- Home

- »

- Advanced Interior Materials

- »

-

Attapulgite Market Size And Share, Industry Report, 2030GVR Report cover

![Attapulgite Market Size, Share & Trends Report]()

Attapulgite Market (2025 - 2030) Size, Share & Trends Analysis Report By End-use (Chemicals, Oil & Gas, Pet Waste Absorbents, Fertilizer & Agrochemical), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-028-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Attapulgite Market Size & Trends

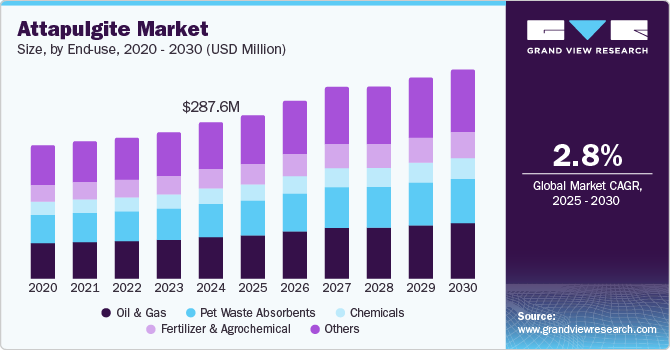

The global attapulgite market size was valued at USD 287.6 million in 2024 and is expected to grow at a CAGR of 2.8% from 2025 to 2030. This growth can be attributed tothe increasing demand from the oil and gas sector for drilling fluids, as attapulgite is valued for its superior suspending properties in challenging geological formations. In addition, the rise in manufacturing absorbent products, particularly in pet waste management and cosmetics, further fuels market expansion. Furthermore, the ongoing industrialization and economic growth in regions such as Asia Pacific also enhance the demand for attapulgite across various applications, solidifying its market presence.

Attapulgite is a clay mineral known for its unique absorbent properties and versatility, making it valuable across various industries. The growth of the attapulgite market is significantly influenced by its increasing demand in diverse sectors such as pharmaceuticals, agriculture, and environmental remediation. Its absorbent nature makes it suitable for applications such as drug delivery systems and soil conditioners, while its effectiveness as a filtering agent enhances its use in wastewater treatment processes.

In addition, growing environmental concerns are propelling market growth as awareness of sustainability rises. Attapulgite's natural composition and biodegradable characteristics position it as an eco-friendly option for pollution control and an absorbent for oil spills and hazardous waste. Technological advancements in extraction and processing methods have improved the quality and usability of attapulgite, enabling manufacturers to produce high-purity variants that expand their application range.

Furthermore, trends toward sustainability are also shaping the market, with increased investments in natural materials positioning attapulgite as a green alternative. Companies actively pursue sustainable sourcing practices and eco-friendly certifications to meet consumer demands. Also, the ongoing research and development efforts foster product innovation, leading to new formulations and composites tailored to specific industry needs, thereby enhancing market competitiveness.

Moreover, emerging markets in Asia-Pacific and Latin America are becoming significant consumers of attapulgite, driven by industrial growth and infrastructure development.

End-use Insights

The oil and gas segment dominated the market and accounted for the largest revenue share of 24.2% in 2024. This growth can be attributed to the increasing demand for efficient drilling fluids. Attapulgite's exceptional suspending properties make it an ideal additive in drilling mud, particularly in offshore operations, where it helps maintain viscosity and stabilize wellbores in challenging geological conditions. The rising number of drilling activities globally, coupled with the need for effective solutions to enhance drilling performance, significantly boosts the utilization of attapulgite in this industry.

The fertilizer and agrochemical segment is expected to grow at a CAGR of 5.1% from 2025 to 2030, owing to its application as a soil conditioner and absorbent in agricultural practices. Its natural absorbent properties enhance water retention and nutrient delivery, making it valuable for improving soil quality. In addition, increasing awareness of sustainable farming practices drives demand for eco-friendly materials such as attapulgite, which supports pollution control and enhances crop yield. Furthermore, as agricultural productivity becomes increasingly vital to meet global food demands, attapulgite's role in this sector continues to expand.

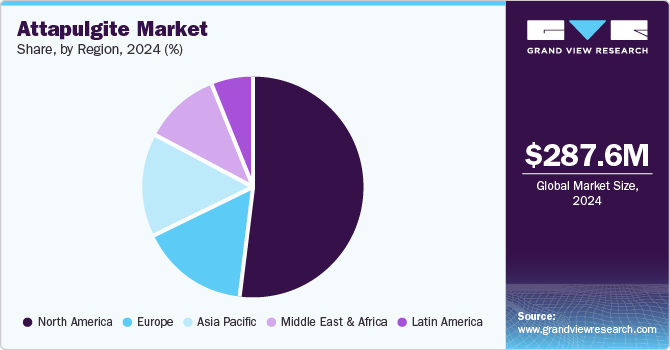

Regional Insights

The North America attapulgite market dominated the global market and accounted for the largest revenue share of 52.5% in 2024. This growth can be attributed to the robust demand from the oil and gas sector, where attapulgite is an essential component in drilling fluids. In addition, the region's increasing domestic oil production and ongoing drilling activities enhance the need for high-quality attapulgite products. Furthermore, the rising popularity of attapulgite in pet waste management and absorbent applications further boosts market growth. As industries seek sustainable and efficient solutions, North America's attapulgite market is poised to expand.

