- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Australia Gummy Market Size & Share, Industry Report 2030GVR Report cover

![Australia Gummy Market Size, Share & Trends Report]()

Australia Gummy Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Vitamins, Dietary Fibres, Melatonin), By Ingredient (Gelatine, Plant-based Gelatine Substitute), By End Use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-247-7

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Australia Gummy Market Size & Trends

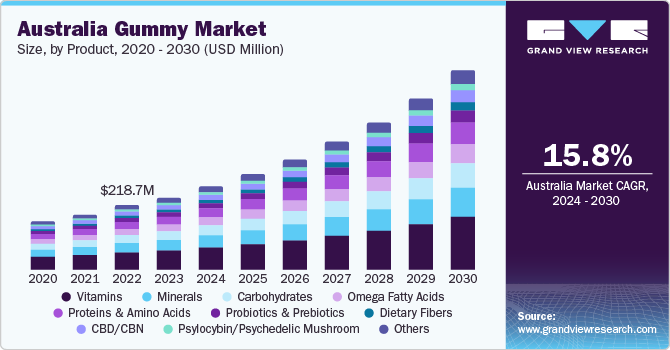

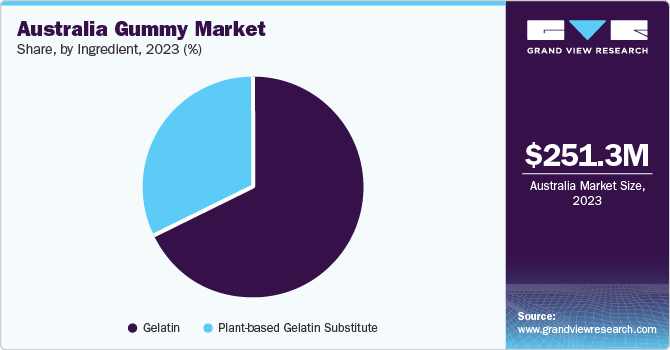

The Australia gummy market size was estimated at USD 251.3 million in 2023 and is expected to grow at a CAGR of 15.8% from 2024 to 2030. With growing awareness of nutrition and preventive healthcare, many Australians are turning to supplements to fill potential nutrient gaps in their diets. Consumers are increasingly interested in maintaining their health and well-being, and gummy supplements are marketed as an easy way to support various health goals, such as immune support, skin health, and overall vitality. The colorful and attractive packaging often emphasizes the vitamins and minerals contained within, appealing to health-conscious individuals.

The Australian market accounted for a share of 2.58% of the global gummy market in 2023. The market’s growth in the country is attributed to growing awareness towards health has resulted in consumers preferring food products with vitamins, proteins, and minerals that offer added health benefits. Moreover, factors such as texture, sweet taste, and convenience drive the demand for gummies.

Companies marketing gummy supplements often target specific demographic groups, such as children, young adults, or seniors, tailoring their messaging to resonate with the unique needs and preferences of each group. For example, gummy vitamins for kids may feature cartoon characters or fun shapes to make them more appealing.

The rising demand for vegan and vegetarian options significantly shapes the gummy market. This trend is driven by a growing consumer preference for plant-based alternatives, reflecting both dietary choices and ethical and environmental considerations.

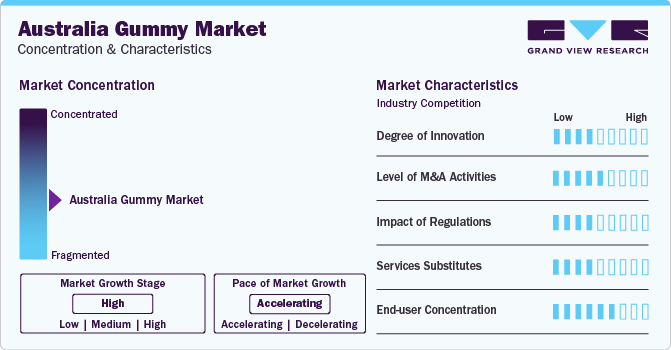

Market Concentration & Characteristics

The Australia gummy industry is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Innovations in formulation, such as new and unique ingredients, customized blends, or specialized formulations for specific health concerns, can also create distinct market opportunities. Manufacturers that stay ahead of trends and incorporate new ingredients into their gummy supplements can differentiate themselves and attract consumers seeking novel and effective solutions.

