- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Gelatin Substitutes Market Size, Share & Trends Report, 2030GVR Report cover

![Gelatin Substitutes Market Size, Share & Trends Report]()

Gelatin Substitutes Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Agar-agar, Carageenan), By Function, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-021-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gelatin Substitutes Market Summary

The global gelatin substitutes market size was worth USD 349.60 billion in 2022 and is expected to reach USD 609.57 billion by 2030, growing at a CAGR of 7.2% from 2023 to 2030. The main factors driving the global market growth are an increasing number of people adopting vegan and vegetarian diets and the growing use of these products in various industries, including cosmetics, food and beverage, and pharmaceutical & nutraceutical.

Key Market Trends & Insights

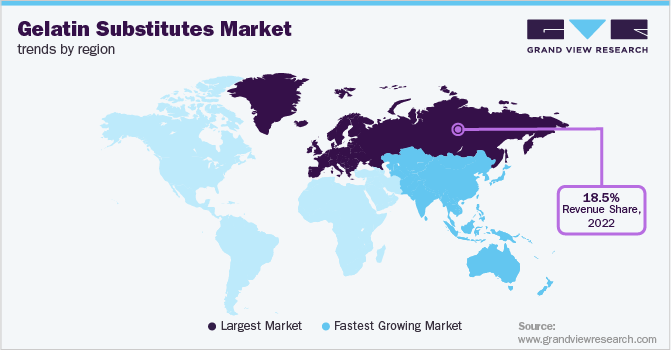

- Europe held a revenue share of 18.5% in 2022.

- Asia Pacific is expected to expand at a CAGR of 6.6% during the forecast period.

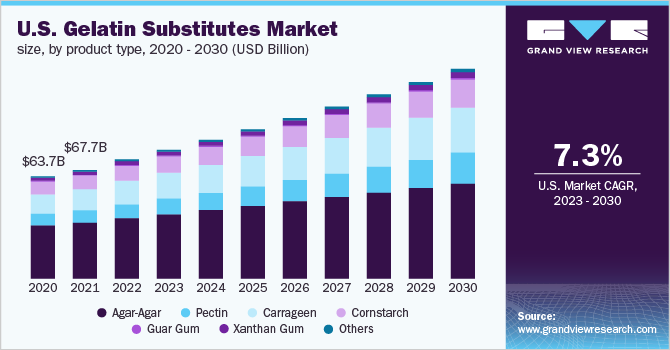

- By product type, agar-agar segment dominated the market with a revenue share of over 39% in 2022.

- By function, the stabilizer segment is expected to grow at a CAGR of 7.6% from 2023 to 2030.

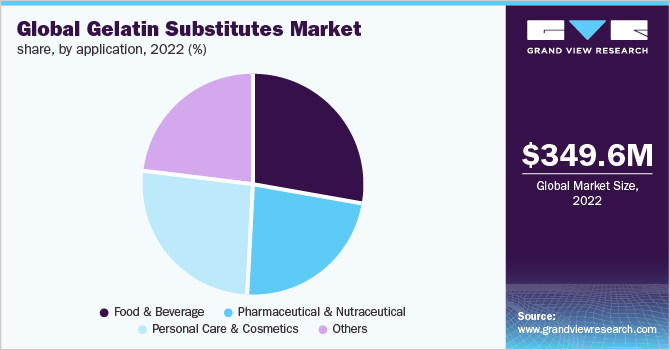

- By application, the food & beverage segment led the global market with a revenue share of over 27.5% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 349.60 Billion

- 2030 Projected Market Size: USD 609.57 Billion

- CAGR (2023-2030): 7.2%

- Europe: Largest market in 2022

COVID-19 had a moderate impact on the global gelatin substitutes market. The manufacturing of gelatin substitutes halted as a result of lockdowns and trade restrictions imposed by various governments across the globe. This led to raw material scarcity and supply chain disruption, negatively impacting overall production.However, the demand for nutraceutical products, functional foods, and dietary supplements such as capsules, gummies, soft gels, and tablets increased during the pandemic owing to rising health consciousness and awareness towards consuming immunity-boosting supplements. Furthermore, the pandemic compelled consumers to stock up on healthy and essential food products such as baked goods, snack bars, and others which led to the rise in demand for gelatin substitute products in the food & beverage industry.

Gelatin substitutes as ingredients are increasingly used in food items such as marshmallows, jellies, jams, cakes, custard, glazes, gummy bears, fruit syrups, flan, icing, and baking dough. One of the most widely used gelatin substitutes, powder agar, has more applications in the commercial food industry while strip agar has traditionally been used only in domestic cooking. Therefore, the rising incorporation of the product in food & beverage applications is expected to positively impact the industry’s growth.

