- Home

- »

- Next Generation Technologies

- »

-

Audiobooks Market Size, Share And Trends Report, 2030GVR Report cover

![Audiobooks Market Size, Share & Trends Report]()

Audiobooks Market Size, Share & Trends Analysis Report By Genre (Fiction & Non-Fiction), By Preferred Device, By Distribution Channel, By Target Audience (Kids Mode, Adult), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-588-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Audiobooks Market Size & Trends

The global audiobooks market size was estimated at USD 6.83 billion in 2023 and is expected to expand at a CAGR of 26.2% from 2024 to 2030. The rising adoption of smartphones has increased the popularity of audiobooks, making them available for consumption anytime and from any location. The advancement of digital technology has made audiobooks more accessible through online platforms and mobile devices, expediting market growth. Furthermore, increased internet penetration has boosted audience traction, creating lucrative growth opportunities.

The rise of digital transformation technologies is expected to catalyze innovation in the market. These technological advancements have revolutionized the way audiobooks are created, distributed, and consumed. Furthermore, the integration of advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) has made it easier for customers to obtain audiobooks. Moreover, AI technology has enhanced the user experience by making tailored recommendations based on personal preferences and customs.

Artificial Intelligence (AI) is revolutionizing the way companies such as Amazon, Apple Books, Google Play Books, and Kobo interact with their users by offering personalized experiences based on individual preferences and behaviors. One key application of AI in this context is the customization of results for users based on their listening history. By leveraging AI algorithms, companies can analyze a user’s past interactions with their platform to recommend content that aligns with their interests, ultimately enhancing user engagement and satisfaction. For instance, in January 2024, Spotify developed a personalized audiobook recommendation system using graph neural networks and a new recommendation engine called 2T-HGNN4. This system considers user preferences, sophisticated graph-based methods, and effective computational methodologies to generate personalized audiobook recommendations.

The increasing popularity of audiobooks among the younger demographic is a significant trend that is expected to drive market growth in the coming years. They are showinga greaterpreference for consuming content in audio format rather than traditional print books. Many audiobooks feature professional narrators or even famous actors who bring stories to life through their performances. This aspect enhances the listening experience and appeals to the younger population.

Audiobooks have witnessed a significant surge in popularity across various industries, including the business world. Professionals are increasingly turning to audiobooks as a convenient and efficient way to consume content on the go. In the fast-paced environment across business, audiobooks offer a valuable resource for continuous learning, personal development, and staying ahead of industry trends.

Market Concentration & Characteristics

The degree of innovation in the market is anticipated to be high owing to the companies continuously investing in new technologies and experiences to enhance user engagement. The integration of advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) has revolutionized how audiobooks are created, distributed, and consumed. These technologies have made it easier for consumers to access audiobooks on various devices and platforms, leading to increased convenience and accessibility. Additionally, AI technologies are being used to automate narrations and provide summaries with key takeaways, further enhancing the overall audiobook experience. For instance, in January 2023, Apple Inc. launched four new AI voices, 'Madison' and 'Jackson' for fiction genres, and 'Helena' and 'Mitchell' for nonfiction, aiming to make the creation of audiobooks more accessible to all.

The level of merger & acquisition activities in the market is expected to be moderate to high. Companies are leveraging mergers and acquisitions to strengthen their operations, enhance profitability, streamline their business processes, and gain a competitive edge. For instance, in January 2023, RBmedia, a leading audiobook publisher, acquired Ukemi audiobooks and Dharma audiobooks. This strategic move is likely to lead to the expansion of RBmedia’s audiobook catalogue.

The impact of regulations on the market is expected to be moderate to high. Regulations play a significant role in the market, affecting the development and distribution of audiobooks. Regulations related to copyright and intellectual property affect the availability of audiobooks. Regulations related to data privacy and security can also impact the market. For instance, the General Data Protection Regulation (GDPR) in the European Union (EU) imposes strict data protection requirements on companies that collect and process personal data, including data related to audiobooks.

The competition from product substitutes in the market is expected to be low. While there are other alternative entertainment options, such as music streaming services, podcasts, and radio, Audiobooks provide a more personalized experience for the audience, making it a popular choice among consumers.