U.S. Attapulgite Market Trends

The U.S. attapulgite market led the North American market and accounted for the largest revenue share in 2024, driven by a strong focus on innovation and product development within the chemical industry. The country's vast deposits of attapulgite and significant investments in refining processes make it a leading producer and consumer of attapulgite products. In addition, the increasing use of attapulgite in various applications, including adhesives, paints, and coatings, enhances its market appeal. Furthermore, growing environmental awareness drives demand for eco-friendly alternatives, positioning attapulgite as a desirable option across multiple sectors.

Asia Pacific Attapulgite Market Trends

The Asia Pacific attapulgite market is expected to grow at a CAGR of 3.4% over the forecast period, owing to the expanding industrial activities and increasing demand from various sectors such as pharmaceuticals and agriculture. In addition, the region's booming construction industry also drives the need for attapulgite as a soil conditioner and absorbent material. Furthermore, rising awareness of sustainable practices among manufacturers encourages the adoption of natural materials such as attapulgite.

The attapulgite market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024, primarily driven by substantial growth in manufacturing sectors, particularly in pharmaceuticals and agrochemicals. Furthermore, the country's focus on improving agricultural productivity fuels demand for eco-friendly soil conditioners made from attapulgite. Moreover, technological advancements in extraction and processing methods enhance the quality of attapulgite products, making them more appealing to various industries.

Europe Attapulgite Market Trends

The Europe attapulgite market is expected to grow significantly over the forecast period, owing to stringent environmental regulations that promote sustainable materials across industries. In addition, the growing emphasis on eco-friendly products drives demand for natural absorbents such as attapulgite in applications such as wastewater treatment and pollution control. Furthermore, advancements in product formulations enhance the usability of attapulgite in various sectors, including cosmetics and personal care. As European industries increasingly prioritize sustainability, the market for attapulgite is expected to see significant growth.

The Spain attapulgite market growth is largely driven by increasing demand from agricultural applications, where it is used as a soil conditioner to improve water retention and nutrient delivery. Furthermore, the country's focus on sustainable farming practices aligns with using natural materials such as attapulgite, further boosting its appeal among farmers. Moreover, Spain's expanding construction sector creates opportunities for attapulgite in various applications, such as adhesives and sealants. As these trends continue, Spain's attapulgite market is poised for expansion.

Key Attapulgite Company Insights

Key players in the global attapulgite industry include Clariant, Hudson Resources Ltd., Tolsa, and others. These players employ various strategies to enhance their market presence and drive growth. Market expansions are a significant focus, with companies targeting emerging regions to tap into new customer bases and increase production capabilities. In addition, new product development is emphasized to innovate and diversify product offerings, catering to specific industry needs. Furthermore, collaborations and partnerships with research institutions and industry stakeholders are also pursued to leverage technological advancements and improve processing techniques, enhancing overall competitiveness in the market.

-

Hudson Resources Ltd. specializes in mining and supplying premium attapulgite clay and diatomaceous earth. The company produces high-quality natural sorbent minerals for various applications, including agriculture, pharmaceuticals, and environmental management. Operating within the mining and materials segment, the company emphasizes sustainable practices and innovation to enhance the performance of its products, which are utilized for soil conditioning, water filtration, and absorbents in multiple industries.

-

Sun Silicates (Pty) Ltd. manufactures and supplies high-quality attapulgite products tailored for diverse applications. The company produces natural agricultural, construction, and industrial absorbents. The company emphasizes using attapulgite for its unique properties, including its ability to improve soil quality and act as an effective filtering agent.

Key Attapulgite Companies:

The following are the leading companies in the attapulgite market. These companies collectively hold the largest market share and dictate industry trends.

- Clariant

- Hudson Resources Ltd.

- Tolsa

- Active Minerals International LLC

- Geohellas

- Oil-Dri Corporation of America

- MYTA a SAMCA Group Company

- Sun Silicates (Pty) Ltd.

- Active Minerals International

- Sepiolsa

- G&W Mineral Resources

- Swell Well Minechem Pvt. Ltd.

- Kutch Bento Clay

Recent Developments

-

In November 2023, Active Minerals International announced the launch of a premium attapulgite product, Min-U-Gel 500+. This innovative product is designed for higher thixotropic performance in water and solvent-based formulations used in paints, coatings, adhesives, and agricultural applications. Compared to its predecessor, Min-U-Gel 400, Min-U-Gel 500+ enhances the dispersion and adsorption properties while demonstrating exceptional performance in lab tests.

Attapulgite Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 304.9 million

Revenue forecast in 2030

USD 349.9 million

Growth rate

CAGR of 2.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East and Africa

Country scope

U.S., Canada, Mexico, China, India, Japan, Bangladesh, Indonesia, Spain, Germany, Russia, UAE, and South Africa

Key companies profiled

Clariant; Hudson Resources Ltd.; Tolsa; Active Minerals International LLC; Geohellas; Oil-Dri Corporation of America; MYTA a SAMCA Group Company; Sun Silicates (Pty) Ltd.; Active Minerals International; Sepiolsa; G&W Mineral Resources; Swell Well Minechem Pvt. Ltd.; Kutch Bento Clay.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Attapulgite Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global attapulgite market report based on end use, and region.

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Fertilizer & Agrochemical

-

Chemicals

-

Pet Waste Absorbents

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Spain

-

Germany

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Bangladesh

-

Indonesia

-

-

Latin America

-

Middle East and Africa

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.