Plant-based food ingredients are in high demand because many consumers want to make significant lifestyle changes, particularly in their eating habits such as shifting towards plant-based food and beverage products. The reasons for such a large-scale dietary change are related to the growing research on the health advantages of plant-based foods, which is being pushed by public health organizations around the world. The market for plant-based ingredients is being driven up by perceptions of the negative effects of animal-based foods on both health and the environment as well as rising awareness regarding animal welfare. As a result, the plant-based gelatin substitutes are anticipated to be positively impacted by such a shift towards using organic and plant-based food ingredients.

Plant-based gelatin substitutes-products, unlike conventional animal-based gelatin desserts, remain firm outside of the refrigerator and quickly set alcoholic and acidic liquids during preparation. Additionally, due to the significant temperature difference between their gelation point and melting point, gelatin substitutes have the unique ability to form a thermo-reversible gel. It smoothly glazes products such as doughnuts and pastries as well as makes the glaze more viscous. These properties of gelatin substitutes are expected to augment the product demand in the coming years.

Increasing product penetration in the pharmaceutical sector is anticipated to be a major growth driver of the overall market growth. The rising prevalence of noncommunicable diseases, the growing aging population, and chronic disorders are expected to fuel the growth of the pharmaceutical sector, resulting in increased product consumption in the application thereby promoting market growth during the estimated timeframe.

Product Type Insights

Agar-agar dominated the product type segment with a revenue share of over 39% in 2022. Agar-agar is a natural hydrocolloid made from the red seaweeds Gracilaria and Gelidium. This product is considered to be more compact and resistant than other carrageenan or gelatin gels. The gel strength of the product is also significantly higher than that of gelatin. It also reduces the need for any foreign substance, such as sugar, acids, proteins, or cations, to be added to improve food flavor or texture. These aforementioned properties of the product are expected to propel the product demand during the forecast period.

Guar gum is an agrochemical that can be used in a variety of food processing applications. Furthermore, its health benefits such as managing bowel movements, obesity, diabetes, and cardiac ailments by reducing cholesterol and high blood pressure characterize the growing use of guar gum in pharmaceutical industries. Such factors are predicted to aid the segment's growth over the next few years.

Corn starch is extracted from corn by steeping, wet milling, grinding, purifying, and drying. Corn starch is widely used as a food ingredient across the globe. It is also commonly used in the processed and packaged food industries. It improves the viscosity, texture, and other important properties of a variety of food products, including canned and frozen extruded snacks, microwaveable food items, and dry mixes. These properties of corn starch along with the rising preference for using clean-label and organic ingredients are the major growth drivers of the market.

Function Insights

The stabilizer segment is expected to grow at a CAGR of 7.6% from 2023 to 2030. Gelatin substitutes such as pectin, guar gums, xanthan gums, and agar-agar among others are commonly used as stabilizers in various applications such as in food & beverage to increase viscosity and shelf life by preventing ice crystallization while being stored. These are also used as stabilizers in cosmetic and personal care applications such as to provide stability and uniformity in creams, lotions, and toothpaste.

Gelatin substitutes are used as a thickening and gelling agent in various food & beverage applications. They are used as thickening agents in gravies, soups, sauces, toppings, and salad dressings, and as gelling agents in jelly, marmalade, jam, low sugar/calorie gels, and restructured foods. Corn starch, guar gum, and xanthan gum are commonly used as thickeners while pectin, agar agar, and carrageenan are used as gelling agents.

Application Insights

The food & beverage application segment led the global market with a revenue share of over 27.5% in 2022. The rising demand for bakery products, functional foods, confectioneries, and desserts is expected to drive segment growth during the forecast period. The product's excellent heat resistance and stabilizing properties have also increased its demand in pie fillings, ice creams, meringues, and other desserts in the bakery & confectionery industries. Furthermore, growing consumer awareness of the health benefits of baked food items such as healthier digestion and lower fat content is expected to propel segment growth.

The rising consumer awareness regarding preventive healthcare and growing health illnesses are aiding the pharmaceutical & nutraceutical sector’s growth. Gelatin substitutes are used for thermos-reversible gelling, binding, and adhesives in manufacturing tablets, syrups, emulsions, and capsules. Furthermore, there was a sharp rise in the demand for immunity-boosting supplements during the pandemic which is likely to continue in the coming years. Additionally, products such as pectin, xanthan gum, guar gum, and agar are classified as Generally Recognized as Safe (GRAS) by the Food and Drug Administration (FDA) which is likely to drive product demand.