Genre Insights

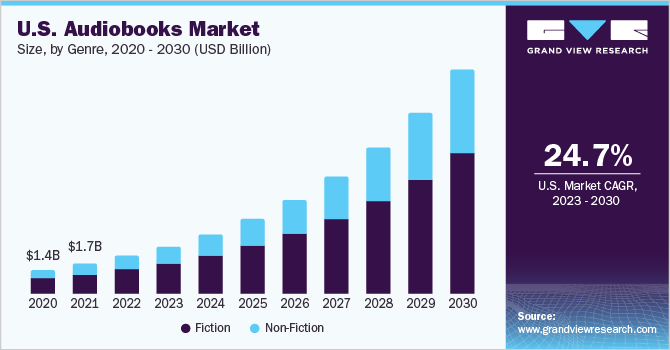

The non-fiction audiobook segment is expected to register the fastest CAGR of over 27% from 2024 to 2030. This can be attributed to the growing popularity of non-fiction audiobooks owing to the growing interest in self-improvement, personal development, and learning new skills. Consumers are increasingly turning to non-fiction audiobooks for educational and informational content. Many non-fiction audiobooks are narrated by well-known celebrities or authors themselves, which adds a personal touch and enhances the appeal of these titles. Additionally, authors often use their platforms to promote their non-fiction works through podcasts, social media, and other channels, which is further propelling the market growth.

The fiction audiobooks segment accounted for a significant share of more than 64% in 2023 and is expected to dominate the market over the forecast period. Fiction audiobooks have always been popular among readers due to their captivating storytelling line. The wide range of sub-genres such as romance, mystery, science fiction, fantasy, and more, catering to diverse listener preferences is further driving the segmental growth.

Preferred Device Insights

The smartphones segment registered the largest revenue share in 2023 and is expected to dominate the market during 2024-2030. Smartphones have become an integral part of people’s daily lives, serving as multi-functional devices that offer convenience and accessibility to various forms of entertainment, including audiobooks. The widespread adoption of smartphones makes them one of the primary platforms for consuming digital content, which is driving segmental growth.

The personal digital assistants or voice-enabled speaker segment is anticipated to witness the fastest growth during 2024-2030, owing to increased product demand. According to the Consumer Technology Association, in 2020, more than 31.0% of households in the United States have at least one personal digital assistant. The association also revealed that the adoption rate of personal digital assistants in the region has doubled over the past two years, which underlines positive growth prospects for the segment.

Distribution Channel Insights

The one-time download segment in the market registered a significant share in 2023. The rising demand for single high-quality audiobooks is contributing to the segment's growth. Many companies provide discounts and distinctive pricing packages to encourage customers to buy recorded content outright. For example, Google LLC sells a couple of its audiobook titles, such as Ready Player One, outright for a 30-50% discount, and it has a family library function that allows family members to be included in the bundle.

The subscription-based segment is anticipated to record the fastest growth over 2024-2030. This is attributed to the development of Streaming Books-On-Demand (SBOD) models. The access to a diverse selection of content that consumers obtain when they subscribe to a package fosters segmental growth. The trend of important firms offering unlimited subscription packages to get a competitive advantage over other market participants is having a significant impact on market growth.

Target Audience Insights

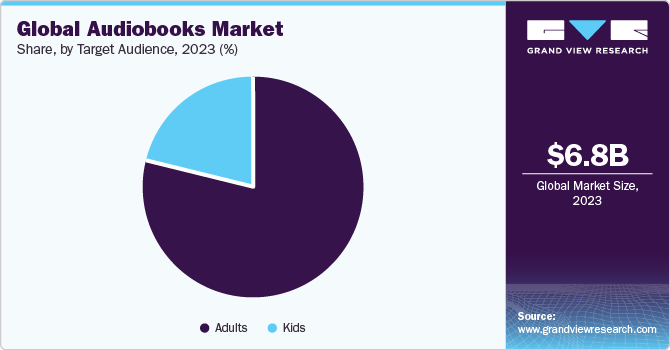

The adults segment registered with the largest revenue share in 2023 and is expected to dominate the market from 2024 to 2030, owing to the availability of diverse range of genres and titles catering to adult audiences. This segment has seen significant growth in recent years, with a wide variety of content available to cater to different tastes and preferences among adult listeners. The trend among companies to launch audiobooks specific to a community or region to attract consumers and gain a competitive edge in the market is also driving the segment's growth.

