- Home

- »

- Pharmaceuticals

- »

-

Atopic Dermatitis Drugs Market Size & Share Report, 2030GVR Report cover

![Atopic Dermatitis Drugs Market Size, Share & Trends Report]()

Atopic Dermatitis Drugs Market Size, Share & Trends Analysis Report By Drug Class (Biologics, PDE4 Inhibitors, Corticosteroids, Calcineurin Inhibitors), By Route Of Administration (Topical, Injectable, Oral), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-546-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Atopic Dermatitis Drugs Market Trends

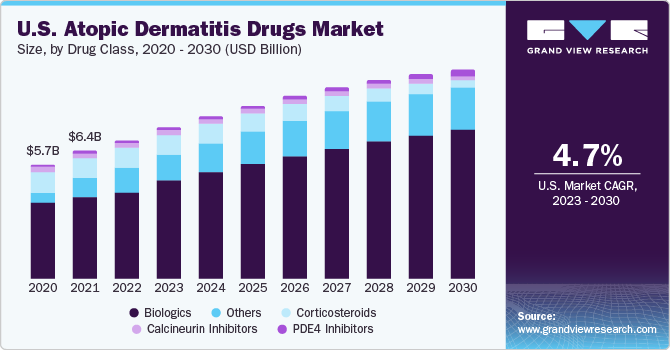

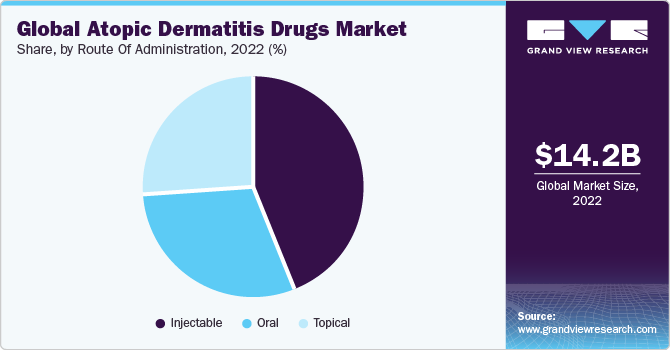

The global atopic dermatitis drugs market size was valued at USD 14.19 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030. The growing prevalence of atopic dermatitis, strong pipeline, emergence of biologics, and untapped opportunities are anticipated to drive the market over the forecast period. The prevalence of atopic dermatitis is rising steadily. As per Acta Derm Venereologica Journal in 2020, the prevalence of atopic dermatitis diagnosed by the doctor ranged between 17.1% in Europe and 10.2% in Asian adults, while the rates were 22.6% and 0.96%, respectively, in children. It has a substantial financial and social burden and has been categorized as the largest skin disability.

The COVID-19 pandemic has increased the frequency of handwashing, leading to cracked and dry skin prone to infections among atopic dermatitis patients. The incidence of hand eczema is also on the rise owing to constant exposure to oil-stripping soaps and handwash. This unmet need creates an opportunity for market players to develop moisturizer-based creams and ointments to capture the newly formed segment.

Atopic dermatitis is a lucrative market, and companies are investing in R&D to develop novel products to capture the market. The growing number of drugs entering the late phase of clinical trials by demonstrating positive results is expected to aid revenue growth for major companies in the coming years. For instance, in April 2021, Galderma announced phase 2b results for its under-development drug Nemolizumab, in patients suffering from uncontrolled atopic dermatitis. In March 2021, Pfizer stated that under development, abrocitinib was non-inferior to the existing treatment Dupixent by Sanofi. Furthermore, there is an unmet need for oral drugs among atopic dermatitis patients, which can be fulfilled by the launch of abrocitinib, a Janus kinase 1 (JAK1) inhibitor. Cara Therapeutics’ Korsuva is a phase 2 oral drug for pruritus caused due to atopic dermatitis.

Furthermore, rising product approvals and the emergence of biologics for the management of atopic dermatitis are anticipated to boost market growth during the forecast period. For instance, in June 2022, Sanofi announced the U.S. Food and Drug Administration (FDA) approval of Dupixent (dupilumab) for children aged six months to 5 years with atopic dermatitis. In January 2022, AbbVie Inc. announced the U.S. FDA approval of RINVOQ (upadacitinib) for the management of severe atopic dermatitis in children over 12 years of age and adults. RINVOQ is suggested for patients who don’t respond to their previous treatment with injections and pills.

