled with treatment of topical drugs. This approval is anticipated to drive market growth.

Atopic Dermatitis Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.40 billion

Revenue forecast in 2030

USD 29.88 billion

Growth rate

CAGR of 9.02% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Pfizer Inc; AbbVie Inc; Sanofi; GALDERMA LABORATORIES, L.P; Eli Lilly and Company (Dermira); Regeneron Pharmaceuticals Inc; LEO Pharma Inc; Otsuka Pharmaceutical Co., Ltd; Novartis AG; Incyte Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Atopic Dermatitis Drugs Market Report Segmentation

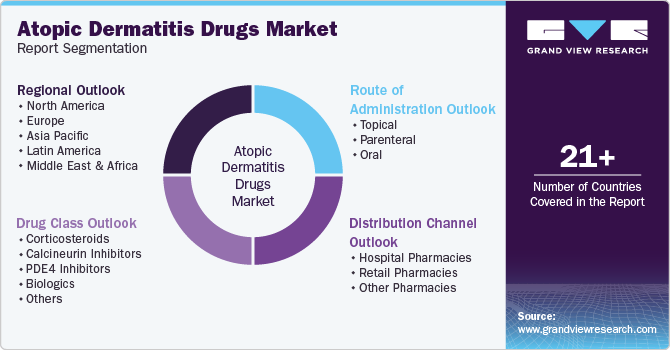

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global atopic dermatitis drugs market report based on drug class, route of administration, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Corticosteroids

-

Calcineurin Inhibitors

-

PDE4 Inhibitors

-

Biologics

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Parenteral

-

Oral

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Other Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global atopic dermatitis drugs market is expected to grow at a compound annual growth rate of 9.02% from 2025 to 2030 and is expected to reach USD 29.88 billion by 2030.

b. The Biologics segment is expected to dominate the atopic dermatitis drugs market with a share of 45.12% in 2024 due to the increased prescription rate of biologics for AD treatment and rate cost of treatment.

b. Some of the key players operating in the market are Bayer AG, Regeneron Pharmaceuticals, Inc., Pfizer Inc., LEO Pharma A/S, Viatris Inc., and Sanofi among others.

b. Launch of novel & effective biologics & small molecules, premium-priced drugs replacing generic first-line and second-line therapeutics, growing incidence of AD, and improved diagnostics are estimated to stoke the growth of the market.

b. The global atopic dermatitis drugs market size was estimated at USD 17.64 billion in 2024 and is expected to reach USD 19.40 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.