The kids segment is expected to grow at the fastest CAGR from 2024 to 2030, This is driven by the growing adoption of audiobooks for educational purposes. In addition, many audiobooks are being made for the enjoyment of children and offer benefits in the form of sophisticated vocabulary, increased vision, enhanced narrative structure, etc. Listening to such content strengthens and improves children's reading comprehension. The rising demand for audiobooks due to these advantages is creating lucrative growth opportunities for the segment.

Regional Insights

The North America region accounted for the highest revenue share of over 45% in 2023 and is expected to dominate the market from 2024 to 2030. The strong presence of various major audiobooks suppliers in the region, such as Audible, Inc., Amazon.com, Inc., Apple Inc., Google LLC, Barnes & Noble Booksellers, Inc., and Playster (Softonic International S.A.), offers ample growth opportunities for the market. Furthermore, the region has one of the largest smartphone user bases globally. The widespread use of smartphones as a primary device for consuming digital content, including audiobooks, has fueled the demand for audiobook services in the region.

U.S. Audiobooks Market Trends

The U.S. audiobooks market accounted largest market share of over 90% in 2023. This is attributed to the early and rapid adoption of technology to enhance user experience across the country. Additionally, the rapid development and the expanding prominence of audiobook subscription start-ups are expected to fuel market growth in the U.S.

Europe Audiobooks Market Trends

The audiobooks market in the Europe region is anticipated to grow at a CAGR of over 28% from 2024 to 2030. This growth is driven by the rising adoption of online local language translation modules and growing popularity of online education in the region.

The UK audiobooks market accounted for over 23% revenue share of the European market in 2023. The flourishing popularity of audiobooks in the nonfiction genre is boosting the market growth in the UK.

The audiobooks market in Germany is expected to grow at a CAGR of 25% from 2024 to 2030. The increasing popularity of digital content and the availability of audiobooks on various platforms is expected to continue its upward trajectory.

The France audiobooks market is projected to grow at a CAGR of over 24% from 2024 to 2030. The market is being driven by the increasing demand for online education and digital literacy, with mobile devices such as tablets and smartphones playing a key role in the growth of online education.

Middle East and Africa Audiobooks Market Trends

The audiobooks market in the Middle East and Africa (MEA) region is expected to account for the fastest growth of over 31% in the forecast period. This is attributed to the widespread implementation of online payments and the easy availability of the internet and smartphones in the region. The regional market appears to be in its early phases, with low penetration rates. Furthermore, global publishers are focusing on employing several narrators for full-cast recordings, upgrading audio material, and releasing direct-to-audio releases to get a competitive advantage over other market participants.

The Saudi Arabia audiobooks market accounted significant market share of over 18% in 2023. Subscription-based services, such as Audible, have become crucial in attracting and retaining audiobook consumers in Saudi Arabia. These models offer users access to a wide range of titles for a fixed monthly fee, providing value and variety that resonates with the audience.

Asia Pacific Audiobooks Market Trends

The audiobooks market in Asia Pacific is expected to grow at a CAGR of nearly 26% from 2024 to 2030. This can be attributed to the availability of a wide range of audiobooks in various regional languages. Also, the adoption of audiobooks in schools both in English and regional languages to enhance student performance is propelling the market growth.

The China audiobooks market is projected to grow at a CAGR of over 24% from 2024 to 2030. The key factors driving the market are the availability of audiobooks in various regional languages and the increasing adoption of audiobooks for educational purposes, especially in acting schools for language instruction and performance enhancement.

The audiobooks market in Japan accounted for over 10% revenue share in 2023. This can be attributed to the increasing middle-class population, and growing internet and smartphone penetration further propelling the growth of audiobooks.

The India audiobooks is expected to grow at a CAGR of 31% from 2024 to 2030. This growth is driven by factors such as the growing number of home-grown audiobook platforms such as Pocket FM, and the growing popularity of regional language content in the country.