The industry is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. The key players are extensively investing in R&D activities to introduce novel food ingredients. Collaborations and partnerships with healthcare professionals, nutritionists, and fitness influencers offer another avenue for market expansion. Endorsements from trusted experts can instill confidence in consumers regarding the efficacy and safety of gummies. Moreover, online and offline partnerships with retailers can enhance product accessibility and distribution, ensuring a wider reach in both developed and developing economies.

End-user concentration is a significant factor in the Australian gummy industry. Consumer preferences for food and nutritional supplements are changing. Consumer demand for nutritional products has increased significantly in recent years due to increased health awareness and concerns about the negative effects of processed foods and artificial ingredients. Consumers are looking for products that taste good and offer health benefits.This trend is particularly noticeable in the gummy industry, where consumers seek chewables that work and are fortified with vitamins, minerals, and other nutrients. The growing demand for this type of chewables is due to the increasing awareness of the importance of maintaining good health through proper nutrition.

Product Insights

The vitamin gummy market accounted for a share of 27.2% in 2023. The rising prevalence of vitamin deficiencies is driving the demand for vitamin gummies. Several consumers are deficient in vitamins such as Vitamin D and Vitamin B12 owing to a lack of a balanced diet and a hectic lifestyle. Vitamin gummies offer a convenient way for consumers to maintain their vitamin intake. Furthermore, the rise of effective marketing campaigns and the expansion of the e-commerce industry have fueled the demand for vitamin gummies.

Dietary fiber gummies are gaining traction from consumers looking for convenient ways to increase their fiber intake. Fiber is an important nutrient that promotes digestive health and maintains blood sugar levels. As more consumers become aware of the importance of a healthy gut microbiome and its impact on overall health, they seek fiber-rich foods like fruits, vegetables, and whole grains. The dietary fiber gummy segment accounted for a share of over 15% in 2023.

The CBD/CBN-based gummy market is expected to grow at a CAGR of 21.4% from 2024 to 2030. CBD/CBN-based gummies are gaining popularity among consumers as they help alleviate the symptoms of anxiety and depression and relieve pain. Increased stress levels due to a hectic lifestyle drive the demand for gummies. In addition, the regulations over CBD and CBN make it difficult to diversify product offerings by manufacturers. The use of CBD/CBN in gummies is an ideal way for manufacturers to control the dosage and cater to the rising demand for these gummies.

Ingredient Insights

The gelatin-based gummy market accounted for a share of 67.5% in 2023.Gelatin-based gummies are the most common supplements provided by manufacturers. Factors such as the ideal texture, cost-effectiveness, and compatibility with other ingredients drive the demand for gelatin-based gummies. These attributes allow manufacturers to create functional gummies with added health benefits.

The demand for gummies made from plant-based gelatin substitutes is expected to grow at a CAGR of 17.3% from 2024 to 2030. Plant-based gummies provide transparency regarding ingredients, appealing to consumers seeking gummies made of natural ingredients. Several manufacturers are increasingly focusing on utilizing naturally sourced ingredients such as agar-agar and pectin, offering plant-based or vegan gummies to cater to the growing demand.

End-use Insights

Adult gummies accounted for a share of 79.7% in 2023.Hectic lifestyles among men are an important factor driving the demand for gummies. Gummies are a convenient way for men to maintain their overall health. Several players have recognized this trend and have responded by launching gummies specially developed for men. These gummies contain ingredients that address several concerns, such as heart health, energy support, and nutritional deficiencies. For instance, in June 2023, Nature's Bounty announced the launch of Sleep3 gummies for adults. The gummies include quick-release melatonin and L-theanine, making them ideal for consumers who face occasional sleeplessness.