Regional Insights

Europe held a revenue share of 18.5% in 2022. This is attributable to the increasing demand for the product in various end-use industries including personal care & cosmetics, food & beverage, and pharmaceutical & nutraceutical. Gelatin substitutes are broadly used in non-starch bread and various desserts in the U.K. to produce low-calorie dishes. Furthermore, agar gains traction and is considered to be one of the healthiest hydrocolloids. It is also approved by the European Food Safety Authority (EFSA) as a food additive. These factors are expected to contribute to regional growth.

Asia Pacific is expected to expand at a CAGR of 6.6% during the forecast period. The consumption of processed and packaged foods has increased in Asia Pacific as a result of rapid urbanization, rising disposable income, and a growing population. As a result, the product demand is rising in the region. Furthermore, the rapidly increasing pharmaceutical & nutraceutical industries along with the shifting preferences of consumers towards using organic and plant-based ingredients are further boosting the market growth.

Key Companies & Market Share Insights

The global gelation substitutes market is characterized by intense competition owing to a large number of large and small-scale manufacturers. Key companies are focusing on geographical expansions, higher product penetration, and research & development to study additional uses of gelation substitutes in various end-use industries. Additionally, consumers favor buying gelatin substitutes through B2C sales channels. As a result, manufacturers in the industry are introducing online platforms for delivering consistent and bulk quantities to home chefs and domestic use.

Major players in the market are introducing new products and are focusing on strategic partnerships, mergers, joint ventures, and acquisitions to increase their market share. For instance, in October 2021, Cargill, Incorporated launched a new kappa carrageenan product named Satiagel VPC614 to expand its carrageenan portfolio. The new product is sustainably sourced and is specifically designed for solid formulations and high-gelling applications in the personal care & cosmetic sectors. Some prominent players in the global gelatin substitutes market include:

-

GELITA AG

-

Cargill, Incorporated

-

B&V srl

-

AGARMEX, S.A. DE C.V.

-

Java Biocolloid

-

NOW Foods

-

Great American Spice Company

-

Special Ingredients Ltd.

-

Brova Limited.

-

AF Suter

-

Niblack Foods, Inc.

Gelatin Substitutes Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 377.24 billion

Revenue forecast in 2030

USD 609.57 billion

Growth rate (Revenue)

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons; revenue in USD million; and CAGR from 2023 to 2030

Report coverage

Market forecasts, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, function, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Australia; Brazil; South Africa

Key companies profiled

GELITA AG; Cargill, Incorporated; B&V srl.; AGARMEX S.A. DE C.V.; Java Biocolloid; NOW Foods; Great American Spice Company; Special Ingredients Ltd; Brova Limited; AF Suter; Niblack Foods, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gelatin Substitutes Market Segmentation

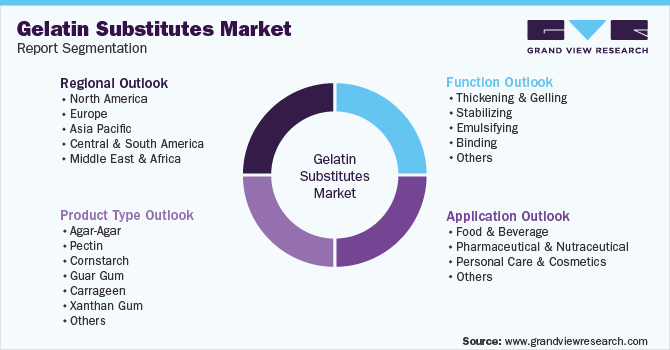

This report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global gelatin substitutes market report based on product type, function, application, and region:

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Agar-Agar

-

Pectin

-

Cornstarch

-

Guar Gum

-

Carrageen

-

Xanthan Gum

-

Others

-

-

Function Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Thickening & Gelling

-

Stabilizing

-

Emulsifying

-

Binding

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Food & Beverage

-

Bakery Goods

-

Functional Foods

-

Desserts

-

Confectionery

-

Others

-

-

Pharmaceutical & Nutraceutical

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gelatin substitutes market size was estimated at USD 349.60 billion in 2021 and is expected to reach USD 377.24 billion in 2022.

b. The global gelatin substitutes market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 609.57 billion by 2030.

b. Asia Pacific dominated the market with a share of 31.12% in 2022. The consumption of processed and packaged foods has increased in Asia Pacific as a result of rapid urbanization, rising disposable income, and a growing population.

b. Some of the key players in gelatin substitutes market include GELITA AG, Cargill, Incorporated, B&V srl., AGARMEX, S.A. DE C.V., Java Biocolloid, NOW Foods, Great American Spice Company, Special Ingredients Ltd., Brova Limited., AF Suter, Niblack Foods, Inc.

b. The main factors driving the global gelatin substitutes market growth are an increasing number of people adopting vegan and vegetarian diets and the growing use of these products in various industries, including cosmetics, food and beverage, and pharmaceutical & nutraceutical products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.