Key Audiobooks Company Insights

Some key players operating in the market include Amazon.com, Apple Inc., and Google LLC.

-

Amazon.com, Inc. is a significant player in the audiobooks market offering a wide range of audiobook titles through its platform. Audible is one of the leading providers of digital spoken audio content, including audiobooks, podcasts, and other audio programs.

-

Apple Inc., a global company, offers the Apple Books platform and the SmartBook audiobook player app. The SmartBook app, available on the App Store, is designed to provide a seamless audiobook listening experience on iOS devices. It supports various file formats, allows users to import audiobooks, and offers features like adjusting playback speed, automatic book cover loading, and saving the last listening position.

W.F. Howes Ltd, Playster, and Rakuten are some emerging market participants in the market.

-

W.F. Howes Ltd. is a UK-based audiobook publisher and distributor, offering a wide range of fiction and non-fiction titles. The company provides high-quality audiobook productions across various genres, including best-selling fiction, educational content, biographies, self-help books, and more.

-

Playster, a subsidiary of Softonic International S.A., is a digital entertainment platform that includes audiobooks, e-books, music, and video games. It offers an extensive library of audiobooks. Users can access a vast collection of titles acrossvarious genres, allowing them to enjoy their favorite books in audio format.

Key Audiobooks Companies:

The following are the leading companies in the audiobooks market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- Apple Inc.

- Audible, Inc

- Barnes & Noble Booksellers, Inc.

- Downpour.com

- Google LLC

- PLAYSTER (SOFTONIC INTERNATIONAL S.A.)

- Rakuten Group, Inc.

- Storytel AB

- VoiceVerse

- W.F.Howes Ltd.

Recent Developments

-

In January 2024, RBmedia announced the acquisition of Berrett-Koehler's audiobook publishing company. This acquisition included taking over the catalog of previously published titles by Berrett-Koehler.

-

In October 2023, Spotify AB launched more than 150,000 audiobooks available for Spotify premium subscription members. The company offers personalized music, podcasts, and audiobooks on a single platform.

-

In January 2023, Apple Inc. introduced AI-narrated audiobooks for selected titles on Apple Books. This indicates a potential shift towards AI-powered narration alongside human narrators.

Audiobooks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.67 billion

Revenue forecast in 2030

USD 35.04 billion

Growth rate

CAGR of 26.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Genre, preferred device, distribution channel, target audience, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Russia; Nordic Countries; China; Australia; Japan; India; South Korea; Brazil; Mexico; Argentina; Chile; South Africa; Saudi Arabia; U.A.E.; Egypt; Turkey

Key companies profiled

Amazon.com, Inc.; Apple Inc.; Audible, Inc; Barnes & Noble Booksellers, Inc.; Downpour; Google LLC; PLAYSTER (SOFTONIC INTERNATIONAL S.A.); Rakuten Group, Inc.; Storytel AB; and W.F.Howes Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Audiobooks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global audiobooks market report based on genre, preferred device, distribution channel, target audience, and region:

-

Genre Outlook (Revenue, USD Million, 2018 - 2030)

-

Fiction

-

Non-Fiction

-

-

Preferred Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Laptops & Tablets

-

Personal Digital Assistants

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

One-time download

-

Subscription-Based

-

-

Target Audience Outlook (Revenue, USD Million, 2018 - 2030)

-

Kids

-

Adults

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Nordic Countries

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global audiobooks market size was estimated at USD 6.83 billion in 2023 and is expected to reach USD 8.67 billion in 2024.

b. The global audiobooks market is expected to grow at a compound annual growth rate of 26.2% from 2024 to 2030 to reach USD 35.04 billion by 2030.

b. The North American region observed the highest revenue share of over 44% in 2023 and is anticipated to dominate the market in the forecast period. This is due to the early and quick technological adoption to improve user experience.

b. Some key players operating in the audiobooks market include Amazon.com, Inc., Apple Inc., Audible, Inc, Barnes & Noble Booksellers, Inc., Downpour.com and Google LLC

b. Key factors that are driving the availability of the internet and various IoT devices provide easier ways for consumers to listen to audiobooks, increasingly popularity among younger age groups and growing users.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."