The demand among pregnant women for gummies is expected to grow at a CAGR of 21.5% from 2024 to 2030. The palatability of gummy supplements over other traditional supplements or pills is a major factor boosting the demand for gummies among pregnant women. Gummies can be easily formulated with active ingredients and minerals, such as folic acid, zinc, calcium, and vitamin D, which help women maintain their health during pregnancy.

Distribution Channel Insights

Offline sales accounted for a revenue share of 80.1% in 2023. Offline channels typically offer a diverse range of health and wellness products, catering to various consumer preferences and needs. The availability of gummy supplements, which are popular for their taste and ease of consumption, contributes to the attractiveness of these stores. The presence of global brands in offline stores enhances the credibility and reliability of the products available. Global brands often invest in marketing and promotion, creating awareness and driving consumer trust, which, in turn, boosts sales.

The sales of gummies through practitioners are expected to grow at a CAGR of 19.5% from 2024 to 2030. Several consumers give high importance to medical advice from health care professionals. Practitioners or health care providers may provide personal recommendations depending on the requirements of individuals. This personalized approach enhances the efficacy of supplementation such as gummies, as patients are more likely to adhere to a regimen that aligns with their taste preferences and health goals.

Key Australia Gummy Company Insights

The Australia gummy market is gradually moving towards market fragmentation, with the introduction of novel products by the established as well as emerging players in the industry. Collaborations and partnerships with healthcare providers, nutritionists, etc. offer a potential avenue for the market players to expand as well as effectively market their products to a larger audience.

Key Australia Gummy Companies:

- Bayer AG

- Herbaland

- Amway

- Nature’s Bounty

- Garden of Life

- Candy People

- New Age Inc.

- CHURCH & DWIGHT CO., INC.

- Perrigo Co.

- CannazALL

Recent Developments

- In October 2023, Garden of Life expanded its well-received Vitamin Code line with a new range of gummy supplements. Consisting of seven products tailored to various needs, these gummies, like the rest of the Vitamin Code line, provide vitamins and minerals within a whole food base derived from raw fruits and vegetables. Moreover, they contain probiotics and enzymes, key elements noted throughout the Vitamin Code collection.

Australia Gummy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 289.5 million

Revenue forecast in 2030

USD 698.5 million

Growth rate

CAGR of 15.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Ingredient, End-Use, Distribution Channel

Country scope

Australia

Key companies profiled

Bayer AG; Herbaland; Amway; Nature’s Bounty; Garden of Life; Candy People; New Age Inc.; CHURCH & DWIGHT CO., INC.; Perrigo Co.; CannazALL

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Australia Gummy Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Australia gummy market report based on product, ingredient, end-use, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins

-

Minerals

-

Carbohydrates

-

Omega Fatty Acids

-

Proteins & Amino Acids

-

Probiotics & Prebiotics

-

Dietary Fibers

-

CBD/CBN

-

Psylocybin/Psychedelic Mushroom

-

Melatonin

-

Others

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Gelatin

-

Plant-based Gelatin Substitute

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Men

-

Women

-

Pregnant Women

-

Geriatric

-

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others

-

-

Online

-

Frequently Asked Questions About This Report

b. The Australian gummy market size was estimated at USD 251.3 million in 2023 and is expected to reach USD 289.5 million in 2024.

b. The Australian gummy market is expected to grow at a compound annual growth rate of 15.8% from 2024 to 2030 to reach USD 698.5 million by 2030.

b. Vitamins dominated the Australian gummy market with a share of 27.2% in 2023. This is attributable to the growing consumption of multivitamins and other vitamin-based gummies among working professionals and sports athletes as part of their regular health & wellness regimes.

b. Some key players operating in the Australian gummy market include Bayer AG; Herbaland; Amway; Nature’s Bounty; Garden of Life; Candy People; New Age Inc.; CHURCH & DWIGHT CO., INC.; Perrigo Co.; and CannazALL.

b. Key factors that are driving the market growth include the increasing consumer awareness regarding nutrition, health, and nutrient gaps, along wiht the growing trend of preventive healthcare.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.