Biologics is a relatively new class of treatment in the market. The targeted approach of the biologics segment is a crucial factor facilitating the growth of this segment. The high rate of disease recurrence is driving companies to invest in the development of novel biologics with high efficacy. Although biologics are not considered first-line treatment, dermatologists believe that for people who face an issue with atopic dermatitis for a major portion of a year, biologics should be considered as the first choice owing to their high efficacy, safety, and targeted approach in treating the disease.

Route of Administration Insights

The injectable segment dominated the market in 2022 with a revenue share of over 40% and is estimated to grow at the fastest CAGR of 12.7% over the forecast period owing to the increased use of injectable products such as Dupilumab. Other injectable biologics under clinical study are tofacitinib and ruxolitinib. Biologics are expected to change the landscape of therapeutics used for AD in the near future. They are being investigated for the treatment of pediatric patients to meet the high unmet needs of this market. There are very limited treatment options for pediatric patients with AD. One of the clinical programs aimed at developing AD drugs for pediatric patients is the dupilumab development program. The program is aimed at improving clinical research.

The oral segment is likely to register the second-highest growth rate of 8.4% CAGR during the forecast period, propelled by new launches in JAK inhibitors, primarily administered through the oral route. Oral corticosteroids are prescribed only in extreme cases when the disease has covered large areas of the body or in case of any complication with other therapies. Traditionally used oral medications are azathioprine, cyclosporine, methotrexate, and mycophenolate mofetil.

Drug Class Insights

The biologics segment held the largest share of over 40% in 2022. Biologics have a major clinical advantage over conventional topical treatments as they target the inflammatory mechanisms fostering the disease rather than just addressing the symptoms. The high specificity of these drugs gives them a competitive edge. Biologics are mostly prescribed for severe cases, such as second or third-line treatment, in patients unresponsive to prior systemic therapies. The growth of the biologics segment is augmented by rising demand for biologics due to high efficacy, rising product approvals, and the availability of a robust pipeline of biologic drugs for atopic dermatitis. Nemolizumab, a monoclonal antibody currently in the pipeline of GALDERMA LABORATORIES, L.P., is being investigated for its use in pruritus and atopic dermatitis.

The PDE4 segment is expected to grow significantly during the forecast period due to wider product availability. For instance, Eucrisa (crisaborole ointment, 2%) is an approved PDE4 inhibitor. The FDA approved Pfizer’s Eucrisa in 2016 for the treatment of mild-to-moderate AD. It has been proven to inhibit Th-2-derived cytokines, such as IL-2, IL-10, and TNF-α. Pfizer continuously expands its market reach and obtains new approvals for Eucrisa (crisaborole). For instance, in March 2020, Eucrisa was approved by the FDA for children over three years of age, thus increasing the revenue-generating capacity of the drug. Another prominent PDE4 in the pipeline is roflumilast by Arcutis Biotherapeutics. In January 2021, the company announced initiating a phase 3 trial of the drug.

Regional Insights

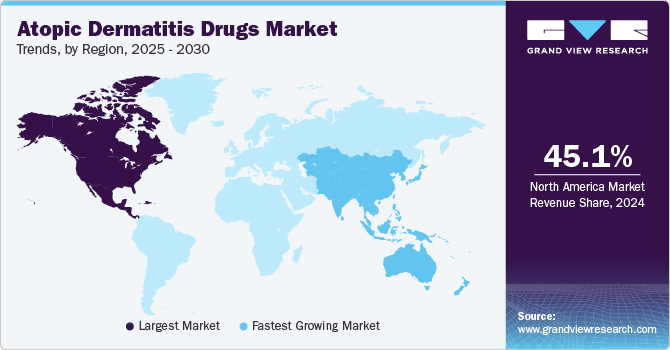

North America dominated the overall market with a revenue share of over 50% in 2022 due to the local presence of leading players, such as AbbVie and Viatris. Key reasons behind the region’s continued dominance include the presence of well-established R&D infrastructure and favorable reimbursement policies. In addition, the regulatory and reimbursement landscape is continuously evolving to adapt to the fast-paced research progress in this sector. The COVID-19 pandemic is expected to impact market growth positively. This can be attributed to the increased frequency of hand-washing by the population adhering to safety and sanitation measures, which helps prevent the spread of SARS-CoV-2. However, constant exposure to soap and water has increased dry skin, leading to increased cases of hand atopic dermatitis.

Asia Pacific is expected to register the fastest growth rate of 11.5% during the forecast period. An increase in pro-health initiatives, adoption of better treatments, and rise in consumer awareness are fueling market growth in this region. In addition, the rising prevalence of atopic dermatitis, increasing demand for cost-effective treatment, and growing population significantly contribute to market growth. Asia Pacific markets such as China, Australia, Korea, and Taiwan already have healthcare reimbursement systems that provide inclusive coverage for molecular diagnostic tests.

Key Companies & Market Share Insights

Competitive rivalry in the market is projected to remain high during the forecast period, which can be attributed to the anticipated launch of novel products over the forecast period. Collaborations between players are becoming common, and partnerships are being formed to develop and commercialize new products. The highly lucrative nature of the market amid the pandemic is attracting new players with innovative products, thus increasing the competition for existing companies. For instance, in April 2021, AbbVie announced the extension of sNDA for the review of RINVOQ for atopic dermatitis adolescent and adult patients. The PDUFA was extended till quarter 3 of 2021.

In June 2023, Leo Pharma’s Delgocitinib was under Phase III clinical development for hand dermatitis (atopic dermatitis), dry eye disease, inverse psoriasis, Sjogren’s syndrome, and frontal fibrosing alopecia.

Key Atopic Dermatitis Drugs Companies:

- Pfizer Inc.

- Sanofi

- AbbVie Inc.

- GALDERMA LABORATORIES, L.P.

- Eli Lilly and Company (Dermira)

- Regeneron Pharmaceuticals Inc.

- LEO Pharma Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Novartis AG

- Incyte Corporation

Atopic Dermatitis Drugs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.76 billion

Revenue forecast in 2030

USD 27.68 billion

Growth rate

CAGR of 8.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, route of administration, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Pfizer Inc.; AbbVie Inc.; Sanofi; GALDERMA LABORATORIES, L.P.; Eli Lilly and Company (Dermira); Regeneron Pharmaceuticals Inc.; LEO Pharma Inc.; Otsuka Pharmaceutical Co., Ltd.; Novartis AG; Incyte Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Atopic Dermatitis Drugs Market Report Segmentation

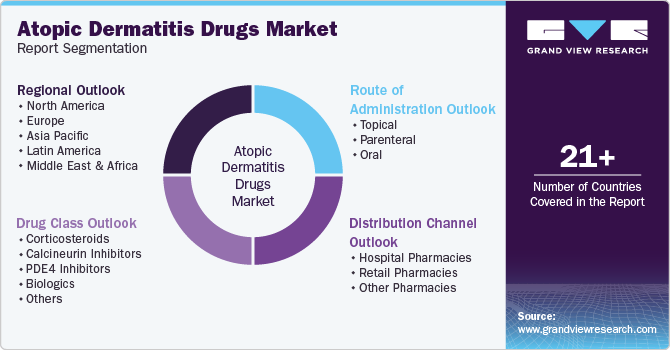

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global atopic dermatitis drugs market report based on drug class, route of administration, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Corticosteroids

-

Calcineurin Inhibitors

-

PDE4 Inhibitors

-

Biologics

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Injectable

-

Oral

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global atopic dermatitis drugs market is expected to grow at a compound annual growth rate of 8.4% from 2023 to 2030 and is expected to reach USD 27.68 billion by 2030.

b. The Biologics segment is expected to dominate the atopic dermatitis drugs market with a share of 43.9% in 2021 due to the increased prescription rate of biologics for AD treatment and rate cost of treatment.

b. Some of the key players operating in the market are Bayer AG, Regeneron Pharmaceuticals, Inc., Pfizer Inc., LEO Pharma A/S, Viatris Inc., and Sanofi among others.

b. Launch of novel & effective biologics & small molecules, premium-priced drugs replacing generic first-line and second-line therapeutics, growing incidence of AD, and improved diagnostics are estimated to stoke the growth of the market.

b. The global atopic dermatitis drugs market size was estimated at USD 14.1 billion in 2022 and is expected to reach USD 15.7 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."